SEC’s Statements on SOL and Liquid Staking: How Will This Impact the Market?

The SEC has acknowledged that liquid staking is not always a security. What does this mean for Solana, how do receipt tokens work, and why could this be a long-term growth driver?

We analyze the potential of SOL, market volume analysis, and opportunities for investors — from DCA to speculative strategies.

Table of content

- 01Introduction: The SEC, Cryptocurrencies, and a New Stage of Regulation

- 02What is Liquid Staking?

- 03Analogy with Fiat Money

- 04DeFi and Solana: The Growing Role of the Platform

- 05The SEC and Liquid Staking: Why This Matters for Investors

- 06Potential Impact on SOL Price

- 07Forecast for 3–5 Years: Is It Worth Investing in SOL?

- 08Short-Term Situation: Speculation or Observation?

- 09Conclusions

Introduction: The SEC, Cryptocurrencies, and a New Stage of Regulation

In 2025, the cryptocurrency market once again found itself in the spotlight after the SEC (U.S. Securities and Exchange Commission) issued a series of statements regarding liquid staking. In these statements, the regulator acknowledged that certain forms of liquid staking do not constitute the offering or sale of securities and, therefore, are not subject to regulation under securities laws.

This news immediately sparked discussions, investment decisions, and analysis — particularly concerning the Solana (SOL) blockchain platform, which is actively used in DeFi protocols.

What is Liquid Staking?

Liquid staking is a mechanism in which a user locks their crypto assets in a network to validate transactions (earning a profit) while receiving a receipt token (e.g., stSOL for SOL) in return. This token can be used in other DeFi services as collateral or a payment instrument without the need to unlock the original asset.

Thus, liquid staking:

- Increases capital efficiency

- Does not increase issuance

- Removes the base token from circulation, creating a supply scarcity

Analogy with Fiat Money

This mechanism resembles the gold backing of fiat money: in the past, banks stored gold and issued receipts in return. Today, receipt tokens in cryptocurrency serve a similar role. They act as a virtual confirmation of asset ownership, enabling alternative liquidity without exiting the position.

DeFi and Solana: The Growing Role of the Platform

Many liquid staking protocols operate on the Solana blockchain, which is known for:

- High transaction processing speed

- Low fees

- A large DeFi ecosystem

As of August 2025, over $67 billion is locked in liquid staking. This means that receipt tokens worth a similar amount are circulating in the market, which can potentially be reinvested into other assets.

The SEC and Liquid Staking: Why This Matters for Investors

The SEC’s recognition that liquid staking, in some cases, is not a security opens the door to:

- More active development of DeFi products

- Widespread use of liquid staking on a legal basis

- The launch of new instruments (ETFs, derivatives, loans backed by receipt tokens)

This decision reduces regulatory risks and encourages capital inflow into the crypto market, potentially creating a long-term bullish trend.

Potential Impact on SOL Price

Solana’s Volatility History:

- Start — $3

- Rise to $260

- Fall to $9

- New peak — $300

- Current price hovers around $100

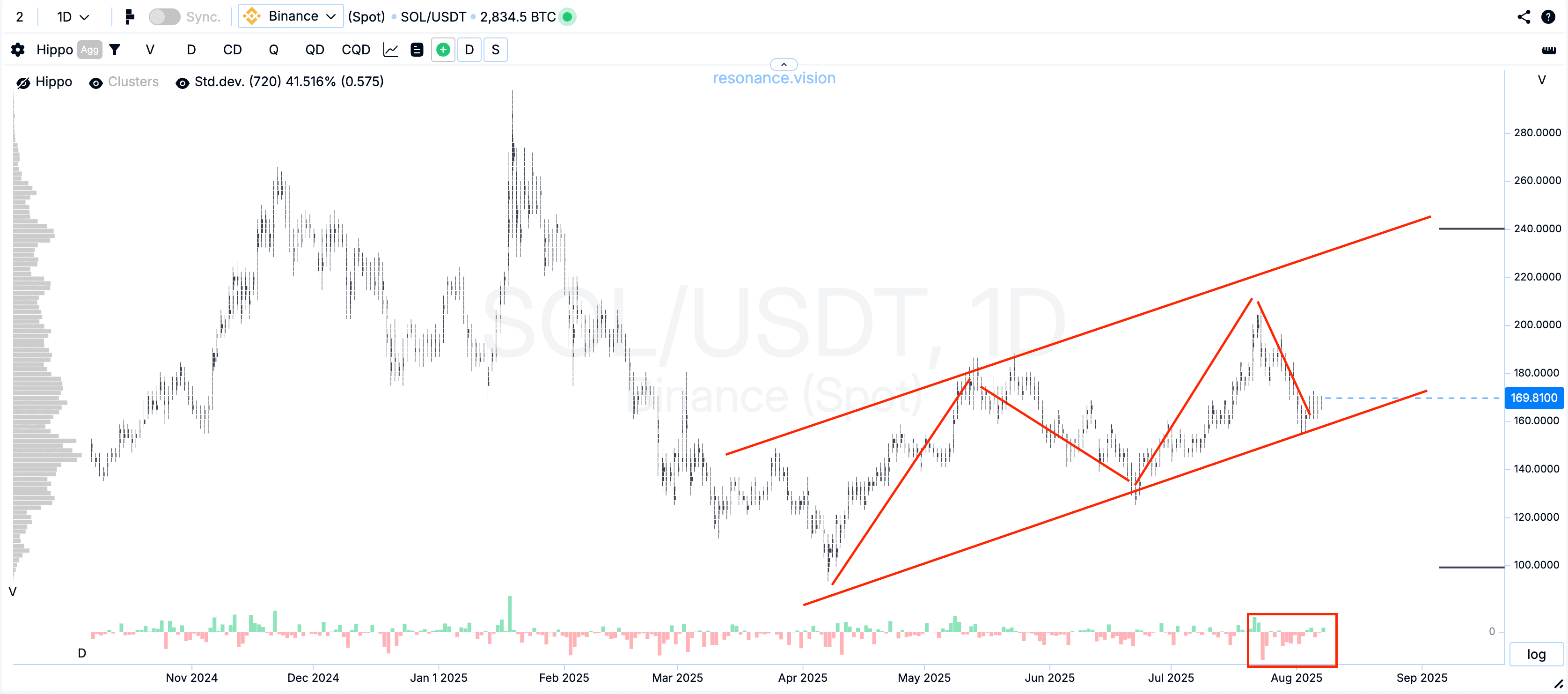

Since the beginning of 2025, the market has shown significant selling volumes, but the price has not declined — a sign that a major player (institutional?) is absorbing the supply.

Trend Analysis:

- Minimum values are not being updated

- High selling volumes, but ineffective

- A supply scarcity is forming, as confirmed by Dow Theory

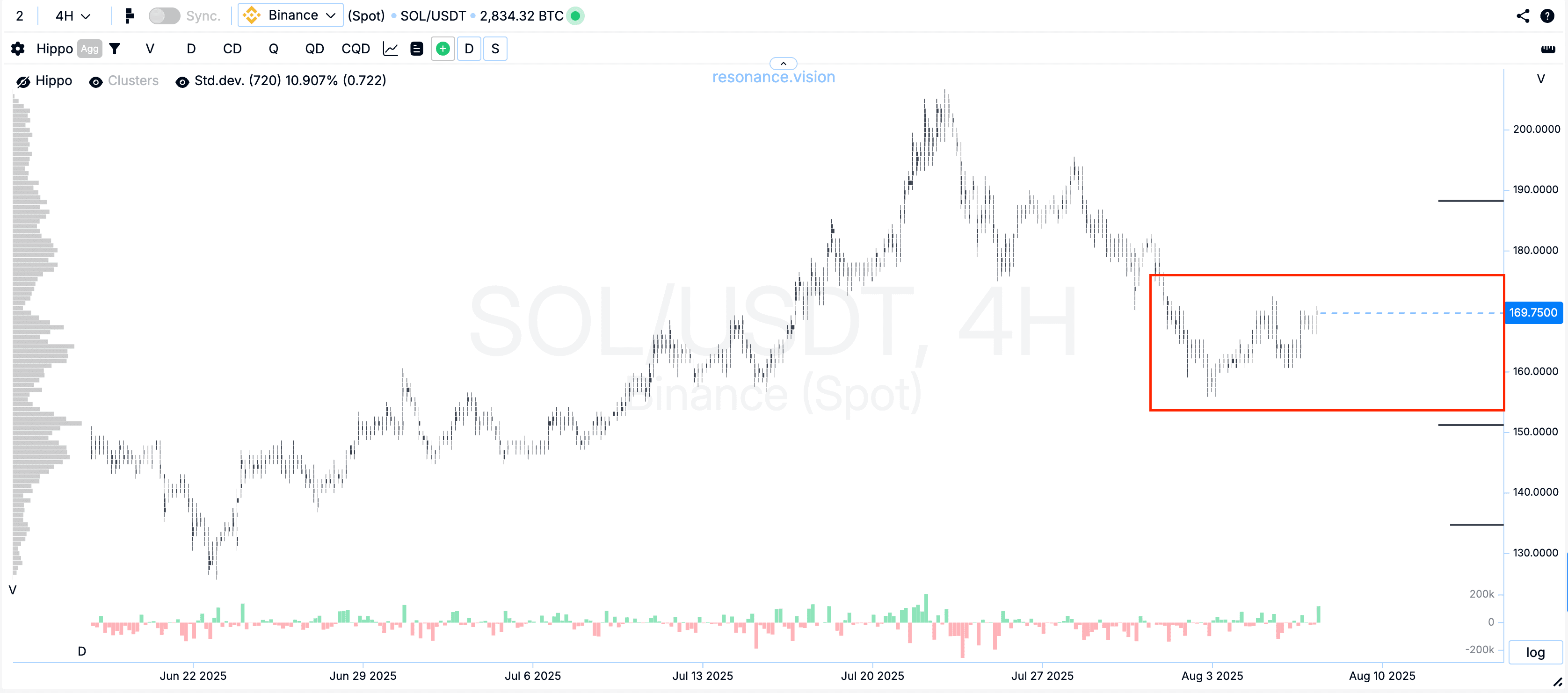

However, validation of the scarcity is needed on smaller timeframes.

Forecast for 3–5 Years: Is It Worth Investing in SOL?

If considering a long-term strategy, such as Dollar-Cost Averaging (DCA):

- Buying SOL today may be promising

- Potential coin growth over 3–5 years

- Important: Have capital available for buying during dips

- Suitable for investors pursuing steady asset accumulation

Short-Term Situation: Speculation or Observation?

At the current stage:

- High volatility, but no validation of growth

- Need to wait for market confirmation: breakout of local highs or the appearance of aggressive buying

- Speculative trades carry high risk at the moment

- Optimal scenario — wait for a sideways trend and reactions to key orders (based on limits/anomalies)

Conclusions

What do we have?

- Liquid staking is recognized as safe from the SEC’s perspective

- This reduces risks and stimulates DeFi development

- Solana (SOL) has growth potential in both the short and long term

- Potential institutionalization of the asset through ETFs and large players likely already accumulating positions

- The price remains stable despite selling volumes — a sign of strong demand

What can investors do?

- Long-term: Gradually build a position through DCA

- Short-term: Wait for signals validating the scarcity

- Analytically: Monitor volumes, support levels, limit order behavior, and market reactions

To stay up to date with analytical reviews, subscribe to us — there’s more information, market situation analyses, and tools for traders and investors.

This article does not contain any calls to action and does not contain investment or speculative recommendations. It is intended for informational purposes only.

No need to invent complex schemes and look for the "grail". Use the Resonance platform tools.

Register via the link — get a bonus and start earning:

OKX | BingX | KuCoin.

Promo code TOPBLOG gives you a 10% discount on any Resonance tariff plan.