BTC Market Review - November 25, 2025

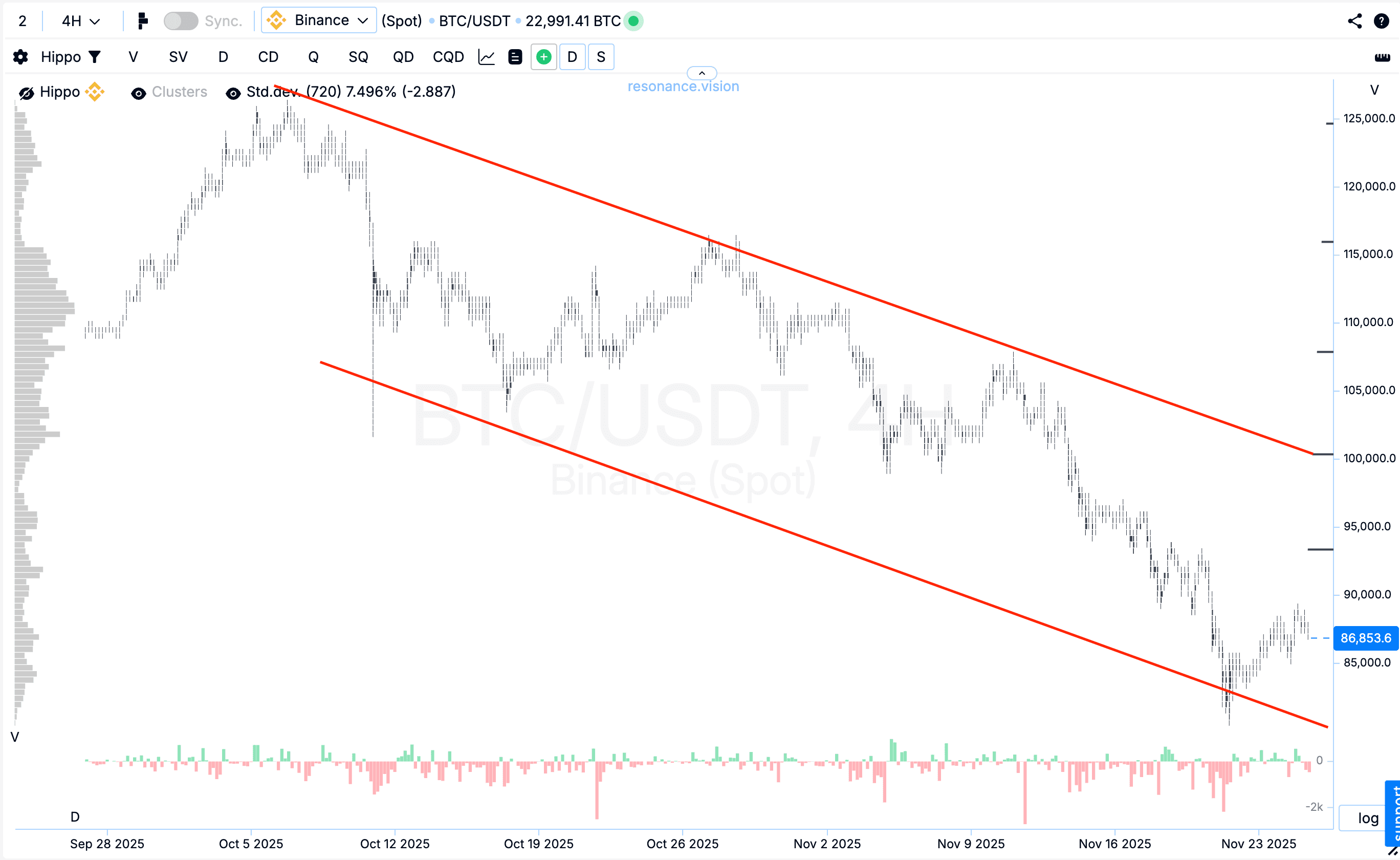

The analysis is based solely on facts reflected in the behavior of market and limit orders, volume dynamics, and price reaction. A gradual increase in buying activity on limit orders, a localized decline in selling efficiency, and abnormal densities on the heat map are noted. However, current buying volumes are still insufficient for a reversal: selling remains effective, and the Charles Dow structure continues to confirm the downtrend—lows are being made but highs are not.

Table of content

In this market review, we are not attempting to predict the future or predict what will happen next. Our task is to state the facts we have at the current moment. We base our actions on these facts, not on our expectations and hopes.

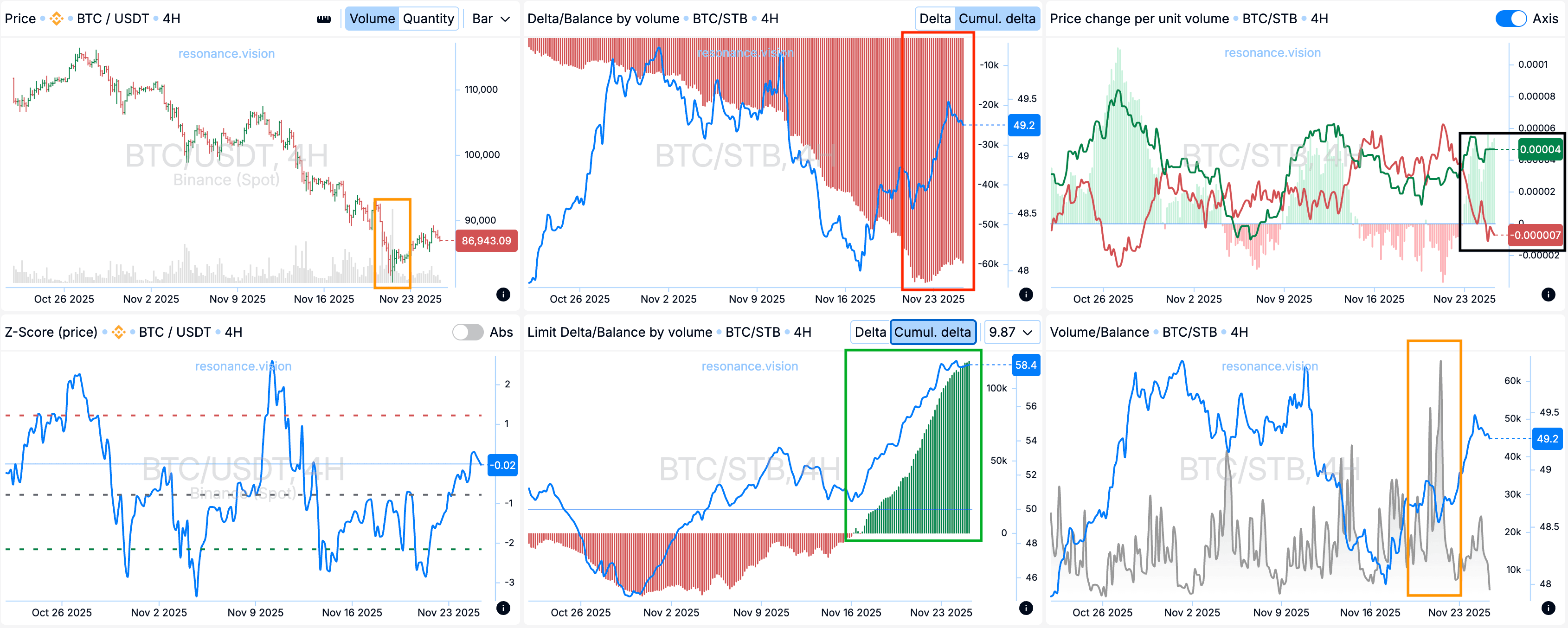

Market Orders (red line)

Sell market orders continue to predominate, but the balance has begun to shift upward, and locally, the market is still declining.

Limit Orders (green rectangle)

Limit orders show that more and more buy orders are being submitted, and the balance continues to shift higher.

Price Change per Unit Volume (black rectangle)

The impact of market orders on price has begun to diverge in favor of buyers (black rectangle).

Volume Balance (orange rectangles)

At the peak of the local low, there was a noticeable surge in volume.

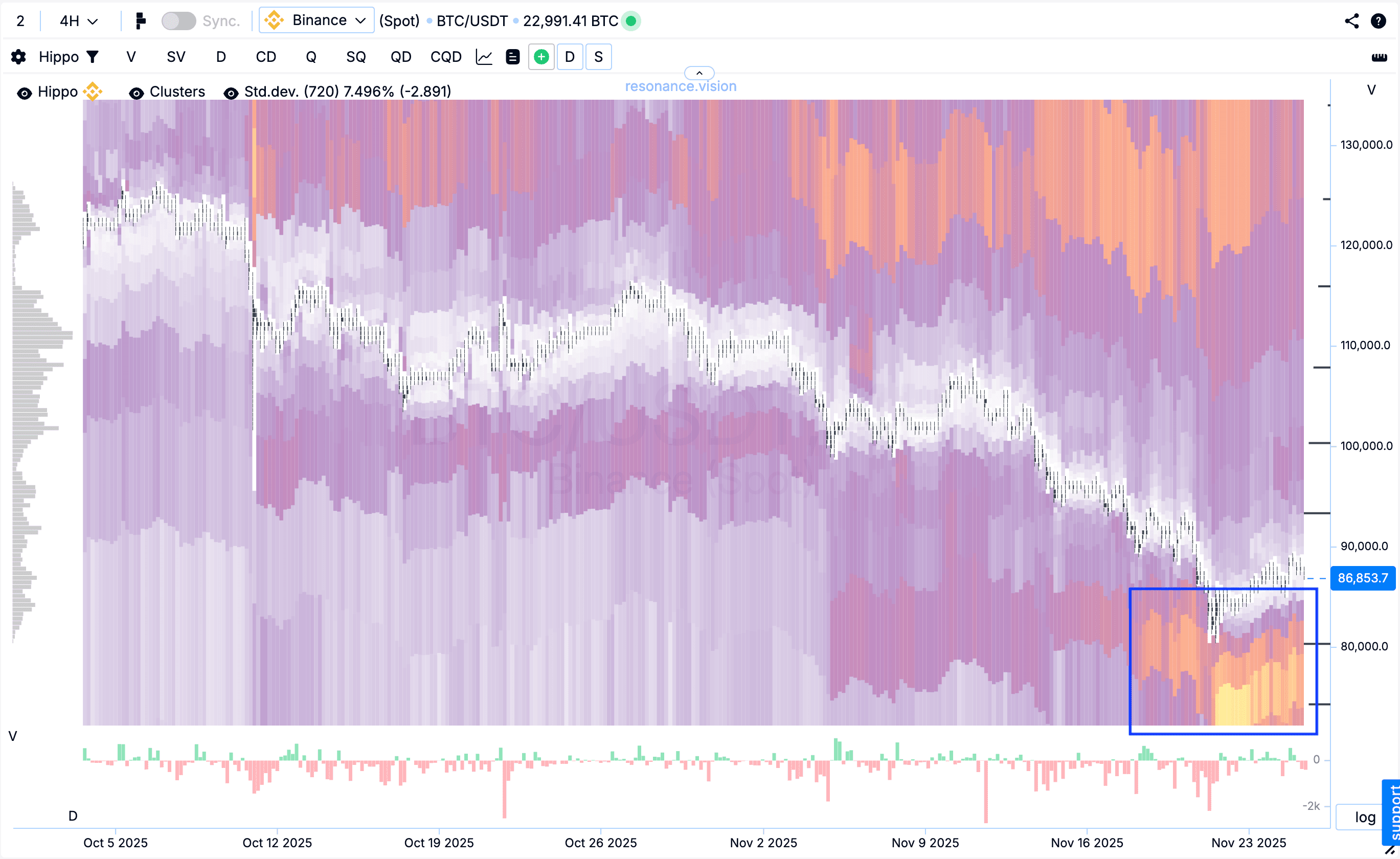

Heatmap in volume mode (blue rectangle)

But the heatmap shows an anomalous cluster in volume mode. The price partially absorbed these volumes, and they began to push them higher.

Price Dynamics

Despite the growing interest in limit orders, as well as the abnormal densities in the volume mode on the heat map, this volume of placed buy orders is still insufficient to create a shortage. As a result, local selling continues to be effective.

Summary:

Currently, according to Charles Dow’s theory, BTC is still in a downward trend. Since the lows are being made, but the highs are not.

Which method dominates your trading?

Follow new insights in our telegram channel.

No need to invent complex schemes and look for the "grail". Use the Resonance platform tools.

Register via the link — get a bonus and start earning:

OKX | BingX | KuCoin.

Promo code TOPBLOG gives you a 10% discount on any Resonance tariff plan.