Trading strategies for beginners

Trading is not just about the Buy and Sell buttons.

The success of a beginner is not in a magic indicator, but in the mindset, discipline and understanding of the market.

A must-read for those who want to learn how to trade consciously rather than just try.

Table of content

If there was a way for newcomers to the stock or crypto market to take a survey and ask a single question, I would ask this:

“What should I do to close a trade successfully?”

I am convinced that the vast majority would answer that in order to have a positive result in a trade you need to choose a good trade entry and exit point.

The so-called "near-marketers” have always known this and tried to use it to their advantage. Technical analysis only described patterns and levels but did not always give answers to the question of when to open the trade, how to accompany it, when to close it, and how to manage the portfolio. As a result, new indicators were invented all the time, and, of course, those that showed entry and exit points directly on the chart were particularly popular with beginners.

Why is the entry and exit point not so important?

Opening trades based on indicator data or trader signals from VIP channels makes you a one-track mind. Your only responsibility comes down to only pressing two buttons: BUY and SELL.

And if trading were that simple, we’d all be sailing our own yachts on warm seas, sipping expensive champagne. But the reality, and more importantly the statistics of beginners’ success is inexorable:

Most beginners lose more than they make in the exchange.

Important factors in trading

In addition to entry and exit points, the following factors are much more important for a trader:

- Risk management (more details in our articles “Trading")

- Choosing a comfortable timeframe for trading

- Context or background assessment: an analysis of what happened to the price before it approached the intended entry point; is there really an imbalance between supply and demand?

- Emotional stability. If you cannot explain your actions in terms of supply and demand, it means that they were made under the influence of emotions and unsupported expectations.

Based on these factors, the main key to a successful trading strategy is to have the right mindset. More specifically, to have the answers to the following questions:

- How much can I afford to lose in a trade?

- Won’t something distract me from trading in my chosen timeframe?

- Have I gathered enough information, are all the conditions within my strategy for opening a trade met?

- Am I able to follow the rules of my trading strategy with discipline?

How can Resonance help beginners develop their trading strategies?

There are several different tools on the Resonance platform that allow new traders to get a deeper insight into what’s going on in the crypto market. Besides, they are constantly being improved and new tools are being developed all the time.

You can find out more about them and read a detailed description in the “Platform" section.

What these tools have in common is that they each contain some actual values, and numbers that can be twisted, compared, and contrasted in various ways. They cannot tell us with 100% probability where the price is going. But we try to squeeze as much information as we can out of the data that exchanges can provide to ordinary participants.

But it is also a mistake to focus only on the actual values (e.g. Market Delta values). The same figures can be interpreted differently if the price behaviour is different or if volumes are increasing or decreasing.

So, our goal as a community is not only to give beginners some trading strategies, but also to teach them how to build a logical chain. After all, sometimes the crypto market situation changes very quickly. Sometimes iron-clad arguments, for example to go long, can be met with the strongest counteraction 15-30 minutes after opening a position, causing the trade to be closed completely or even to turn in the reverse direction. Without the ability to adapt, without understanding when to raise a stop or fix part of the profit, you will always take a loss that could have been avoided.

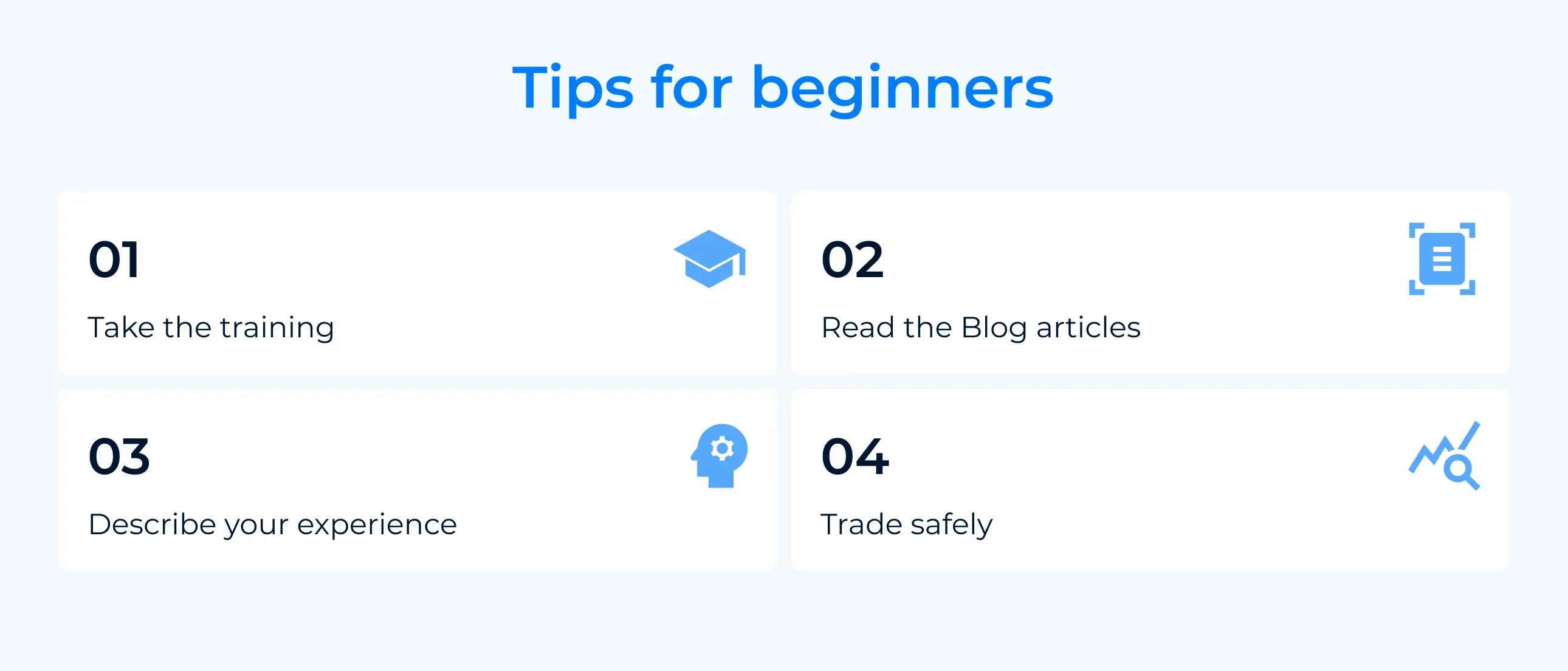

Tips for beginners in crypto trading

Best tips for beginners

- Be sure to take the Resonance University training. Basic and intermediate levels are available at the moment.

- Follow our blog posts. Try to get into what they describe, what tools are used in them.

- Write down your trades. It doesn’t matter whether it is Notion or a private channel in Telegram. Upload your interesting finds there, trying to describe in detail what exactly is happening in terms of supply and demand. Later you will be able to evaluate how accurate your thoughts were.

- Trade safely. If you are a complete beginner, use capital that will not affect your family or personal budget in any way. Start trading with the smallest amounts possible. Do not overestimate the risk in one trade by more than 1% of your deposit. Remember that if you do not have enough money, no strategy will allow you to increase it many times in a short period of time. On the contrary, there will only be additional psychological pressure due to the fear of losing everything.

There’s no need to invent complicated schemes or look for the 'holy grail’. Use the tools on the Resonance platform.

Register via the link to get a bonus and start earning:

OKX | BingX | KuCoin.

Use promo code TOPBLOG to get 10% off any Resonance plan.

Success in crypto trading has far less to do with the perfect entry point and far more to do with mindset, structure and risk control. The best trading strategies for beginners are about learning how supply, demand and real-time data shape every movement on the chart. Once you understand this, even day trading becomes less chaotic, because you’re operating on logic instead of emotion.

Resonance helps new traders build this foundation: not by promising shortcuts, but by giving tools that teach you how to think, adapt and make decisions based on real market behaviour. This approach is what turns beginners into confident, consistent traders.