How to Create a Trading Robot: A Step-by-Step Guide for Traders

Trading automation has long ceased to be the prerogative of funds or companies using high-frequency algorithms. Today, any trader can create their own trading bot without programming skills — simply by adjusting the necessary parameters. A guide to setting up grid bots.

Table of content

Introduction

Most traders try to predict the trend: they catch reversals, look for breakouts, and attempt to jump into impulses. But the market is not just about upward or downward movement. According to statistics, 80% of the time the market is in a range (flat). So why not use the period when the price “seems to stand still” to earn money?

Grid bots emerged as a response to this pattern — tools that allow systematic profit-taking when supply and demand are in equilibrium.

In such conditions, a novice trader usually does nothing, while an experienced one launches an algorithm that turns the flat into a series of small but controlled profits.

What looks like “boring sideways movement” to most people becomes a profitable trading cycle in the right hands. Dozens of small trades create stable profitability, freeing the trader from routine market monitoring.

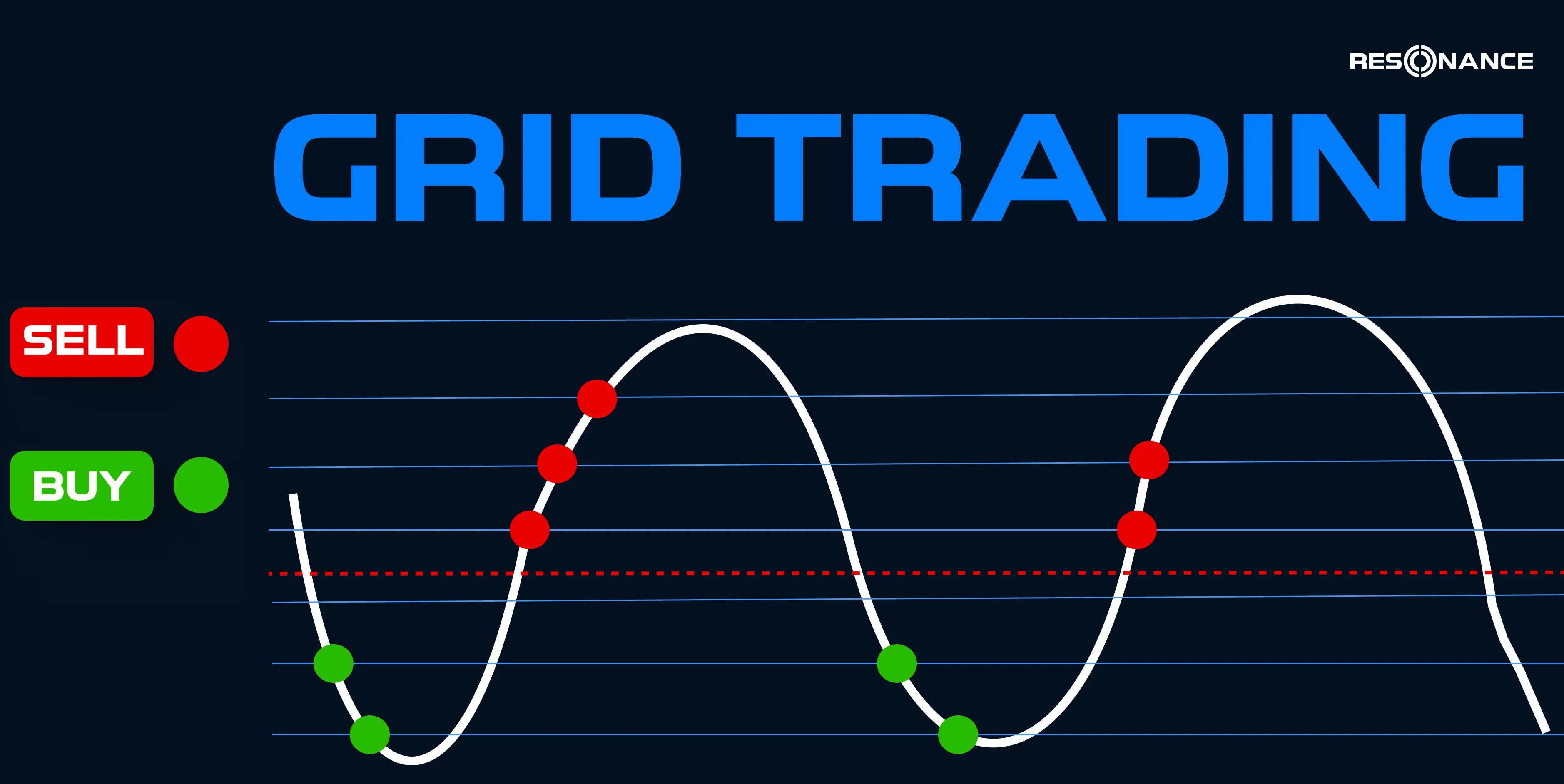

One of the most effective automation formats is the grid bot — a programme that places limit orders within a specified range: buying when the price drops and selling when it rises.

If automation was once a privilege reserved for professionals, today anyone can set up a bot for cryptocurrency trading in just a few minutes. The key is understanding why, right now and right here, the market is ripe for this trading method.

In plain terms, a crypto trading robot automates execution inside a predefined range, capturing mean-reversion swings while you focus on analysis.

What is a Grid Bot and Who is it For?

A grid bot is a specialised trading algorithm — a programme that automatically places a grid of limit buy and sell orders within a defined price range.

In other words, the bot “divides” the market into levels and operates where a trader usually cannot keep up — in micro-movements where the price constantly oscillates between supply and demand.

The principle is simple: buy on dips, sell on rises.

When the price reaches the lower grid level, the bot buys; when it climbs to the upper level, it sells. Each micro-trade brings a small profit, and their cumulative effect forms stable returns.When the price reaches the lower grid level, the bot buys; when it climbs to the upper level, it sells. Each micro-trade brings a small profit, and their cumulative effect forms stable returns.

This is an ideal tool for traders who understand market logic — the balance between supply and demand that underlies all price movements.

A grid bot does not replace analysis — it automates the execution of an idea, eliminates emotional decisions, and ensures strict discipline.

Advantages of Trading Automation with Grid Bots

- Emotion-free operation. The algorithm knows no fear, euphoria, or desire to “win back” losses.

- Continuity. While the trader sleeps, the programme continues executing trades, capturing profit from every micro-fluctuation.

- Systematic approach. All actions follow pre-set parameters — no chaotic decisions or human errors.

- Time savings. Automation frees you from constant chart monitoring, allowing focus on finding new trading ideas.

- Micro-profits that compound into significant results. A grid bot earns not from one “big trend” but from dozens of stable movements, creating a smooth equity growth curve.

Types of Grid Bots

- Spot grid bot. Operates without leverage, so there is no risk of liquidation. Profits accumulate more slowly but more steadily. This format suits conservative traders and long-term ranges.

- Futures grid bot. Uses leverage (from ×2), increasing both potential returns and risk. Suitable for active traders who control ranges, react quickly to market changes, and adhere to strict risk management.

A crypto trading robot is only as good as its risk plan: range selection, order sizing, stop-loss, take-profit and periodic rebalancing.

The Ideal Market for a Grid Bot

To know exactly where to launch a grid bot, you need to see and understand the full market cycle.

It consists of four main phases:

- Phase 1 — Balance, formation of a deficit state

The market enters a range: buys and sells balance out. Large players accumulate positions here. - Phase 2 — Realisation of the state (upward trend)

A shortage of supply pushes the price higher, forming an uptrend. - Phase 3 — Consolidation A state of surplus

Volatility is high, but growth slows. Participants who bought in Phase 1 actively take profits. - Phase 4 — Search for balance Sellers dominate buyers, forming a downtrend

Large sell volumes push the price lower; the market prepares to return to accumulation.

A grid bot works best when the market shifts from directional movement to equilibrium between buyers and sellers.

First, the trend exhausts itself (Phase 4 — search for balance). Then the market enters Phase 1 — range formation. At this point, neither side can significantly move the price:

- Buys do not create new highs;

- Sells do not break lows;

- Volumes are symmetrically distributed in the order book.

This is where real liquidity exchange occurs — large capital gradually accumulates positions.

For most traders, this is a “dead” period, but for the experienced, it is the most valuable: the order grid works like clockwork, executing hundreds of small trades and steadily generating profit.

Phase 1 is the best environment for a grid.

Sign: neither buys nor sells significantly move the price — highs/lows are not updated, the price “holds” the range. This is where the flat actually forms.

Tip: First, validate the range (channel): check whether volumes are absorbed evenly in the middle. Only then select parameters and launch the grid bot.

After the deficit state is realised, Phase 3 — consolidation — begins.

Sign: Usually high volatility and a halt in further growth. Buyers exhaust themselves, market participants actively redistribute volumes; the market calms but still moves within wide bounds (range).

Practical meaning: at the end of Phase 3, we see large sells no longer dropping the price and large buys no longer pushing it higher — both sides become inefficient.

This is a clear signal that the market is entering a flat — exactly where the grid bot reveals its potential.

Phase 3 is profitable but short: it delivers quick results yet lasts briefly, so it is crucial to lock in profits or update the grid in time.

During strong trends (Phases 2 and 4), the bot becomes inefficient: the market loses balance, market orders flow one way, the grid is either fully bought or sold without compensation.

Therefore, we recommend determining the market phase before launching a grid bot. It performs best in flats or moderately volatile markets. Only then does a grid bot make sense.

Preparation for Launching a Grid Bot

Choosing a Trading Pair

Selecting a pair is not about your “favourite coin” but its market condition. A grid bot is effective only where the price has lost momentum in one direction — i.e., supply and demand are balanced.

When buy volumes do not push the price up and sell volumes do not push it down — this is the ideal situation for a grid.

Before creating a trading bot, define your pair, volatility regime, order book liquidity, fees and acceptable drawdown.

The main condition for launching a grid bot is a sideways market.

The coin should be:

- either after a sharp drop, having regained equilibrium;

- or after a growth period, trapped in a channel.

In these scenarios, the market shifts from impulsive movement to deficit formation or consolidation. That is when the flat begins, which the bot can work through with a series of small profitable cycles.

Volatility vs Duration

Consolidation is, in a sense, the most profitable market phase, but it is very short. You must decide what matters more: catching short high-volatility moments or long calm sideways markets.

High volatility means the bot generates profit quickly, but the grid’s active period is limited (usually a few days).

A slow, long sideways market means smaller fluctuations, yet the bot can run for weeks, delivering stable returns.

Liquidity

The coin must have:

- active volumes (so orders execute quickly);

- a narrow bid-ask spread;

- adequate daily trading volume — small altcoins pose a risk of significantly reduced grid efficiency.

Context Check Before Launch

Before selecting an asset:

- Find coins suitable for grid trading and add them to your session list.

- Analyse supply and demand — if volumes are balanced and the price oscillates in a range, the pair fits.

- Assess the market phase: consolidation or deficit formation phases are optimal launch moments.

- Check minimum exchange volumes so the number of grids does not exceed the allowed minimum order size.

Choosing a Platform

Launch a grid bot on an exchange with its own interface for creating and monitoring bots.

Binance, Bybit, KuCoin, BingX are the most convenient options because:

- the bot works directly with exchange orders;

- reports are stored in your account;

- fees are lower than with external services.

Most major exchanges let you create a crypto trading bot via native interfaces without third-party tooling.

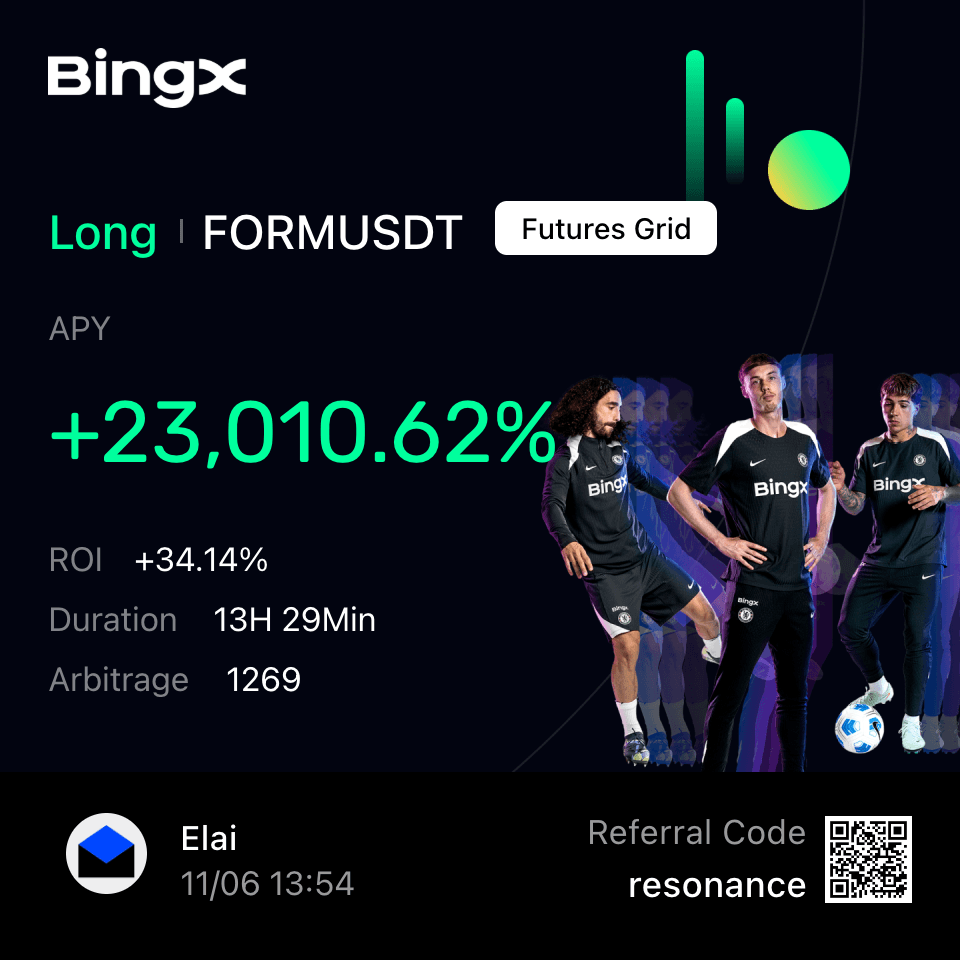

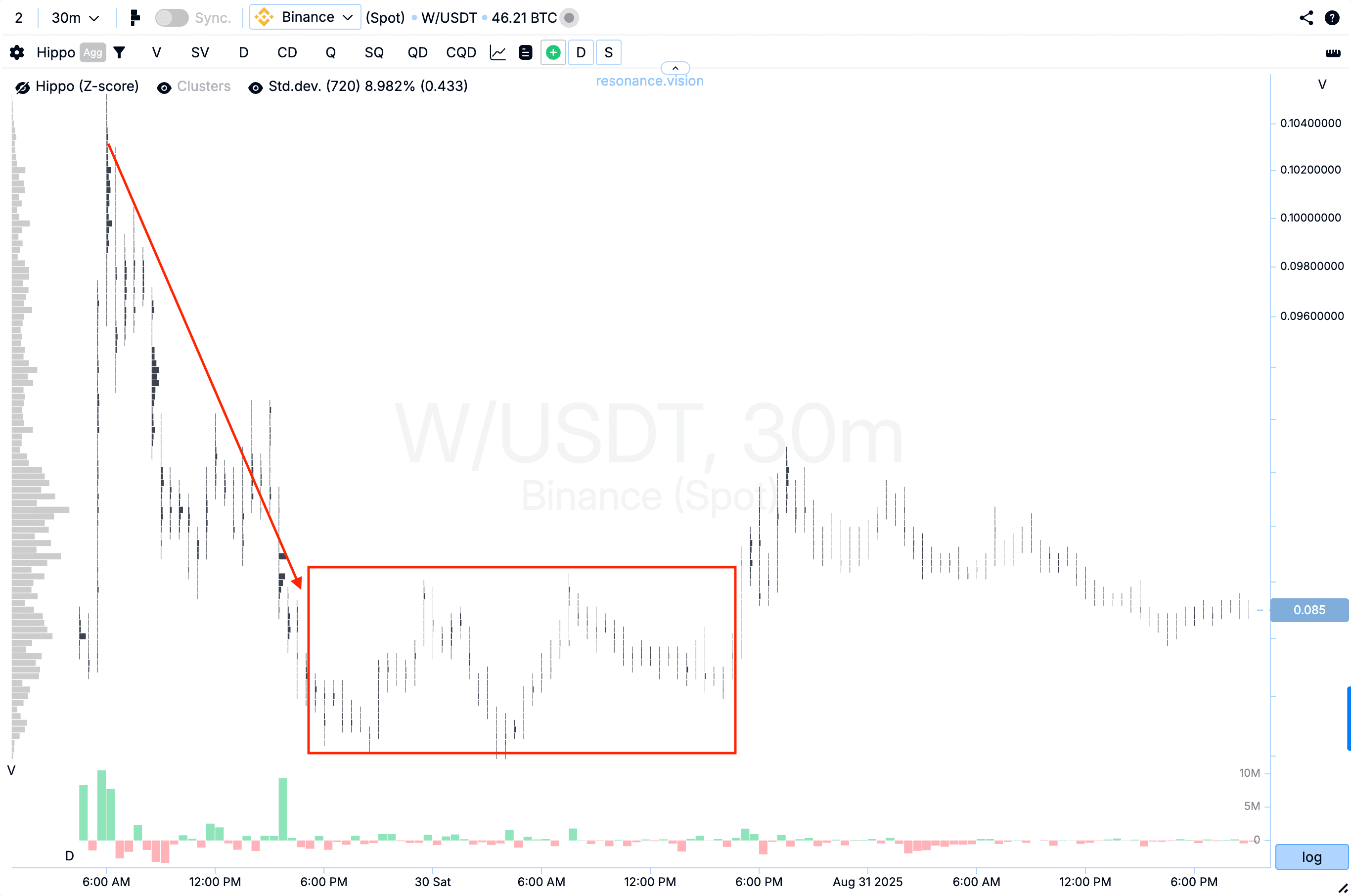

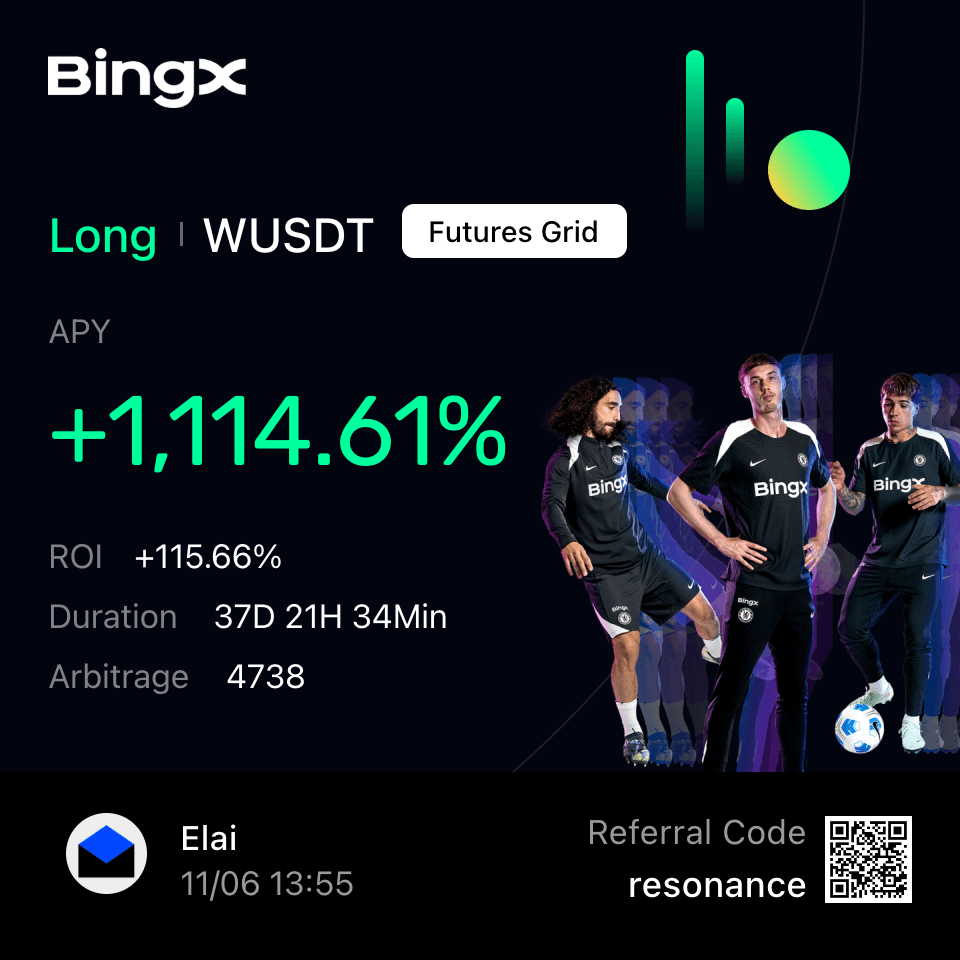

Example:

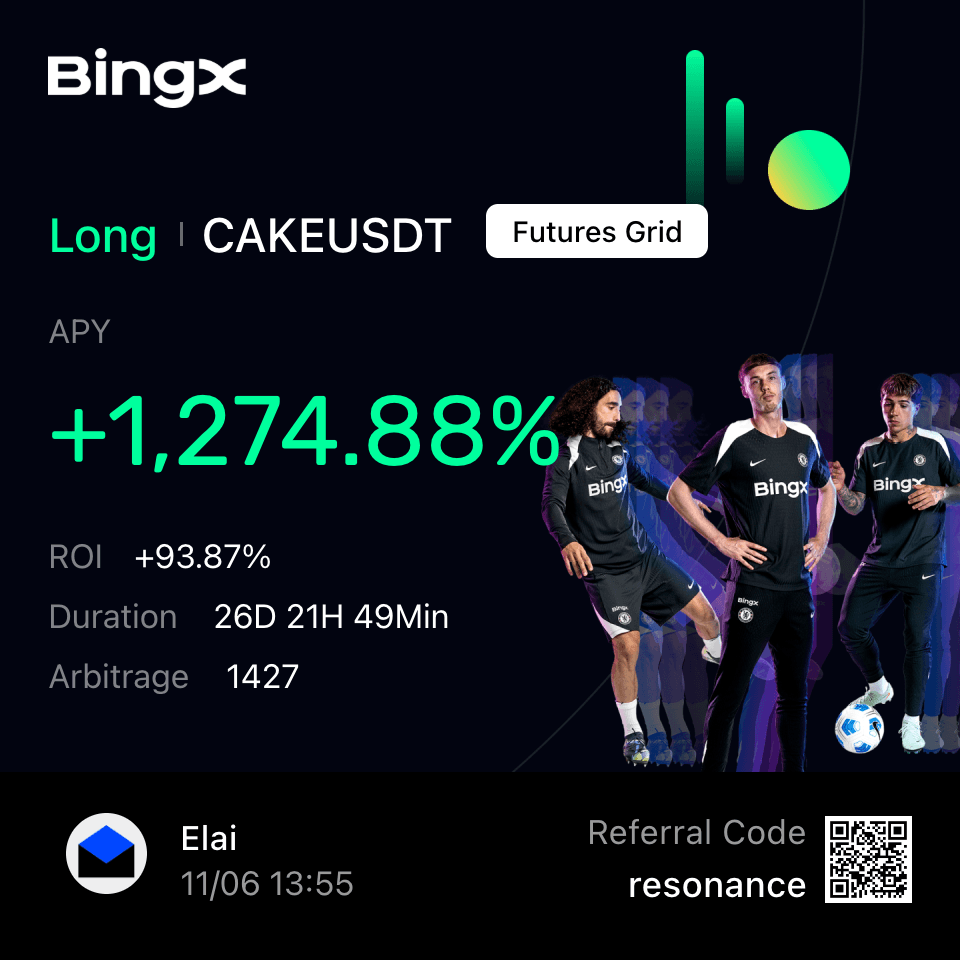

After an impulsive rise, the price of the W/USDT pair dropped and entered a flat — neither buys nor sells significantly affected the price (red rectangle). This is a perfect opportunity to profit using a grid bot:

The grid range boundaries were set, and the bot ran for 37 days, delivering a solid income:

Key Grid Bot Settings Parameters

Price Range — the boundaries within which the bot places orders.

The range must be set from the support zone to the resistance zone, identified via volume analysis.

Grid bot boundaries should cover the entire flat but avoid zones where market volumes become inefficient. Lower boundary — where demand prevails; upper boundary — where buyer activity fades. When the price exits the set range, the bot stops opening orders.

Number of Grids — the number of levels at which orders are placed inside the range.

A denser grid means more frequent trading but smaller profit per trade. Fewer levels mean rarer trades but larger profit per trade.

Statistically, the best distance between grid levels is 0.2–0.3% of price movement.

The formula for calculating the grid step is simple:

Grid step = (Upper boundary – Lower boundary) / Number of grids.

Investment Capital

Capital size determines not only potential returns but also risk.

On BingX or KuCoin, funds allocated to the bot are placed on isolated margin — meaning your risk is limited to that exact amount.

Your maximum risk is the money you allocated to the grid bot. Even if stop-loss fails, you lose only that sum, as the exchange isolates the position from the rest of your capital.

Money management tips:

- start with the minimum (e.g., 50 USDT on BingX);

- split total capital across several exchanges (as a backup);

- remember liquidation is possible only with leverage (futures bot).

Profit per Grid — the parameter showing the profit built into each micro-trade.

0.2% per grid is the optimal balance between trade frequency and profitability.

Too small a percentage (0.1% or less) means exchange fees can eat the profit.

Too large (1–2%) means the bot loses sensitivity to micro-movements and trades less often.

Leverage

For beginners, ×3–×5 is optimal to avoid liquidations on pullbacks.

Interrelation of Grid Bot Parameters

All four parameters function as a single system:

- range defines the playing field;

- number of grids — sensitivity to movement;

- capital — position scale;

- profit per grid — profit growth rate.

Changing one affects the others: increasing the number of grids requires either narrowing the range or increasing allocated capital.

Risk Management with a Grid Bot

What to Do When Price Exits the Range?

A grid bot is an automated strategy but not risk-free. No strategy is entirely risk-free because price risk always exists.

Each grid is a separate isolated position, and risks must be controlled no less than in manual trading.

If price exits the set range, it signals that the original trading scenario is no longer valid — your idea is strategically outdated.

The reason is simple: when price falls below the lower boundary, the bot keeps buying the asset, increasing position size. The overall position goes negative — logically, since buying continues “against the trend”. Holding such a grid only deepens the loss.

A grid bot cannot be risk-free. It is not “eternal profitability” but systematic trading that requires monitoring.

Therefore, if price breaks the set range, close the position via Stop-Loss. Do not wait for a return.

This is not a “defeat” but capital preservation for a new cycle.

Difference Between Futures and Spot Bots

A futures grid uses leverage — risks rise proportionally.

Holding an open position after exiting the range is inadvisable.

A spot grid is safer: even with a deep drawdown, the asset stays with you, and you can wait for recovery.

Stop-Loss and Take-Profit in grid trading are not formalities but part of the logic.

Stop-loss is placed below the critical support zone; take-profit above the resistance zone.

Profit is set outside the range. Range boundaries are calculated as a volatility channel. If the high is not updated and the low holds — that is your working zone.

Profit Reinvestment

Managing profit is no less important than risk management.

If the bot generates profit, you can adjust the margin and withdraw part of the funds. This is not just profit but a reduction in margin — thereby lowering risk.

For example, on BingX this can be done manually; on Binance part of the profit may reinvest automatically.

Recommendation: after each full cycle (e.g., 5–7 days) or upon reaching planned ROI, withdraw 20–30% of profit to reduce risk or expand the grid using the “compound interest effect”.

Need to Monitor Leverage

If trading futures, constantly check the calculated liquidation price.

When liquidation gets too close — reduce leverage.

Optimal leverage for stable flats is ×3–×5, maximum ×10 for short volatile periods.

This maintains control and prevents the bot from “burning out” on a brief price spike.

Risk management is not a tick-box exercise but a core element of the strategy:

- Define the range and place Stop-Loss/Take-Profit beyond it.

- If price exits the range — stop the bot; do not wait for a pullback.

- Monitor leverage — reduce it if liquidation price is too close.

- Periodically withdraw profit.

- Remember that even isolated margin does not eliminate risk entirely — it only limits its size.

Thus, a grid bot transforms from a mere “automatic programme” into a controlled capital management strategy that operates on clear rules and discipline, delivering stable profit.

You can create a crypto trading bot without coding by using exchange templates.

Conclusion

A grid bot is an assistant for the structurally-minded trader. When used correctly, a cryptocurrency trading robot improves the profitability of a trader’s trading idea.

Its task is to turn a flat or calm market into a sequence of small but systematic wins.

Where most see a “dead period”, the experienced trader sees opportunity: a balance of supply and demand that can be converted into steady profitability.

A grid bot works precisely in these conditions — when the market shifts from impulse to balance and price moves inside a channel.

Its effectiveness begins where the trend ends.

When the market loses direction, the algorithm takes over the routine, allowing the trader to watch not every micro-movement but the overall logic of supply and liquidity.

A grid bot is the realisation of one of the trader’s ideas, a tool of discipline and consistency.

It trades by your rules, turning a quiet market into stable profit.

And that is its greatest advantage.

Follow new insights in our telegram channel.

No need to invent complex schemes and look for the "grail". Use the Resonance platform tools.

Register via the link — get a bonus and start earning:

OKX | BingX | KuCoin.

Promo code TOPBLOG gives you a 10% discount on any Resonance tariff plan.