LINK +65.4% (Resonance Directional Strategy)

A practical breakdown of a long trade through the mechanics of supply and demand. Using a cluster chart and aggregated metrics, it shows how to identify selling inefficiency, confirm the involvement of a limit buyer, and justify the entry.

Table of content

This breakdown is for those who are learning to find trading ideas through the mechanics of supply and demand. The foundation is the analysis of cryptocurrency cluster charts with an emphasis on traded volumes and limit activity: exactly what supply and demand analysis reveals.

The coin was selected via a crypto screener on the 30-minute timeframe. Next, the logic was simple: market selling prevails, but the price does not обновляет lows and begins to recover. When selling pressure is present but there is no result, selling loses effectiveness, and this often means that demand absorbs supply. In such conditions, it is easy to see signs of a local deficit and get a rationale for entry.

And one more thing: while scanning the market, a similar picture repeated across a large number of coins. This suggested that it was a broader market condition, which strengthened confidence in the decision to open a long position.

Reasons for entry

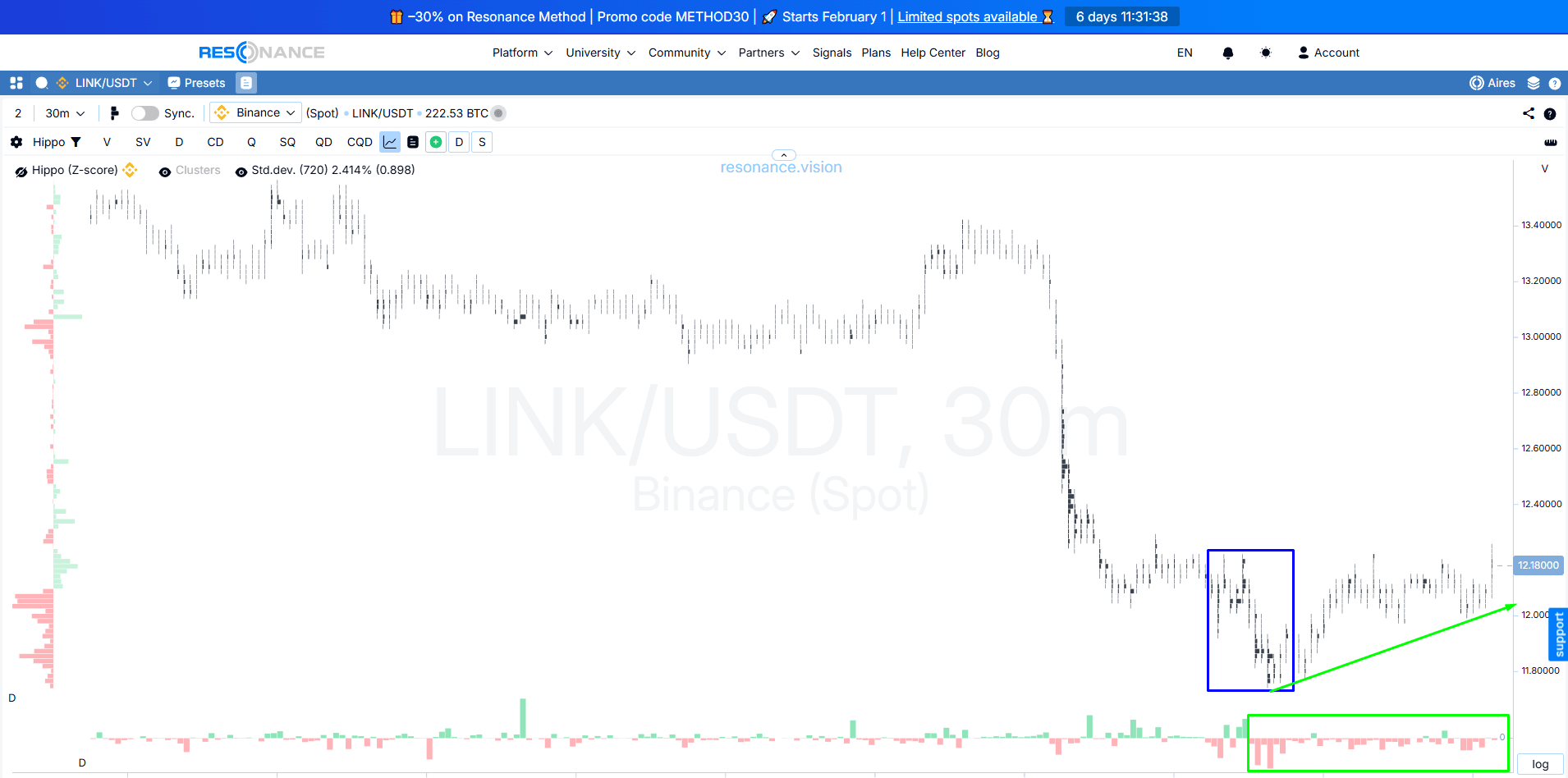

1. Cluster chart:

In the balance-search phase, noticeable volume accumulations began to form at the bottom of the cluster bars (blue rectangle).

Next, we see that selling clearly prevailed (green rectangle), and despite strong pressure, the price stopped declining. On the contrary, it recovered: local lows were not обновлялись (green arrow). This indicated that a limit buyer stepped in and held the price.

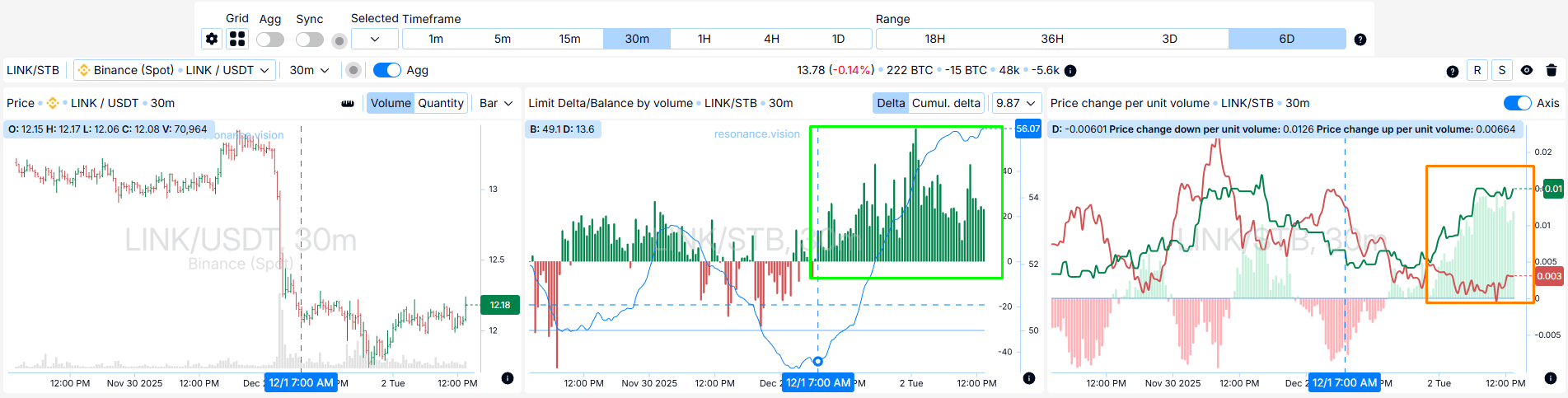

2. Dashboard: confirmation with aggregated metrics

Limit Delta/Volume Balance:

The predominance of limit buy orders (green rectangle) based on aggregated data from all exchanges indicated steady passive interest from buyers. Such activity forms strong support and increases the probability of further price growth.

Price change per unit of volume:

The charts of the effectiveness of market orders from buyers and sellers diverged in favor of buyers (orange rectangle), which indicated an increase in the effectiveness of buying.

Any trading idea must be executed within a clear risk management plan. The position size was calculated based on the acceptable loss per trade — 1% of the deposit, and the stop-loss was placed immediately upon entry, beyond the zone of ineffective selling.

Reasons for exit

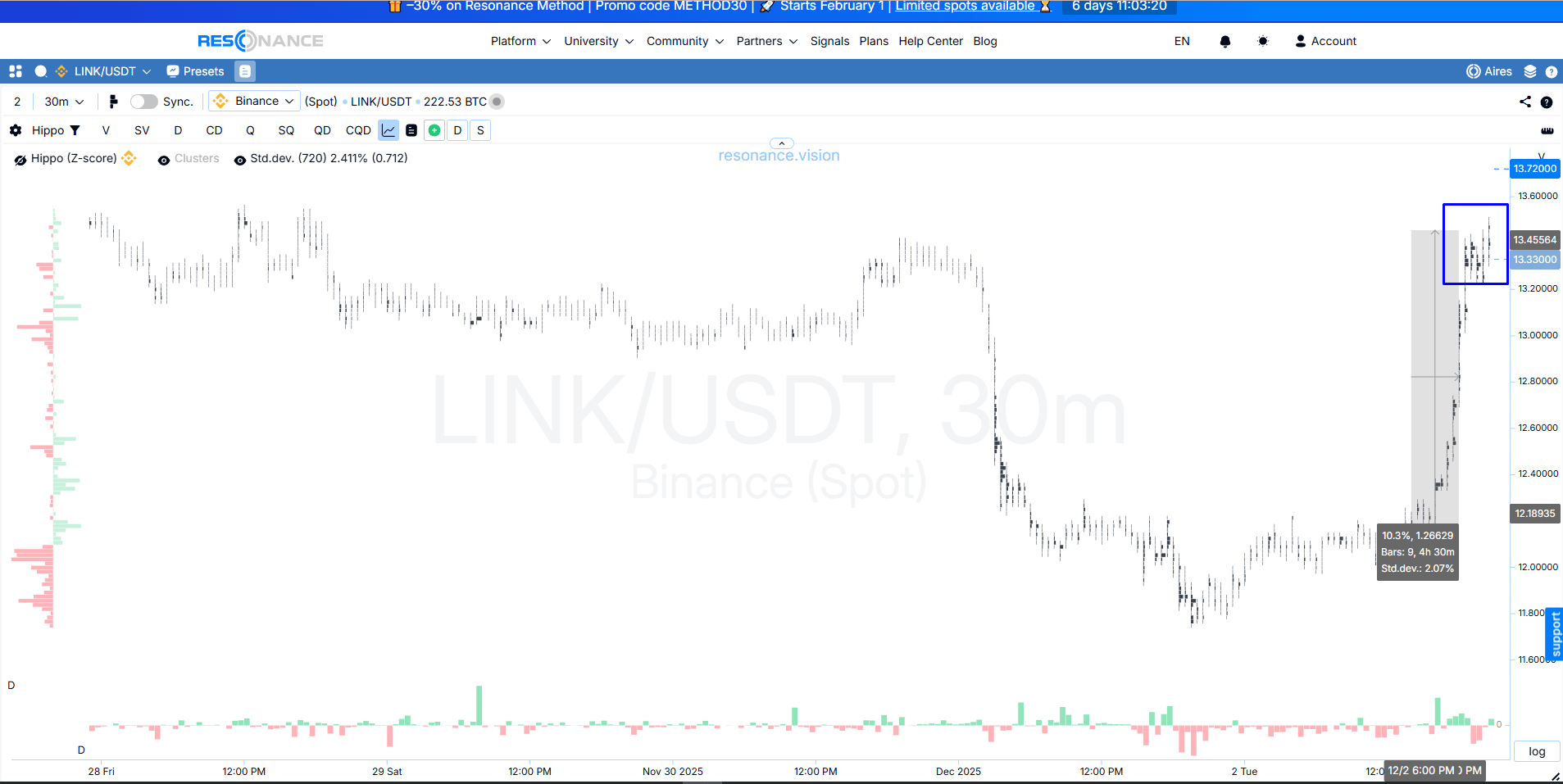

1. Cluster chart: a stop in the price move

A deficit was formed and the price showed an impulsive breakout upward. From the entry point, the price rose by more than 10%, and within a day this is a significant price move. Volume cluster accumulations also began to form (blue rectangle). This is a sign of a stop in the price move and a possible reversal.

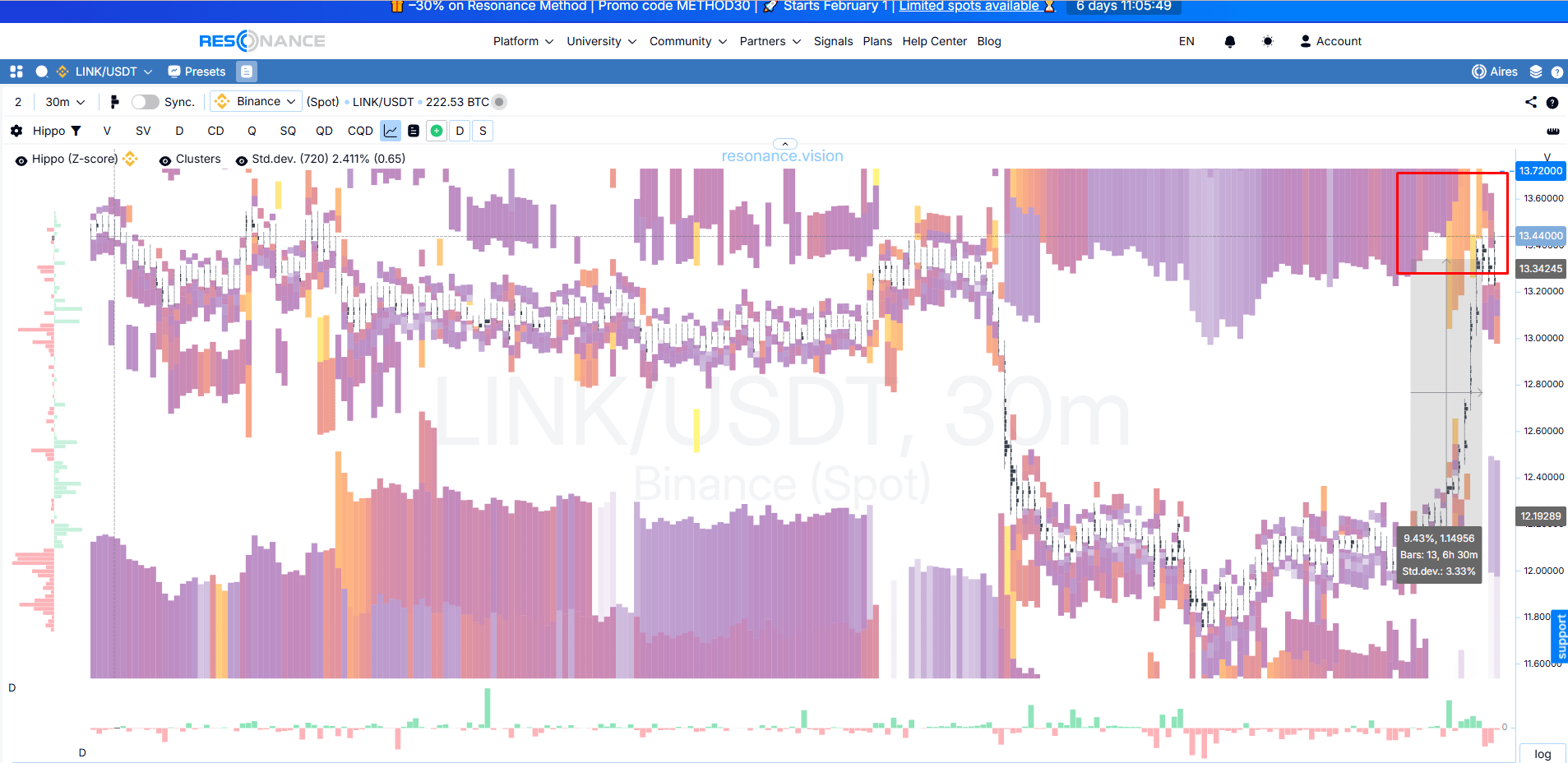

2. Heatmap: limit resistance

On the heatmap, a strong predominance of limit sell orders is recorded (red rectangle). For now, it is difficult to understand whether the buyer will have enough strength to pass such an obstacle, so closing the position is quite logical.

The exit was done a bit prematurely, and it was still possible to earn well.

Trade conclusion:

This is another excellent example of a position opened based on volume analysis. The position was opened based on signs of a deficit: market sells dominated, but the price began to rise slowly, local lows were not обновлялись. All of this was accompanied by strong limit buyer activity. Then, after the price increase, a decision was made to close the position on signs of a surplus: predominance of seller limits and a stall in the move.

Follow new insights in our telegram channel.

No need to invent complex schemes and look for the "grail". Use the Resonance platform tools.

Register via the link — get a bonus and start earning:

OKX | BingX | KuCoin.

Promo code TOPBLOG gives you a 10% discount on any Resonance tariff plan.