BTC Market Review - February 3, 2026

The market remains under selling pressure: the price continues to decline, but there is still insufficient counter-demand to reverse the structure. The downward trend persists.

Table of content

In this market review, we are not attempting to predict the future; our task is to state the facts we have at the current moment. We base our actions on these facts, not on our expectations and hopes.

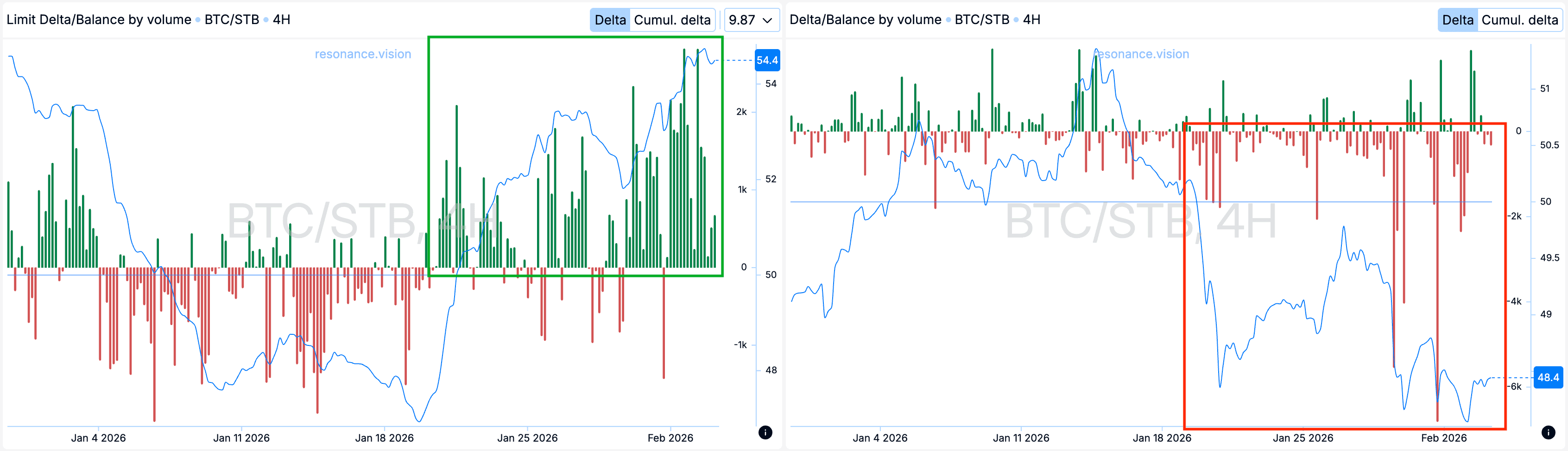

Market Orders and Limit Orders

Over the period under review, aggregated market orders show a predominance of sell trades. Locally, these orders remain effective—the price is declining (red rectangle).

At the same time, locally, limit orders show a predominance of buy orders (green rectangle). This indicates the formation of counter-limit demand in the current price range, but the volume of these orders is insufficient to maintain the price.

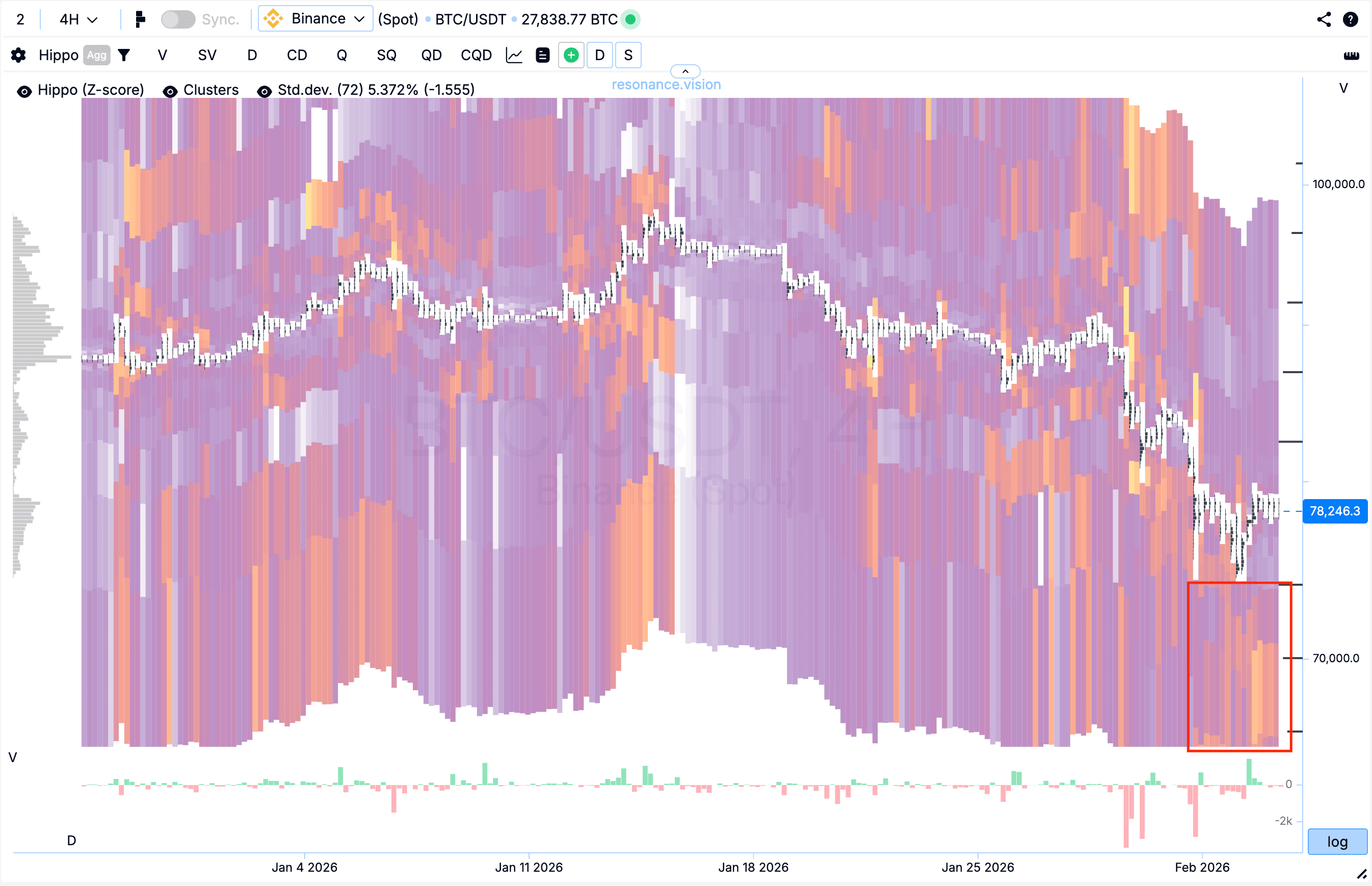

Heatmap in Z-Score mode (red rectangle)

The heatmap in Z-Score mode shows abnormal clusters of buy limit orders slightly below the current price. Previously formed abnormal densities were partially absorbed, after which the price continued to move within this price range.

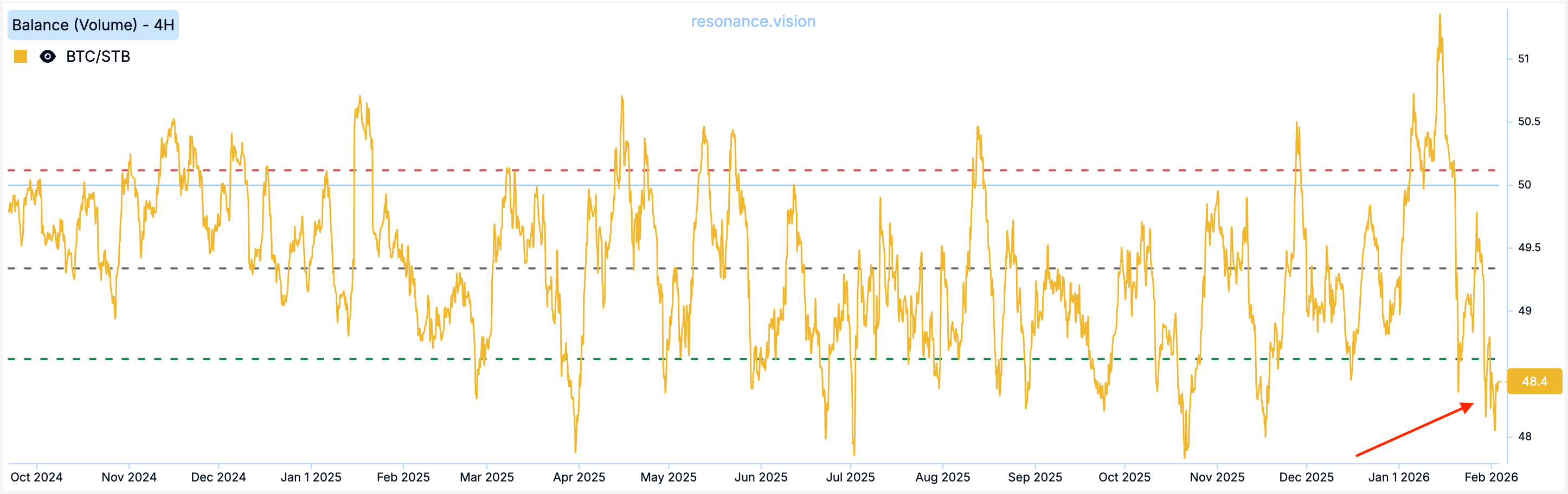

Balance Index

The Balance Index is shifted downwards and is in the abnormal percentile zone, reflecting increased selling pressure.

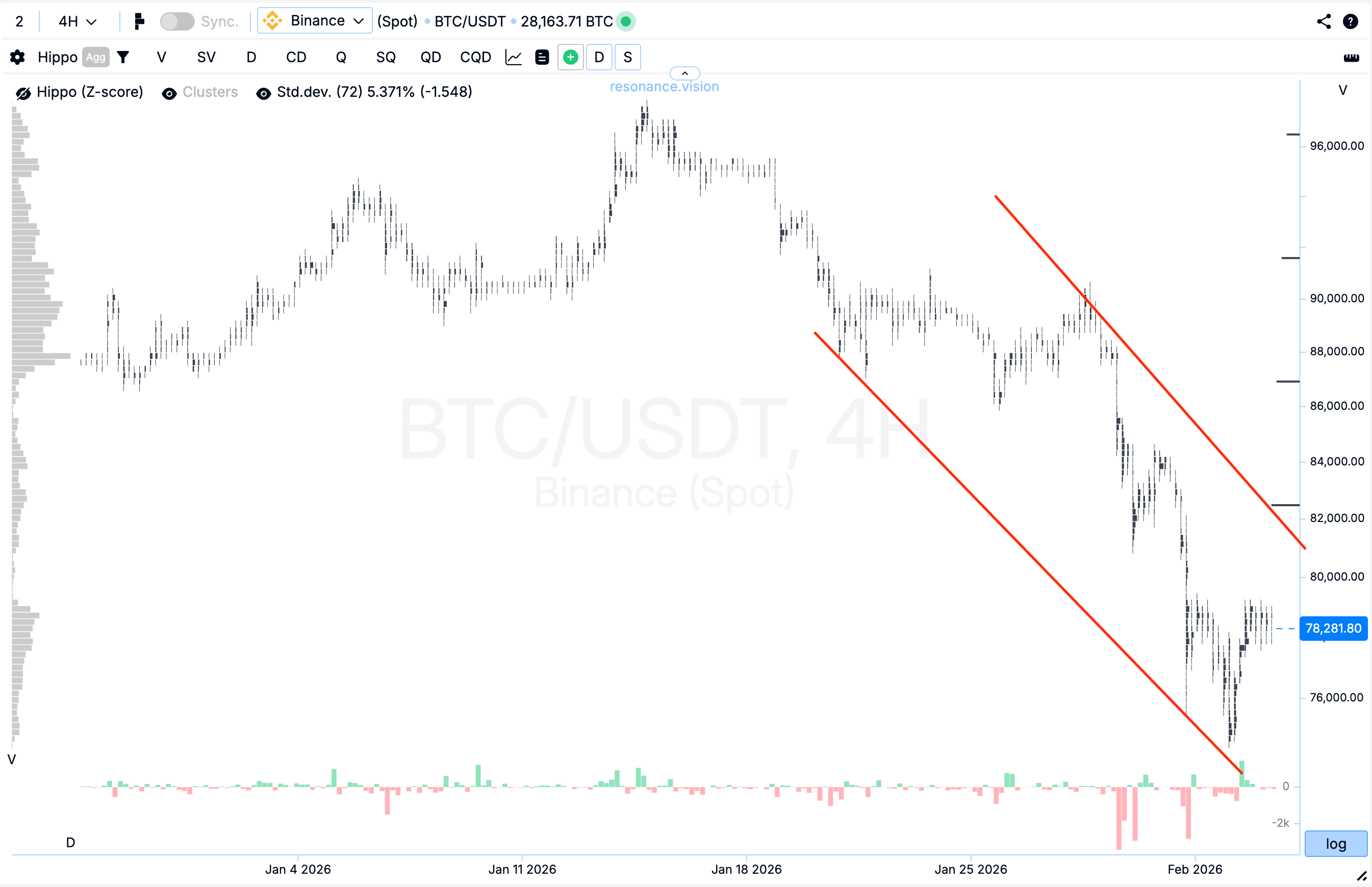

Price Dynamics

Market orders continue to put pressure on the price, leading to a local decline. At the same time, the balance of limit orders is shifting upward, creating local support from limit demand. However, at the moment, these volumes are insufficient to reverse or halt the movement.

Summary:

Currently, according to Charles Dow’s theory, the downtrend persists: lows are being made while highs remain unchanged. There are currently no signs of a change in market structure.

What approach to implementing trading ideas do you use in practice?

Follow new insights in our telegram channel.

No need to invent complex schemes and look for the "grail". Use the Resonance platform tools.

Register via the link — get a bonus and start earning:

OKX | BingX | KuCoin.

Promo code TOPBLOG gives you a 10% discount on any Resonance tariff plan.