SUI and SUI Group: Analyzing the Token's Prospects Amid a Stock Buyback

An analysis of the SUI token’s potential following the news of the SUI Group stock buyback. A breakdown of the project’s fundamental indicators, tokenomics, and staking. A detailed analysis of the chart, volumes, and growth potential in the context of the overall market trend. A discussion of optimal strategies for investors.

Table of content

Recent news that the public company SUI Group is actively conducting a buyback of its shares has caught the attention of the crypto community. SUI Group, formerly known as Millicity Ventures, rebranded and focused on the SUI ecosystem, and has now repurchased $2 million worth of shares. This is a positive development for shareholders, as a decrease in the supply of shares on the Nasdaq market can contribute to their growth. But how does this affect the SUI token?

What is SUI and its Ecosystem?

SUI is a Layer 1 blockchain developed by the Mysten Labs team. Its goal is to create a scalable, secure, and user-friendly platform for Web3 applications. The SUI token is used for:

- Paying transaction fees.

- Participating in staking.

- Project governance through the DAO.

- Use within the ecosystem (DEXes, games, NFTs).

SUI is also actively developing user tools, such as zkLogin for simplified login and the ability for third parties to pay user fees, which makes interacting with the blockchain more convenient.

Analysis of Fundamental Indicators and Tokenomics

From a fundamental perspective, SUI is an infrastructure project that earns revenue from fees. While it plays an important role, it is not a project that generates profit from external sources, like some platforms.

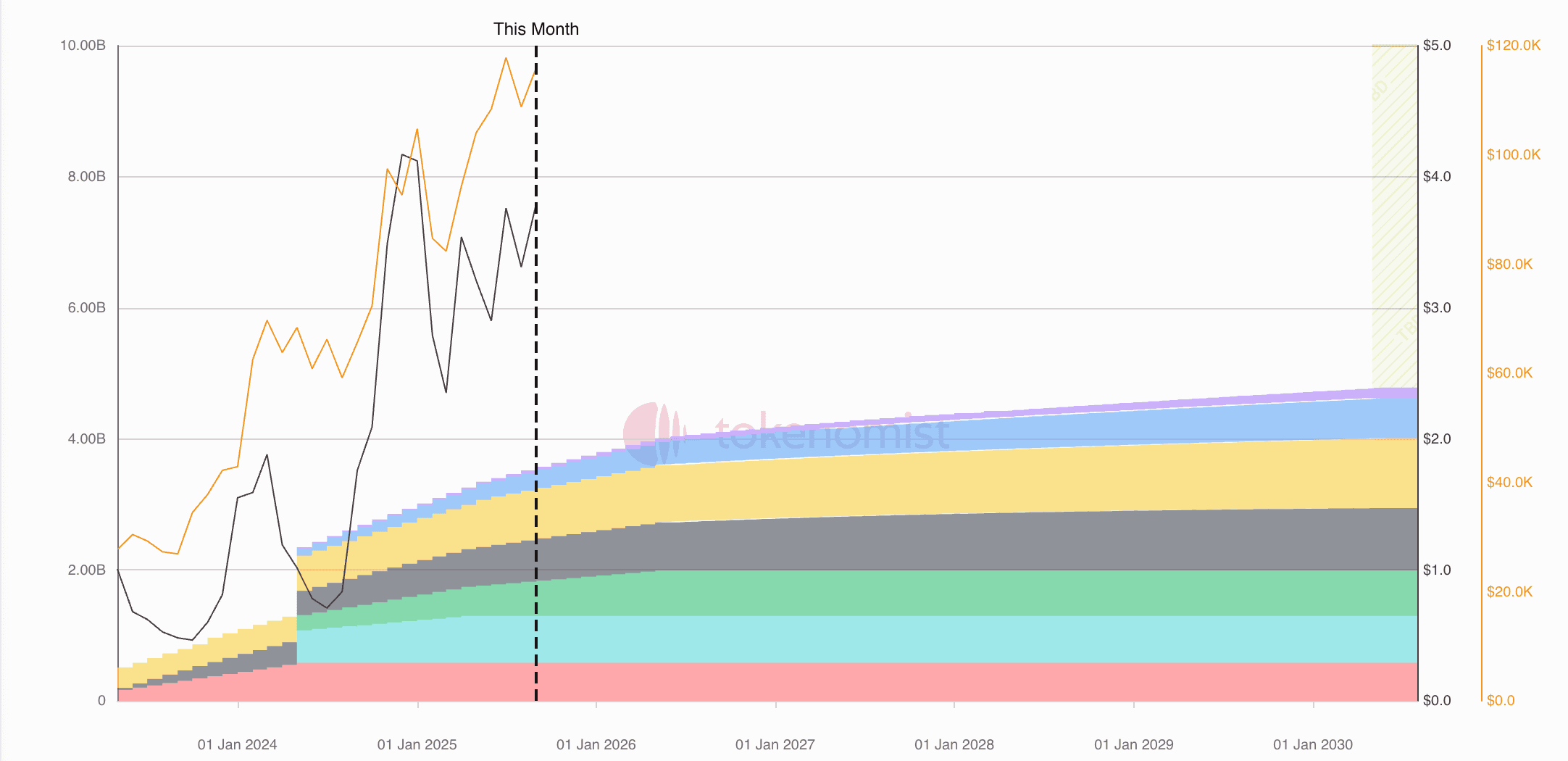

- Token Unlocks: According to the tokenomics, a significant token unlock is only expected in 2030. Until then, the emission will be relatively small.

- Staking: The staking yield is currently around 2% annually, which is not a strong motivation for passive income.

Analysis of the Chart and Growth Potential

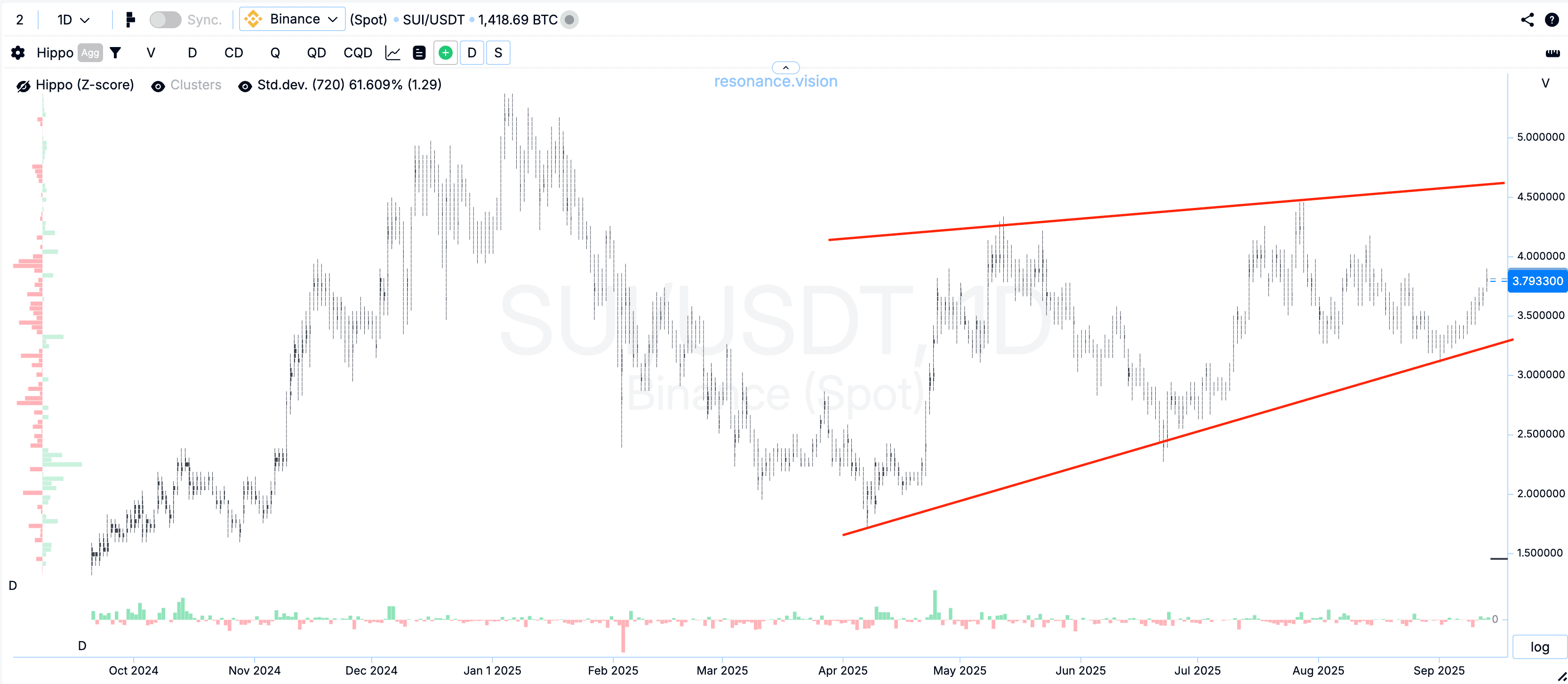

An analysis of the SUI chart shows that after significant volatility, it has entered a phase that, according to Charles Dow’s theory of trends, can be described as an upward trend. While the price is moving up, this movement is likely driven more by the overall market trend than by unique fundamental events within the project. The SUI chart shows a movement characteristic of the entire market.

Although there are some signs of scarcity, indicating an increase in demand, this demand is not strong enough for a self-sustained impulsive rally. In such conditions, pursuing a directional long position may be risky.

Conclusion: How to Profit from SUI?

Given the current situation, SUI is an interesting asset, but its behavior is primarily dependent on the overall market trend, not on unique events within its ecosystem.

The best strategy for investors who already hold SUI or plan to buy it is to use a Grid bot with a long bias. This will allow them to profit from volatility within the existing upward trend, collecting gains from small fluctuations. If SUI generates stronger signs of scarcity (e.g., through powerful fundamental news or increased volumes), then a shift to a directional long position could be considered.

Remember risk management! The news about the buyback on the stock market is positive, but its impact on the SUI token is indirect. It’s important to analyze the token’s own behavior to make effective investment decisions.

Follow new insights in our telegram channel.

No need to invent complex schemes and look for the "grail". Use the Resonance platform tools.

Register via the link — get a bonus and start earning:

OKX | BingX | KuCoin.

Promo code TOPBLOG gives you a 10% discount on any Resonance tariff plan.