ZK +68.5% (Directional Strategy Resonance)

An analysis of the ZK/USDT pair demonstrates how volume and delta can reveal the true balance of supply and demand in the market. The formation of a W-shaped formation and the ineffectiveness of selling indicate a weakening of selling pressure and the emergence of a localized shortage. Confirmation through aggregated Dashboard data strengthens the signal—limit buys have begun to actively accept market sells, forming the basis for a rally. This example perfectly demonstrates why it’s important to analyze not just price, but the impact of this volume on price movement.

Table of content

Coin: ZK/USDT

Risk: Medium

Experience Level: Beginner

Entry Reasons

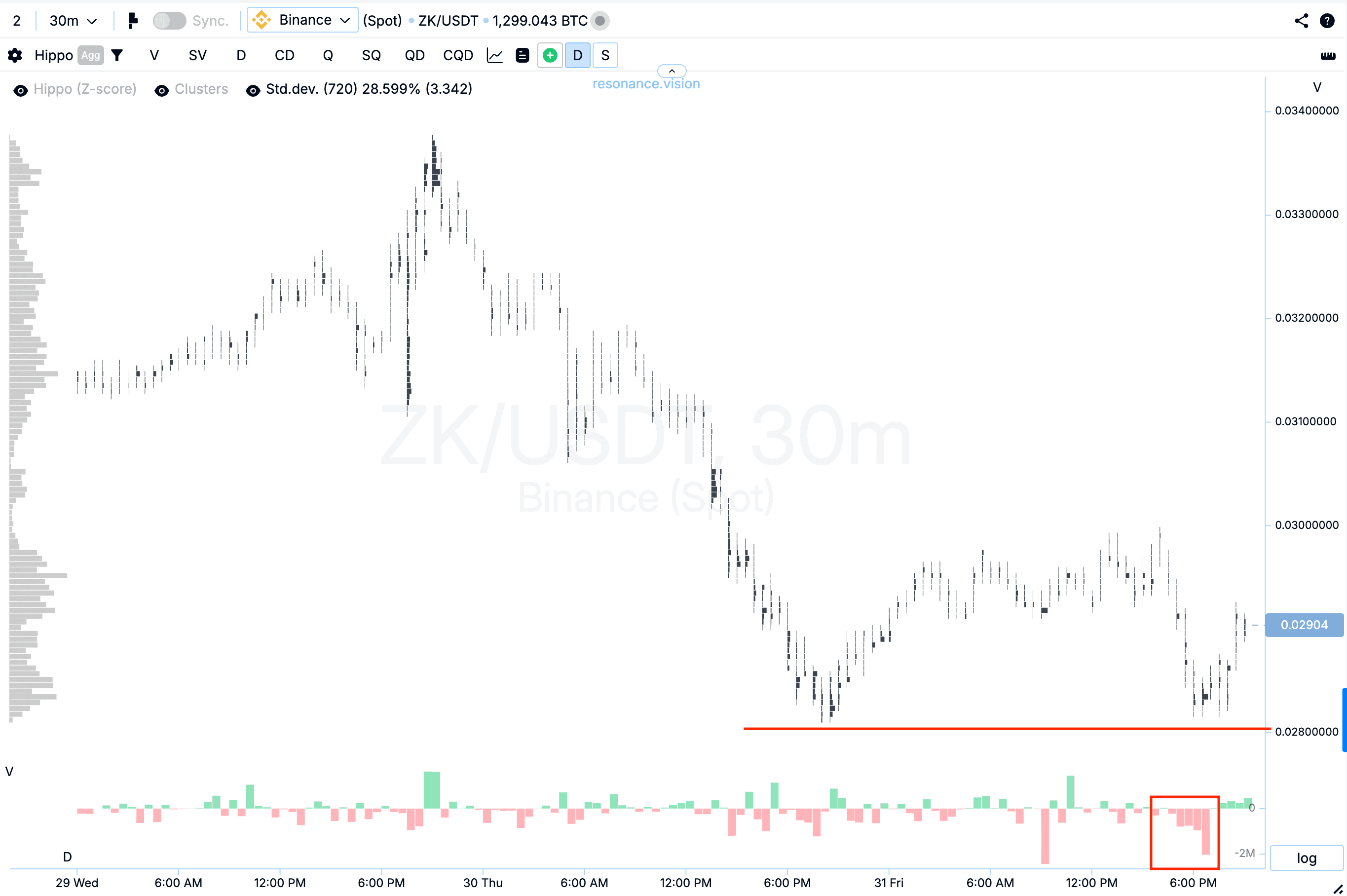

Cluster Chart: A W-shaped formation appeared, in which significant sell volumes (red rectangle and line) did not lead to a new local low. This dynamic indicates the presence of a local supply shortage and weakening selling pressure.

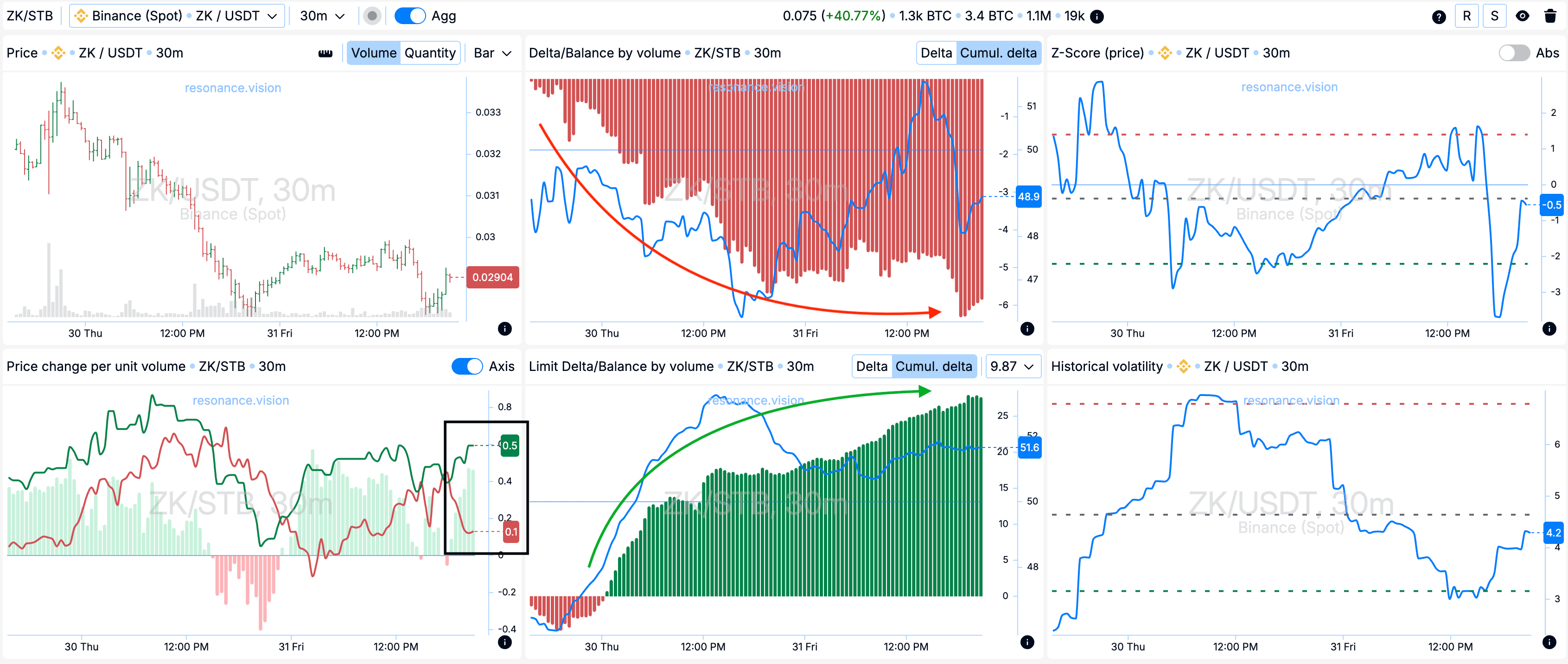

Dashboard

Delta / Volume Balance and Limit Delta: Aggregated data across all pairs and exchanges confirm the picture seen on the cluster chart. During this period, sell volumes dominated — clearly visible on the cumulative delta histogram (red arrow). At the same time, limit orders showed a noticeable increase in buy-side activity (green arrow), indicating that participants were ready to absorb all market sell volume with limit bids, thus forming local support.

Price Change per Volume Unit: The efficiency of market orders’ impact on price began to shift in favor of buyers (black rectangle), serving as an additional argument for entering a long position.

Exit Reasons

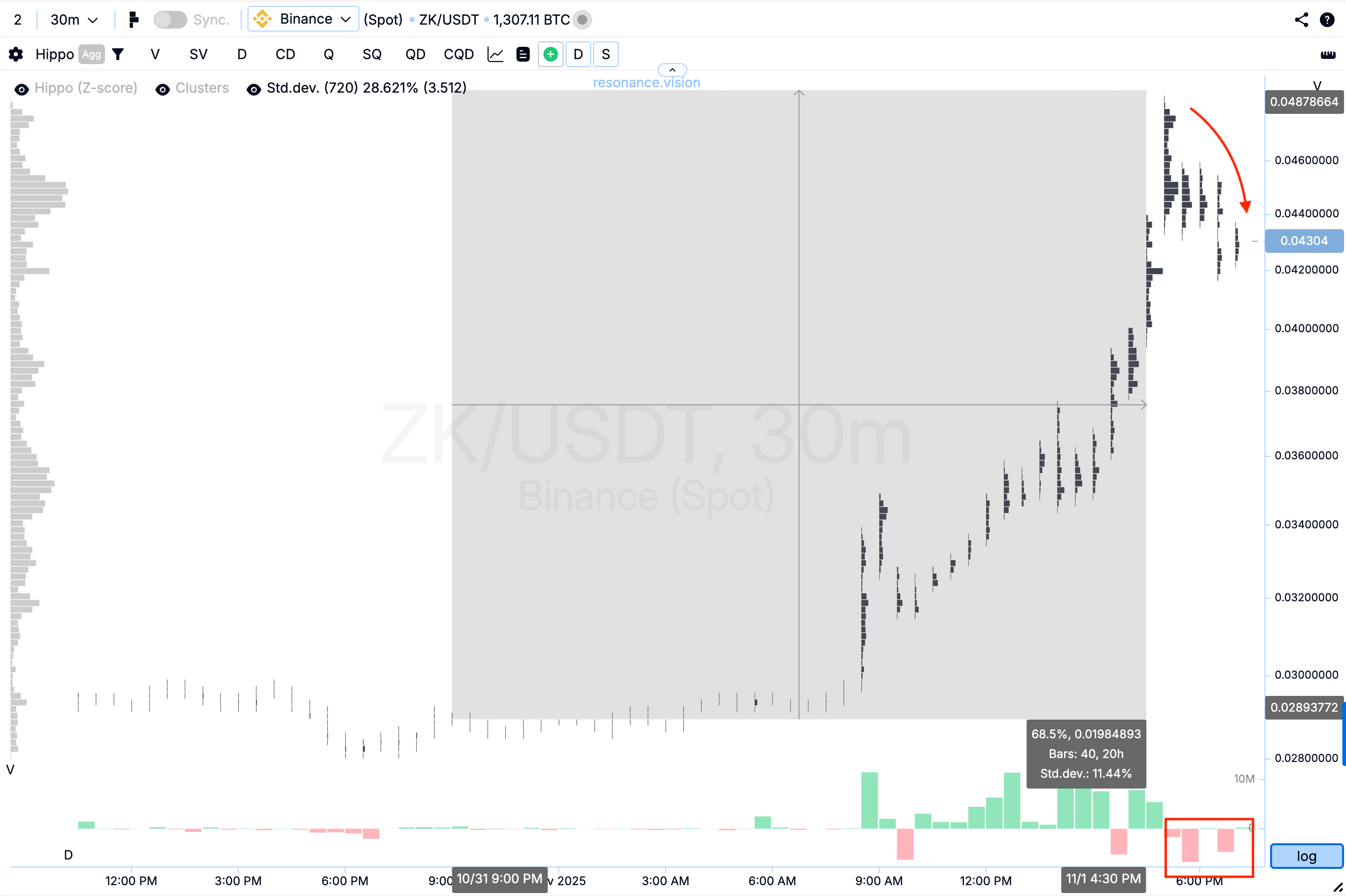

Cluster Chart: From the entry point, the price increased by nearly 70%, which in itself is a strong move. However, an evident pullback followed, accompanied by heavy selling (rectangle and arrow), suggesting that sellers might be regaining control. In such conditions, continuing to hold the position carries higher risk, so taking profit appeared to be the most rational and balanced decision.

Conclusion

This example clearly demonstrates that all price movements are the result of an imbalance between supply and demand. Volume data allows us to see where one side of the market weakens and where the other gains an advantage.

In this case, large sell volumes failed to push the price to new lows, signaling a contraction in supply. Confirmation through the Dashboard — an increase in limit buying and a shift in market order efficiency toward buyers — showed the balance tilting in favor of demand.

Thus, cluster analysis helps not just to “guess” the direction but to understand what is happening inside the market. Remember — price is always a consequence of supply and demand interaction, and evaluating clusters and delta provides a structured view of market dynamics, allowing traders to make informed and data-driven decisions.

Follow new insights in our telegram channel.

No need to invent complex schemes and look for the "grail". Use the Resonance platform tools.

Register via the link — get a bonus and start earning:

OKX | BingX | KuCoin.

Promo code TOPBLOG gives you a 10% discount on any Resonance tariff plan.