Pump.fun Regains Leadership: What Awaits the Memecoin Market on Solana?

Pump.fun revenue has exceeded $800M. We analyze why developers are choosing Pump.fun again, how the platform’s token works, and which investment strategies can be effective. We also examine the reasons for the decline of competitor Let’s Bong. The article will help to understand the prospects of memecoins and the role of Pump.fun in the future of this segment.

Table of content

Introduction

The memecoin market on the Solana blockchain has recently become one of the most dynamic segments of the cryptocurrency industry. At its peak stands the Pump.fun platform, which allows anyone to create their own token and launch it on the market. After temporary competition with the new player Let’s Bong, Pump.fun regained leadership, surpassing $800M in cumulative revenue.

In this article, we will look into how Pump.fun works, why it maintains dominance, what opportunities open up for memecoin developers and investors, and what risks accompany this market.

What is Pump.fun and How Does It Work

Pump.fun is a platform for launching memecoins on Solana that has become the main hub for developers and traders. Its algorithm is simple:

- Anyone can create their token

- Users start investing in it, forming the initial liquidity

- Once the token reaches a certain capitalization, it is automatically listed on Raydium

- After Raydium, the most successful tokens can even reach Binance

This process makes creating and promoting memecoins maximally accessible. For many traders, Pump.fun has become the birthplace of new trends, and for developers — an opportunity to quickly launch a product without complex technical procedures.

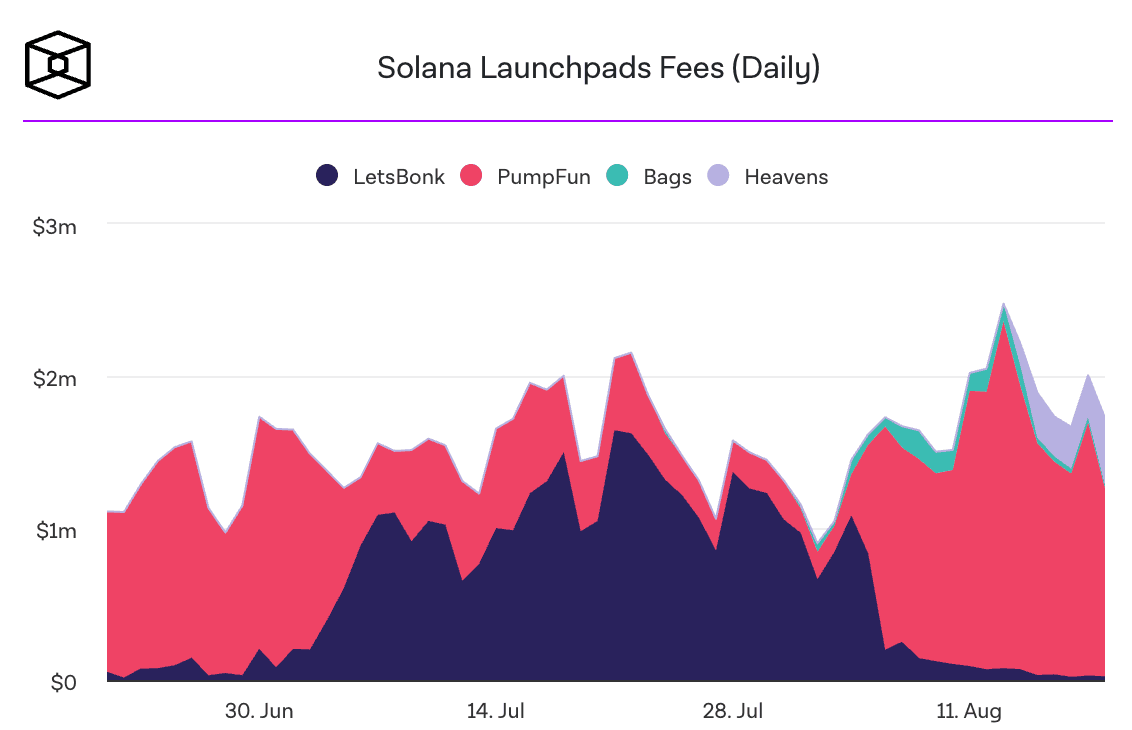

Competition with Let’s Bong

In April 2025, a new platform Let’s Bong entered the market, supported by Raydium Launch Labs and the Bong community. At first, it managed to outperform Pump.fun in profitability, reaching over $1M per day.

However, this success was short-lived: Let’s Bong’s revenue plummeted by almost 99%, down to $30,000 per day.

Reasons for the decline:

- Lack of stable liquidity.

- Outflow of users and developers.

- Insufficient integration into the Solana ecosystem.

In contrast, Pump.fun proved its resilience, as the platform is already deeply integrated into the market and has many years of experience, making it more attractive for long-term use.

Why Pump.fun is #1 Again

There are several key reasons why Pump.fun maintains leadership:

- Infrastructure: the project is integrated into most important segments of Solana.

- Liquidity: tokens created on Pump.fun receive greater market access.

- Reputation: the top 10 major developers who temporarily moved to Let’s Bong have returned to Pump.fun.

- Strategic moves: launch of a memecoin liquidity support fund that helps developers scale their tokens.

These factors create a network effect: the more users and developers work with Pump.fun, the stronger its dominance becomes.

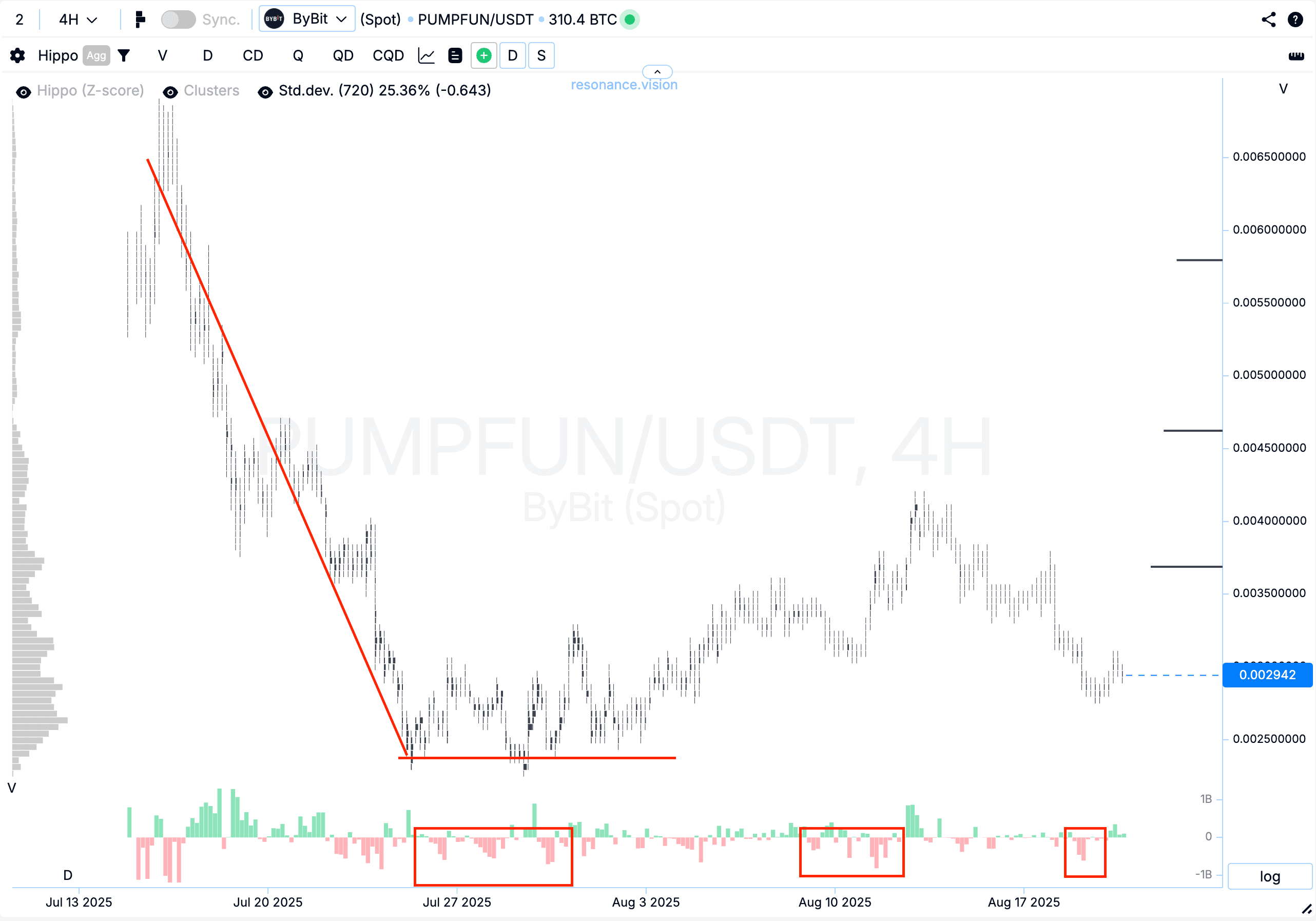

Pump.fun Token Analysis

The platform’s token is traded on several exchanges and directly depends on the service’s revenues.

- After listing, the price declined, but participants actively created scarcity through purchases.

- Despite the overall market decline, Pump.fun continues to maintain stable interest.

- The recent launch of the liquidity fund may become a new driver for the price.

Analysts note: expecting “thousands of percent growth” from the token, as with memecoins, is not realistic. It is rather an exchange infrastructure asset that reflects the profitability of the platform itself.

How Investors Can Profit

There are several options:

- Direct investments in memecoins — a high-risk strategy that can bring both super-profits and total losses.

- Trading the Pump.fun token — a more stable option, as it is tied to the platform’s revenues.

- Grid bots — automated strategies that allow earning on sideways market movements, especially when the token trades within a narrow range.

Prospects of the Memecoin Market

- Demand for memecoins is growing — they have become part of crypto culture.

- Pump.fun has a significant advantage over competitors thanks to its experience and reputation.

- If the liquidity support fund proves effective, this may further strengthen the platform’s positions.

However, it should be remembered: memecoins remain high-risk assets, so investors must correctly assess risk management and not allocate a significant part of their capital solely to this segment.

Conclusion

Pump.fun regained leadership in the Solana memecoin market, proving its viability and competitive advantages. The platform has become an entry point for new projects, a place for traders and developers, and its token — an indicator of ecosystem profitability.

Despite competition from Let’s Bong and other projects, Pump.fun holds its positions thanks to liquidity, integration, and strategic steps. For investors, this is a chance to benefit, but only with a competent approach to risks.

Follow new insights in our telegram channel.

No need to invent complex schemes and look for the "grail". Use the Resonance platform tools.

Register via the link — get a bonus and start earning:

OKX | BingX | KuCoin.

Promo code TOPBLOG gives you a 10% discount on any Resonance tariff plan.