How PUMP groups work

Find out what really lies behind cryptocurrency pumps: who profits, how the illusion of growth is created, and why most participants in pump groups fall into the trap. A real-life example reveals the mechanics of artificial price acceleration, the role of organisers, and how to spot preparations for a pump in advance using cluster charts and delta analysis. This material will help you understand the inner workings of the cryptocurrency market and teach you to recognise manipulation before it drags you into a losing game

Table of content

This is an article in which I will reveal to you the mechanics behind cryptocurrency pump formations. So read it through to the end.

But first, let’s talk a bit about what this Pump and Dump scheme actually is.

What is Pump and Dump?

Pump and dump in cryptocurrencies is simply a sharp increase in the asset’s price followed by a severe collapse.

This scheme is far from new; it’s been around for several decades. The infamous Jordan Belfort (and not only him) carried out similar manipulations back in the 1990s. Mostly, such manipulations were done with so-called “penny stocks.”

Penny stock refers to shares of companies with low market capitalization that are traded at low prices.

Initially, these cheap stocks were bought by the scheme organizers and then recommended to inexperienced market participants, fueling interest in the asset. As we know, increased demand plus scarcity often leads to a rise in price. After that, the stocks were simply dumped on the market, causing a sharp price collapse…

Such a simple strategy has been enriching organizers and leaving trusting investors at a loss for a long time. Even back then, such fraud could land you in prison — which eventually happened to Belfort and his associates.

But we are dealing with the cryptocurrency market, which is practically unregulated, leaving a wide space for carrying out such crypto pump and dump schemes.

Let’s examine a real-life case of pump organization.

Cryptocurrency Pump

Most likely, many of you have come across so-called crypto pump groups. These are channels or communities, usually on Telegram. So how does it work?

- The community organizers set a date when they will allegedly pump an asset.

- Subscribers to this channel, possibly having paid money for access to this “insider” information, are expected to earn from the asset’s rise.

- Organizers send out the asset’s ticker and exchange — these are the so-called crypto pump signals where the event will take place.

- Community participants rush to open their terminals and buy the coveted asset in hopes of making a profit.

But — spoiler alert — the only ones profiting from crypto pumps are the organizers, and maybe a couple of lucky ones who manage to catch the wave.

What it actually looks like

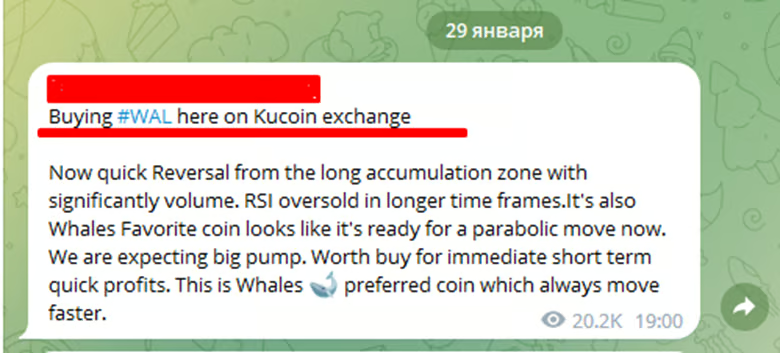

I’m subscribed to one channel. There’s typical TA analysis or attempts to capitalize on news events. But sometimes they post signals like this one:

Let’s look at the date and time of the post: January 29 at 19:00.

Now let’s check how the asset looked just before this post on a standard candlestick chart, literally one minute before the publication:

Also, let’s take a look at the highlighted zone on the chart. I’ll explain what happened there later.

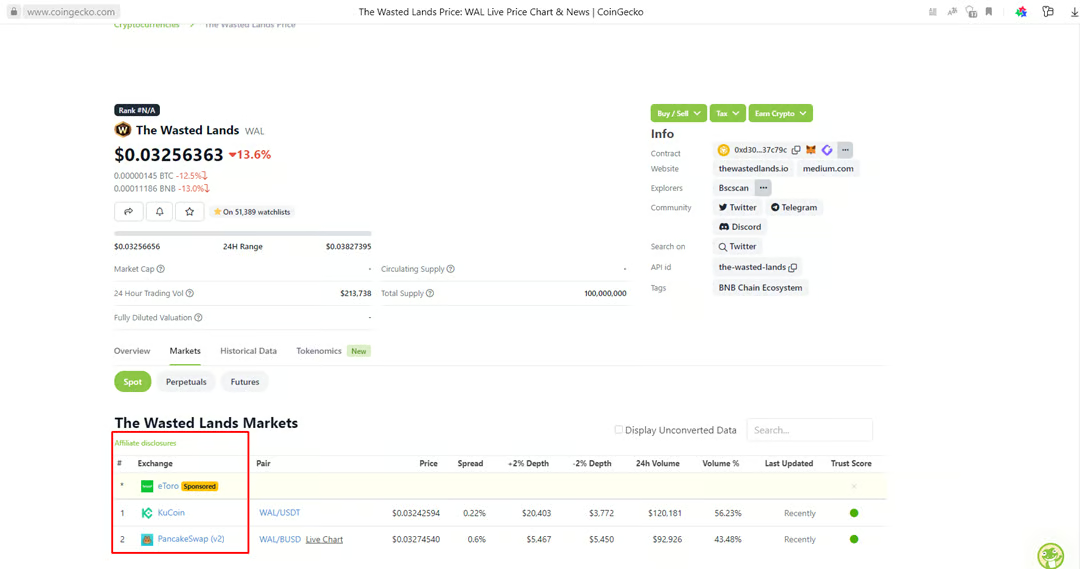

Now, let’s see what this ticker actually is:

A true shitcoin: low market cap, small trading volume concentrated on just two exchanges, one of which is a DEX.

So what happens after the post is published? The asset skyrockets. At its peak, the growth reached 1700%. Not bad at all.

You’d think, what’s the harm? Nice folks sharing a cool idea.

But now let’s return to that zone I mentioned earlier. This time, don’t look at those uninformative candles, but at the cluster chart — let’s x-ray those red and green sticks and examine the deltas, where buying and selling took place.

Starting from early December, there was activity on the asset. Even if I hadn’t highlighted these areas, you’d notice the volume spikes.

In delta mode, the picture is even more vivid! From mid-December to mid-January, there were clear buy-ins during volume spikes (visible from the green delta bars on the lower histogram).

And I think by now, you understand where I’m going with this. These so-called “altruists” bought up the asset right at the bottom. Then, by feeding the idea to their flock, they made a handsome profit.

Conclusion

The scheme is simple: accumulate an asset at the bottom, then announce a pump is coming. But what are crypto pumps really? – A sharp price increase. And how does this growth occur? – Through market buy orders. Market orders, as we know, move the price by executing the limit orders in the order book. At some point, supply dries up, and the upward movement continues almost without pause. The audience (and it’s not small) of such groups has little understanding of market mechanics and blindly follows the channel author’s recommendation.

Perhaps there was no conspiracy at all. And everything that happened was just a series of coincidences.

The point of this story is that you can find “pumps” on your own and in greater numbers. You have access to Resonance tools and free education for that.

Follow new insights in our telegram channel.

No need to invent complex schemes and look for the "grail". Use the Resonance platform tools.

Register via the link — get a bonus and start earning:

OKX | BingX | KuCoin.

Promo code TOPBLOG gives you a 10% discount on any Resonance tariff plan.