ALT Market Review - January 23, 2026

Prevailing market selling led to a pullback, but the decline was halted by abnormal limit buying. The price remains in a sideways range, trading near its lower boundary.

Table of content

In this market review, we are not attempting to predict the future; our task is to state the facts we have at the current moment. We base our actions on these current facts, not on our expectations and hopes.

Market Orders and Limit Orders

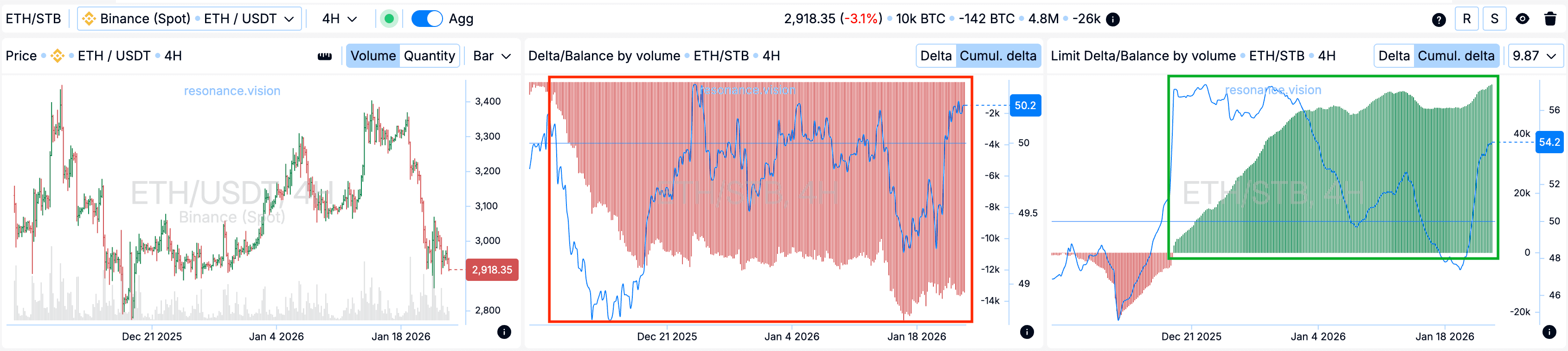

In aggregate, over an extended period, sell orders have remained dominant in market orders (red rectangle). This is clearly reflected in the cumulative market delta histogram and indicates persistent pressure from market selling.

At the same time, buy orders (green rectangle) are cumulatively dominating in limit orders. Currently, these volumes are acting as support, holding the price within a wide sideways range. However, locally, a fairly significant downward price pullback has been recorded.

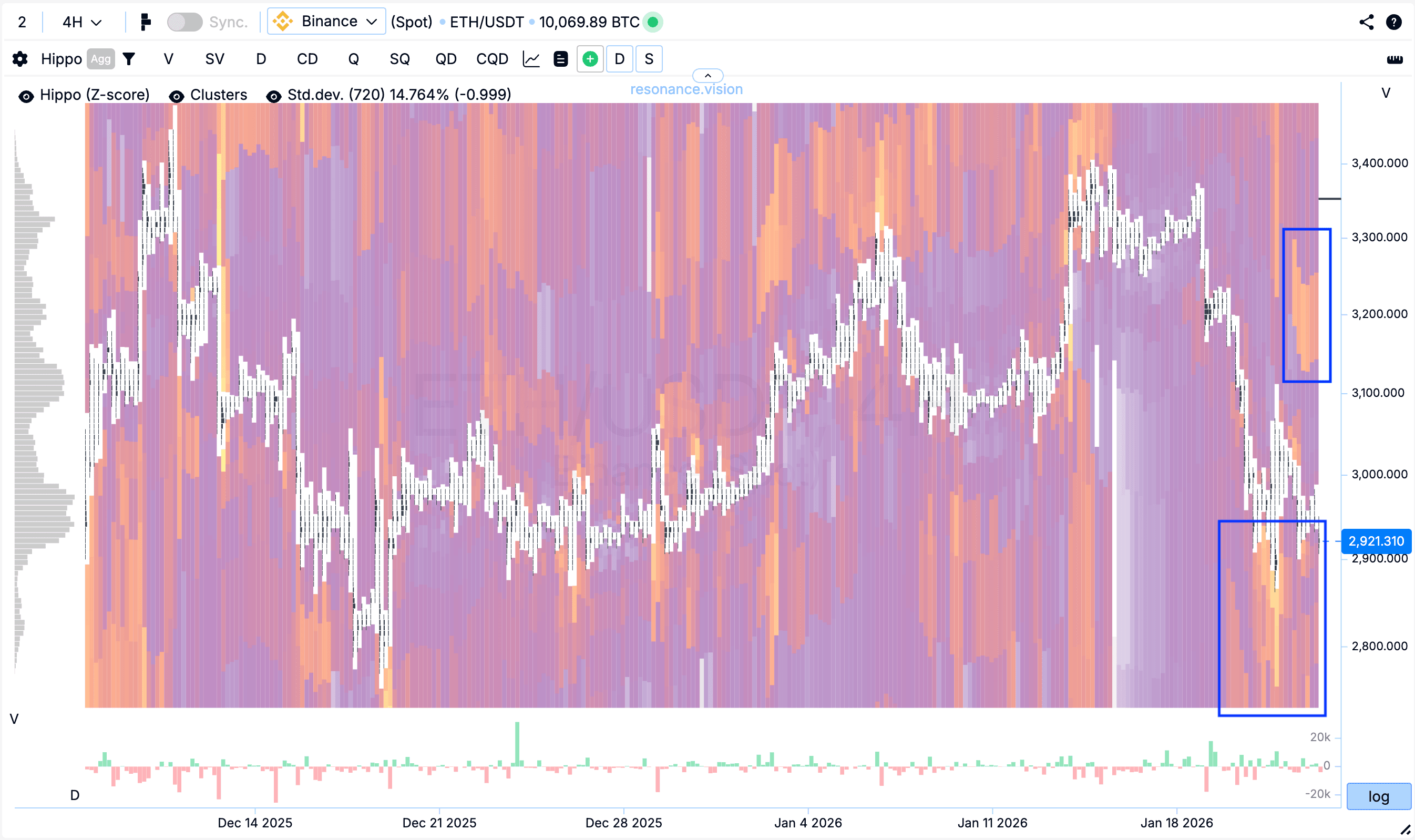

Heatmap in Z-Score mode (blue rectangles)

The heatmap in Z-Score mode shows abnormal clusters of limit buy orders. These volumes partially absorbed the market selling volume, causing the price to locally halt its decline. Abnormal densities are also observed above the current price.

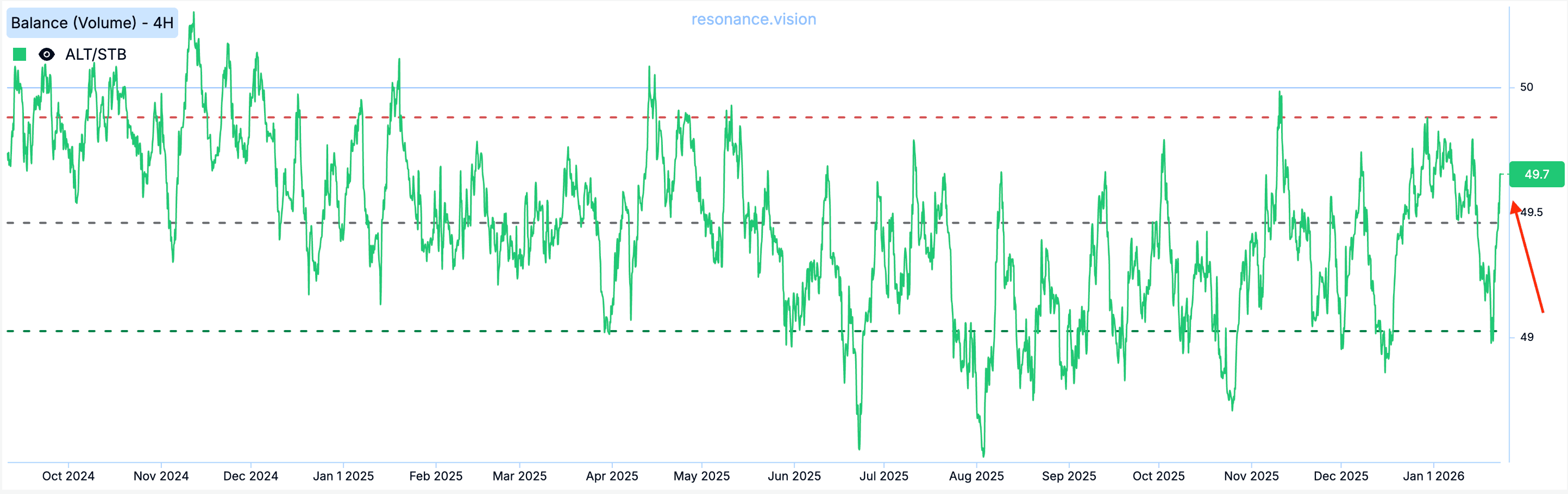

Balance Index

The Balance Index has currently shifted and is in the middle percentile zone, without a pronounced bias toward buyers or sellers.

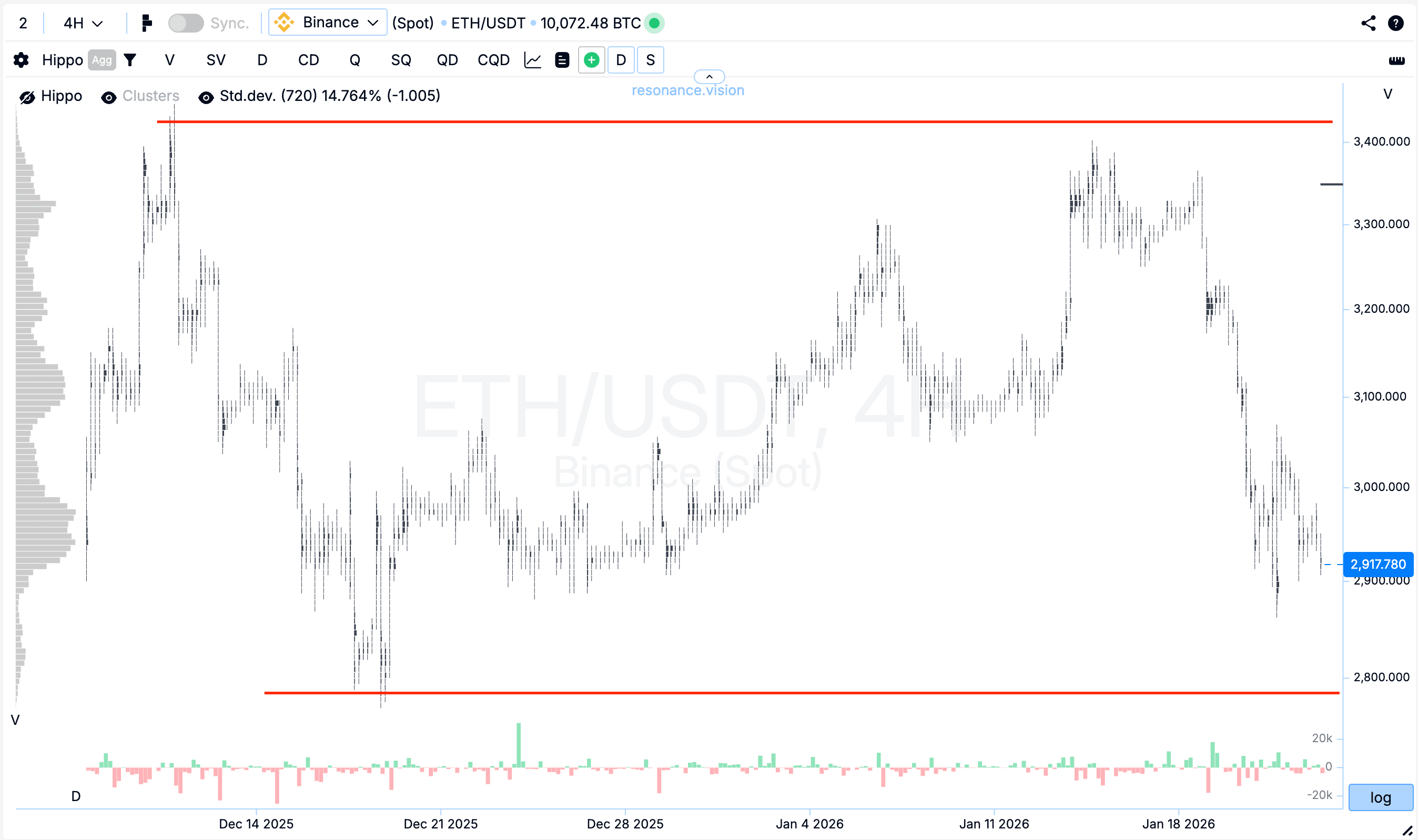

Price Dynamics

Amid prevailing market selling, a noticeable price pullback occurred. However, the decline was halted in the zone of abnormal limit clusters, indicating the presence of significant countervailing volume.

Result:

The price still remains within the formed range and remains in a sideways movement: neither the local high nor the local low have been updated. Currently, the market is in a trading phase near the local low.

How would you implement a trading idea in this situation?

Follow new insights in our telegram channel.

No need to invent complex schemes and look for the "grail". Use the Resonance platform tools.

Register via the link — get a bonus and start earning:

OKX | BingX | KuCoin.

Promo code TOPBLOG gives you a 10% discount on any Resonance tariff plan.