Pin Bars in Trading: A Price Reversal Signal for Profitable Trades

The pin bar is one of the most popular reversal signals, but the overwhelming majority of traders interpret it incorrectly. In this article, we’ll examine what really lies behind the long shadow of the candle, how to identify a genuine pin bar, and why it serves only as a trigger for attention rather than a command to enter a trade. You’ll learn how professionals use cluster analysis and Resonance algorithms to detect real market anomalies and trade deliberately, rather than blindly.

Table of content

Pin bars have long been one of the most recognisable elements of price action analysis in cryptocurrency trading. While novices see them as ready-made “buy” or “sell” signals and build pin bar strategies around them, experienced traders use them differently — as a pin bar trading indicator that the market has encountered strong resistance in a particular zone.

A true pin bar pattern is a trace of the struggle between supply and demand, which can be identified on a cluster chart and confirmed only through volumes, delta, and bar structure. How do you distinguish a bullish from a bearish scenario? Let’s dive in!

What is a Pin Bar and Why Does it Work in the Real Market?

A pin bar is a candle with a small body and a long shadow that captures the moment of sharp price rejection within the bar. Initially, the market moves in one direction, but then the opposing side applies resistance, completely reversing the final price direction. The pin bar records precisely the moment when the impulse fails.

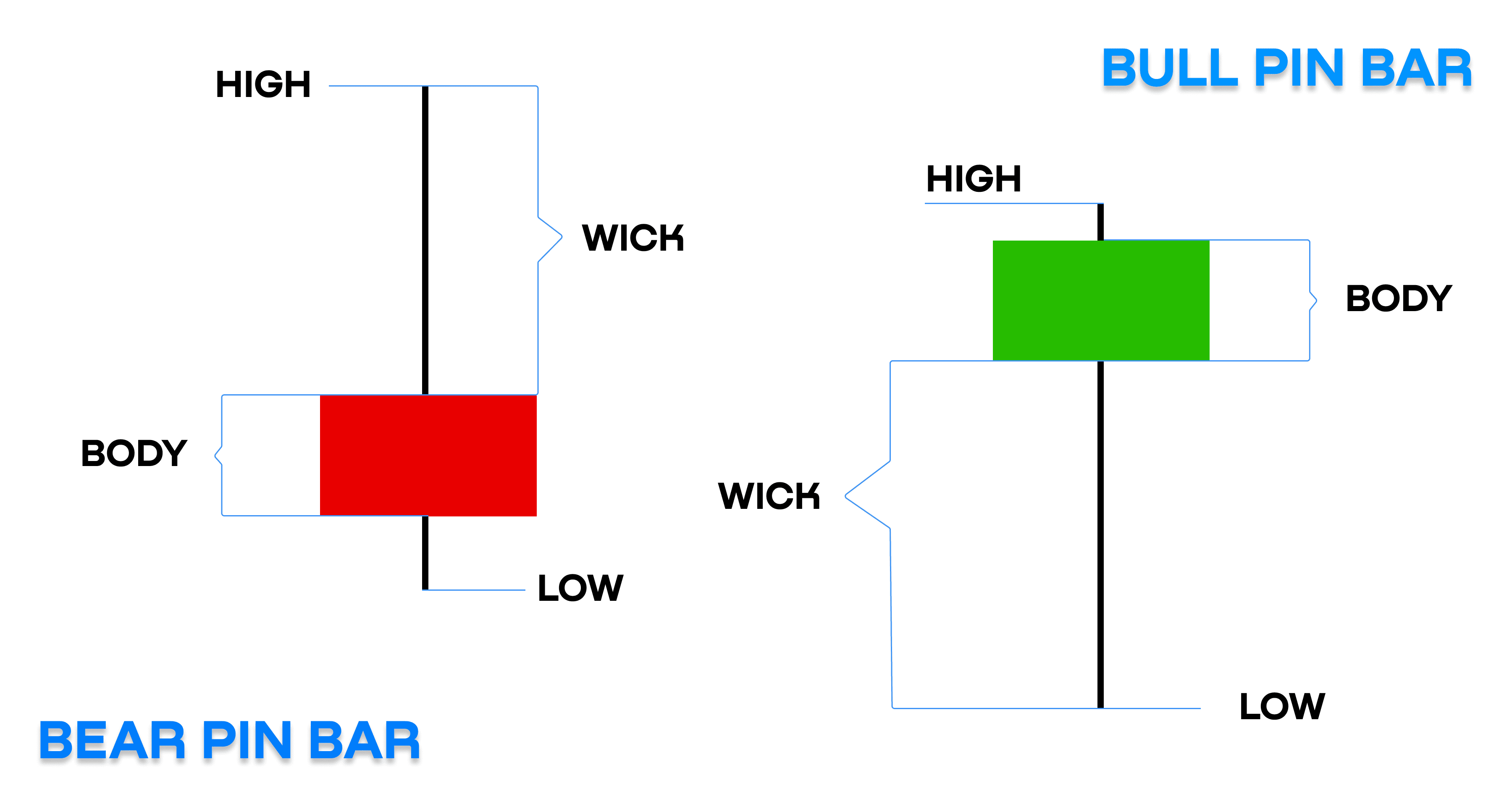

A classic pin bar consists of three visual elements:

- Body — a small range between the open and close; it shows which side controlled the price by the end of the bar.

- Wick (or Shadow) — a long rejection zone where price was pushed back by opposing order flow.

- High/Low — the extreme points where aggressive buying or selling occurred and liquidity was absorbed.

In technical analysis, this structure is supposed to help determine where the market tried to go and where it met resistance.

It is generally accepted that:

- If the tail points downwards — this is a bullish scenario.

- If the tail points upwards — this is a bearish scenario in trading.

A pin bar is indeed easy to spot: the tail-to-body ratio is at least 3:1.

However, in cryptocurrency trading, it’s crucial to distinguish a valid signal from a candle that merely resembles one externally. Experienced traders focus not so much on the candle’s shape as on the context and the nature of the participants’ struggle:

- Pin bars appear at extremes. That’s where emotions most often kick in: most enter the market late, often on FOMO, trying to chase the trend.

- The tail must contain real volumes. A long shadow alone does not imply reversal. What matters is that significant trade volumes passed through this zone—they confirm the move stopped deliberately. If volumes are absent, the shadow may result from low liquidity or coincidence, not a genuine battle between buyers and sellers.

A robust pin bar trading system integrates volume analysis, price structure, and participant behaviour into one decision-making framework.

Which Pin Bars are Considered Valid from a Volume Perspective?

A pin bar’s strength is determined not by shape, but by what happened with volumes before the pin bar formed, inside the candle’s tail, and after its completion.

Only a bar showing volume accumulation in the tail zone that matches the direction of price rejection deserves attention:

- If the tail is below — the lower part of the candle should show large limit buys that absorbed the flow of market sells. This means limit orders took on all the volume pressing the price down, forming a local supply shortage here.

- If the tail is above — the upper part of the candle should display significant limit sell volume that halted buyers’ attempts to push the price higher. This indicates limit sellers created a local surplus and absorbed demand.

Thus, a valid pin bar is not a perfectly shaped candle but a bar rich in content: the tail records real opposition among participants sufficient to shift the local balance.

Colour, shape, or symmetry are of little importance.

Only one thing matters — volumes confirming price rejection precisely in this zone.

A bull market often amplifies emotional decision-making, which is why cluster analysis becomes essential when evaluating reversal signals.

Mechanics of Pin Bar Formation

A pin bar in trading cannot be viewed as a standalone signal. A true working pattern is defined not by appearance but by changing participant behaviour. To grasp its meaning, it’s vital to understand how the market transitions from inertial trend movement to resistance and then to reversal.

Any trend movement rests on a simple principle: when the market rises, most participants buy; when it falls, they sell. This creates a flow of market orders in the direction of the existing move.

However, at a certain point, this flow collides with large limit participants.

The process unfolds as follows:

- Price continues along the trend, supported by most participants’ trades.

- Strong counterparties stand in the resistance zone, not following the move but absorbing incoming market orders into their limits.

- They consume the entire flow of market trades that previously moved the price relatively unimpeded.

- Trend-side pressure exhausts itself: the market stops updating highs or lows.

- When the order flow fully butts against limit volumes, a sharp rebound occurs.

- This sharp return forms the pin bar’s tail—a trace that the move was halted “by force”.

This is a recorded fact of a specific volume clash and differing participant interests.

Thus, a pin bar pattern is meaningful only when it reflects a genuine market phase shift: the moment one side stops driving the market while another gains the ability to halt and reverse it.

What Does a Pin Bar Actually Show as an Indicator?

A pin bar does not dictate where price “should” go. It merely points to facts:

- where a liquidity conflict occurred;

- where limit participants absorbed the flow of market orders;

- where trend momentum lost strength;

- where the market shifted (or is preparing to shift) from surplus to deficit (or vice versa).

In essence, the candle declares:

“Here the strong side revealed itself. This doesn’t mean reversal, but it’s a point that must be checked further.”

One of the best ways to evaluate a pin bar is to analyse whether large participants actually defended that price zone. That’s why a pin bar is not a trading signal but an attention trigger requiring verification via volumes, delta, and market context before integration into your strategy.

If you lack your own strategy, Aires’ mini-training will provide the necessary foundation to trade a directional approach.

The Best Pin Bar Trading Indicator: Rapid Search for Candles with Reversal Signs

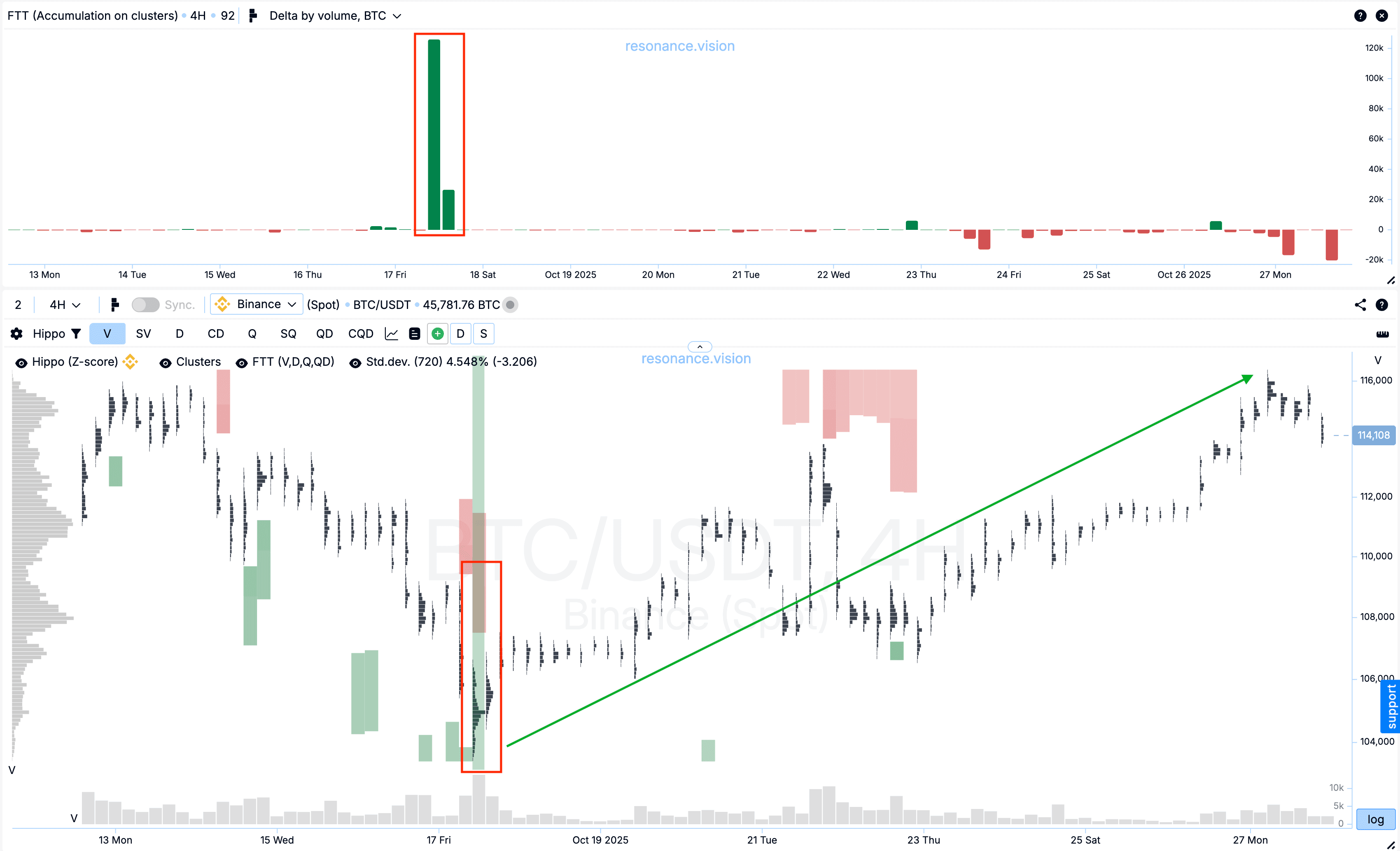

Understanding pin bar mechanics is only half the task. To trade multiple assets, you need to locate such situations quickly, filter noise, and analyse only points where large-volume clashes likely occurred. That’s why Resonance developed the FTT (Fast Trigger Tool) algorithm and its aggregator—FTT Index.

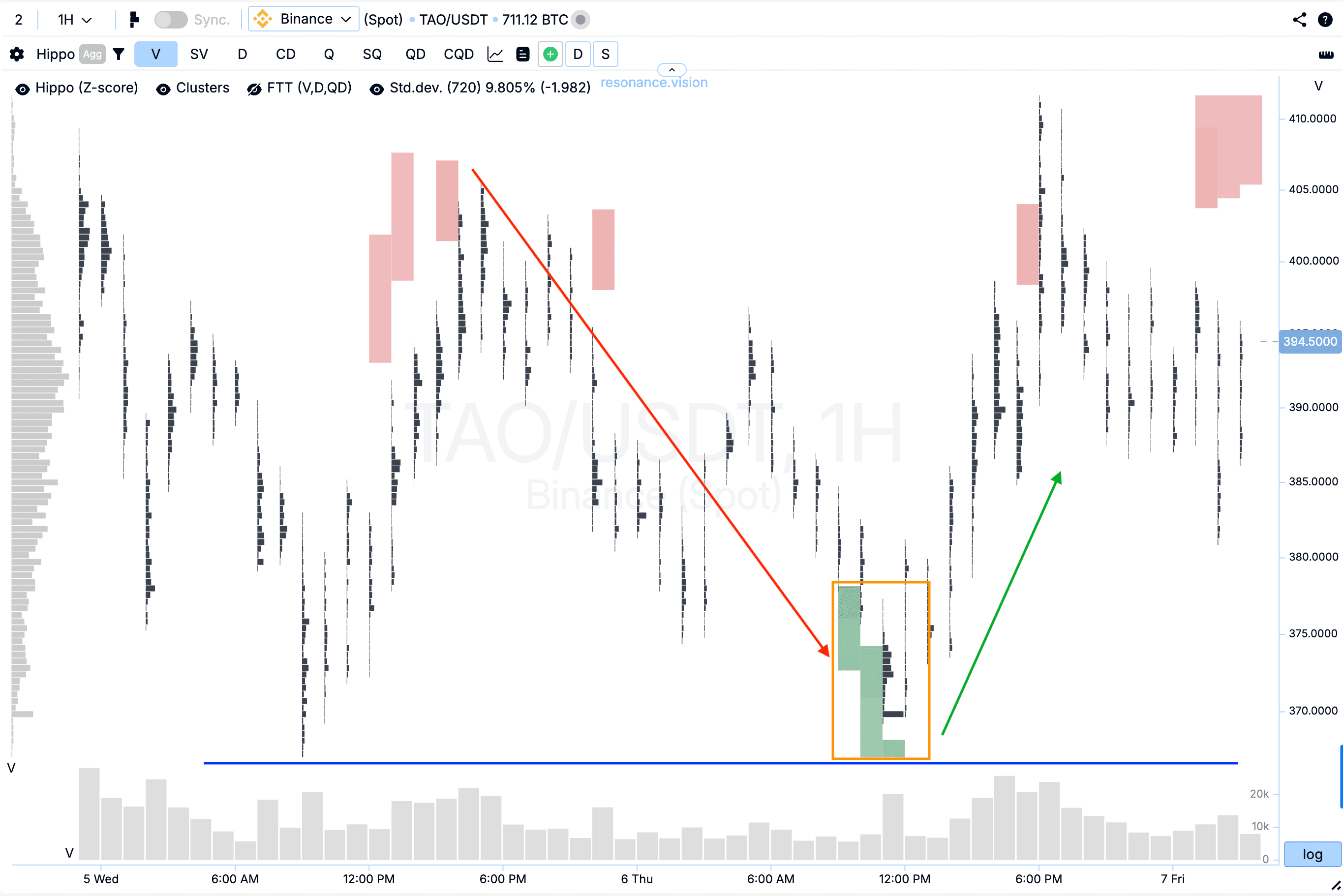

FTT automatically screens cluster charts, seeking places where price halts at local lows or highs and large volumes traded in the pin bar tail—clear signs of major player collisions.

In the FTT table, you instantly see:

- which tickers and exchanges currently show such volume clusters;

- exactly where they appeared—at the bar’s bottom or top;

- on which timeframes and data types anomalies were detected.

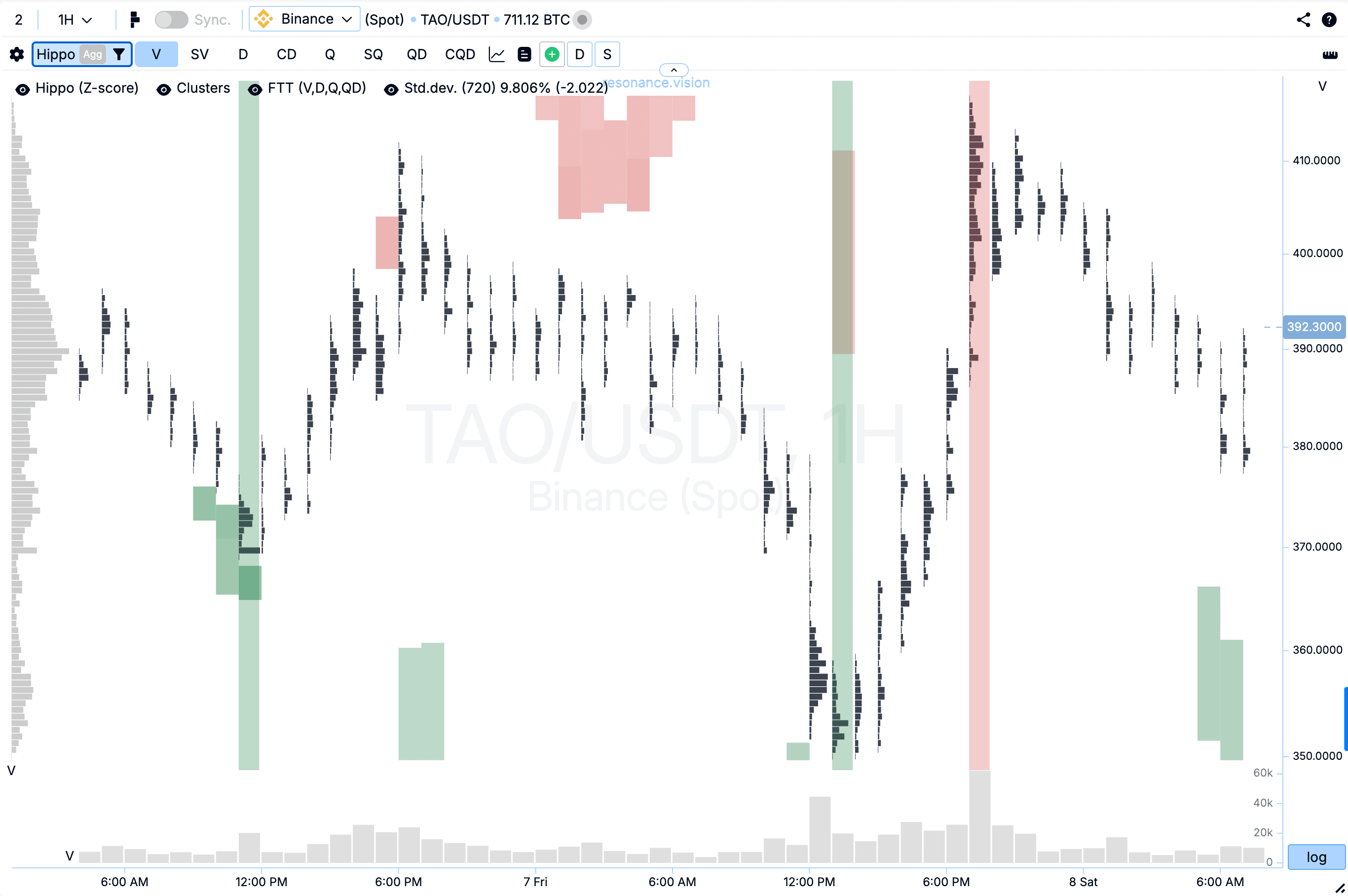

On the cluster chart, these zones are highlighted with vertical lines:

- green — accumulations near local lows (buying from below);

- red — accumulations near local highs (selling from above).

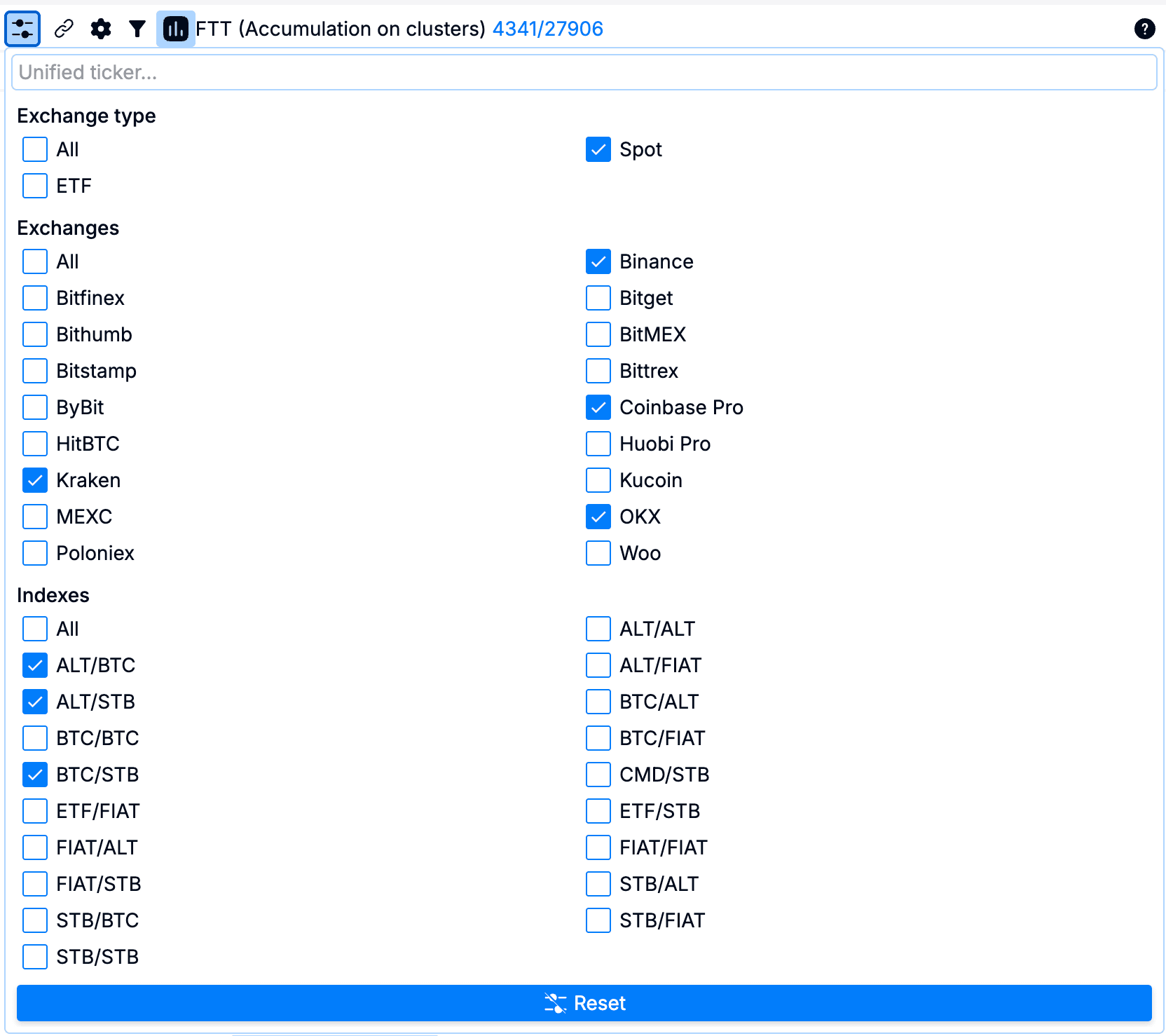

How Search Works in the FTT Table

- You select:

– Exchange type, exchanges, index groups;

– Timeframes for search;

– Data types. - FTT processes historical data immediately and displays pin bars confirmed by volumes in the bars’ “tails”.

- The system highlights such candles on the cluster chart.

The market is full of random pin bars, especially on lower timeframes. The best anomaly detector on cluster charts—FTT—filters out irrelevant bars, leaving only those that truly matter.

FTT Index: An Instant View of the Entire Market

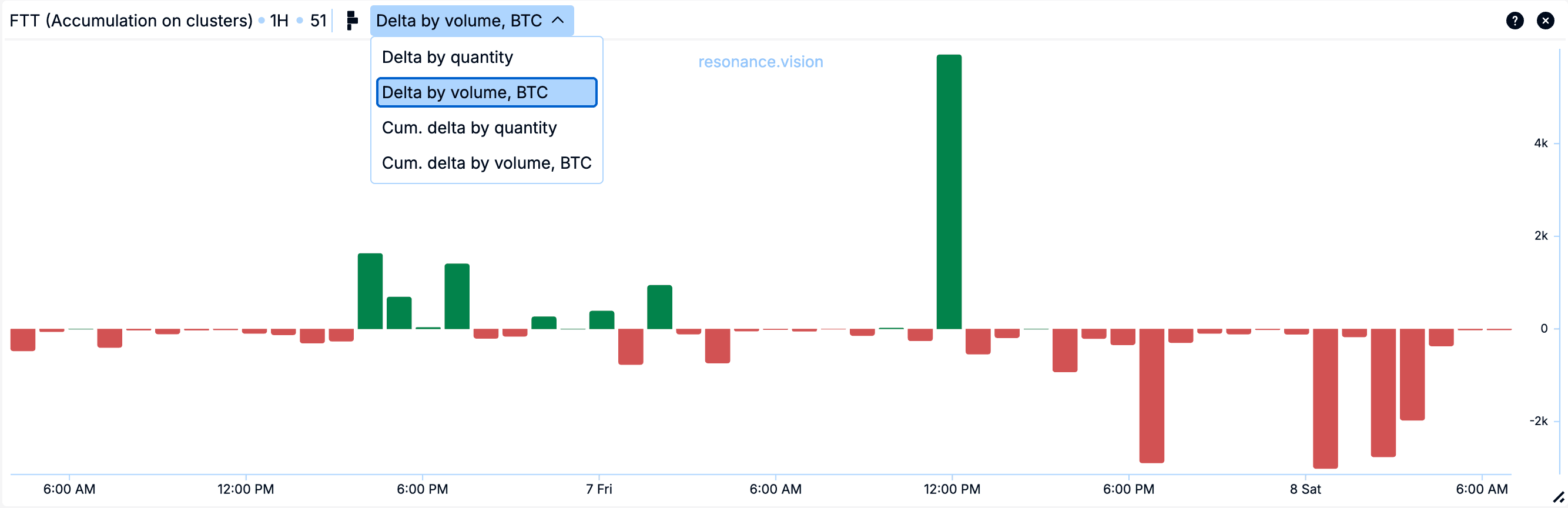

FTT Index aggregates FTT data across all coins and timeframes, showing how the number of bullish and bearish pin bars changes dynamically.

This is no longer a local tool but a pin bar trading indicator of market conditions.

FTT Index is a histogram based on various market data types, such as volumes and trade counts.

Green histogram bars indicate rising bullish pin bars—not “market growth” but more instances where demand halted a decline.

Red histogram bars indicate rising bearish pin bars—more moments where supply absorbed demand.

FTT Index consolidates all these market signals into one pin bar trading indicator.

The index helps understand:

- when buyer or seller interest accumulates;

- which market phase prevails;

- whether reversal activity signs are strengthening;

- whether market structure is becoming more aggressive.

This is especially useful for those systematically trading the entire crypto market and monitoring dozens of coins. For rapid discovery of trading ideas, FTT is the best market anomaly detector.

Thanks to this, the FTT algorithm provides not random attention points but a comprehensive picture of supply-demand balance: where interest clashes occurred, who currently dominates—buyers or sellers—and how systemic the imbalance is.

These tools do not pinpoint reversal but automatically locate areas where the market has shown atypical activity—prompting the trader to engage more actively in analysis.

FTT scans the market by selected exchange and timeframe, highlighting bars matching pin bar characteristics.

FTT’s core idea is to spare traders manual sifting through useless candlestick charts and reveal specific points where participant behaviour anomalies may have emerged.

Pin Bar: A Trigger, Not a Command to Enter a Trade

A pin bar often looks convincing: long shadow, sharp rebound, visual reversal. Yet this makes it dangerous for those who treat the candle as a ready signal. In real markets, a pin bar does not command “buy” or “sell”—it only shows where an unusual situation arose, not what the trader should do.

Professionals use it differently: as an attention point after which full analysis begins, not an immediate trade. Trading demands analysis and discipline, not mindless order placement. Any pin bar trading system should rely on objective data, allowing traders to interpret market behaviour rather than react emotionally to single candles.

Why Does a Pin Bar Alone Guarantee Nothing?

A tail’s appearance only says someone stopped the move in that zone. But price could halt:

- on a large limit order;

- during a temporary pause;

- due to local impulse exhaustion;

- from a major participant closing positions;

- amid news-driven volatility.

The candle itself reveals no further participant intentions.

It records what has happened—not what will.

Thus, the “saw a pin bar and entered immediately” strategy works only in technical analysis textbook illustrations. In a volatile market environment, a pin bar trading strategy works best when the trader evaluates not only the candle shape but also the underlying order-flow dynamics.

What Makes a Pin Bar a Valuable Trigger?

A pin bar matters not as an entry point but as a hypothesis checkpoint.

After it appears, the trader must answer:

- Why did the move stop here?

- Does it align with an extreme or liquidity zone?

- Do volumes confirm a major player behind the turn?

- Is initiative continuing on the next bar?

- Is trade character shifting in delta and clusters?

Only then can you consider trading the idea—and not always.

Essentially, a pin bar marks an intriguing event after which analysis starts, not a trade.

Proper Use of Pin Bars in Trading Logic

A pin bar should launch a decision-making algorithm, not be the decision itself.

Trader checklist after spotting a pin bar:

- Pin bar candle appearance — attention trigger.

- Market context assessment — trend structure, extremes, market phase.

- Cluster chart check — real volumes in the tail?

- Delta — signs of trend weakness?

- Confirmation by subsequent bars — initiative continuation signs?

- Apply personal trading strategy — entry, stop, risk.

A pin bar is merely the first step in a trading decision.

It is meaningless without follow-up stages.

Therefore, a pin bar trading strategy—like any other—must include:

- Trigger — market anomaly attracting trader attention. Starting point, but not an entry signal.

- Analysis — context check: coin’s market phase, supply-demand balance state.

- Validation — confirmation via volume, delta, clusters.

- Execution — entry per your strategy (entry, position size, stop, take-profit, etc.).

- Management — position handling: scaling in, breakeven move, partial profit-taking, stop-loss adjustment, etc.

- Exit — planned exit without emotional decisions.

A consistent pin bar trading strategy must always combine price action signals with volume confirmation to avoid false market reactions.

Conclusion

A pin bar is a reason to pause and analyse a coin, not to trade blindly without strategy.

It is not a ready “enter trade” command but an informational marker helping the trader spot where the market displayed an atypical reaction. A pin bar pattern alone guarantees no reversal and offers no precise direction forecast; it merely captures the moment when buyer and seller forces clashed.

In trading, seeing beyond candle shape to its substance is key: volumes, price struggle character, deficit or surplus emergence, initiative shift. This transforms a visual trigger into actionable information integrable into a strategy.

Remember: trade the idea per your strategy, managing entry, stops, and risk—not the pin bar itself.

Here, FTT and FTT Index elevate analysis to a new level. These tools turn pin bar hunting from chaotic chart scanning into a systematic, objective process, enabling rapid identification of potential initiative-shift zones.

Read the article “Pin Bar as a Trigger: How Volume Saves Traders from Losses?” before going through the pin bar again: it explains how to distinguish a real reversal from a beautiful illusion.

Follow new insights in our telegram channel.

No need to invent complex schemes and look for the "grail". Use the Resonance platform tools.

Register via the link — get a bonus and start earning:

OKX | BingX | KuCoin.

Promo code TOPBLOG gives you a 10% discount on any Resonance tariff plan.