How to Trade Intraday: Scalping Cryptocurrencies

How to quickly earn in crypto on short price movements? We explore what scalping cryptocurrencies is, who suits an aggressive or conservative approach, how to find the best entry points using tools and patterns, and what a beginner trader should know before entering a trade. In focus — working strategies for intraday trading, indicators, risk management, and an example of a real trade using the Speed Print algorithm. Ideal for beginners who want to start trading online today.

Table of content

Scalping Cryptocurrencies — this is a popular trading strategy that allows traders to profit from small price movements on cryptocurrency exchanges. This approach is ideal for those seeking quick trades and wanting to capitalize on market volatility. In this article, we will explore what scalping in trading is, how to develop a scalping strategy, which tools to use, and how beginners can master this trading method.

What is Scalping in Trading?

Scalping — this is a trading style in which a trader executes a large number of trades throughout the day, earning from small price changes. Scalping Cryptocurrencies involves using short timeframes (M1, M5, M15) to identify market opportunities. This method suits those ready for aggressive trading, requiring quick reactions, or a conservative approach that involves lower risk.

Scalping requires analytical skills, discipline, and the right choice of tools from a trader. Traders who choose this strategy are called scalp traders. They leverage volatility in crypto assets to profit from rapid price movements.

Why is Scalping Cryptocurrencies Popular?

The cryptocurrency market is known for its high volatility, making it ideal for scalping. Traders can earn from short-term price fluctuations, such as 1–5% per trade. Thanks to online platforms and cryptocurrency exchanges, scalping has become accessible to both beginners and experienced traders.

Main Advantages of Scalping:

- Quick trades: A trader can open and close positions within minutes or hours.

- Independence from global trends: The short holding time of positions reduces the impact of long-term market trends on trading.

- Flexibility: Scalping is good for both aggressive and conservative trading styles.

Aggressive vs Conservative Scalping

- Aggressive Scalping: Involves a high frequency of trades (10–20 per day) and working with highly volatile assets. Suitable for experienced traders willing to take risks.

- Conservative Scalping: Fewer trades (2–5 per day) with clear signals. Ideal for beginners who want to minimize risks.

How to Identify Short-Term Trends in Cryptocurrencies?

Identifying short-term trends is a key skill for scalp traders. It is based on analyzing supply and demand, specifically detecting states of deficit or surplus.

In any case, a scalper opens a position in a certain direction: either long or short. Therefore, to increase trading efficiency, a trader must understand the basics of a directional strategy.

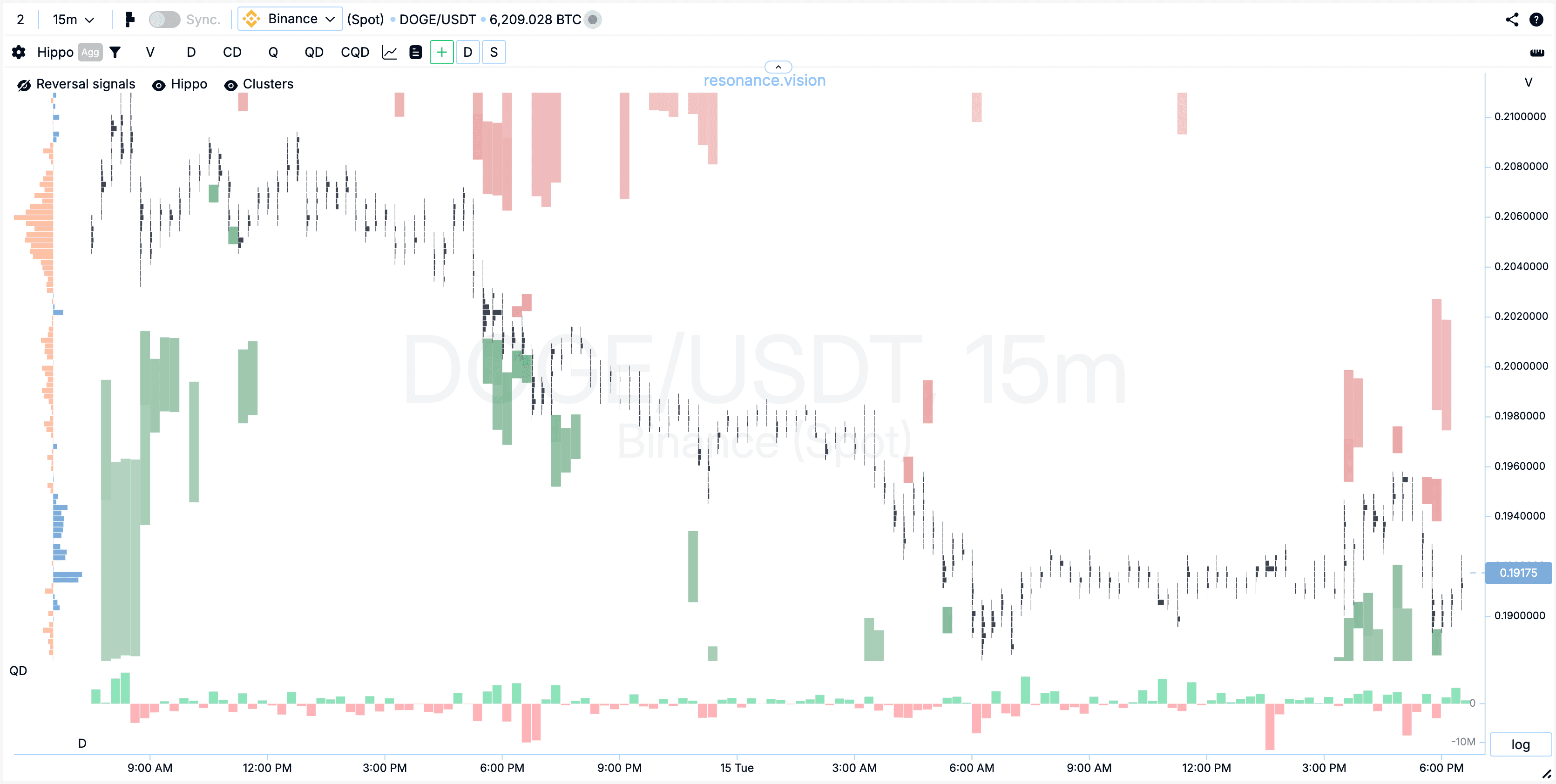

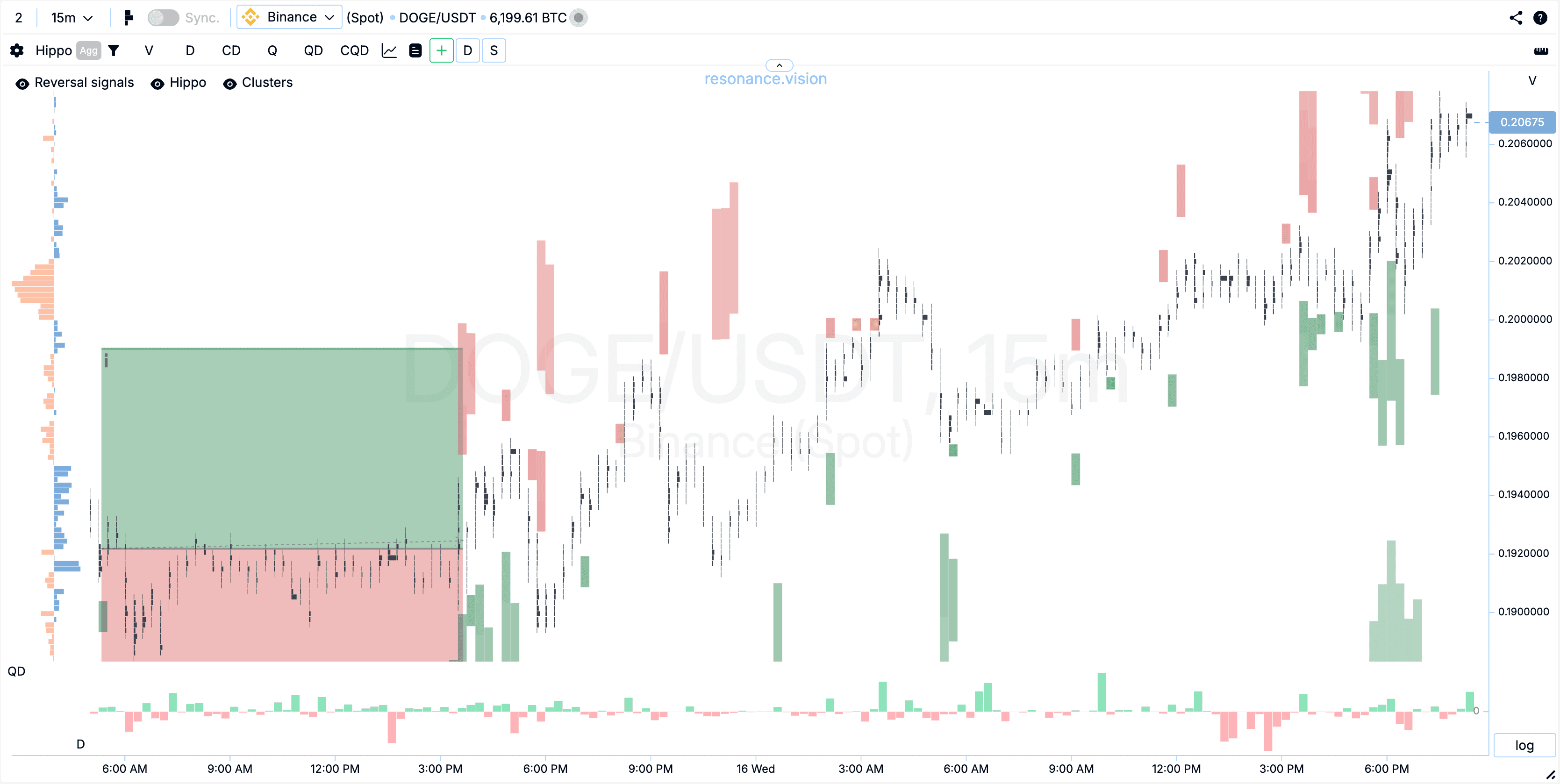

Example Analysis (Formation of deficit)

We see that on the DOGE/USDT pair, the price decreased over a certain period due to market sales. Market participants placed large limit buy orders, absorbing market sales. This gradually created a supply scarcity. At a certain point, sellers exhausted their resources — large volumes of market sales (compared to previous ones) stopped leading to price drops and updates of local lows. Buyers began placing limit orders more actively, creating additional support.

If you see that sales do not lead to a price drop, while purchases actively push it upward, this is a signal to open a long position. For short trades, it’s the same, but mirrored.

By the way, on the Resonance platform, there is a ready-made solution for scalp traders — Aires Reversal. These are trading signals that speed up the search for coins for intraday trading and scalping, sending notifications with recommendations to a Telegram channel. All you need is a subscription, validation of the signal according to a directional strategy, and adherence to the bot’s recommendations. If it’s still not entirely clear what was discussed, take the free mini-training on directional strategy from Aires. It will become a solid foundation for successful scalping.

Step-by-Step Plan for Beginners

To develop the best scalping strategy, you need to consider several key aspects: choosing tools, analyzing market activity, and risk management.

1. Choosing Tools for Scalping

Scalp traders use specialized tools for market analysis. One such tool is Speed Print, which tracks the speed and volume of trades on cryptocurrency exchanges. This tool helps detect abnormal activity, such as spikes in volatility or volume accumulation, which are key for scalping cryptocurrencies. Read more in the article “Speed Print — Your Tool for Scalping Cryptocurrencies.”

Other tools for intraday trading include:

- Cluster charts: Show trade volumes, delta (buy minus sell), quantity, delta by trade count, and accumulations.

- Market indices: For example, Altcoin Stablecoin Index (ALTSTB) or FTT index, which help assess overall market dynamics.

- Hippo and BAS: Allow tracking volumes, anomalies, and limit order activity, which is important for confirming reversal patterns and setting stop-losses.

2. Analyzing Market Activity

Scalping strategies are based on detecting market anomalies, such as a sharp increase in trade count or directed volume movements. For example, when large clusters (volume accumulation) appear on a chart, it may signal the start of a price movement. A trader must monitor:

- Volatility: Assets with dynamic price changes are ideal for scalping.

- Volume delta: Shows whether buys or sells dominate the market.

- Anomalies and patterns: For instance, a sudden increase in trade count may indicate actions by large players or algorithms.

3. Risk Management

Risk management is a key element of any trading system. For scalping, the risk-to-reward ratio is typically 1:2 or 1:3. For example:

- Stop-loss: Set in a zone with signs of deficit/surplus, considering limit support/resistance.

- Take-profit: Calculated based on asset volatility and standard deviations.

- Position size: Depends on asset liquidity. On average, within risk management, the position size per trade is 2%.

Traders should avoid manually closing trades without clear signals, such as a sudden increase in opposing volumes. Discipline is the key to success in scalping.

Scalping Strategy in Short with Speed Print

Speed Print is an innovative search algorithm designed to detect abnormal accelerations order flow tape based on executed trades. Its main task is to quickly identify exceedances of the average number of trades per minute across all exchanges and trading pairs, allowing detection of aggressive trading activity at the start of a move.

The tool converts market “noise” into precise signals for scalping, recognizing actions by large algorithmic players.

Basis of a Short Scalping Strategy

- Open Speed Print in the RTT menu. Set settings and filters:

– Search bar: Enter ticker mask — */USDT

– Exchange type — Spot

– Cryptocurrency exchange — Binance

– Price change in % — 0.3 - Next, review assets appearing in the search algorithm table by clicking on ticker names.

- Look for those where the price has risen and there are signs of surplus: large accumulations at the top of cluster bars, significant (relative to previous) buy volumes that do not lead to price increases.

- Check for limit resistance from sellers.

- Open a short position.

- Risk/reward ratio ½ or ⅓. Position size is calculated so that risk does not exceed 2% of the deposit.

Example of a Short Scalping Trade According to the Strategy:

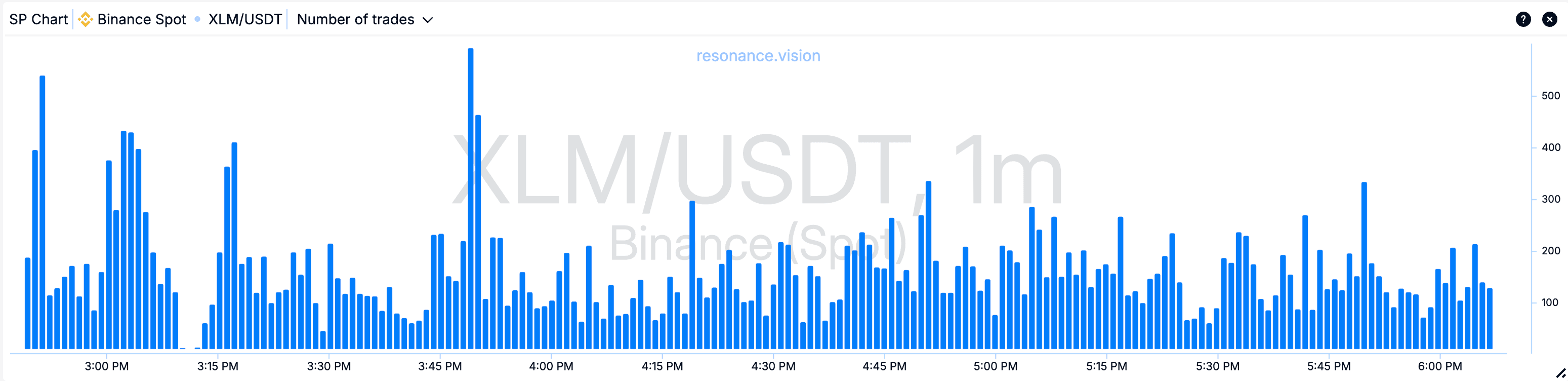

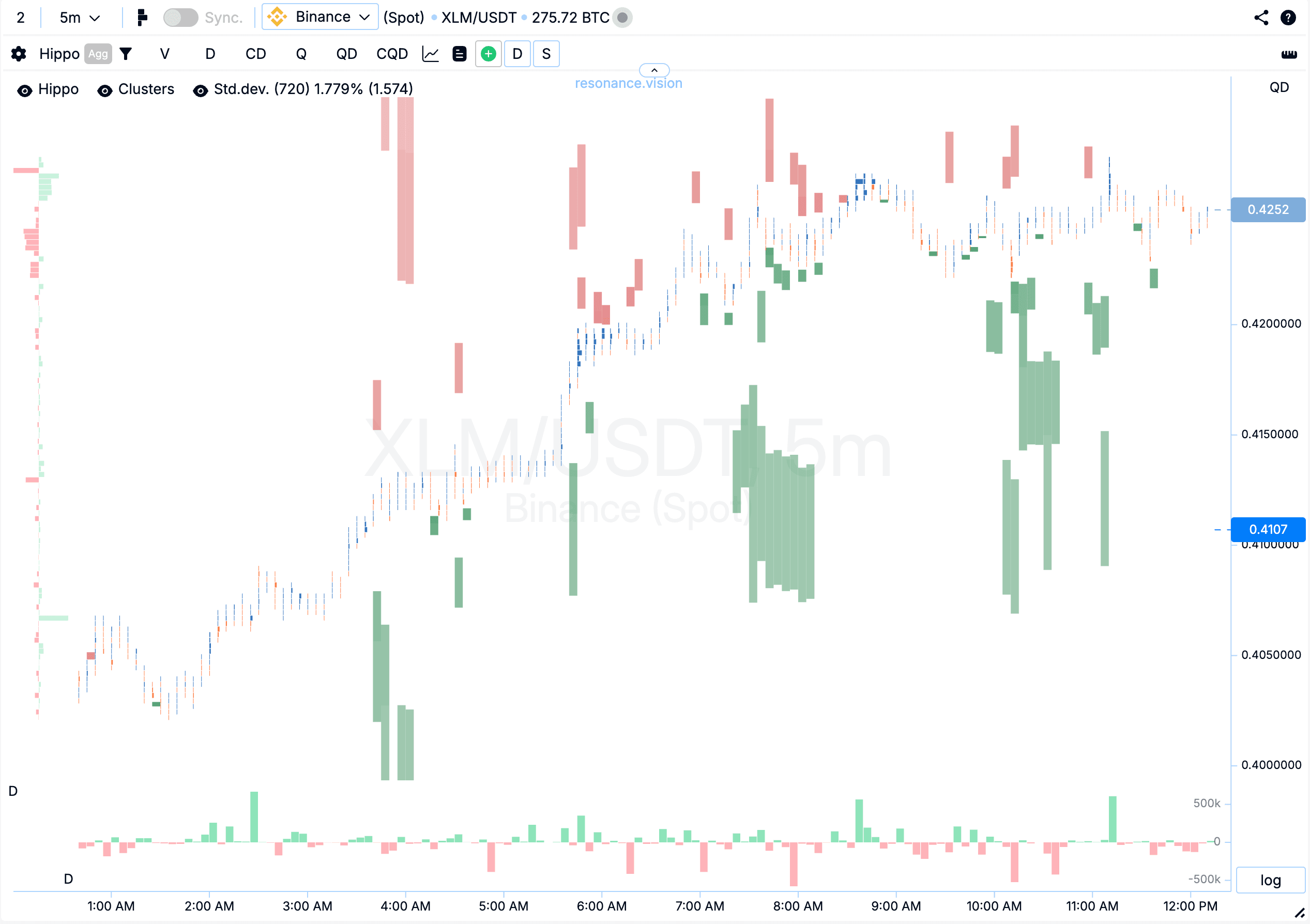

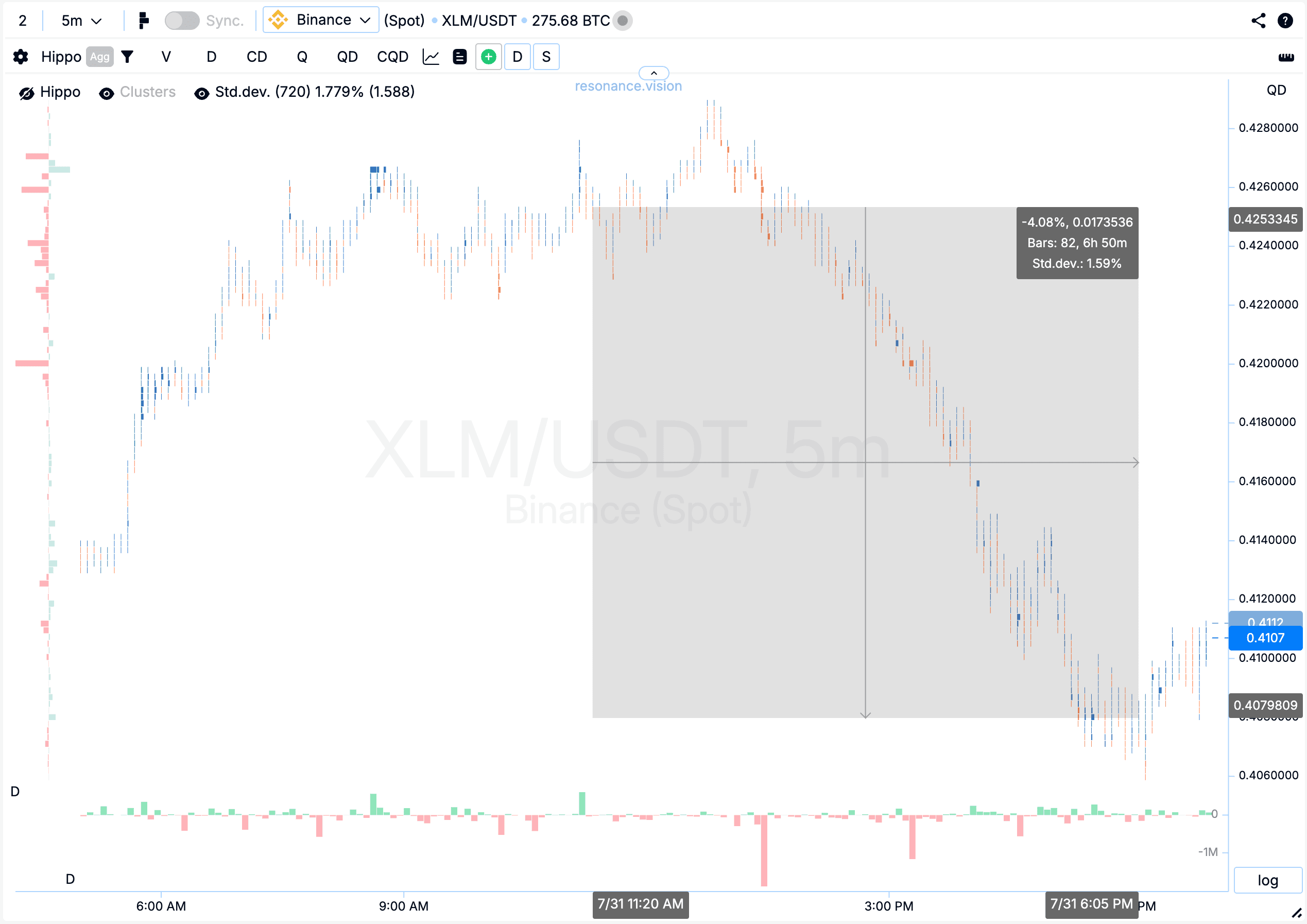

- Asset Detection: Speed Print shows a trade spike on the XLM/USDT coin:

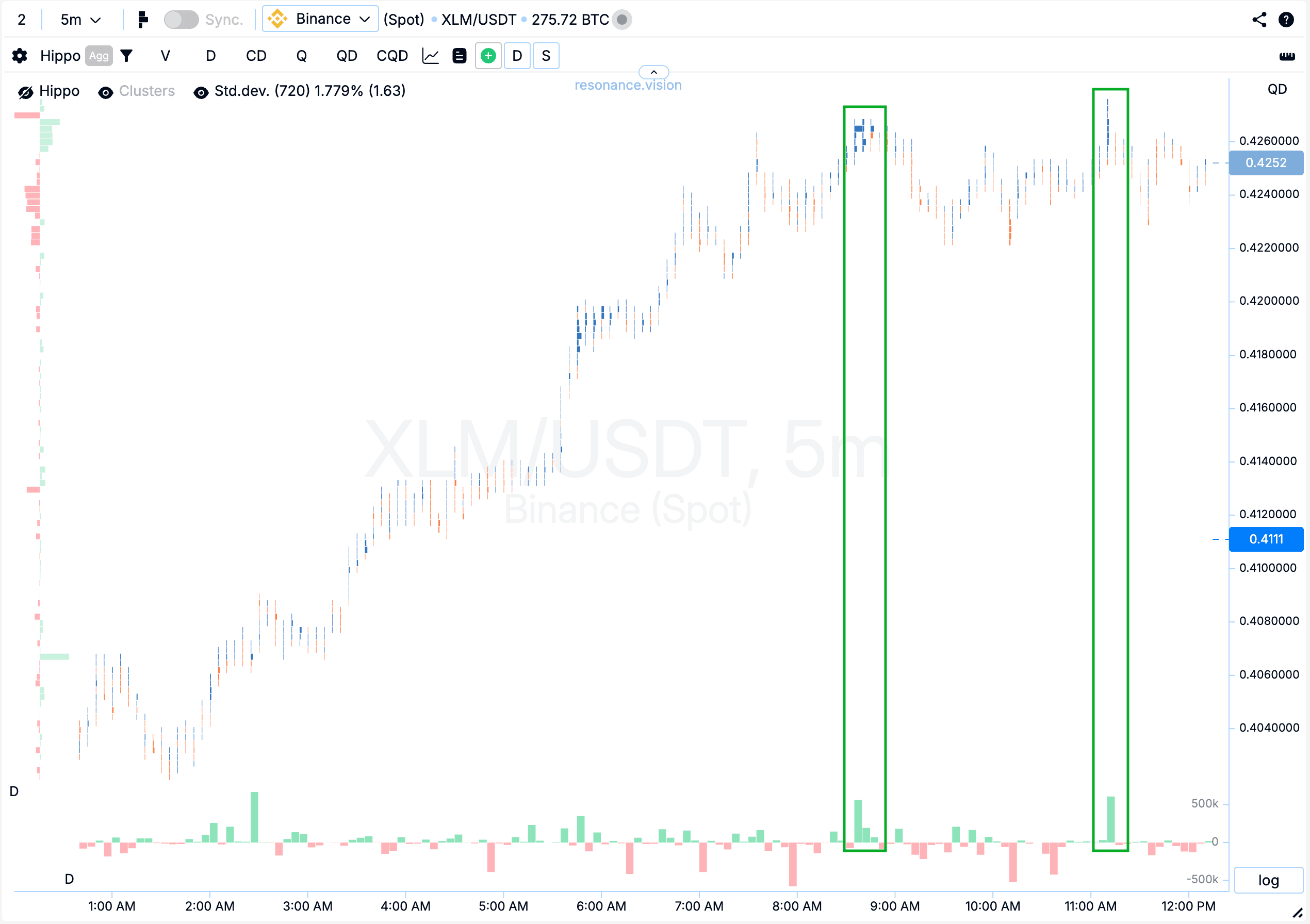

- Cluster Analysis: On the M5 chart, volume accumulation and positive green delta (buys dominate by count) are visible. But the price could not significantly update its high.

- Adding Hippo Heatmap: We see limit resistance — large limit sell orders from sellers.

- Entry into Position: Open a short.

- Risk Management: Stop above the scarcity zone and seller limit orders, take-profit — 1:3 with partial step-by-step profit fixation. Position size is calculated so that risk does not exceed 2% of the deposit.

- Exit: The trade closes automatically at take-profits.

Advantages and Risks of Scalping

Scalping is a trading style that involves opening a large number of trades on lower timeframes. This approach has its pros and cons, which should be considered before starting active trading.

Advantages:

- Profiting from slight price movements

Scalp traders don’t need big trends or significant news. Even fluctuations of a few percent can be a profit source. - High trade frequency

Many trades per day mean more opportunities to earn. This is especially attractive for traders aiming to profit here and now without waiting days or weeks for a favorable market situation. - Quick profit accumulation

With a working strategy, effective analytical tools, a large number of trades, and strict risk management, a trader can quickly grow their deposit. - Minimal impact of fundamental factors

A scalper operates within lower timeframes, so long-term trends and macroeconomics are not decisive. - High flexibility

A scalper is not tied to a specific asset or trend. They can trade when they see an opportunity and instantly close a trade if conditions change.

Risks:

- High competition

On small timeframes, bots, arbitrageurs, and HFT-algorithms operate. A trader often competes with algorithms that have an advantage in speed and accuracy. - Constant attention and stress

Scalping requires full concentration. This leads to fatigue, burnout, and loss of efficiency. - Emotional strain

Rapid shifts between profitable and losing trades pressure the psyche. Even experienced traders sometimes make impulsive decisions under the influence of fear or greed. - Technical difficulties

A stable connection to the exchange, a fast computer or laptop, and a reliable terminal are needed. Any delay = potential loss. - Risk of significant losses

Since trades are frequent and intense, one mistake or a series of unsuccessful entries can quickly reduce the deposit. Especially if risk management is not followed. “Strategy is important, but risks are more important”.

Considering these factors, scalping is not for everyone. Not everyone is ready to sit for several hours in front of a monitor, closely tracking market participant activity. Undoubtedly, it’s psychologically challenging to maintain such a trading pace, so it’s better to prepare in advance. Specific practical tips can be found in the material “Psychology in Trading: How to Manage Stress and Emotions?”.

Conclusion

Scalping Cryptocurrencies is an exciting and dynamic trading style suitable for both beginners and experienced traders. With the right scalping strategy, use of effective analytical tools, and disciplined risk management, you can achieve stable results. Regardless of whether you choose an aggressive or conservative approach, the key to success is knowledge, analysis, practice, and the use of modern online tools.

If you want to deepen your knowledge, join our trader community Resonance and start trading with confidence!

Follow new insights in our telegram channel.

No need to invent complex schemes and look for the "grail". Use the Resonance platform tools.

Register via the link — get a bonus and start earning:

OKX | BingX | KuCoin.

Promo code TOPBLOG gives you a 10% discount on any Resonance tariff plan.