Hippo: usage of the tool. Part 2. Scalping

Improve your scalping skills with the Hippo heat map. In this article, you’ll learn how to find hidden entry points in the crypto market, identify limit levels, and use price movements to make a steady profit.

Table of content

This article is a continuation of the first part of “Hippo: trading strategy with limits.”, where we explained how to analyse the market structure using Hippo. In this part, we will focus on the practical application of the tool for scalping cryptocurrencies: how to identify the moment of weakness of the aggressive side and react quickly to reversals. If you trade in the moment, this is a must read.

Scalping

The closer a limit order is placed to the price, the more influence it has, both psychologically on those who see this order and directly on the opposite orders that are executed against this limit.

The principles of work of any directional strategy on the market are described in the article about market configurations.

In this article, we will not repeat ourselves and simply analyse all the principles of market analysis with the help of the cluster chart and Hippo tool on the example of one situation.

First of all, we need to set up queries (filter in the table) to filter out situations that are not interesting and there is nothing abnormal.

The Z-Score is responsible for ‘anomalousness’ (read more about the settings description here):

- If the indicator is 1, it is a normal state of limit orders.

- If the indicator is 2 or higher, then the volumes of limit orders are conditionally twice as much as usual.

- If the indicator is more than 4, then the participants have set very large limits, which are not typical to observe on the analysed distances.

An abnormal value on the distance can become in two cases:

- participants have set very large limits

- or the price has approached the previously set large limits.

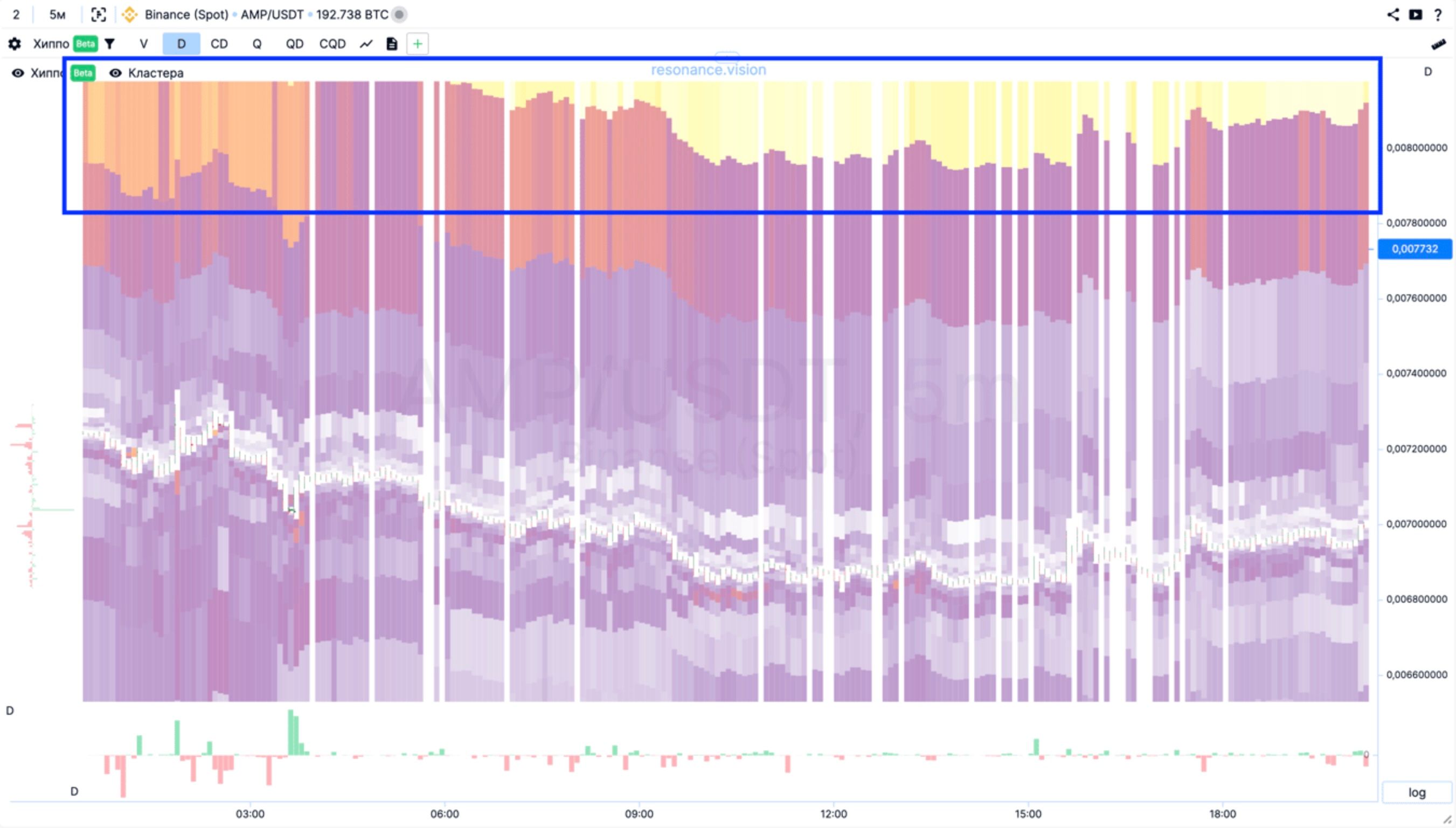

In the example below, we see large orders (highlighted in blue) on a long distance. We are not interested in them, as they are very far from the current price. In general, they have no influence on the current price.

Using the heat map settings, we’ll hide the far ranges. And let’s break down what is happening on the coin.

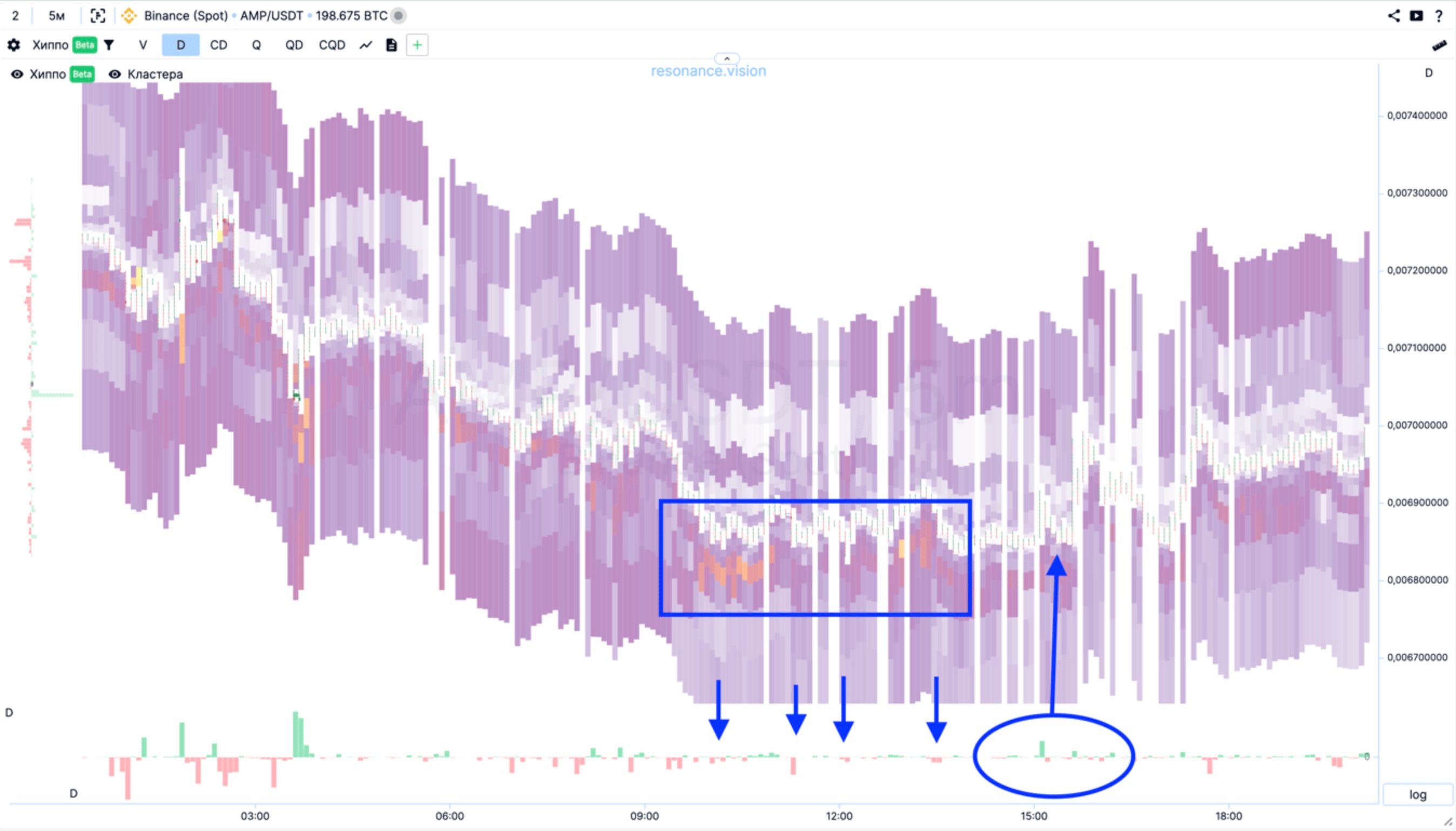

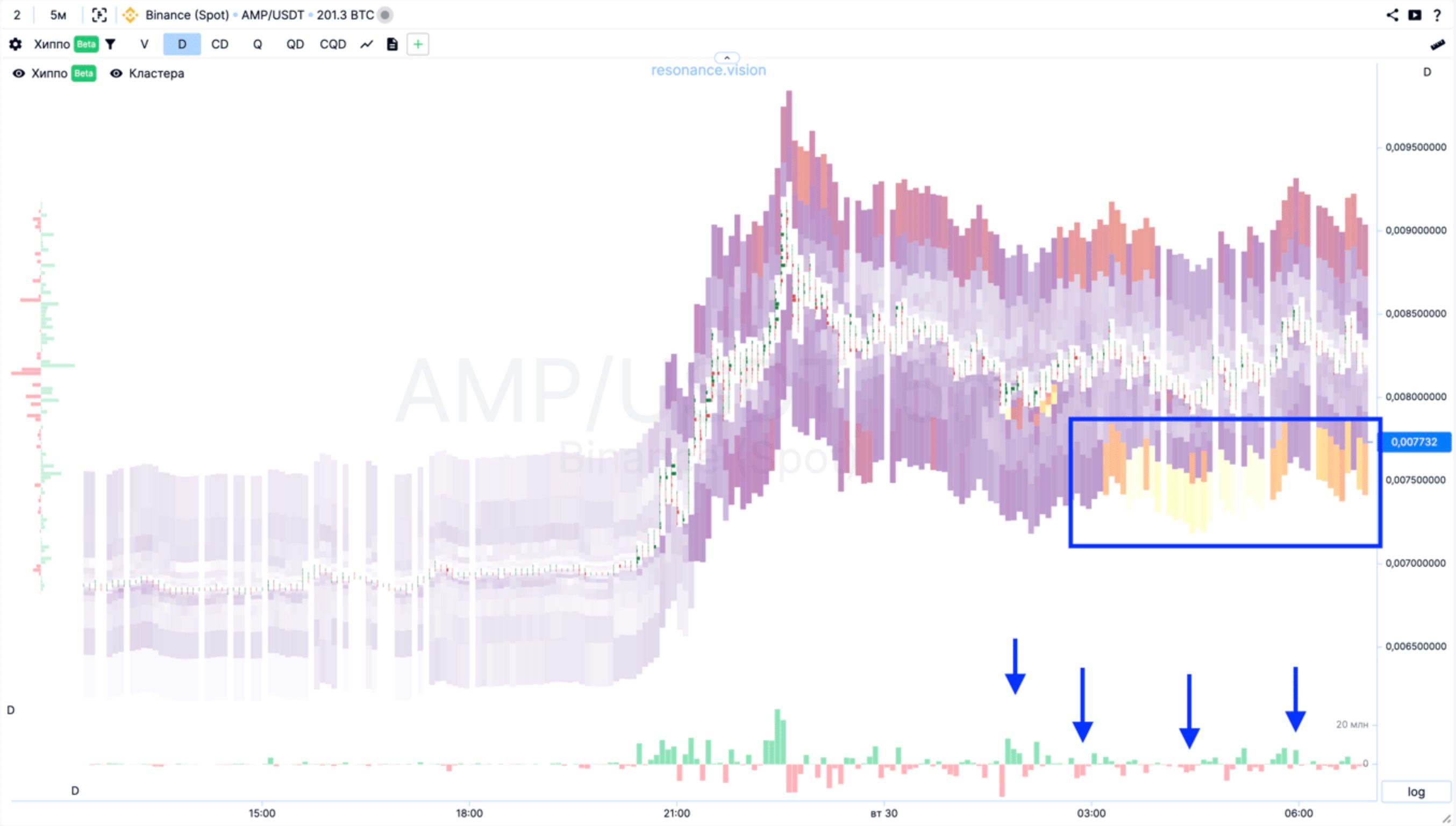

The delta histogram (below the chart) shows (by the red bars, downward arrows) that sellers are selling and lowering the price (sloping red arrow). And the efforts of buyers (green bars between the red arrows) do not lead to success. This means that the sellers are outnumbered and the buyers have not yet created a sufficient level of deficit, although the heat map shows that they are setting large purchase limits (red areas).

The first configuration: stop of movement

Next on the chart we see the formation of the first configuration - stop of movement (read about configurations here).

The chart shows a place (square blue zone) where buyers set limit orders, and market sales (blue arrows) do not lead to price decrease.

Also on the chart we can see (oval zone with an arrow) that the efforts of buyers lead to price growth. From the article about configurations we understand that this is part of the confirmation of the buyers’ outnumbering. And after this zone we see (red bars of the histogram) that the efforts of sellers do not lead to success.

This situation was found through the Hippo table. The range through which this situation was found has a relatively small volume of 1.023 bitcoins, but the Z-Score of this range is 2.407, which is already interesting for a closer look.

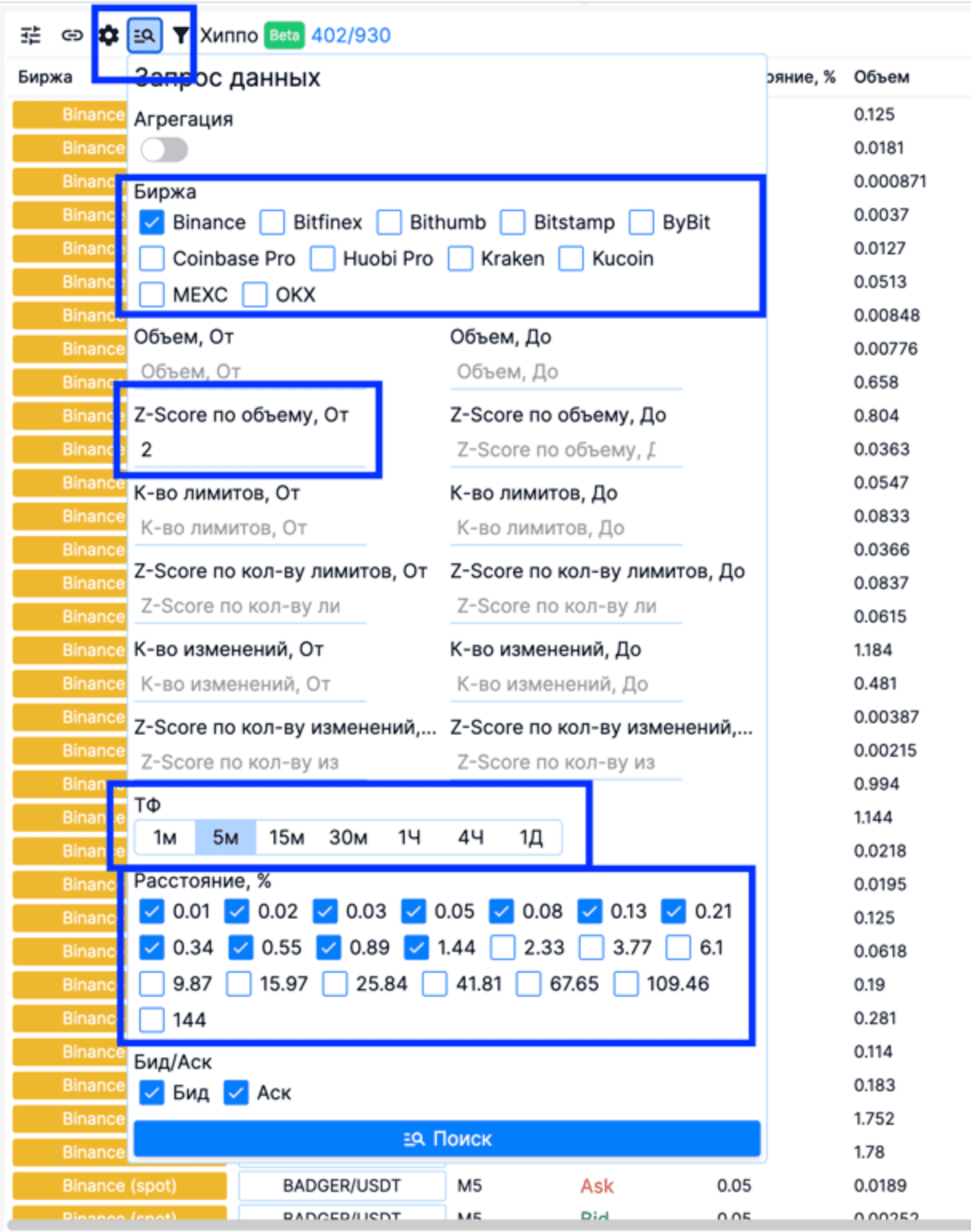

To set up the table, open the data query filter:

- Select an exchange

- Set Z-Score by volume, From

- Select timeframe

- Select distance

- Press the search button

Additionally, you can filter the table by tickers. For example, if you trade only futures, then it is worth filtering by writing */USDT in the unified ticker field

If you have volume restrictions, for example, if your capital does not allow you to trade low-liquid assets, then you can specify a minimum volume threshold in bitcoins in this filter (Volume, From), which will allow you to filter the results in the table in advance.

Entering a position

Once we have discovered the configuration and have been able to validate it, we need to enter the position.

To enter a position, it is worth understanding how much the volume of your future position will affect the price. If your capital does not exceed the average volume limits, then you can enter with a single order, but we recommend placing several orders in case the participants make another attempt to sell the price.

Exiting the position

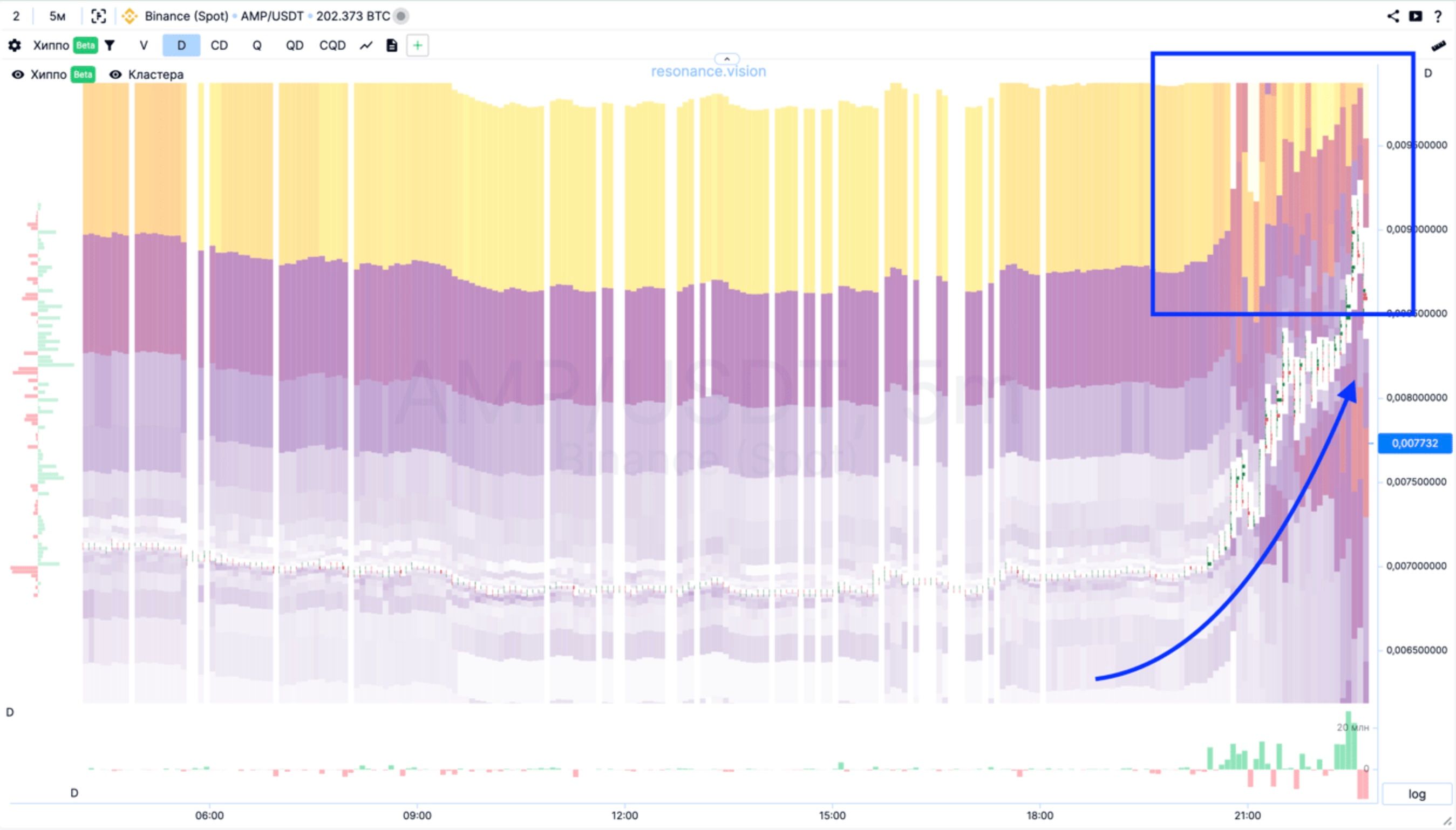

Next, the buyers made a series of efforts and without much resistance raised the price by 30%, just to the zone with large limits, which we hid earlier.

For intraday trading, this is a very large price movement. Plus the price has reached a zone with significant limit resistance.

Bottom line

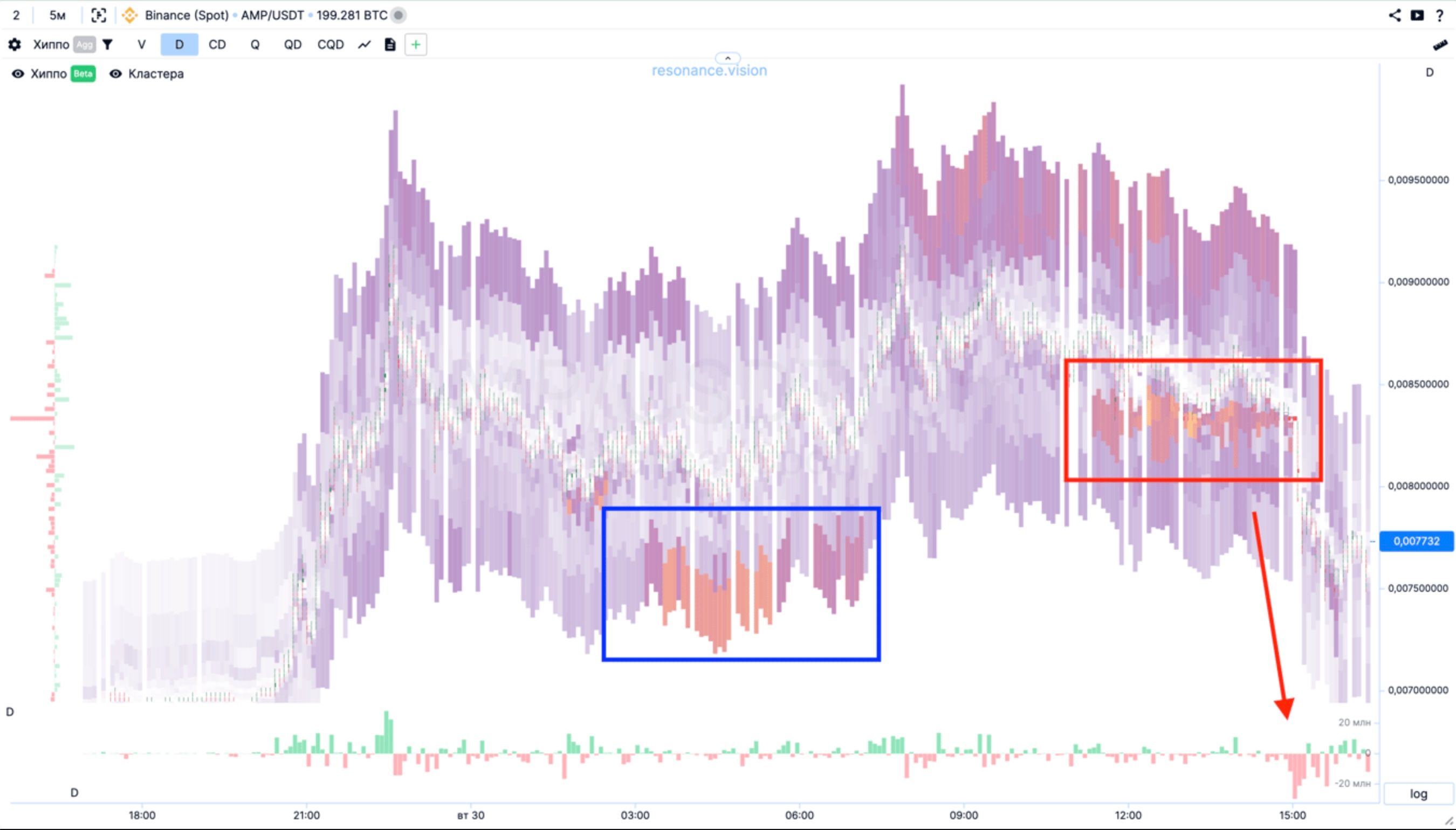

If we look further, we can see that the participants have reached parity, large purchases do not lead to growth, and sales to decline (blue arrows).

After a short time, a limit support zone is formed on this asset, not far from the price (blue zone).

And buying starts to drive the price up again.

Further we see a new attempt of buyers to renew the price maximum. (blue oval zone).

We can see that the maximum on purchases was not updated (red line).

It was not updated because of the big limit resistance from the seller’s side (blue square zone).

Conclusion

- Is the hippo tool (table) suitable for finding significant overweight buyers or sellers? Yes.

- Is the hippo tool (heat map) suitable for visually finding a significant preponderance of buyers or sellers? Yes.

- Is limit information alone sufficient to make a decision to open a trade? No.

For complex analysis and validation of a trade idea, it is necessary to use a cluster chart, because limit orders are just intentions. And even if we see dense support (blue and red zones) all over the market (heat map in aggregation mode), it does not always mean that the price will go in the opposite direction from the limit support.

In one case we see that the limit support zone (blue zone) was accompanied by market purchases. And in the second case the limit support (red zone) appeared after an unsuccessful attempt to update the price maximum. Plus dense market selling (red arrow) rather indicates that participants with open positions saw the limit support and decided to use it as liquidity to close long positions.

Summary

The Hippo tool is a unique search algorithm that helps you find the right settings for your strategy to find weighty limit orders, while the wide filtering allows you to quickly assess the balance of forces.

No need to invent complex schemes and look for the "grail". Use the Resonance platform tools.

Register via the link — get a bonus and start earning:

OKX | BingX | KuCoin.

Promo code TOPBLOG gives you a 10% discount on any Resonance tariff plan.