TRUMP-backed ETF: Hype or Real Opportunity?

A deep dive into the TRUMP-backed ETF application: SEC approval requirements, risks, tokenomics, price trends, and potential investment strategies.

Table of content

The crypto world is once again buzzing — Canary Capital has filed an application with the SEC to launch an ETF backed by TRUMP tokens. This isn’t their first attempt, as the company is known for flooding the regulator with ETF filings.

Conditions for ETF approval

For a crypto ETF to exist, a futures contract must have been traded for at least six months. TRUMP doesn’t meet this requirement yet. However, by the time the SEC reviews the application, such a futures contract may already exist.

TRUMP token allocation

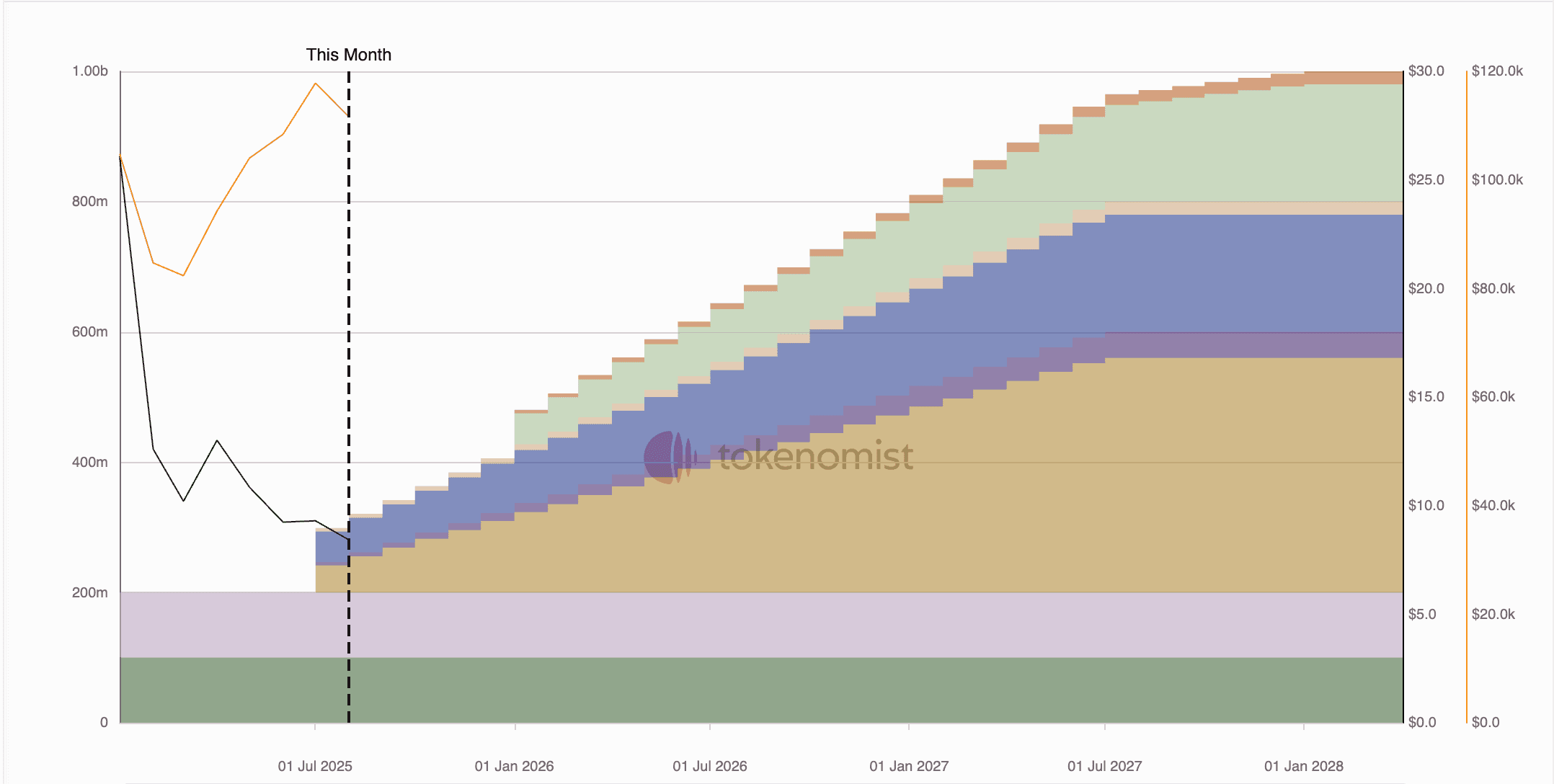

Looking at the tokenomics:

- Only a few percent of the total supply are in public circulation.

- The rest will gradually enter the market until 2028.

- Each month, a few percent of the supply are released.

This means constant selling pressure, which negatively impacts price.

What is TRUMP really?

TRUMP is a memecoin with no connection to a real project or revenue model.

Unlike stocks of companies like Apple, which grow alongside product sales, TRUMP doesn’t generate value. Instead, it’s more of a way to raise money from the market. Moreover, most of the supply remains in the hands of its developers.

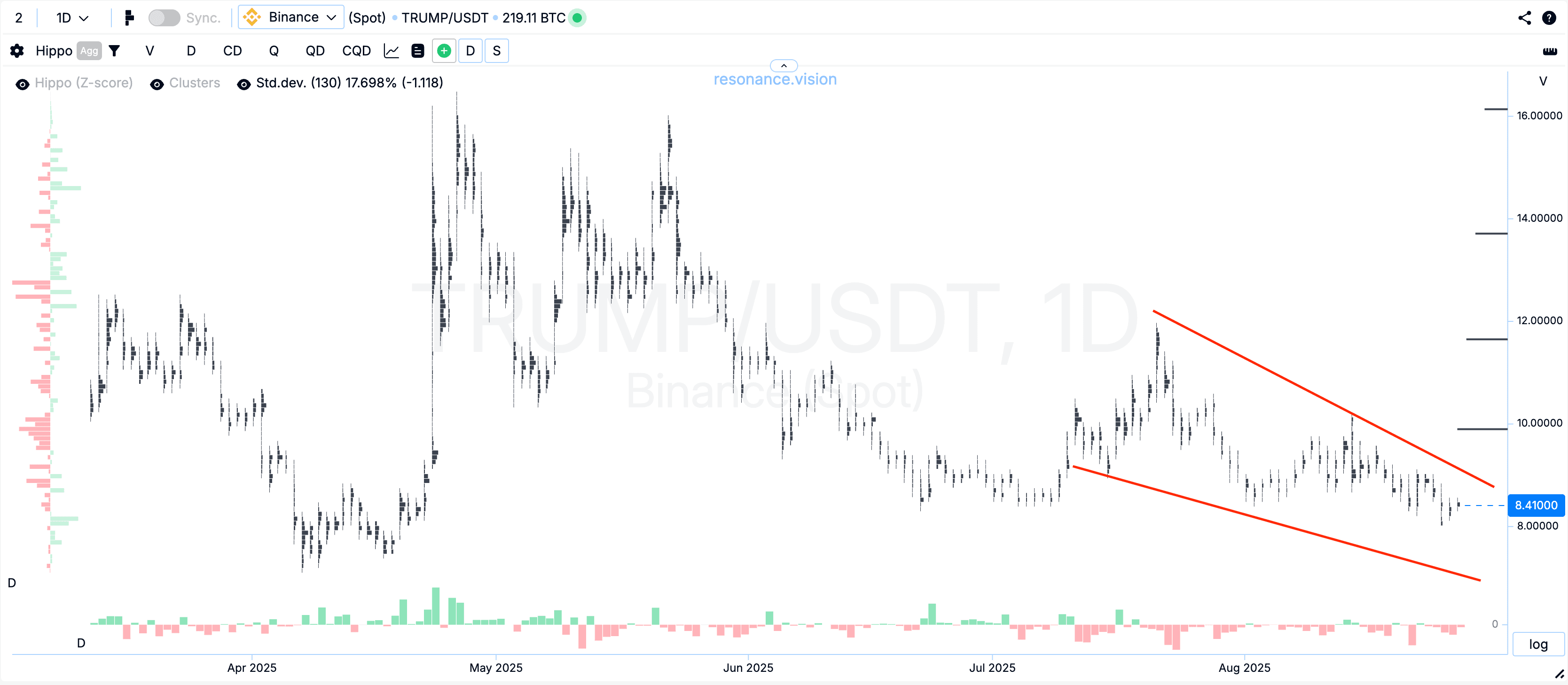

Price dynamics

- Since listing, TRUMP has lost over 80% from its peak.

- In spring, there was a 100% pump, followed by smaller 20–30% moves.

- Overall, the trend is bearish, consistent with Charles Dow’s theory.

Thus, there is no token shortage, and selling pressure dominates.

Investment outlook

- HODLing long-term doesn’t make sense.

- Grid bots or staking won’t work in a downtrend.

- The only viable strategy is short-term speculative longs, when selling pressure temporarily eases.

At best, one could catch 20–30% upward moves, but long-term, TRUMP looks like yet another pointless memecoin.

Follow new insights in our telegram channel.

No need to invent complex schemes and look for the "grail". Use the Resonance platform tools.

Register via the link — get a bonus and start earning:

OKX | BingX | KuCoin.

Promo code TOPBLOG gives you a 10% discount on any Resonance tariff plan.