Institutional boom for Cardano: Grayscale's ADA ETF is already under consideration by the SEC

Grayscale has filed for a Cardano (ADA) ETF, with the SEC’s approval odds now at 80%. We break down what this means for the project, how it could impact ADA’s price, institutional interest, and which investment strategies may work in 2025.

Table of content

Introduction: A New Wave of Institutional Interest in Crypto

2025 can already be called the year of cryptocurrency ETFs. Just a few weeks ago, Grayscale filed for a Hedera (HBAR) ETF, and now the company has announced plans to launch a Cardano (ADA) ETF.

According to market estimates, the probability of this initiative being approved has risen to 80%, sparking significant interest among investors and traders.

If the U.S. Securities and Exchange Commission (SEC) approves this ETF, Cardano will join the ranks of cryptocurrencies with regulated investment funds available to the traditional capital market — a potential game-changer for ADA.

What Is Cardano (ADA) and Why It’s Unique

Cardano is a third-generation blockchain platform launched in 2017, operating on the Proof of Stake (PoS) consensus mechanism. Its primary goal is to provide decentralized financial tools and enable the creation of dApps and smart contracts with high security, scalability, and energy efficiency.

Key Features and Advantages:

- Academic Approach — All technologies undergo peer-reviewed research, minimizing protocol risks.

- Deflationary Model — ADA’s total supply is capped at 45 billion coins, with over 31 billion already in circulation.

- Eco-Friendly — PoS consumes far less energy compared to Proof of Work blockchains.

- Real-World Use Cases —

- Ethiopia: tracking coffee bean shipments from farms to consumers.

- Ethiopian Ministry of Education: storing and verifying educational certificates.

- ADA is used in DeFi, on decentralized exchanges, and in lending platforms.

Why a Cardano ETF Matters

ETF (Exchange-Traded Fund) is an investment fund traded on an exchange that tracks the value of an underlying asset — in this case, ADA.

Benefits of Launching a Cardano ETF:

- Access for Traditional Investors without needing a crypto wallet

- Institutional Capital Inflow from pension funds, investment firms, and hedge funds

- Liquidity Growth with increased trading volumes

- Long-Term Demand from accumulation-focused ETFs

Grayscale’s proven track record with crypto ETFs means this could be a major step toward mainstream adoption of ADA.

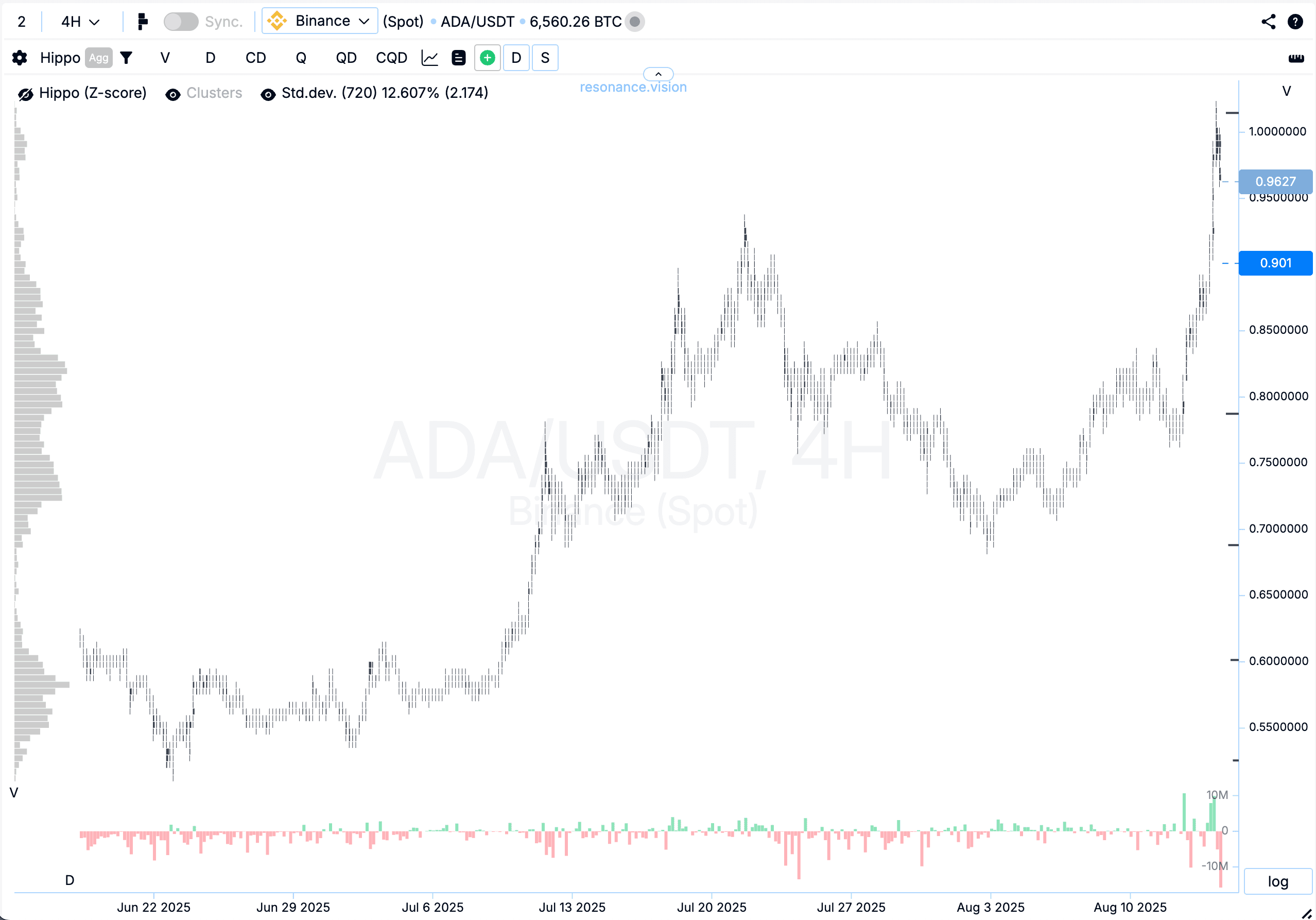

Current Market Situation: Volume Analysis

Since early 2025, ADA has shown an uptrend — higher highs and higher lows per Dow Theory. Large sell volumes are being absorbed without significant price drops (sign of supply shortage). Daily charts show consistent buying after pullbacks, indicating strong interest from large players.

Given the interest in the project from institutional investors, it is advisable to consider a long-term strategy (HODL + DCA):

- Regular ADA purchases regardless of price

- Staking for passive income

- 3–5 year horizon, especially if ETF is approved

What to Expect if ETF Is Approved

Approval could lead to:

- Long-term institutional support for ADA

- Potential price growth over the coming years

- Improved market stability

However, corrections are inevitable, making risk management essential.

Conclusion

The Grayscale Cardano ETF filing could make ADA more accessible to investors worldwide.

With strong fundamentals, real-world use cases, and a growing network, Cardano is well-positioned for both long-term investing and short-term trading.

If approved, it could follow the success of Bitcoin and Ethereum ETFs — or even surpass their growth pace.

Follow new insights in our telegram channel.

No need to invent complex schemes and look for the "grail". Use the Resonance platform tools.

Register via the link — get a bonus and start earning:

OKX | BingX | KuCoin.

Promo code TOPBLOG gives you a 10% discount on any Resonance tariff plan.