10 tricks of successful traders

Want to trade crypto like a pro? This article packs 10 actionable techniques: trading psychology, risk management, tactical moves. Discover why partial profit-taking protects gains, how news trading can backfire, and what it really takes to earn consistently. No “magic bullets” — just proven tips from successful traders who grow their accounts through strategy and discipline.

Table of content

Intro

You’ve probably heard that trading — especially on the **crypto market **— is an aggressive arena where only a few earn steadily. To line up with the pros, beginners need the best advice and secrets of successful traders that keep emotions and discipline under control. Trading is more than hunting for an entry; outcome depends on mindset, trading psychology and a serious attitude to the deposit. In the world of cryptocurrency there are no shortcuts. Below are ten tips for crypto trading — field-tested crypto trading tricks that help both beginners and seasoned traders, whatever their style.

Top 10 tips

1. Loss-free trading doesn’t exist

The biggest fear of beginners is to make a loss. It is this fear that makes us not put stops in the hope that the price will turn around and go where we want it to go. Beginners do not realise that losses from a series of several unsuccessful trades closed by stops can be covered by just one successful trade with a good risk/profit ratio within the framework of risk management. For some people 5 stops in a row is a disaster, for others it is just an experience. It all just depends on your perception of loss. Strive to treat losses as something inevitable, but at the same time, so that these losses do not weigh you down psychologically. For those new to crypto, the fear of losses is huge. Remember: five stop losses in a row can overlap one trade with a better R/R.

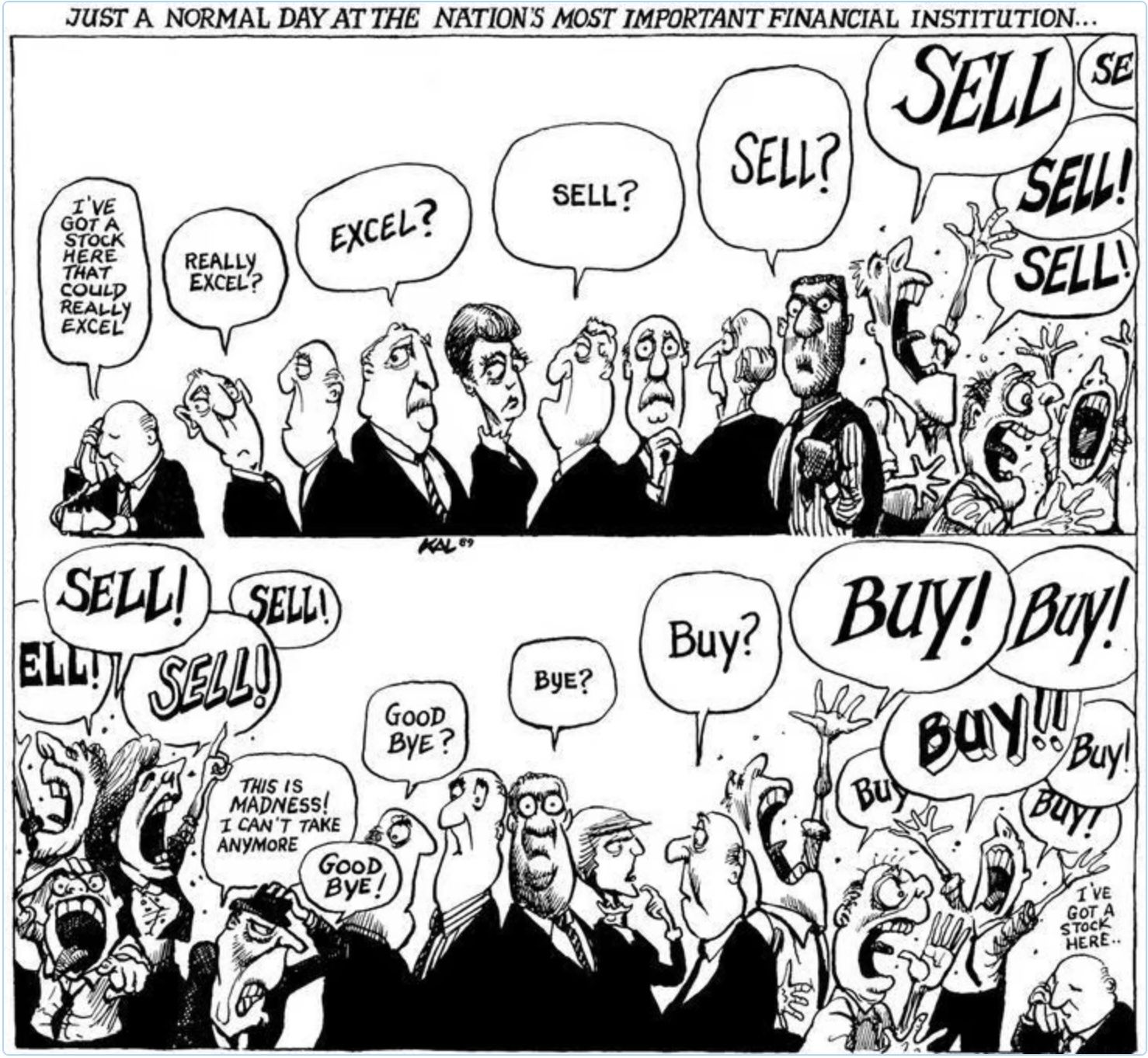

2. Curb your emotions

Before opening a trade, ask yourself if the trade matches your checklist according to the strategy.

It is better to skip the trade if:

- the arguments are insufficient or they are ‘overblown’

- the entry conditions have not been tested over a long distance

- the entry conditions meet the criteria, but the entry point has already been missed.

Such simple tricks are useful in scalping and intraday trading.

3. Cut risk in a bad market phase

I think you have often caught yourself thinking after a series of unsuccessful trades that such a streak cannot last forever, and therefore you can enter with a larger amount than usual and, thus, cover all previous losses with one trade. But the problem is that the principles of planning do not work here, and no deal has nothing in common with the previous one. And a series of 5 unsuccessful deals can just as easily turn into a series of 10 or even more. Except that the losses in case of overestimating the risk will be much more serious.An experienced trader in the cryptocurrency market knows: reducing the volume of a position is the best choice when you are not completely sure about a trade. As paradoxical as it may sound, in case of an unfavourable market phase, you should also reduce the number of trades. And ideally, it is better not to trade, but to wait for the market situation that is clear to you.

If you don’t know what to do, don’t do anything!

4. Don’t let trading be your only income

This rule follows from the previous point. Having a solid capital and receiving even a small profit of about 5%-10% per month you can quite provide your living needs. But what to do if you have closed 3 months in a row with a loss? You will have to either significantly save on your spending or ‘pinch’ your capital.

Ideally, the most favourable conditions for trading are closed life needs, stable additional sources of income (investments, business or hired work). A stable side income is the best safety net for beginners on volatile cryptocurrency markets.

5. Think for yourself

Do not copy someone else’s trades blindly. For the author of the trade idea the amount in the deal may be insignificant, while for you such a risk will cause the strongest emotions, which, in the end, may negatively affect your decisions. Adapt risk to your own comfort zone — one of the core crypto trading tricks.

6. News is already priced in

One piece of advice that has already become a classic: ignore ‘hot’ news in the cryptocurrency market; the price has factored it in beforehand. Public news is outdated the first second after its release. The news that everyone knows does not give you personally any advantage. Traders who knew about the news in advance have already analysed it and got into the right position. And it is quite possible that on the increased volatility is already ‘giving away’ to the happy crowd. Therefore, avoid trading on the news. Especially if you are a beginner. And remember that at the moment of high volatility the best market analysis can work poorly.

7. Scalping is profitable, yet exhausting

For many traders, fast tempo kills focus… No matter how mentally tough a person is, it is quite difficult to stay focused on something day in and day out. If we add the ‘emotional swings’ to which a scalper is exposed due to the constantly changing situation in the financial market, it becomes clear that prolonged trading at such a pace can seriously undermine health and even worsen relationships with loved ones.

That said, no one is saying that short-term trading is bad. You can also trade 5 minute and even minute charts. But you should try to build your work in such a way that you do not spend all your free time behind the screen. If you love day trading and scalping, plan sessions so the screen doesn’t steal the whole day.

8. Squeeze the most out of a profitable trade

Partial exits plus breakeven stops are classic tricks against greed. Expectations that are too high can eventually lead to significant losses. To avoid this, use partial locking and move stop losses to breakeven or guaranteed profit. Naturally, such decisions should not be based on intuition, but on market logic.

9. If the ship is sinking - jump off

That trick can protect the crypto account long-term. Any experienced trader will tell you: “If the price is rushing on large volumes not in your direction, then perhaps it is better not to wait for a full stop, and exit a little earlier with a smaller loss.”

Of course, the price may reverse, but this advice can save you a lot of money on the distance.

10. One trade won’t make you rich

Sooner or later in a trader’s work there may be a situation when the purchased asset may shoot to the ceiling, bringing profit ten times more than you expected. But you should not fill yourself with illusions that it is only the merit of your analysis. You should treat it with the understanding that life is a series of coincidences and this very time luck has smiled on you. But it is not a reason to immediately change your strategy and overestimate risks. It is just a pleasant bonus, a ‘bonus’, nothing more.

X100 happens, but it is luck. Do not change your trading strategy and do not overestimate the risk. Consistency is the best solution.

Conclusion

Watching experienced traders, we expect that they will tell us some secret that will allow us to earn steadily on the market. But there are no secrets as such and cannot be. Instead, there are basic principles that must be followed in order not to lose at least, and at most - to start gradually increasing your deposit.

It is important for the beginning trader to realise that there is no magic button. These advice from successful traders are the foundation for growing your deposit. Discipline wins in the crypto market. Only a systematic approach makes trading a business. Keep these useful tips - they will help you in the volatile cryptocurrency market many times over.

We hope for a magic button. There isn’t one. Instead, these tips for crypto trading lay the foundation for steady growth: discipline, risk control and clear rules.

There’s no need to invent complicated schemes or look for the 'holy grail’. Use the tools on the Resonance platform.

Register via the link to get a bonus and start earning:

OKX | BingX | KuCoin.

Use promo code TOPBLOG to get 10% off any Resonance plan.

In the fast-moving crypto market, discipline will always beat impulse. Whether you prefer swing setups or day trading, the traders who grow their deposits are those who follow clear rules and avoid emotional chaos. These practical tips and tricks for crypto trading aren’t theory — they are everyday principles that help you protect capital, stay focused, and survive volatility without burning out. Build habits, follow your system, and treat trading like a long-term craft, not a lottery. When your decisions are based on logic instead of hope, the market finally starts working for you, not against you.