BANANAGAN +52.8% (Resonance Directional Strategy)

A trade analysis based on cluster analysis and aggregated volumes. Despite the predominance of market selling, the price stopped declining, indicating a local shortage and the presence of limit demand. The exit was made after the abnormal movement and signs of sellers taking over, capturing the momentum already realized.

Table of content

Asset: BANANAGAN/USDT

Risk: Medium

Experience level: Beginner

Reasons for Entry

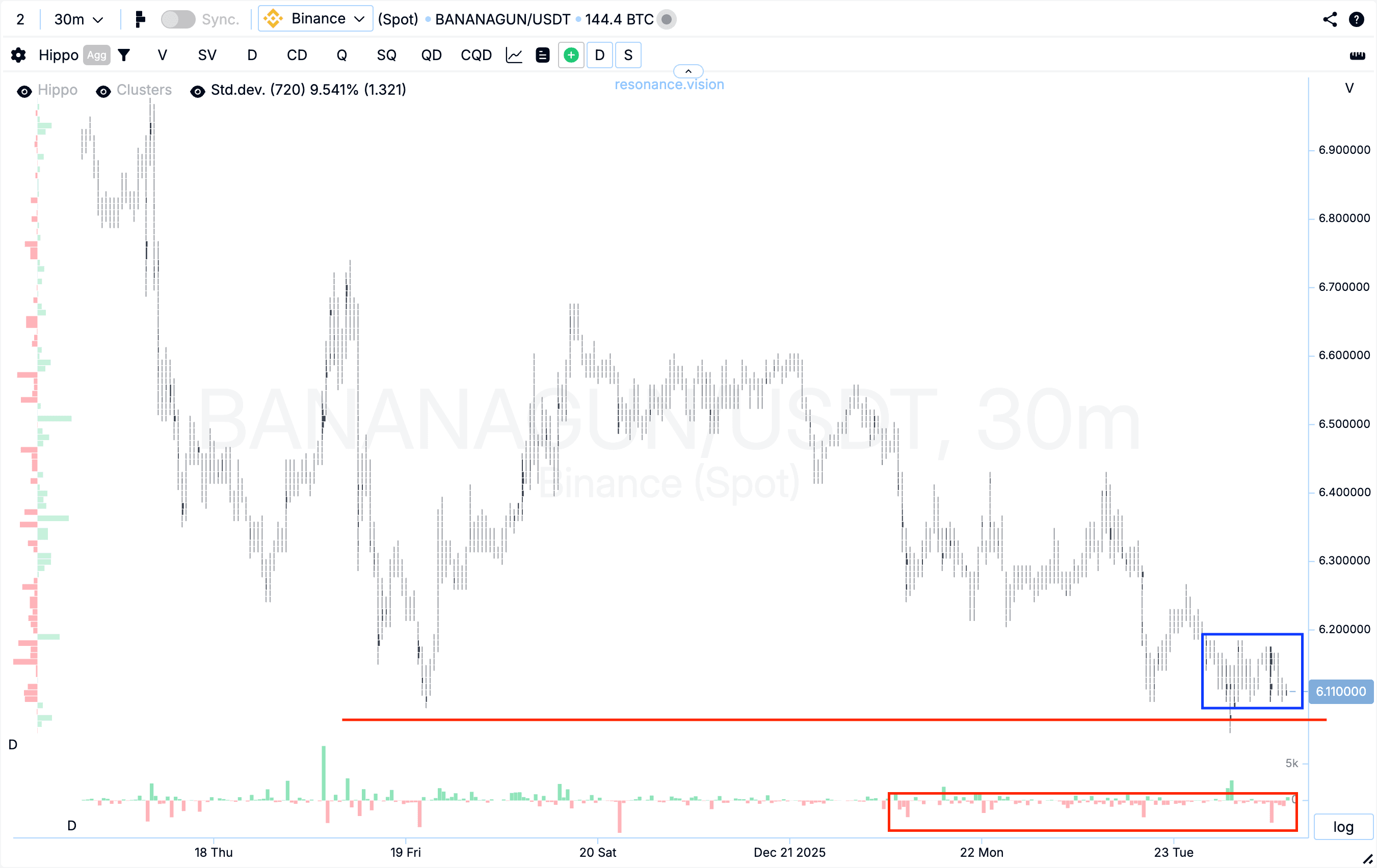

Cluster Chart: During the decline phase, large volume clusters began to form (blue rectangle). Throughout this move, market sells continued to dominate; however, their pressure was insufficient to significantly update the local low (red rectangle and arrow). Such price behavior indicates the emergence of local deficit signs and a noticeable weakening of seller initiative.

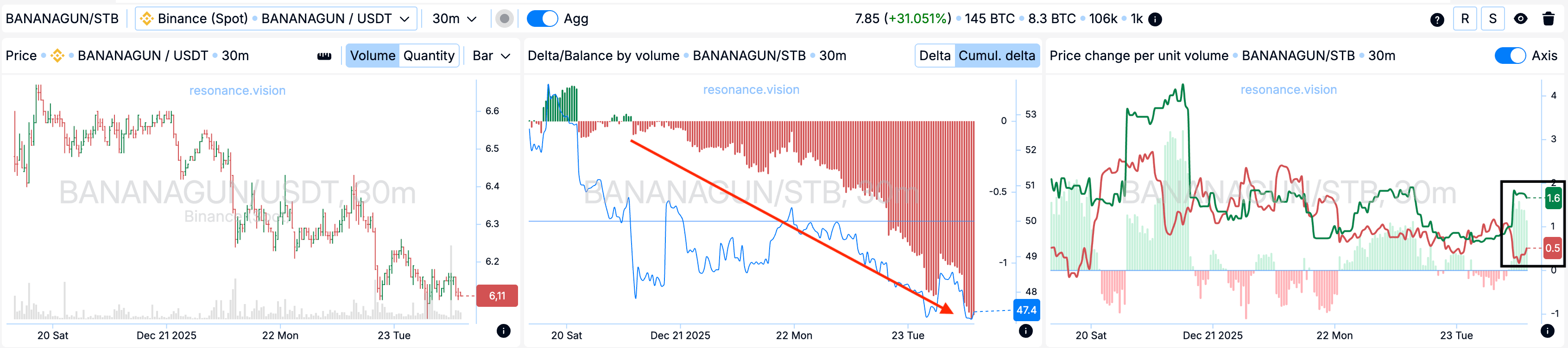

Dashboard

Delta / Volume Balance: Aggregated data across all pairs and exchanges confirms the observations from the cluster chart. During the analyzed period, market sell volumes were increasing, which is clearly visible on the cumulative delta histogram (red arrow).

At the same time, the price stopped declining, indicating the willingness of limit buyers to absorb all incoming market sell volume. This situation forms local support and further confirms the weakening of selling pressure.

Price Change per Unit of Volume: Additionally, it can be seen that the efficiency of market order impact shifted in favor of buyers (black rectangle), indicating increased effectiveness of buying activity.

Reasons for Exit

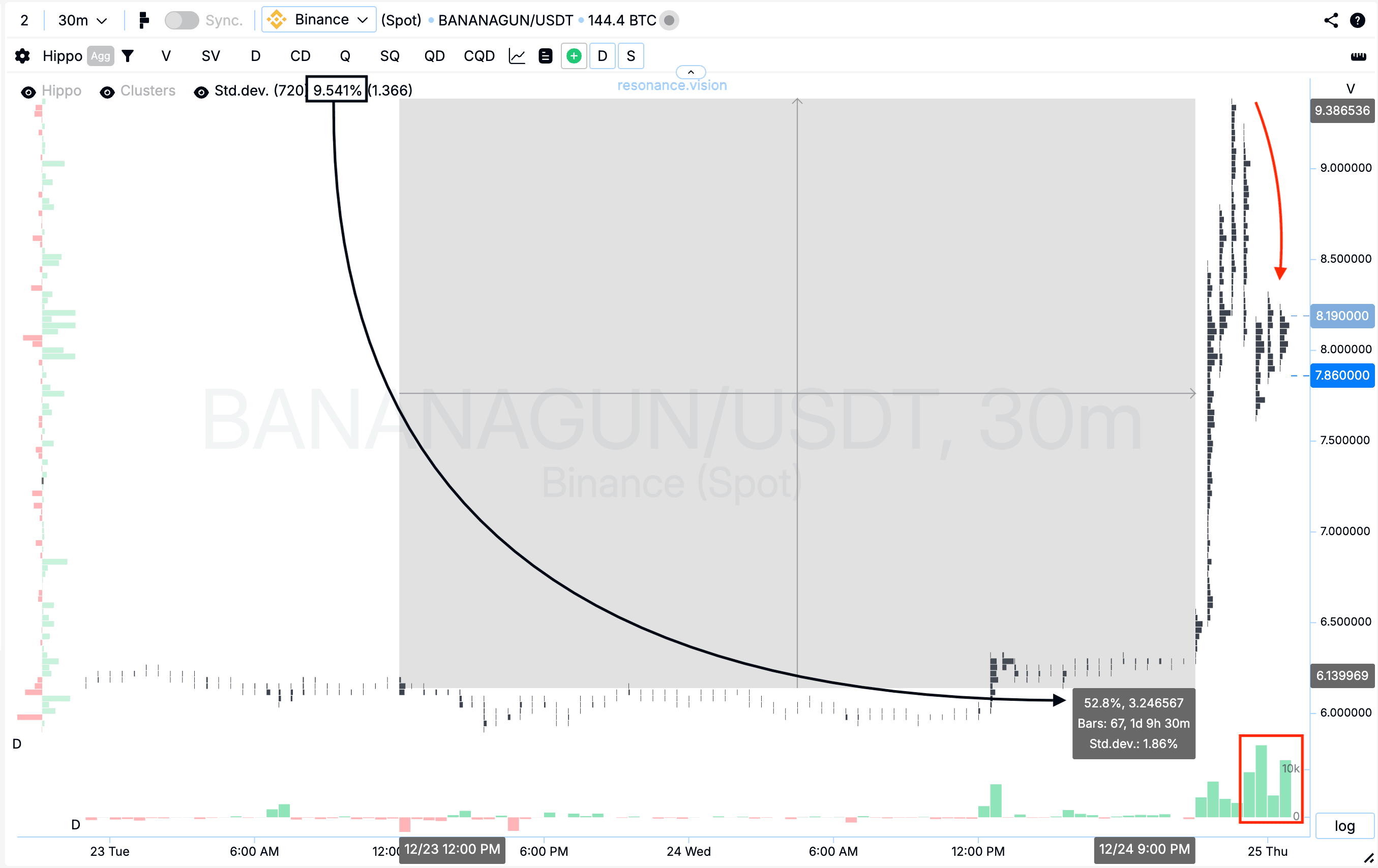

Cluster Chart: After the entry point, the price increased by 52.8%, while volatility noticeably increased within this range. Against the background of continued buying, a pronounced pullback formed (red rectangle and arrow), indicating a shift of initiative toward sellers.

It is also important to note that this move exceeded 5 standard deviations, while one standard deviation for this asset equals 9.541% (black rectangle and arrow). Such a move already falls into the category of significant and anomalous movements.

Under these conditions, further holding of the position would only increase risk; therefore, profit-taking appeared to be the most logical and well-balanced decision.

Conclusion

This case is a clear example of how the combination of cluster analysis and aggregated volume data allows traders to identify moments of seller weakness and the formation of local deficit.

The entry was executed during a phase of declining selling efficiency, while the exit followed the realization of an anomalous price move and the emergence of signs indicating a shift in initiative.

This approach enables systematic trading, effective risk control, and timely profit realization under changing market dynamics.

Follow new insights in our telegram channel.

No need to invent complex schemes and look for the "grail". Use the Resonance platform tools.

Register via the link — get a bonus and start earning:

OKX | BingX | KuCoin.

Promo code TOPBLOG gives you a 10% discount on any Resonance tariff plan.