Uniswap: How the Protocol Works and Whether It’s Really Possible to Earn 95% Annual Returns Without Risk

Discover how Uniswap (UNI) works, why it is considered one of the key projects in the DeFi world, and whether it is really possible to earn 95% annual returns without risk. This piece explores the principles of the automated market maker, the specifics of liquidity pools, the concept of Impermanent Loss, and the prospects of the UNI token. It will help you understand the opportunities the platform offers investors and the risks that should be taken into account.

Table of content

Introduction

The world of DeFi (decentralized finance) offers countless opportunities for investors and traders. One of the key players in this space is Uniswap (UNI) — a decentralized cryptocurrency exchange protocol built on Ethereum. Its unique feature is an automated liquidity system that opens new approaches to trading and investing.

But is it really possible to earn 95% annual returns without risk, as is often advertised in online communities? Let’s take a closer look at how Uniswap works, what Impermanent Loss is, and what prospects the UNI token holds.

What is Uniswap and How Does It Work?

Uniswap is a DEX (decentralized exchange) launched in 2018 by programmer Hayden Adams, inspired by the ideas of Ethereum founder Vitalik Buterin.

The core technology behind the protocol is the Automated Market Maker (AMM).

- On centralized exchanges (CEX), liquidity is formed through an order book, where traders place buy and sell orders.

- On DEX, liquidity is created within a liquidity pool. Users add pairs of assets (for example, ETH/USDC) and earn a share of the fees from all transactions that pass through that pool.

This way, Uniswap eliminates intermediaries and ensures trading solely through smart contracts.

How Can You Earn 95% Annual Returns?

On the platform, you can deposit your funds into a liquidity pool. For example, you can contribute equal parts of ETH and USDC. In return, you earn fees from every transaction.

In some cases, Uniswap has shown yields exceeding 95% APR. But it’s important to understand:

- This is a floating rate. Today it may be 95%, but tomorrow it could drop to 30–40%.

- Returns depend on trading volume. The more activity in the pool, the higher the rewards.

- Additionally, Uniswap sometimes incentivizes users by distributing UNI tokens as rewards.

Therefore, claiming 95% annual returns without risk is misleading. These are peak figures rather than actual average yearly earnings.

The Risks: What is Impermanent Loss?

The main risk for liquidity providers is Impermanent Loss.

It arises due to arbitrage opportunities between DEX and CEX:

- Arbitrage traders profit from price differences between exchanges.

- Liquidity providers, meanwhile, suffer losses because the ratio of assets in their pool changes.

However, there is also a positive side: arbitrageurs pay fees, which form the income of liquidity providers. As a result, many still end up in profit.

Is It Worth Investing in UNI Right Now?

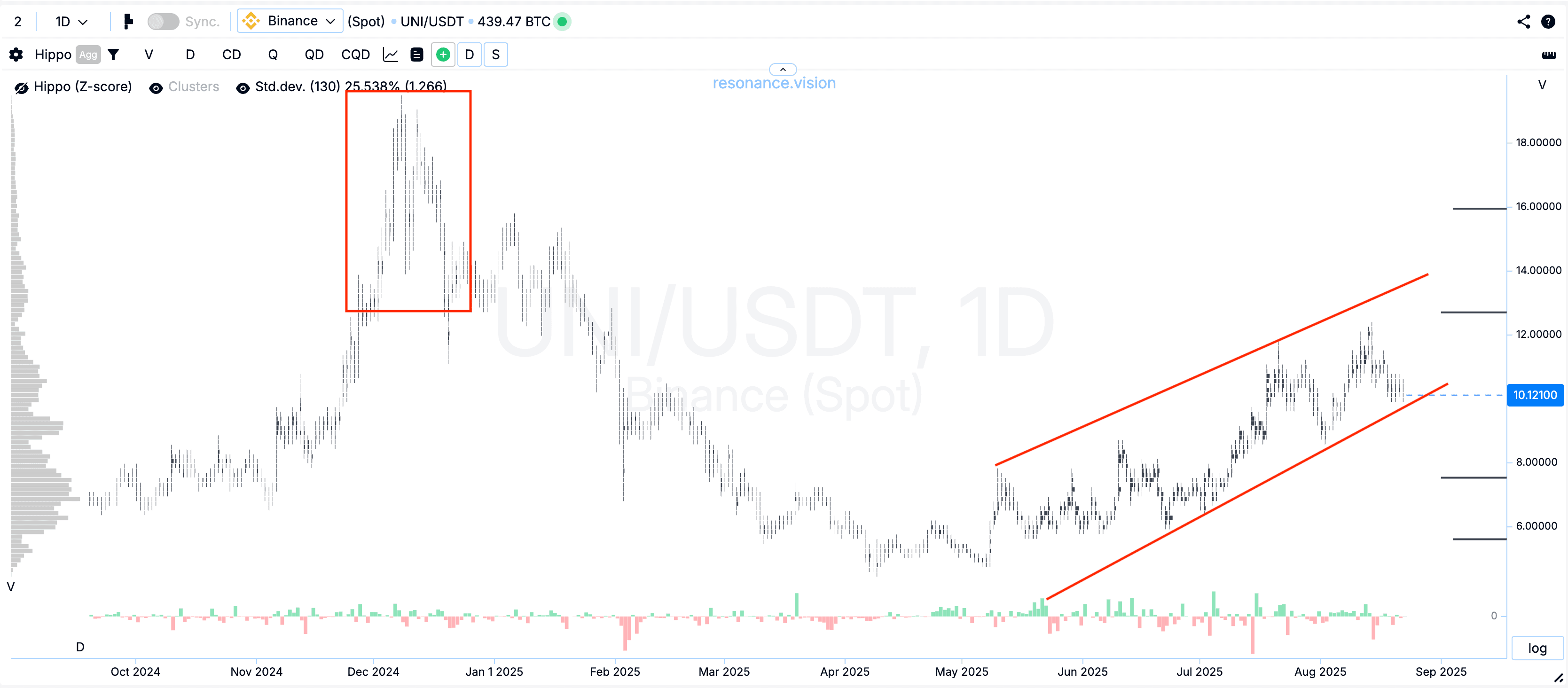

The UNI token has shown a bullish trend following a consolidation phase. Although the market is characterized by high volatility, the project is considered an infrastructural one and has strong long-term potential.

Factors in favor of UNI:

- a stable DeFi user base;

- solid reputation among both institutional and retail investors;

- high liquidity across the market.

Factors against UNI:

- strong dependence on Ethereum;

- competition from other DEX platforms;

- uncertainty in the global regulatory environment.

Conclusion

Uniswap is one of the most successful projects in the world of DeFi, allowing investors to earn from providing liquidity. However, the phrase “95% annual returns without risk” is more of a marketing slogan than a realistic expectation.

For investors, it is crucial to take into account:

- the floating APR rate,

- the risk of Impermanent Loss,

- the volatility of the cryptocurrency market.

Still, for those who understand how DEX mechanics work and are willing to take on the risks, Uniswap can be an attractive way to generate passive income in the decentralized finance space.

Follow new insights in our telegram channel.

No need to invent complex schemes and look for the "grail". Use the Resonance platform tools.

Register via the link — get a bonus and start earning:

OKX | BingX | KuCoin.

Promo code TOPBLOG gives you a 10% discount on any Resonance tariff plan.