Arthur Hayes Manipulates ENA: What’s Really Happening with the Token?

Arthur Hayes has bought 2 million ENA tokens. At first, this might seem to have an effect on the market, but is it really so? We have looked closely at the details of the purchase, the market situation, and how Hayes himself can make money even when the price drops.

Table of content

- 01How significant is the purchase of 2 million ENA tokens?

- 02What is ENA and why does this DeFi token attract attention?

- 03How to earn from ENA? Staking and yield

- 04ENA Market Activity Analysis: Supply and Demand

- 05What does Arthur Hayes’ purchase mean for the ENA market?

- 06How can Arthur Hayes profit even if ENA drops?

- 07Conclusions: What Investors and Traders Should Know

The crypto community is buzzing again: Arthur Hayes, founder of the BitMEX exchange, purchased 2 million ENA tokens, bringing his total position to nearly 7.7 million. At first glance — it sounds big. But did it really affect the market? Let’s examine whether this is market manipulation or just media noise, and what traders can actually take away from it.

How significant is the purchase of 2 million ENA tokens?

Arthur Hayes is a well-known figure in the crypto community and founder of BitMEX, a derivatives exchange. Recently, he bought 2 million ENA tokens, which at the current rate amounts to about one million dollars. His total position now reaches 76–77 million ENA tokens.

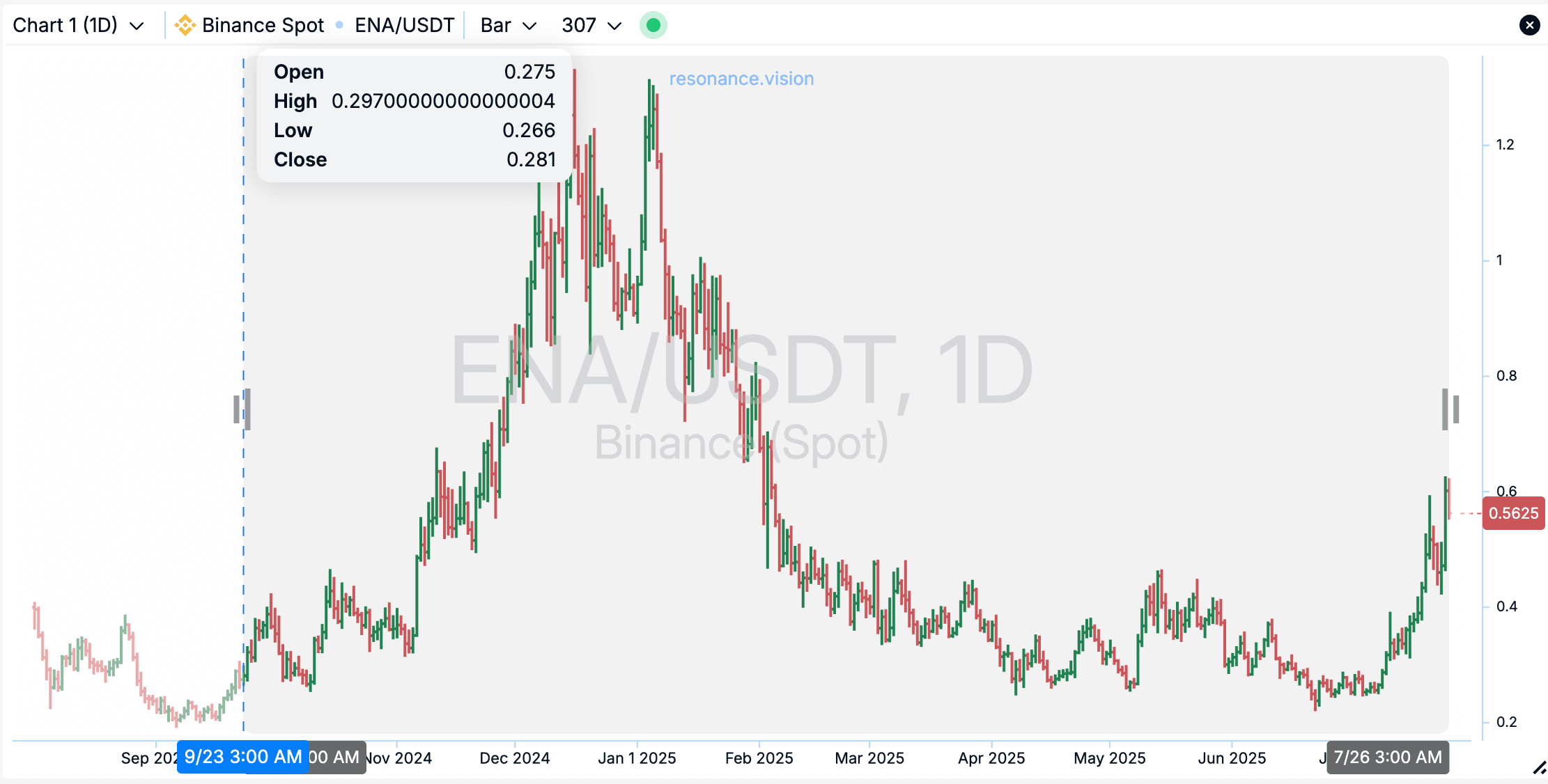

However, it’s important to understand the scale of this purchase relative to the overall trading volume. On Binance alone, up to 176 million ENA tokens were being sold per day at certain moments. Even during periods of low volatility, the daily trading volume reaches around 100 million tokens. Therefore, 2 million — just 2% of daily volume — is a negligible share that technically didn’t impact the price.

The only influence here is psychological: participants see an action by a well-known player (Arthur Hayes) and follow blindly. But from a market logic standpoint — this has little actual weight.

What is ENA and why does this DeFi token attract attention?

ENA is a protocol operating on Ethereum and is a synthetic dollar protocol. It’s not just a token but a utility asset tied to the revenue of the company behind the project. The more the company earns, the higher the token’s value.

At the core of ENA is the stabilization of the synthetic dollar USDe using a delta hedging mechanism through derivatives. This not only helps maintain price stability but also generates yield.

The protocol’s staking blocks manage billions of dollars, so even investments of several million dollars are just a drop in the ocean. As a result, even large purchases cannot significantly change the token’s price.

How to earn from ENA? Staking and yield

As of today, ENA offers fairly decent staking returns, making it attractive for long-term investment, since investors can earn passive income. There were even times when yield levels were astronomical, but now the reality is stable and moderate returns.

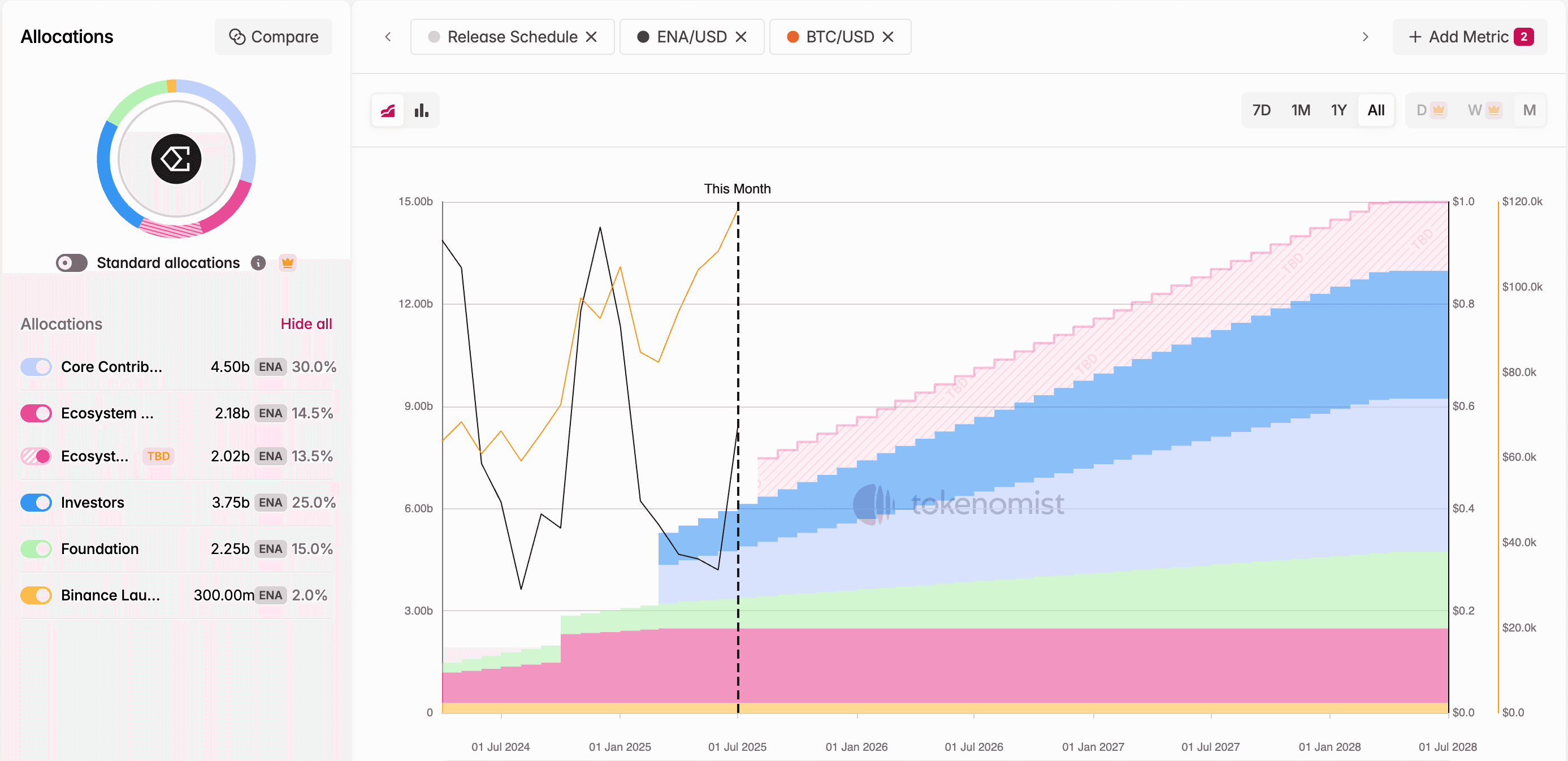

However, it’s important to account for upcoming token unlocks. For example, a large unlock is expected in the coming month, which could potentially put pressure on the market.

These unlocks may cause market participants to start offloading their positions in anticipation of increased overall supply. This could trigger a short-term drop, even though the long-term trend remains positive.

ENA Market Activity Analysis: Supply and Demand

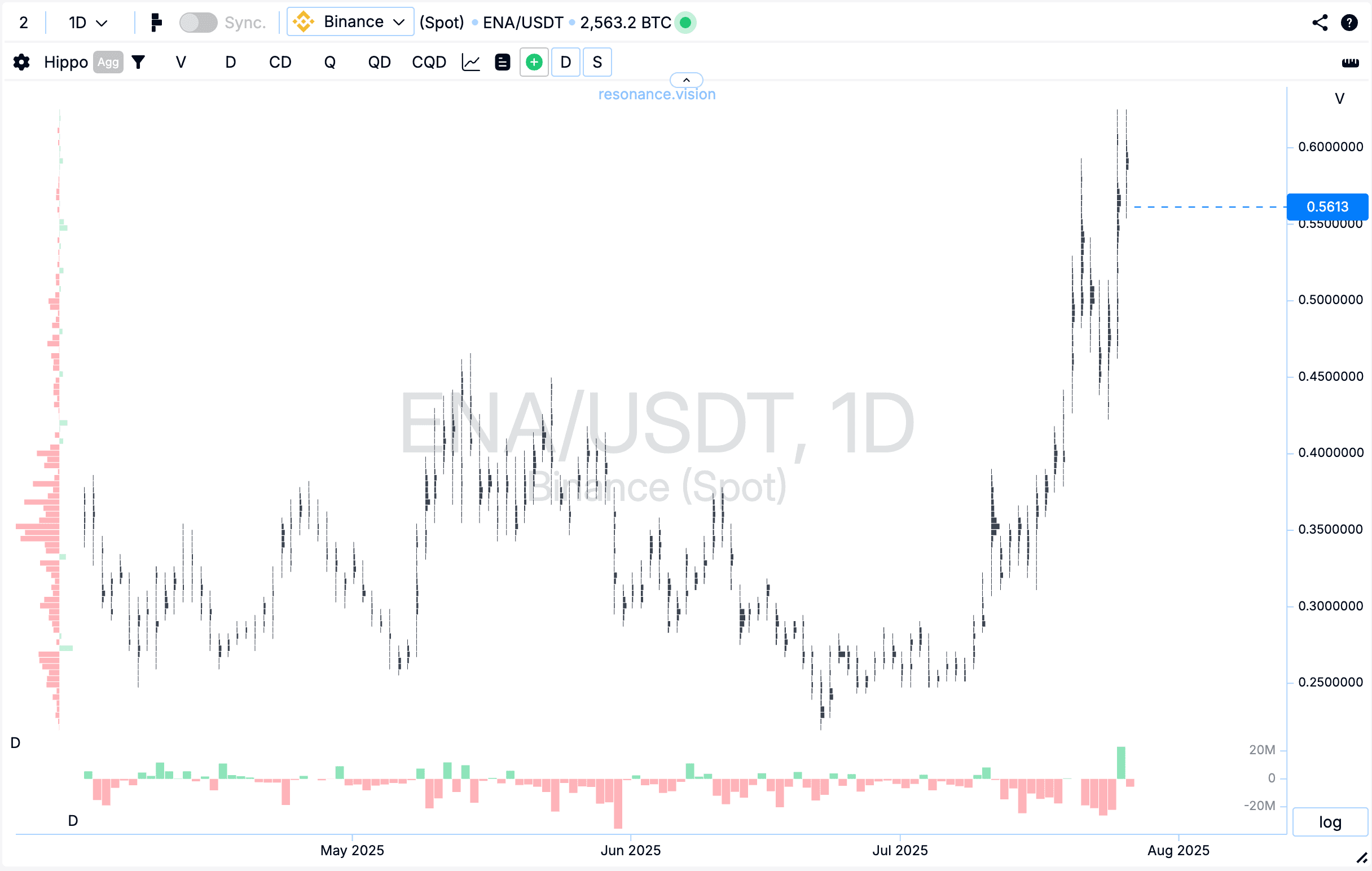

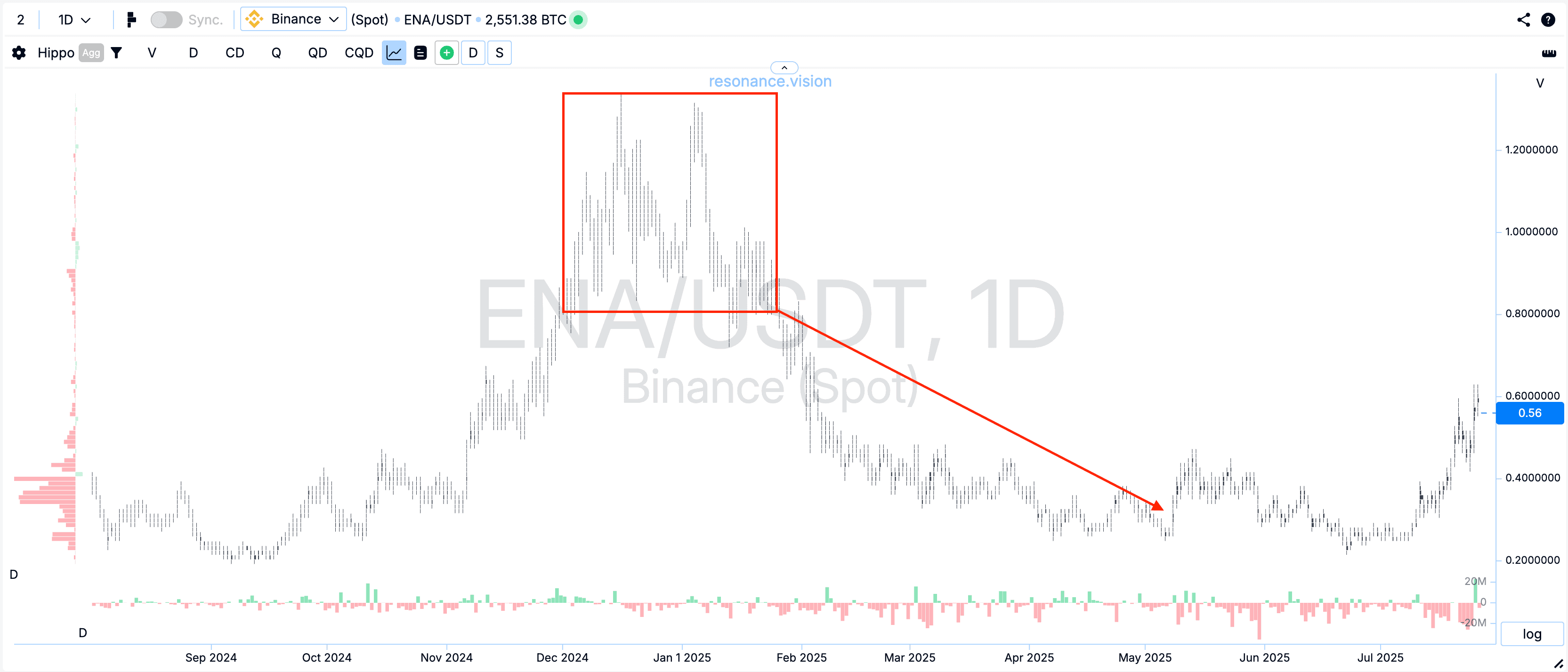

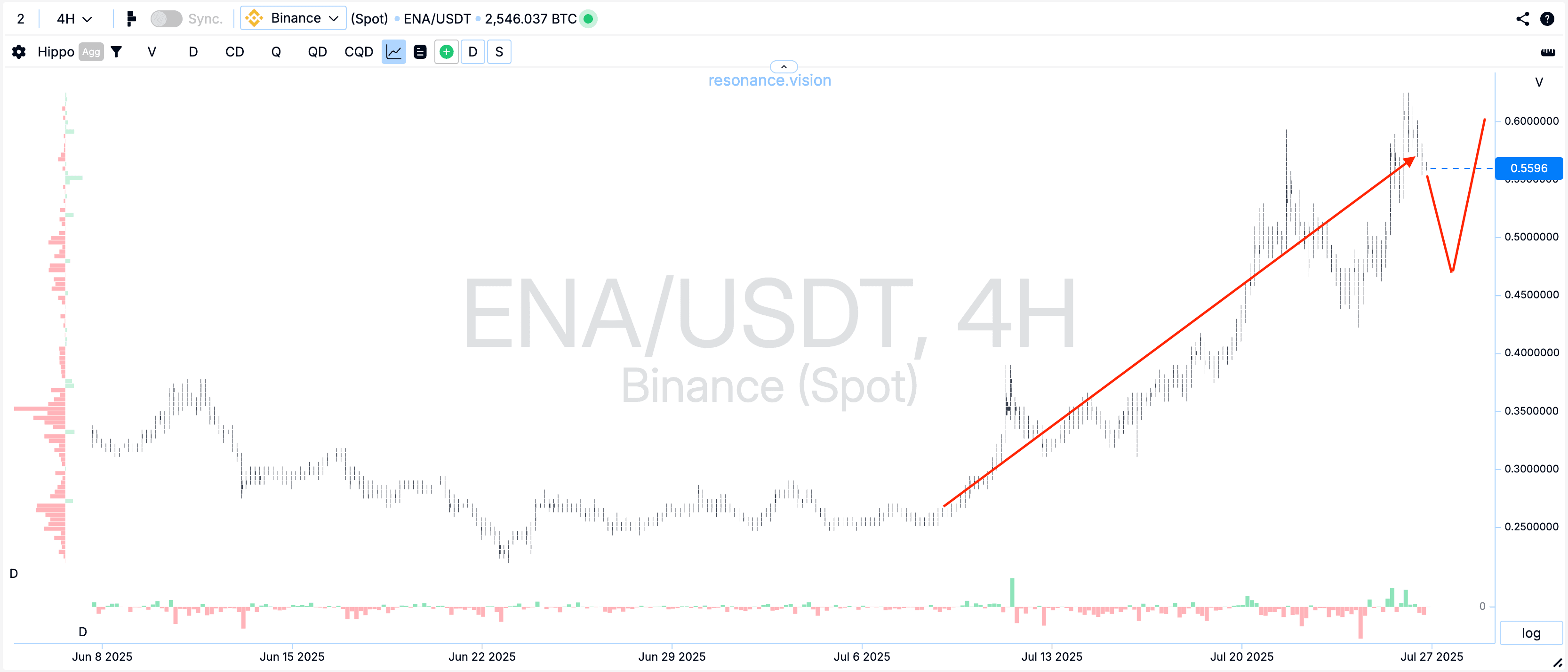

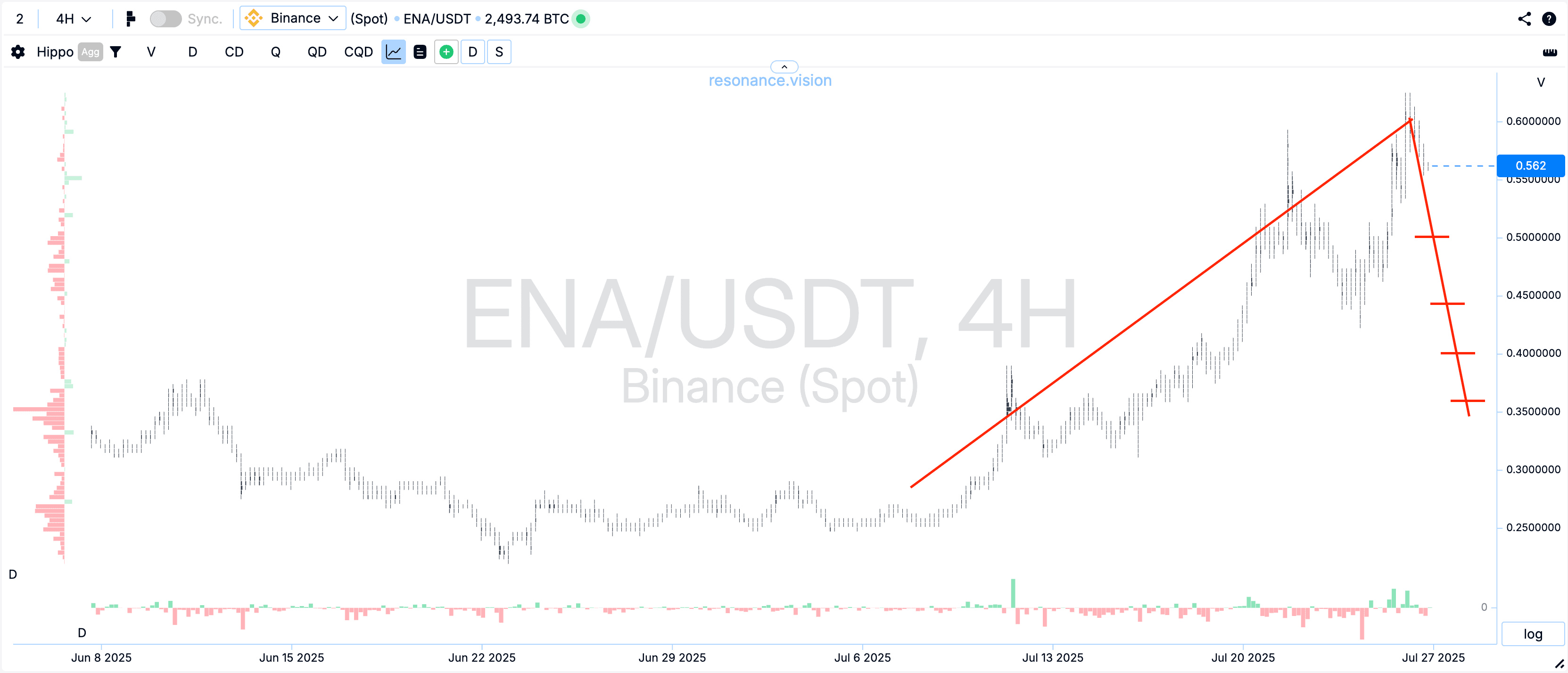

Over a year and a half, ENA has traded in a very wide range — from 20 cents to $1.50. Currently, the price is around 57 cents.

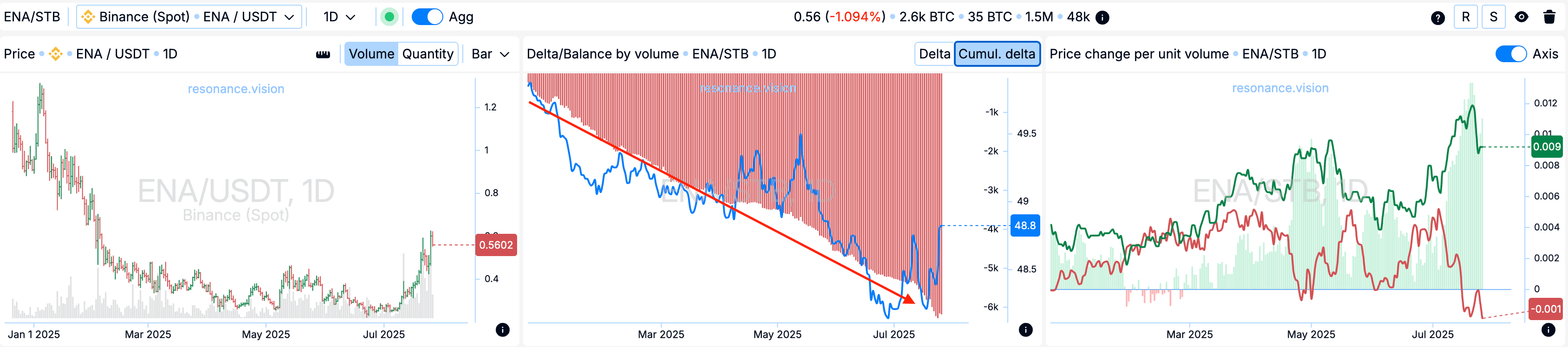

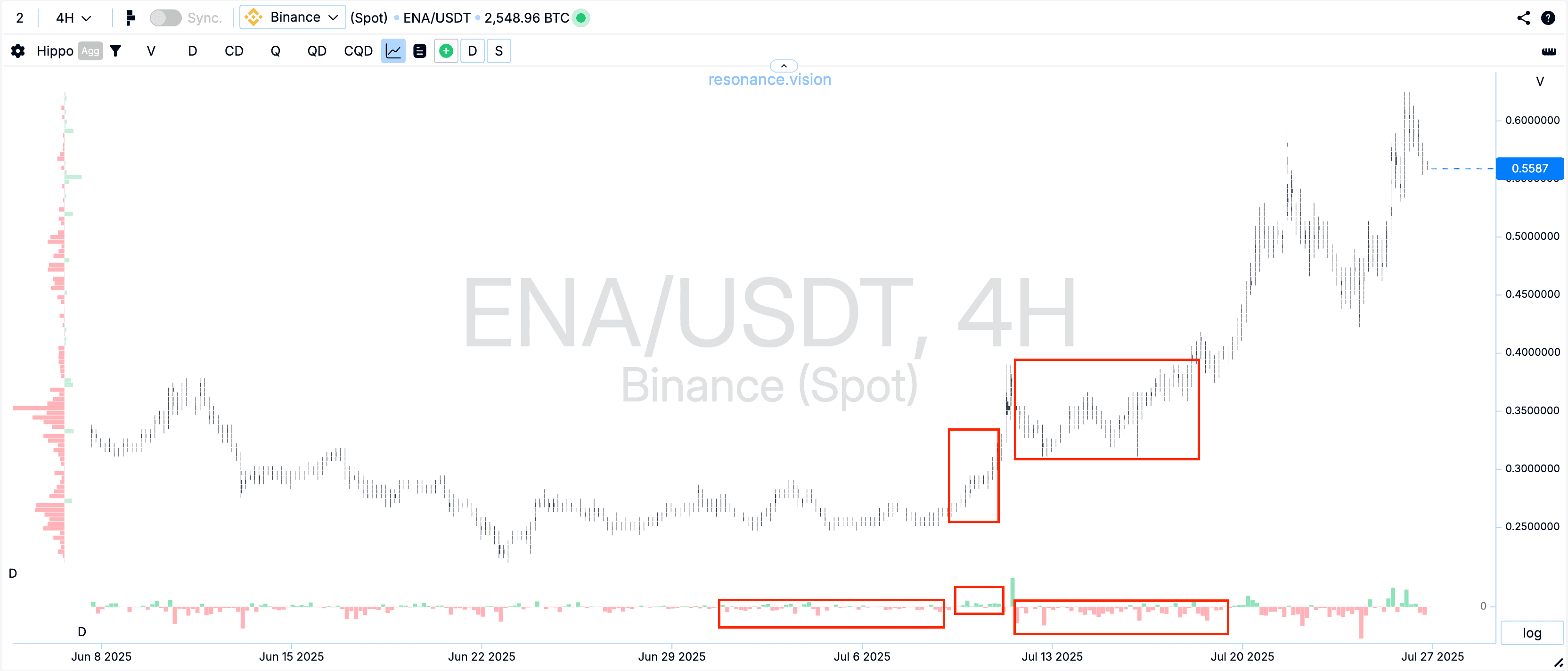

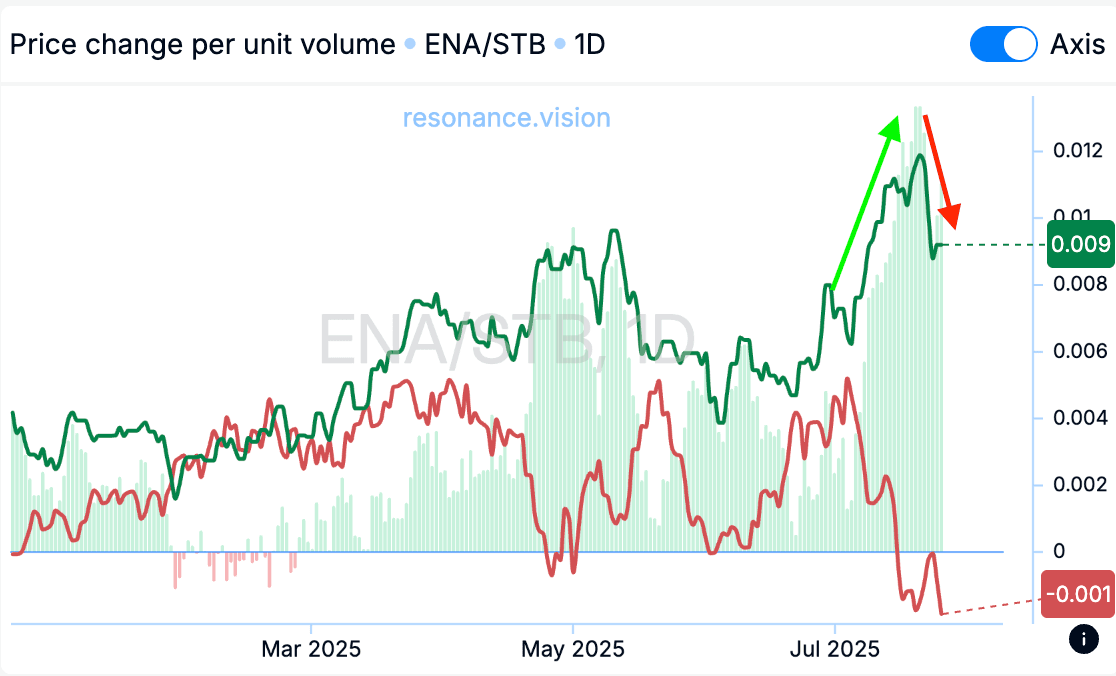

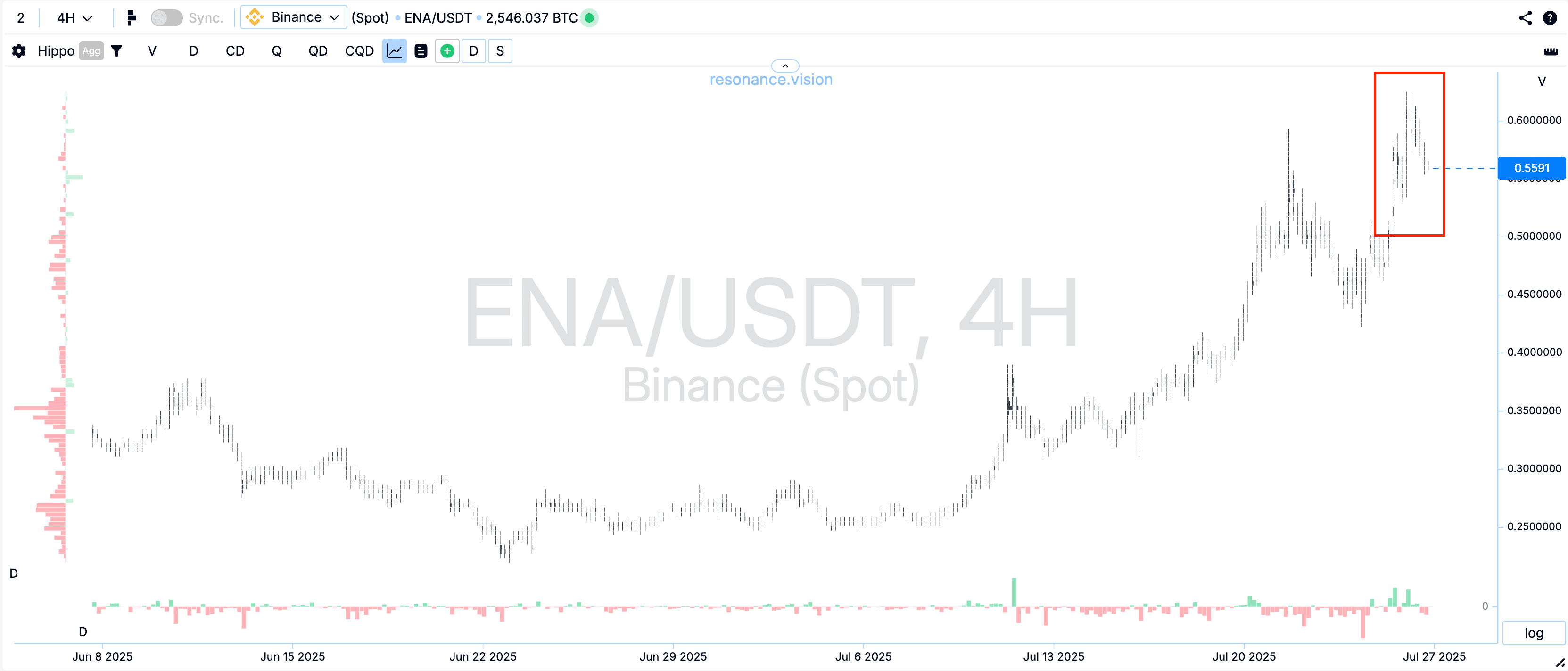

Volume analysis shows that there are significantly more sell orders than buys, and the number of sell-offs is growing at an astronomical rate.

The market has gone through a period of consolidation, followed by a phase of balance-seeking.

Large sell-offs were previously very effective, but their efficiency is now decreasing, while buyers are gradually pushing sellers out, creating a supply deficit in the market.

However, recently, the efficiency of buy orders has also declined, signaling the beginning of a pullback. Market participants are starting to partially offload their positions, which may lead to a temporary price drop.

What does Arthur Hayes’ purchase mean for the ENA market?

Looking at Hayes’ purchase, it seems more like a media trigger for attention. Although ENA’s trend remains upward, the risks from high volatility and upcoming unlocks remain substantial.

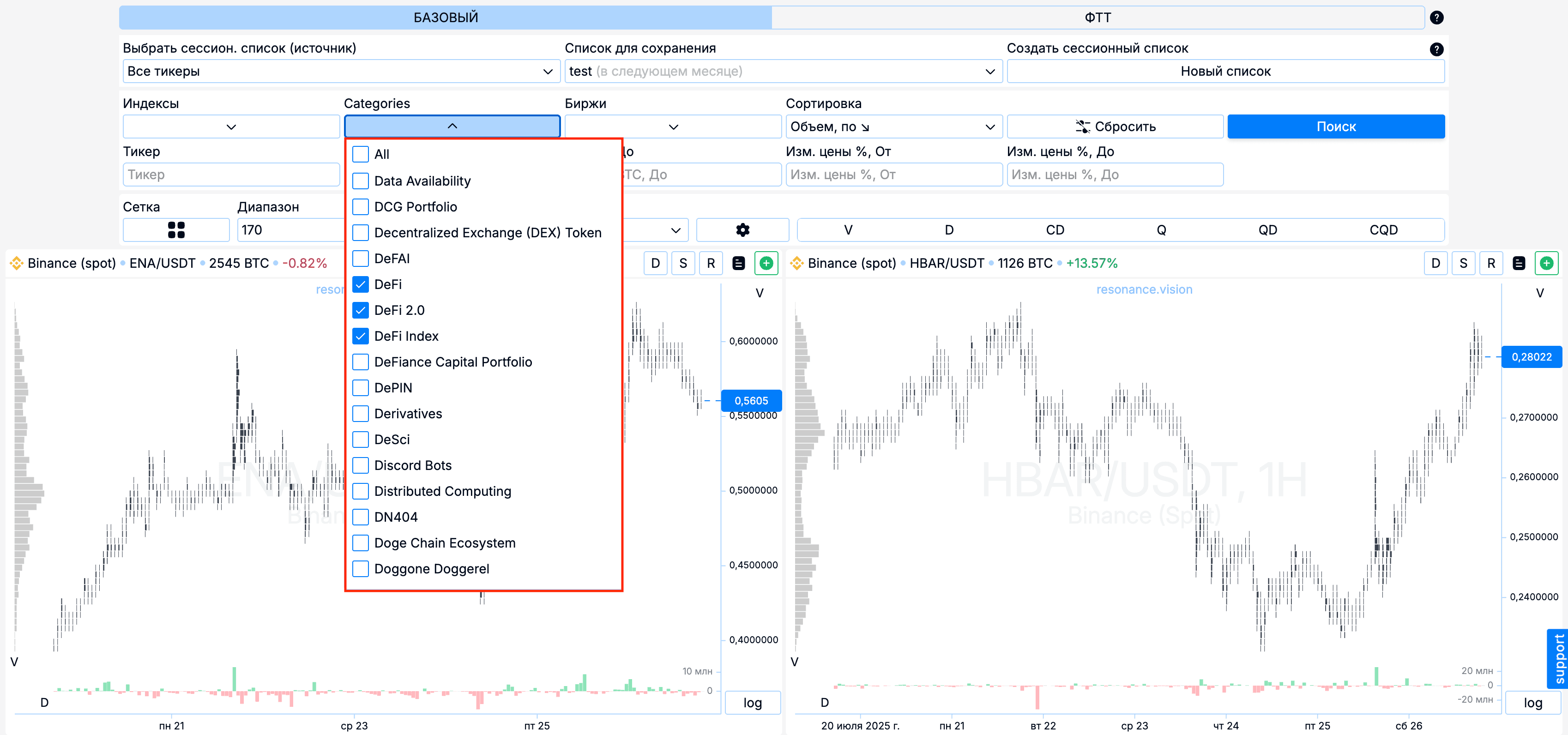

From our perspective, buying ENA on the spot market now without a clear strategy doesn’t seem efficient due to possible corrections. It’s better to look more broadly at the DeFi sector and search for interesting coins for statistical arbitrage or other strategies through a screener.

How can Arthur Hayes profit even if ENA drops?

As the owner of an exchange and a market professional, Hayes has sophisticated tools at his disposal:

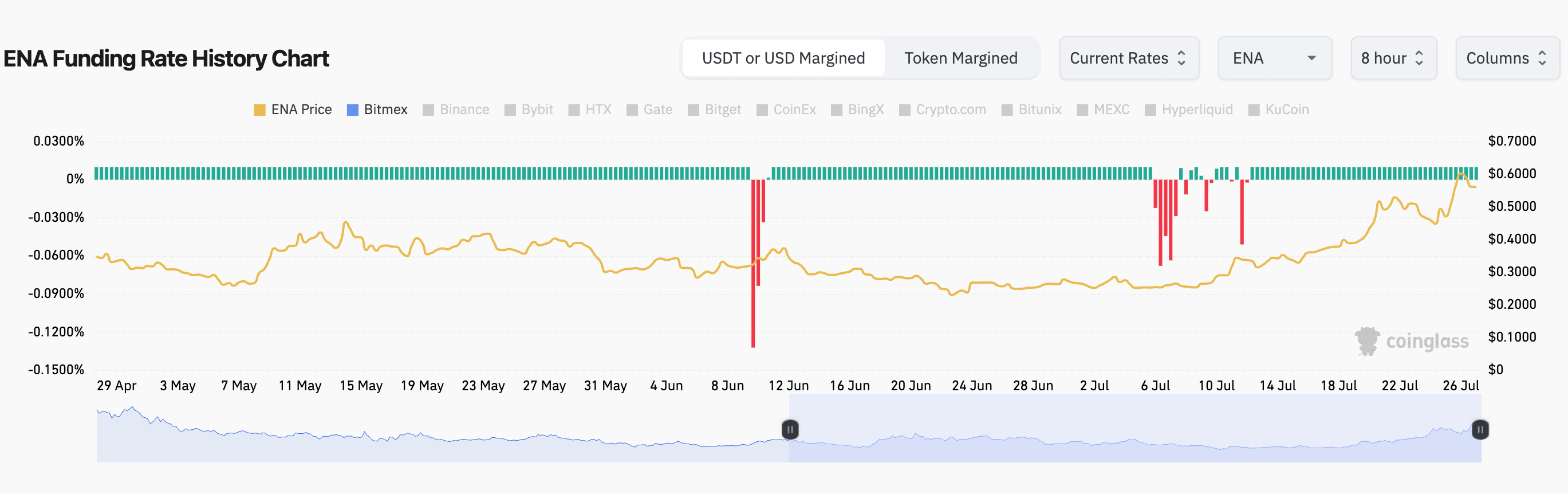

- He can buy ENA on spot and transfer the tokens into staking

- At the same time, he can short ENA futures on his own exchange, BitMEX, collecting a positive funding rate (financing fee) when longs pay shorts. This allows him to earn a funding payout every 8 hours, regardless of price movement.

He can hedge positions, lock in profits, buy more tokens during pullbacks, and continue earning passive income.

So even if the price of ENA drops, Hayes can come out ahead through smart hedging and the use of various financial instruments.

Conclusions: What Investors and Traders Should Know

First of all, don’t fall for loud headlines without understanding the context and market mechanics. Arthur Hayes’ purchase is not a guarantee of instant ENA price growth.

ENA is an interesting project with potential and can be considered for long-term investment with risk awareness. However, due to high volatility and upcoming token unlocks, buying spot without a strategy right now is risky.

If you want to work with ENA or other DeFi tokens, we recommend studying analytical tools, using screeners, analyzing supply and demand, and understanding how hedging and funding rates work.

And remember: trade consciously, follow risk management, and don’t fall for media-driven manipulation.

Join our Telegram channel to stay updated on key analytics and educational materials.

We wish you thoughtful and successful investments!

No need to invent complex schemes and look for the "grail". Use the Resonance platform tools.

Register via the link — get a bonus and start earning:

OKX | BingX | KuCoin.

Promo code TOPBLOG gives you a 10% discount on any Resonance tariff plan.