Sonic Blockchain: A Fundamental Analysis of the Team, Technology and the Future of the S Token

The fundamental analysis of Sonic is not just another review of a new network. It is an attempt to look deeper: what lies behind the bold claims, who is shaping the team, and whether it is worth investing in this project. If you want to understand whether Sonic has a chance to become a leader among blockchains, this piece is well worth your attention.

Table of content

Introduction

Sonic is a Layer 1 (L1) blockchain that emerged at the end of 2024 following the relaunch of the Fantom network. The developers set an ambitious target from the outset: they claimed that Sonic would become the fastest EVM-compatible blockchain. This means that all applications from Ethereum can be seamlessly migrated here without code changes. The project focuses on speed, security, and a new economic model that makes the network appealing to both users and developers.

Team

The Sonic team comprises a blend of crypto veterans and professionals from traditional finance. CEO Michael Kong has been involved with Fantom since 2018. Executive Chairman David Richardson brings a background in traditional finance, facilitating bridges between blockchain and Wall Street.

However, the central figure is Andre Cronje, one of the most renowned architects of DeFi. He was instrumental in the inception of Fantom and created Yearn Finance. In 2023, Cronje returned to the project, taking on the role of Sonic’s CTO. His name has become a symbol of Sonic’s serious intentions and willingness to take on responsibility.

The team also includes leaders across research, operations and strategy, comprising over 50 specialists worldwide. Notably, they are transparent: names and roles are listed on the website, fostering transparency and trust.

Another significant step is the establishment of Sonic USA LLC, a New York-based division focused on engaging with US regulators. This approach demonstrates that Sonic aims not only to advance technology rapidly but also to integrate into the global financial system.

Technology

Sonic is a blockchain that combines proven solutions with new innovations. Its core is a consensus mechanism built on DAG and aBFT. In simple terms, transactions in Sonic do not queue up in a single line as in most networks but occur in parallel. This enables remarkable speed.

- In tests, the network processed up to 400,000 transactions per second.

- Confirmation time — ~0.7 seconds in testnet and ~1 second in mainnet.

- For comparison — Solana finalisation takes around 12 seconds.

Sonic also features its own virtual machine, SonicVM, which is compatible with Solidity and Vyper but operates faster and more securely. A dedicated SonicDB database enables more efficient storage and processing of information.

Another critical component of the infrastructure is the Sonic Gateway, a bridge connecting the network to Ethereum and ensuring secure asset exchange between them. Unlike third-party bridges, Gateway has been audited by leading firms (OpenZeppelin, Quantstamp), reducing risks for users.

Additionally, Sonic supports advanced features like Account Abstraction and dynamic fees, providing developers with greater flexibility. For instance, transactions can be structured so that part of the fee is sponsored by the application itself.

Tokenomics

Role of the S Token

The S token is the “fuel” of Sonic. It is used for paying transaction fees, participating in staking, earning rewards, and voting in the community. Fees are extremely low — approximately $0.001 per transaction, making the network accessible even for micropayments.

Fee Monetisation

The most innovative idea of Sonic is Fee Monetisation (FeeM). Instead of all fees going solely to validators, 90% are allocated to application developers. This means the success of any application directly translates into profit for its creators. This model resembles YouTube, where creators earn revenue from views, but here it’s based on user activity within the blockchain.

Issuance and Deflation

Initially, all S tokens were created through a 1:1 conversion from Fantom tokens, resulting in approximately 2.66 billion tokens in circulation.

In 2025, the team initiated an additional issuance of 200 million S, which was supported by the community. This decision funded development in the US, the launch of a PIPE fund on Nasdaq, and the creation of an exchange-traded product (ETP) through BitGo.

In early September 2025, another proposal was approved: the total token supply will increase from ~3.41 billion to ~3.89 billion S, with the circulating supply rising by 14.2% to 472 million S. A further $50 million worth of tokens will only be added once the ETF receives final approval.

Thus, the Sonic team and community continue to use issuance as a tool for growth — in this case, to support the launch of an ETF product. On the one hand, this increases the token supply, which could theoretically pressure the price. On the other, the connection to an ETF and collaboration with exchanges adds credibility to the project and may attract new investors.

To mitigate the inflationary effect, Sonic employs a deflationary mechanism: 50% of all transaction fees are burned. This means that as network activity grows, the number of tokens in circulation will gradually decrease, balancing issuance and scarcity.

Market Metrics

- At present, approximately 2.88 billion S are in circulation, with further increases expected after new issuance decisions.

- Current price — approximately $0.30 (~70% below the peak).

- TVL in the network exceeds $560 million.

- Sonic consistently ranks among the top 10–15 blockchains by this metric.

What the Volumes Say: Analysing the Cluster Chart

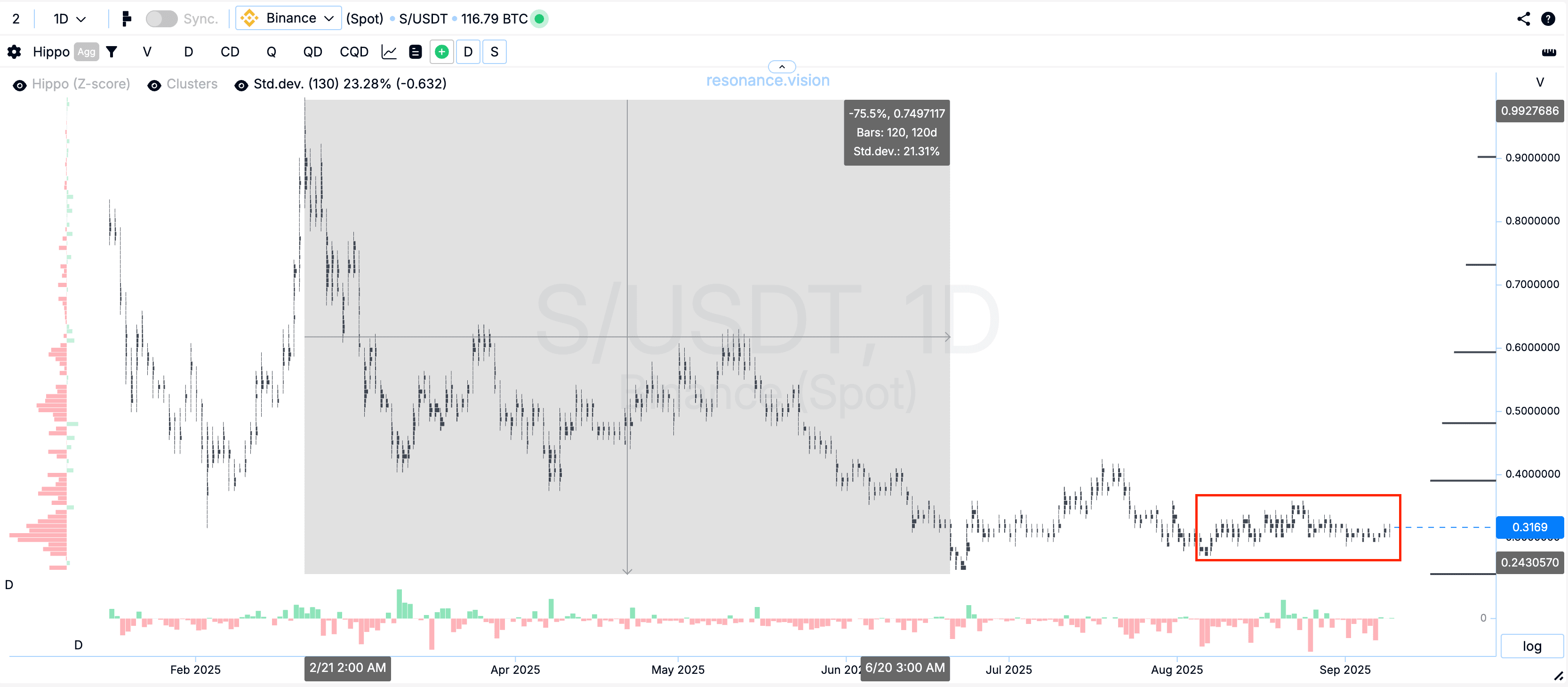

Following the relaunch, the S token experienced a period of high volatility: it initially hit a new high, nearly reaching $1, but later dropped by over 70%. However, the current situation appears intriguing — even during significant sell-offs, the price no longer prints new lows. This suggests a shortage of supply.

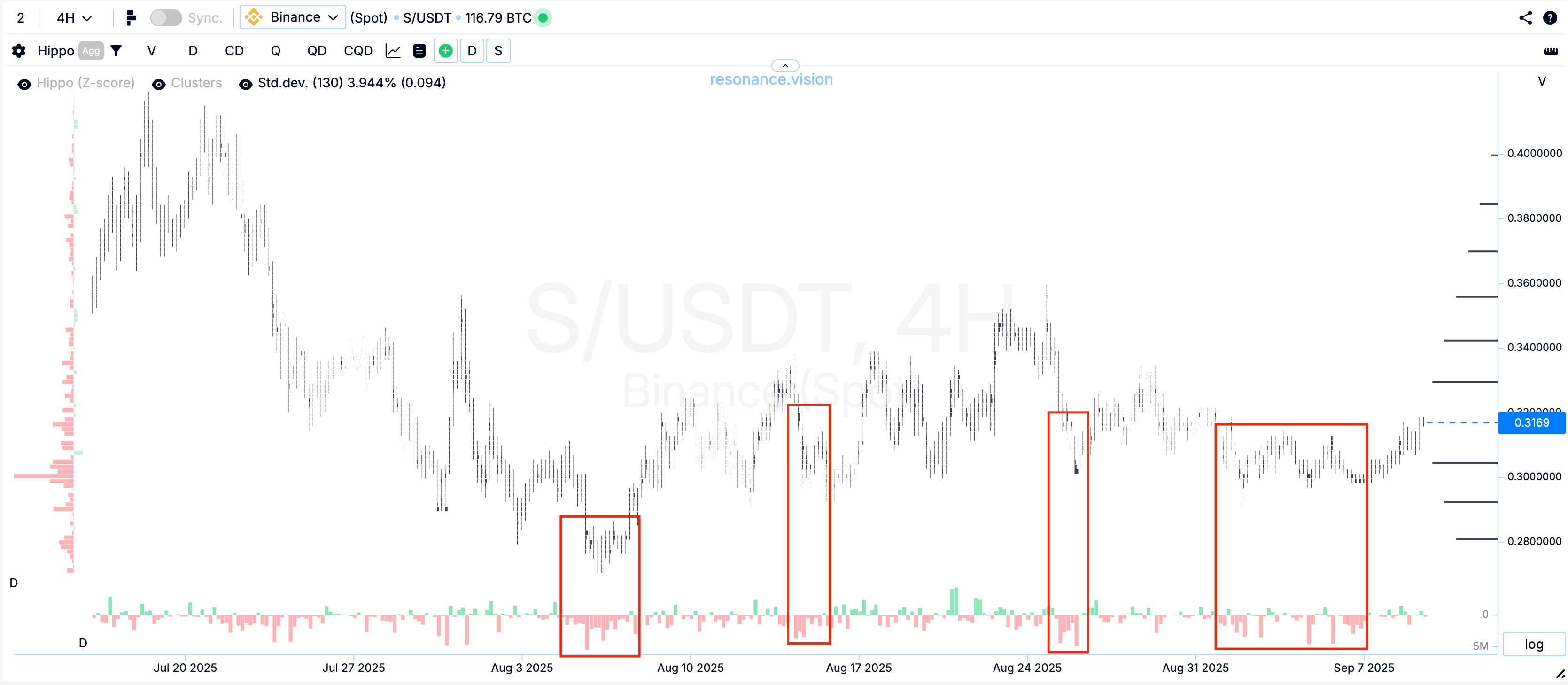

On smaller timeframes (H4), it’s evident that during waves of market sell-offs, tight clusters form. The price does not break below these areas, indicating that market sales are actively absorbed into limit orders.

Two scenarios are possible — either large investors are gradually accumulating positions, or the team itself is buying back tokens from the market.

Notably, Sonic/Fantom faced a unique situation: after the relaunch, the foundation held less than 3% of tokens for development, while most competitors maintain substantial ecosystem reserves.

As a result, the team had to buy back tokens from the market to fund initiatives. This practice was indeed employed: instead of large internal reserves, the team purchased tokens on exchanges to secure resources for grants or development programmes.

However, there are important nuances:

- It is costly and risky. When the foundation is forced to buy tokens on the open market, it operates like a regular investor, dependent on price and liquidity. This can create additional pressure on the project’s finances.

- PIPE strategy. In 2025, Sonic explicitly planned to allocate part of the new issuance ($100 million in S) to establish a Private Investment in Public Equity (PIPE) fund. Essentially, this is a reserve for buying back tokens on the exchange to maintain liquidity and price stability during the launch of an exchange-traded product on Nasdaq.

Thus, the team not only has the ability but is officially planning to do so — in a more structured manner, ensuring token buy-backs serve as a tool for growth rather than a forced measure due to a lack of funds.

We cannot be certain whose limit orders are absorbing the sales — those of large investors, funds, or the team itself. However, the mere presence of supply-shortage signals is a reason to pay attention: the token warrants close monitoring, and trading strategies should be planned in advance.

Sonic: Interesting Facts About the Project

- High-Profile Investors.

Sonic was backed early on by major players such as Galaxy Digital, SoftBank, and the founders of Aave, Compound and Curve. These are not just casual investors but individuals and funds that have built key DeFi protocols, adding weight to the project’s fundamentals. - Limited Fantom Reserves and Forced Issuance.

A critical detail: at the time of the relaunch, the foundation held less than 3% of tokens for development. In other words, Sonic lacked an “ecosystem treasury” and was forced to conduct an additional issuance in 2025 to fund its expansion into the US. This explains the decision to issue $200 million in new tokens. - PIPE and ETP via BitGo.

Part of the new tokens ($100 million) will support a PIPE fund on Nasdaq, with another $50 million allocated to launch an exchange-traded product (ETP) based on S, managed by the regulated custodian BitGo. This is a unique move for a blockchain: few L1s integrate with such TradFi instruments so early. - Fee Monetisation via Off-Chain Oracles.

The fair distribution of 90% of fees among different applications is overseen by off-chain oracles, enhancing transparency and reducing the risk of manipulation. - Name Confusion.

An interesting branding issue: CoinMarketCap listed a meme token called Sonic Meme Coin (SONIC) alongside Sonic. This could confuse new users and deter some investors who fail to distinguish the “serious L1” from a joke token. - Development in RWA and AI.

The Sonic team is exploring tokenisation of real-world assets (bonds, funds, real estate) and even has a Head of AI on the team. This suggests the network may develop services at the intersection of blockchain and artificial intelligence. - Community Voting on Issuance.

The decision to issue $200 million in new tokens was supported by 99.99% of votes (~700 million tokens). This reflects strong community consensus and trust in the team’s strategy.

SWOT Analysis

Strengths

- Experienced Team with a Strong Background.

Sonic is led by individuals who have made significant marks in the crypto space. Andre Cronje is well-known for Yearn Finance and other DeFi protocols. These are not “newcomers” searching for their path but professionals who have proven their ability to deliver functional products. This boosts trust in the project and gives Sonic a reputational advantage. - Speed and Low Fees.

The network confirms transactions in under a second and can handle hundreds of thousands of operations simultaneously. This makes it suitable for DeFi as well as more “mainstream” areas like gaming, NFTs or micropayments. User comfort is key, and Sonic delivers exactly that — speed and accessibility. - Developer Support Model.

Thanks to Fee Monetisation, 90% of transaction fees go to application creators. This unique system could incentivise the development of high-quality products on Sonic. The more applications and users, the stronger the ecosystem will grow. - Inherited Ecosystem from Fantom.

Sonic did not start from scratch but inherited part of Fantom’s liquidity, wallets and existing protocols. This enabled rapid TVL growth and created the impression of a “live” network from its early months. Other blockchains take years to build such a foundation. - Integration with Traditional Finance.

A dedicated company in the US, collaboration with BitGo, and plans for ETF and PIPE demonstrate that Sonic is not confined to the crypto community. If it succeeds in entering the traditional finance market, it could unlock new liquidity sources and attract major institutional players.

Weaknesses

- Limited Decentralisation.

Sonic has few validators, and becoming one requires a substantial stake. This reduces the number of independent participants and may pose a centralisation risk. For many users, decentralisation is a core value, so this compromise could alienate part of the community. - Weak Price Performance.

Post-relaunch, the S token initially surged but then fell by over 70% from its peak. This has created distrust among investors and shown that early “hype” alone is insufficient. Rebuilding positive sentiment towards the project may be challenging. - Lack of a “Killer App”.

While Sonic is fast and user-friendly, it lacks a standout application to attract millions of new users. DeFi protocols and DEXes exist on nearly every network, so they are not enough for a true breakthrough. Without something unique, Sonic risks remaining “one of many”. - Fierce Competition Among L1s.

The market is saturated with players like Ethereum, Solana, Avalanche, Sui and Aptos, all offering speed and vying for developers with grants. Sonic must compete not only with technology but also with marketing, community and reputation — a daunting task for a relatively new brand.

Opportunities

- Entry into the US Market.

Plans to launch an exchange-traded product and collaborate with Nasdaq could open doors to institutional capital. If Sonic gains support from major players, it will significantly elevate its status in the crypto world. - Attracting Developers.

With Fee Monetisation and new funds, Sonic offers real incentives for teams to build on its network. This could propel the ecosystem forward: more products and users mean greater token demand and network liquidity. - New Use Cases.

Sonic’s technical capabilities are well-suited for gaming, NFTs, social networks and micropayments — niches where speed and low fees are critical. If Sonic establishes itself in even one of these, it could gain a competitive edge. - RWA Development (Tokenisation of Real-World Assets).

The crypto space is seeing growing demand for tokenisation of bonds, funds and real estate. With its ambition to integrate with TradFi, Sonic has a chance to become a platform for such solutions, attracting both crypto enthusiasts and traditional investors.

Threats

- Dominance of Other Blockchains.

Ethereum remains the primary platform for DeFi, while Solana is aggressively capturing the gaming and NFT niches. Against this backdrop, Sonic may appear as “just another fast blockchain” without a clear unique value proposition. - Regulatory Risks.

Despite efforts to operate within legal frameworks, there is always a risk that regulators may classify the token as a security. This could limit Sonic’s opportunities in the US or other countries, and any regulatory changes could derail the team’s plans. - Insufficient User Base.

Although the network is technically capable of handling hundreds of thousands of transactions, actual activity is far lower. If Sonic fails to attract enough users and companies, its advantages will remain theoretical. - Dependence on Key Figures.

Much of the trust in Sonic hinges on Andre Cronje. If he steps away from the project again (as he has in the past), it could trigger panic among users and investors.

Conclusion

Sonic is an example of a relaunch that seeks to blend proven technologies with fresh ideas. The project boasts a strong team, an intriguing economic model, and ambitious plans for integration with traditional finance. However, it faces a formidable challenge: proving it can attract not just capital and developers but also mass users.

It is therefore worth keeping a close watch on the project. If Sonic can demonstrate unique use cases and withstand competition, it could secure a place among leading blockchains. If not, it risks becoming yet another fast but overlooked L1.

Follow new insights in our telegram channel.

No need to invent complex schemes and look for the "grail". Use the Resonance platform tools.

Register via the link — get a bonus and start earning:

OKX | BingX.

Promo code TOPBLOG gives you a 10% discount on any Resonance tariff plan.