CHZ +30.7% (Directional Strategy Resonance)

A comprehensive analysis of the asset with a focus on clusters, delta, and supply/demand balance. Entry occurs when local shortages occur, and exit occurs when buyer initiative weakens and counter-pressure increases.

Table of content

Coin: CHZ/USDT

Risk: Medium

Understanding Level: Beginner

Reasons to Enter

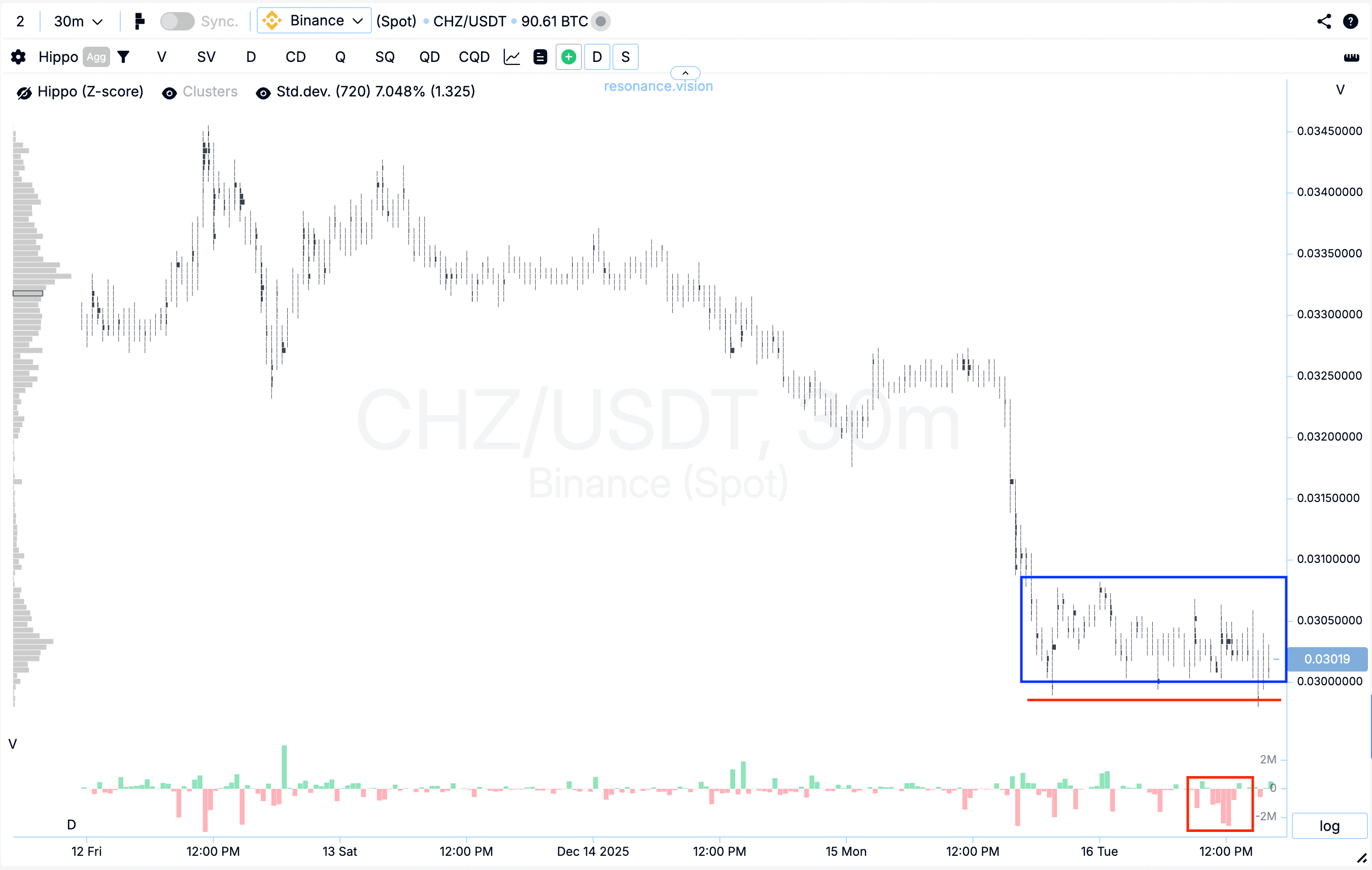

Cluster Chart: Large, high-volume clusters (blue rectangle) began to form during the decline, with significant selling volumes occurring within them. However, despite this pressure, the price stopped responding to the selling and did not break the local low (red rectangle and line). This market reaction indicates signs of a local deficit and a gradual easing of selling pressure.

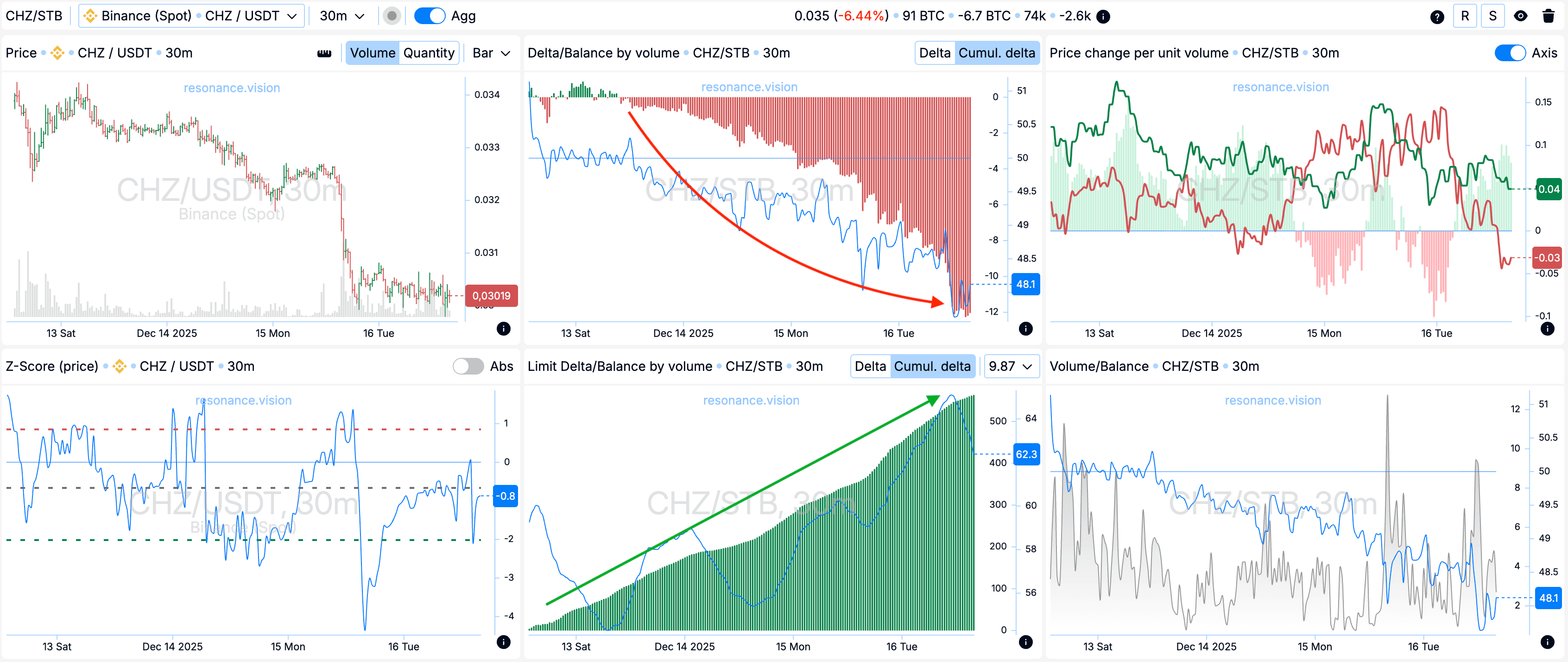

In the Dashboard

Delta / Volume Balance and Limit Delta: When analyzing aggregated data for all pairs and exchanges, we see confirmation of the pattern noted in the cluster chart. During the period under review, the market was dominated by increasing market sell volumes, which is clearly visible in the cumulative delta histogram (red arrow).

At the same time, there was an increase in buyer activity for limit orders – the number of limit buy orders increased, as reflected in the limit delta histogram (green arrow). This structure indicates participants’ willingness to absorb incoming market selling volume to the limit, forming the local support mentioned above.

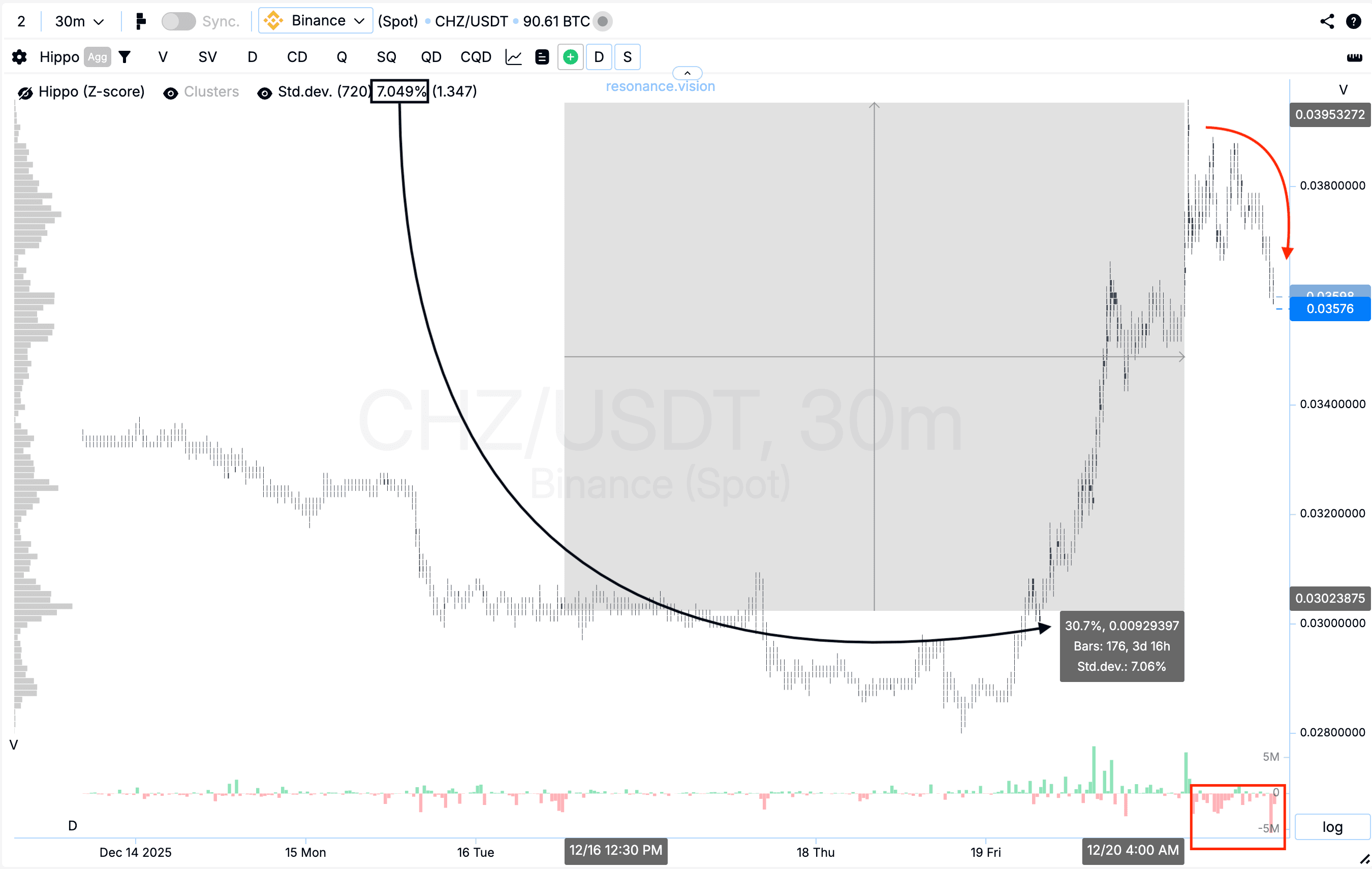

Reasons for exit

Cluster chart: From the entry point, the price rose by 30.7%, which corresponds to more than four standard price movements for this asset. After this, a significant pullback formed, within which market selling began to dominate (rectangle and arrow). This dynamic indicates a possible shift in the initiative toward sellers. In the face of counter pressure, further holding the position would have increased the risk, so taking profits at this point seemed the most rational and prudent decision.

Conclusion

This setup clearly demonstrates how the combination of cluster analysis and aggregated volume indicators allows for the timely detection of shifts in the supply and demand balance.

At the entry stage, the market showed signs of localized shortage: sellers continued to apply pressure with market volume, but the price stopped responding with a decline, indicating the presence of localized shortage.

The subsequent move was successfully realized, but the appearance of a pullback amid increased market selling was the first sign of weakening buyer initiative. Under these conditions, locking in the position allowed the gains to be maintained and avoided increased risk.

The analysis highlights the importance of assessing not only volumes, but also their performance relative to price—this is what gives a trader an objective advantage in decision-making.

Follow new insights in our telegram channel.

No need to invent complex schemes and look for the "grail". Use the Resonance platform tools.

Register via the link — get a bonus and start earning:

OKX | BingX | KuCoin.

Promo code TOPBLOG gives you a 10% discount on any Resonance tariff plan.