VISA integrates Stellar and Avalanche — a signal for crypto investors?

The world of cryptocurrencies is constantly evolving. But some events are not just news — they are major signals. For example, when VISA officially adds support for the Avalanche (AVAX) and Stellar (XLM) blockchains. What does this mean for investors, traders, and the long-term growth of these tokens? Let’s find out.

Table of content

- 01VISA, Stellar, Avalanche and stablecoins: a new crypto infrastructure already reshaping the game

- 02VISA — a marker of trust

- 03The stablecoin market: from $10 billion to $270+ billion

- 04Stellar (XLM): financial infrastructure, not a speculative token

- 05Avalanche (AVAX): a platform for DeFi, subnets, and scaling

- 06How to profit from XLM and AVAX: 3 real-world strategies

- 07Conclusion

This isn’t just a “headline-worthy” announcement, but a long-term infrastructural signal. VISA has officially added support for two new blockchains — Stellar and Avalanche. Alongside existing support for Ethereum and Solana, these are now four key crypto networks integrated into a global payment giant.

VISA, Stellar, Avalanche and stablecoins: a new crypto infrastructure already reshaping the game

There’s a lot of “noise” in crypto — but there are also defining events that shape the industry’s future for years to come. One of those events just happened, almost without much publicity. VISA has integrated two more blockchains — Stellar (XLM) and Avalanche (AVAX) — into its payment system.

And this is official information from VISA’s website, not rumors or speculation.

At first glance, it may seem minor. But dig deeper and it’s an infrastructural breakthrough that opens the door to legal, scalable, and everyday use of cryptocurrencies.

VISA — a marker of trust

Let’s not forget:

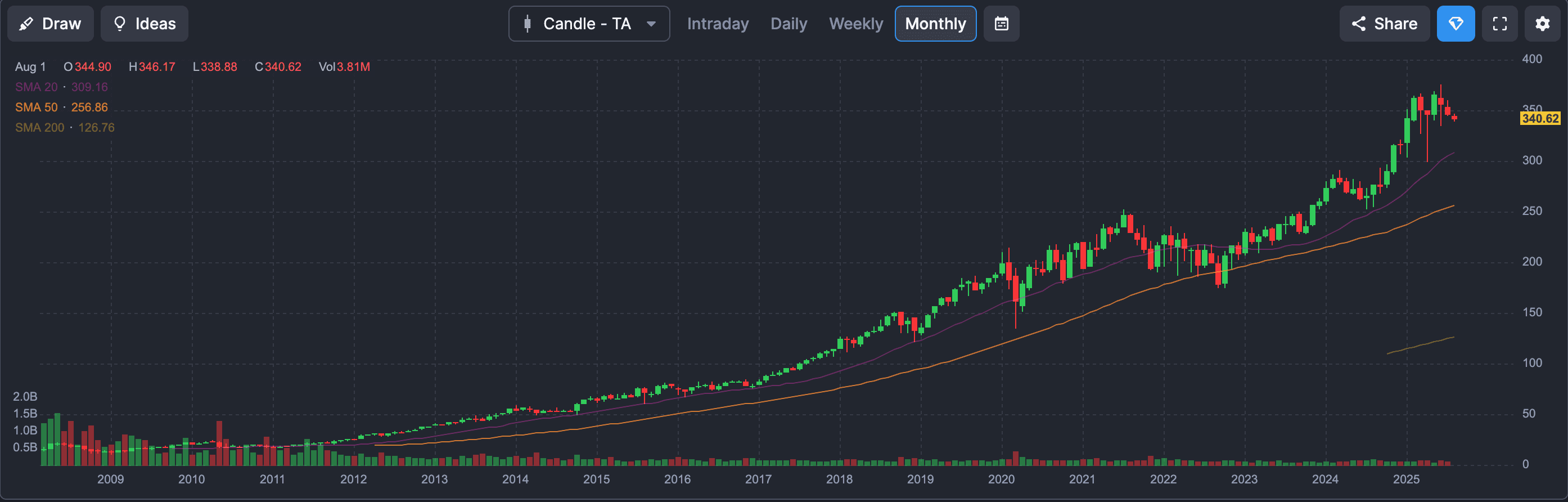

In 2012, VISA stock was worth around $30.

In 2025 — it’s around $345.

That’s +1000% in 10 years. And the reason is simple: the company integrates technologies earlier than others. The same is happening with crypto now.

If you’re investing in crypto not “because of hype” but based on institutional integration — this is one of those moments.

VISA and cryptocurrencies: not the first step, but a key stage of development

At the time of the news, the company already supported Ethereum and Solana. Now it’s adding Stellar and Avalanche. Thus, four major blockchains have become part of VISA’s payment infrastructure.

This means VISA is no longer “experimenting with crypto.” It is integrating it as a tool for global payment development.

Yes, the share of crypto in VISA’s total transaction volume is currently less than 1%. But that figure is not a sign of failure — it’s a sign of early-stage adoption. The infrastructure is already in place. Now all it needs is time and regulatory formalization.

It’s worth mentioning the Genius Act — a legislative initiative that became another catalyst for the stablecoin market. On the back of this bill’s discussion, many major players, including banks and payment systems, began actively testing stablecoin integrations.

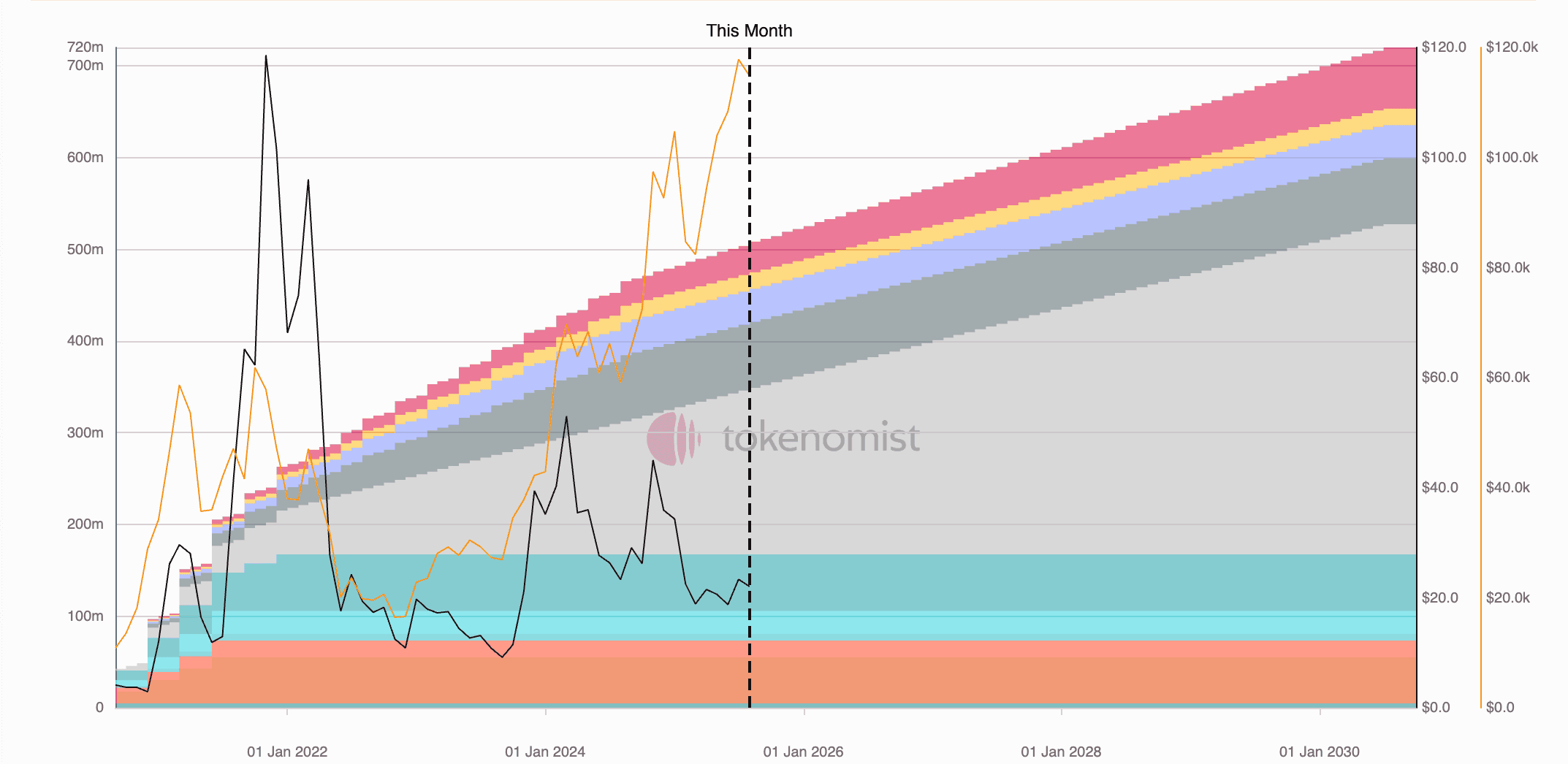

The stablecoin market: from $10 billion to $270+ billion

Let’s take a look:

- In 2020, the stablecoin market capitalization was around $10 billion

- In 2025, it’s already over $270 billion

What’s important is that stablecoins are:

- A bridge between fiat and crypto

- Used for international settlements, B2B transfers, and digital payments

- An asset that VISA is working with

Stellar (XLM): financial infrastructure, not a speculative token

Launch year: 2014

Goal: To build a global network for fast and cheap international payments + tokenize real-world assets (funds, bonds, CBDCs)

Key features:

- Stellar is not a centralized company. There are no shareholders, no “profit targets.”

- Transaction fees are paid in XLM, creating stable, organic demand

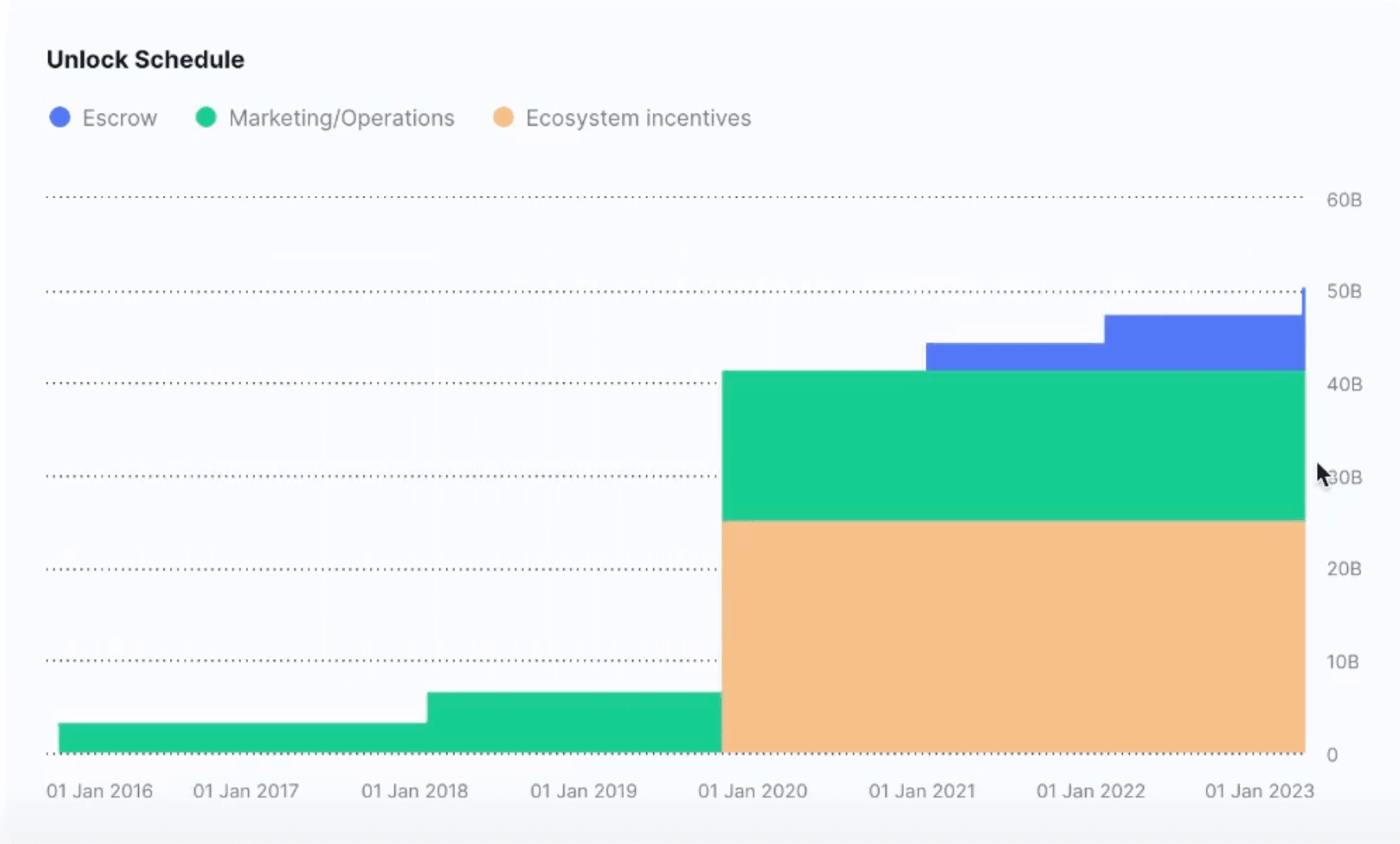

- Token supply is fully in circulation. The last unlock was in 2023.

What does this mean for investors?

- No inflation risk from future emissions

- Demand is driven by real transactions

- The network is suitable for institutional and governmental use

Price behavior:

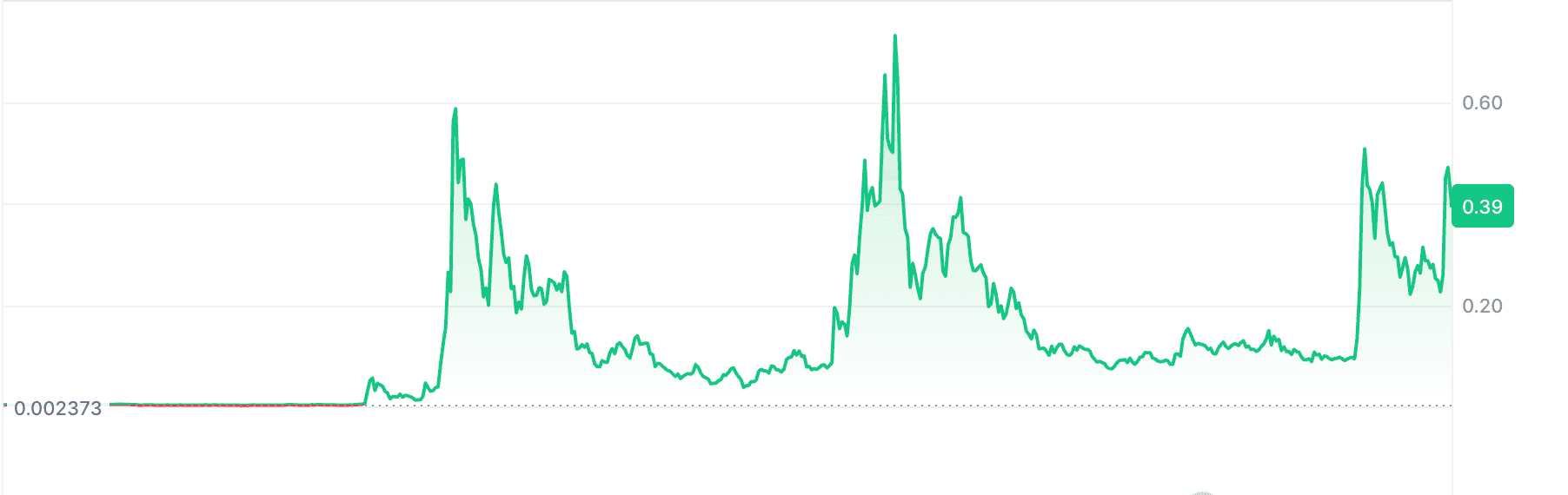

XLM has gone through multiple cycles of growth and decline, but has not set new all-time lows.

Current state: balance-seeking phase after heavy selling.

This suggests: a potential accumulation period before a new upward trend.

Avalanche (AVAX): a platform for DeFi, subnets, and scaling

Launch year: 2020

Goal: To create a blockchain capable of scaling, supporting DeFi, DApps, and private networks

What makes AVAX stand out:

- Transaction fees are paid in AVAX

- Every entity that launches a custom subnet pays fees and maintains the infrastructure

- Part of the token supply is burned, creating a deflationary effect

Token supply:

- 70% is already in circulation

- The rest will be gradually unlocked by 2030

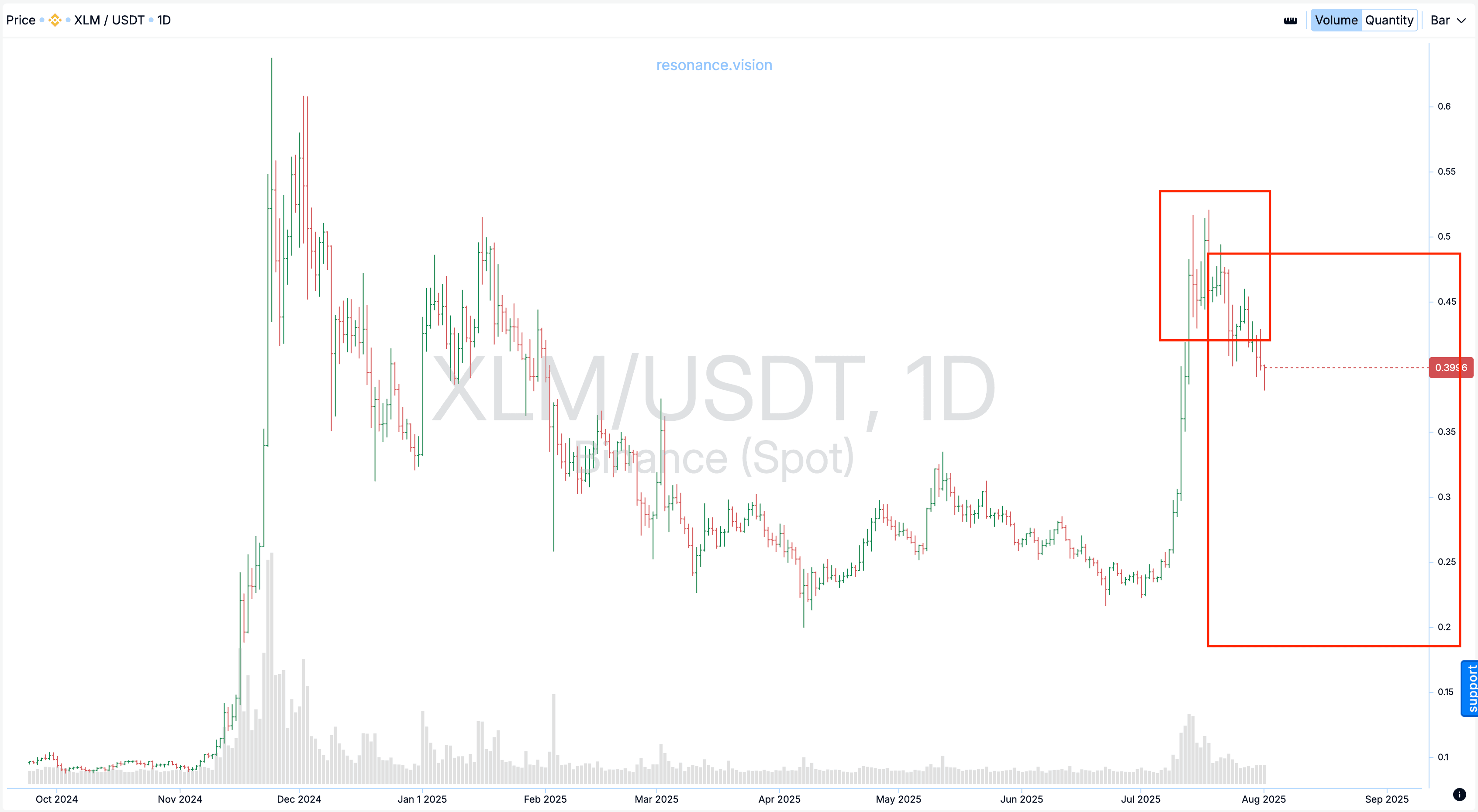

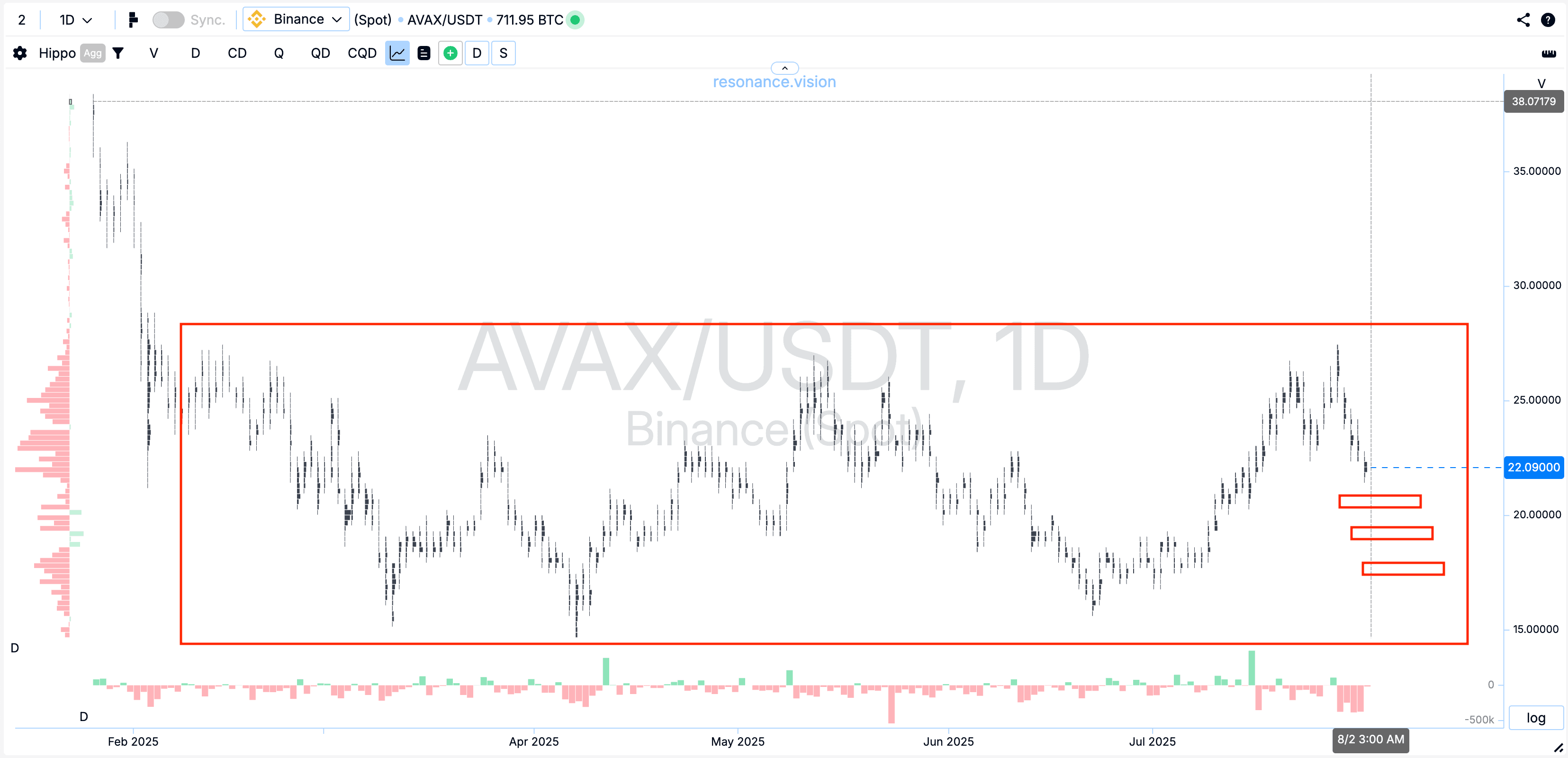

Price behavior:

AVAX is known for its high volatility.

In 2021, it hit $123 → in 2022 dropped to $9 → currently fluctuates between $20–50.

The token is in a wide sideways range — an ideal setup for grid bots.

How to profit from XLM and AVAX: 3 real-world strategies

1. DCA (Dollar-Cost Averaging)

A strategy of entering gradually. Suitable for those who don’t want to catch the bottom but believe in long-term growth.

This approach works best with XLM, given its stability, completed emission, and organic demand.

If you’re ready to wait — XLM + DCA + staking → an optimal combo.

2. Staking

- XLM: ~5% annual yield (via Viraxy)

- AVAX: 4–6%, with a wider choice of validators

- This provides extra income and helps support the network.

3. Grid bots

This method is perfect for AVAX due to its volatility.

Algorithmic trading within a range is one of the most effective ways to profit from AVAX’s sideways movements and deep pullbacks.

Conclusion

The integration of Stellar and Avalanche into the VISA system is not just news — it’s a strategic signal for the crypto market. It’s further proof that the future of finance lies in the fusion of traditional systems and decentralized technologies.

Follow new insights in our telegram channel.

No need to invent complex schemes and look for the "grail". Use the Resonance platform tools.

Register via the link — get a bonus and start earning:

OKX | BingX | KuCoin.

Promo code TOPBLOG gives you a 10% discount on any Resonance tariff plan.