SYN +22.3% (Directional Strategy Resonance)

An example of a trade where, despite market selling dominating, the price stopped declining. Cluster analysis, aggregated data, and volume absorption limit allowed us to objectively determine the entry point and promptly capture the move.

Table of content

Coin: SYN/USDT

Risk: medium

Level of understanding: beginner

Reasons for entry

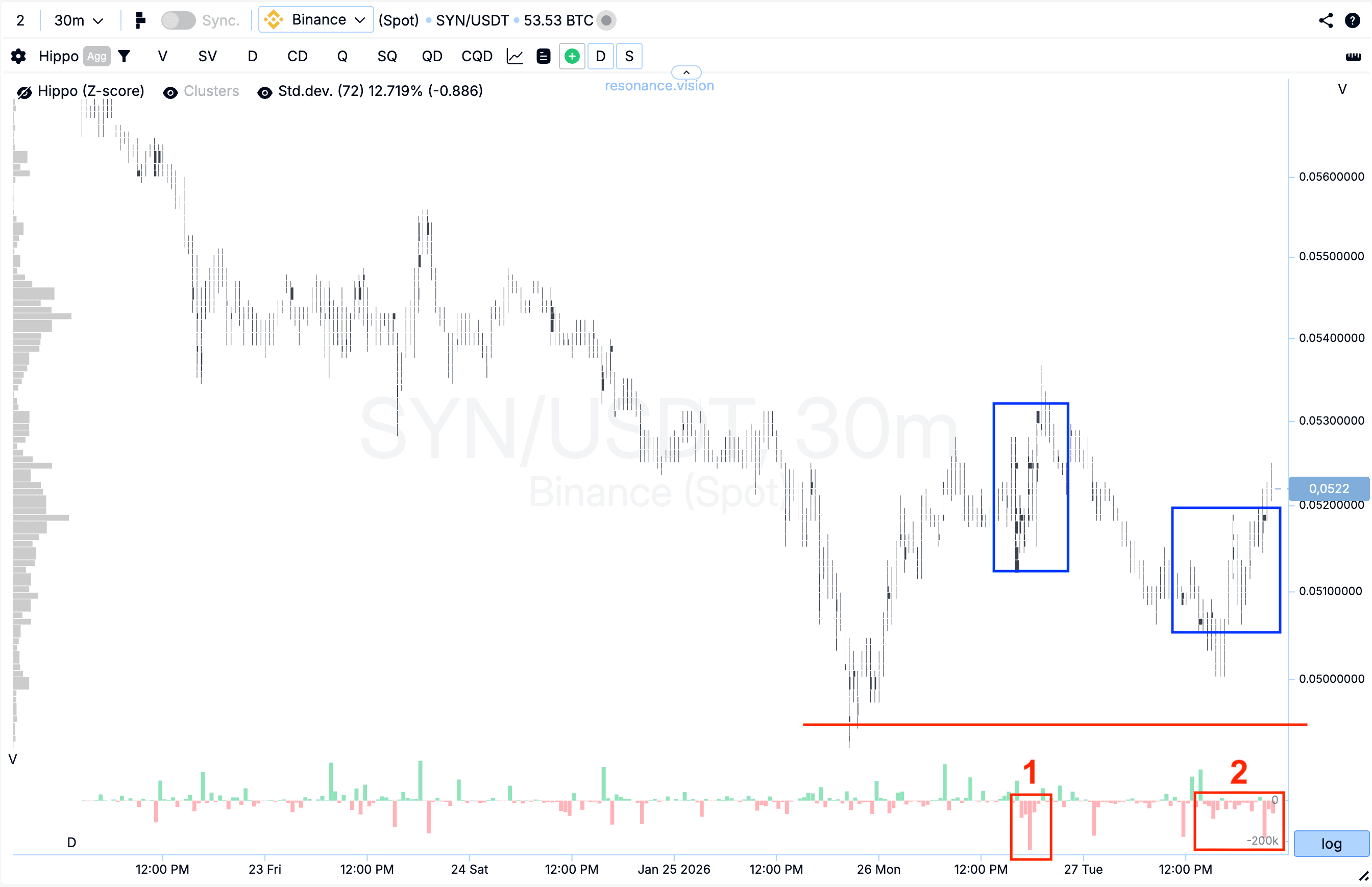

Cluster chart: In the zone of local sideways consolidation, large volume clusters began to form (blue rectangles). During the first attempt, there was a significant dominance of market sell orders, however the price showed almost no reaction to this volume (red rectangle №1).

After that, a minor pullback occurred; pressure from market sellers persisted, but on the subsequent sell orders the price started to gradually rise (red rectangle №2), while the local low was not updated (red line).

Such a price reaction to volume indicates signs of a local deficit and a decrease in seller efficiency: volume continues to come into the market, but its impact on price noticeably weakens.

In the Dashboard

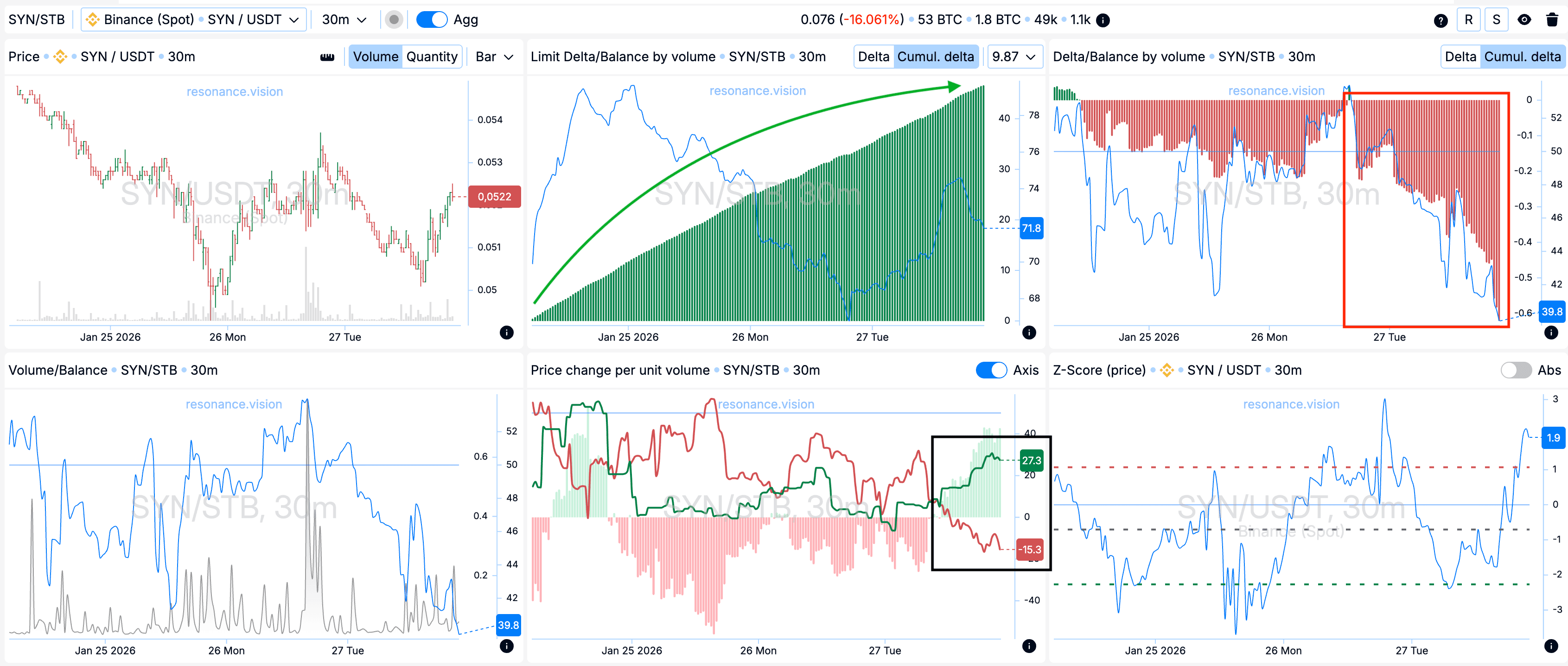

Delta / Volume balance and limit delta: Analysis of aggregated data across all pairs and exchanges fully confirms the observations from the cluster chart. During the analyzed period, the market was under pronounced pressure from market sell orders, which is clearly visible on the cumulative delta histogram (red rectangle).

At the same time, limit buy orders were consistently accumulating, reflected by the growth of the cumulative limit delta (green arrow).

Despite the dominance of market sells, the price did not show further decline. This indicates the presence of stable limit demand that absorbed the entire incoming market sell volume and formed local support in this range.

Price change per unit of volume: Additionally, it can be seen that the effectiveness of market orders shifted in favor of buyers (black rectangle), indicating an increase in buying efficiency.

Reasons for exit

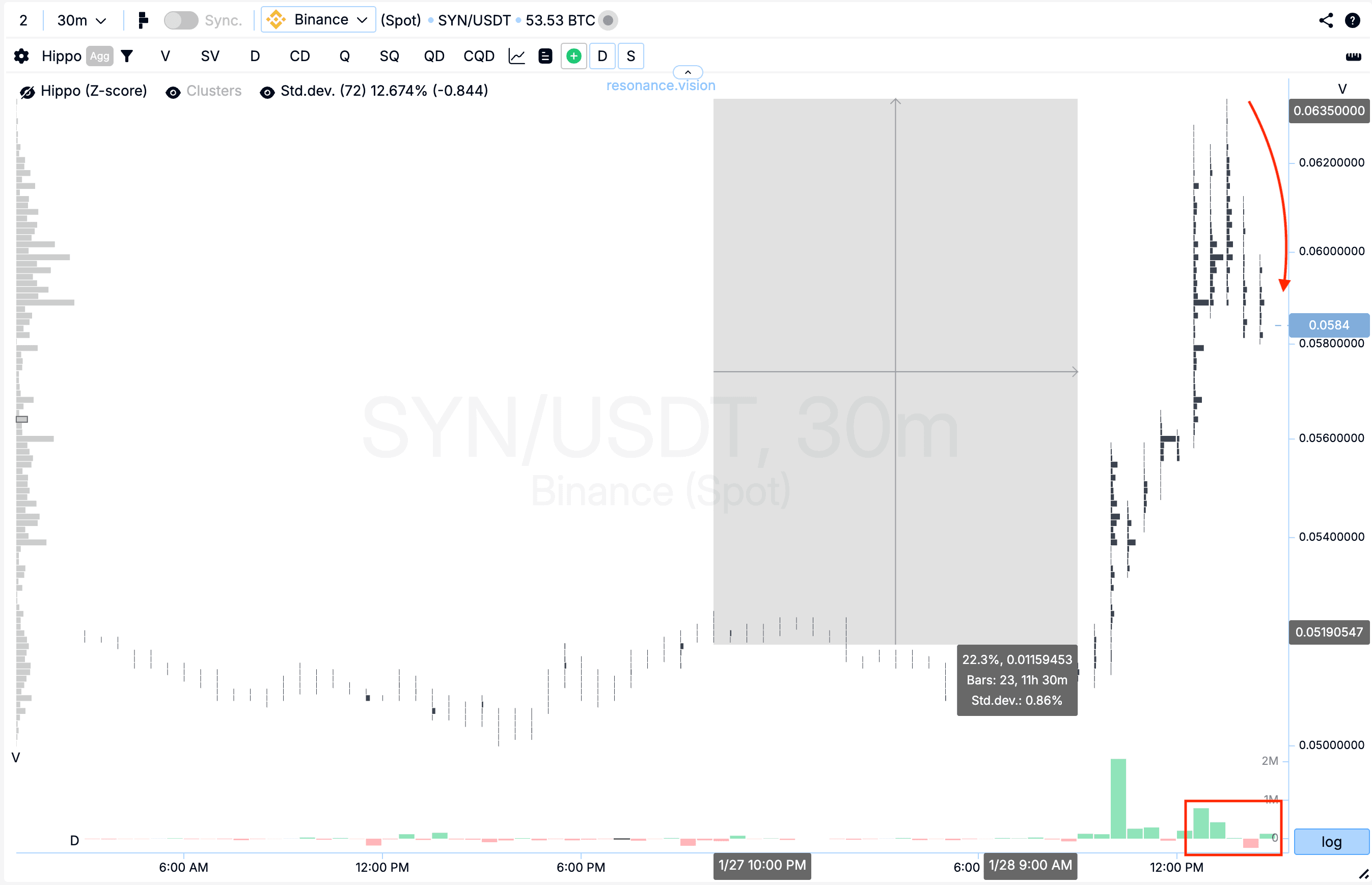

Cluster chart: From the entry point, the price increased by 22.3%, which qualifies as a relatively strong price movement. Against the background of this rise, volatility increased noticeably, after which a pronounced pullback formed.

Within this movement, buy volumes began to gradually decrease, giving way to dominant market sell orders (rectangle and arrow). Such dynamics indicate a shift of initiative toward sellers.

Under these conditions, further holding of the position became less justified from a risk perspective, therefore taking profit appeared to be a logical and balanced decision.

Conclusion

This analysis clearly shows that strong and high-quality moves are formed not because of volume itself, but because of the price reaction to that volume. Despite the dominance of market sell orders, the price stopped updating lows, and the subsequent accumulation of limit demand led to the formation of local support and a further upward move.

Such situations occur quite often in the market, however the key task of a trader is not to look for volume itself, but to assess its effectiveness. When volume continues to enter the market but the price stops reacting to it, this often becomes the first signal of a shift in market initiative. It is precisely this objective approach that allows trades to be built with clear logic and controlled risk.

Follow new insights in our telegram channel.

No need to invent complex schemes and look for the "grail". Use the Resonance platform tools.

Register via the link — get a bonus and start earning:

OKX | BingX | KuCoin.

Promo code TOPBLOG gives you a 10% discount on any Resonance tariff plan.