Follow the whale: how big capital thinks and how a trader should act

Find out who the whales are in the cryptocurrency market, how to track their actions, and how to use their strategies for your own profit.

Table of content

Introduction

In the world of cryptocurrencies, the word ‘whales’ has become commonplace. At the same time, many traders do not fully understand who they really are, how they act and how their actions can be used to their advantage.

In this article, we will discuss:

- who whales are in cryptocurrencies;

- how they affect prices;

- why their strategies differ from those of other market participants;

- how to track whale activity;

- and how to make money with them.

Who are the whales in the cryptocurrency market?

Every market participant wants one thing: to increase their assets. This is natural, because no one wants to lose significant amounts of money.

However, whales think very differently from most traders. Their decisions are based on large-scale calculations and long-term strategies, which we will discuss further.

Whales are market participants who own significant amounts of assets and, as a result, have real power to influence trends, manage liquidity, and withstand long-term losses for strategic goals.

They can build up positions over a long period of time or, conversely, gradually exit them without panic so as not to move the market too drastically.

Whales usually include not only individual investors with large capital, but also:

- large investment funds;

- hedge funds;

- venture capital companies;

- mining pools;

- large crypto exchanges with their own coin reserves.

Such structures often manage hundreds of millions or even billions of dollars. Their actions are usually planned in advance and backed by clear risk management strategies.

Sometimes, a group of small traders who unite to act as a single powerful participant can also play the role of a whale. In any case, a whale is someone who has sufficient assets to significantly influence the balance of supply and demand.

At the same time, it is important to understand that there are many such large players in the market, and each of them has their own strategies, time horizons and capital volumes. It cannot be said that all whales are manipulative — they differ in style and motivation.

How do whales influence the cryptocurrency market?

Large players influence the market through their ability to operate with huge volumes. This allows them to:

- move prices by buying or selling coins in large volumes;

- create a deficit or surplus, affecting liquidity;

- manipulate traders’ emotions, forcing them to sell or buy at an unfavourable moment (you’ve probably heard of spoofing);

- hold positions much longer than a small investor can afford, simply ‘sitting out’ the downturn.

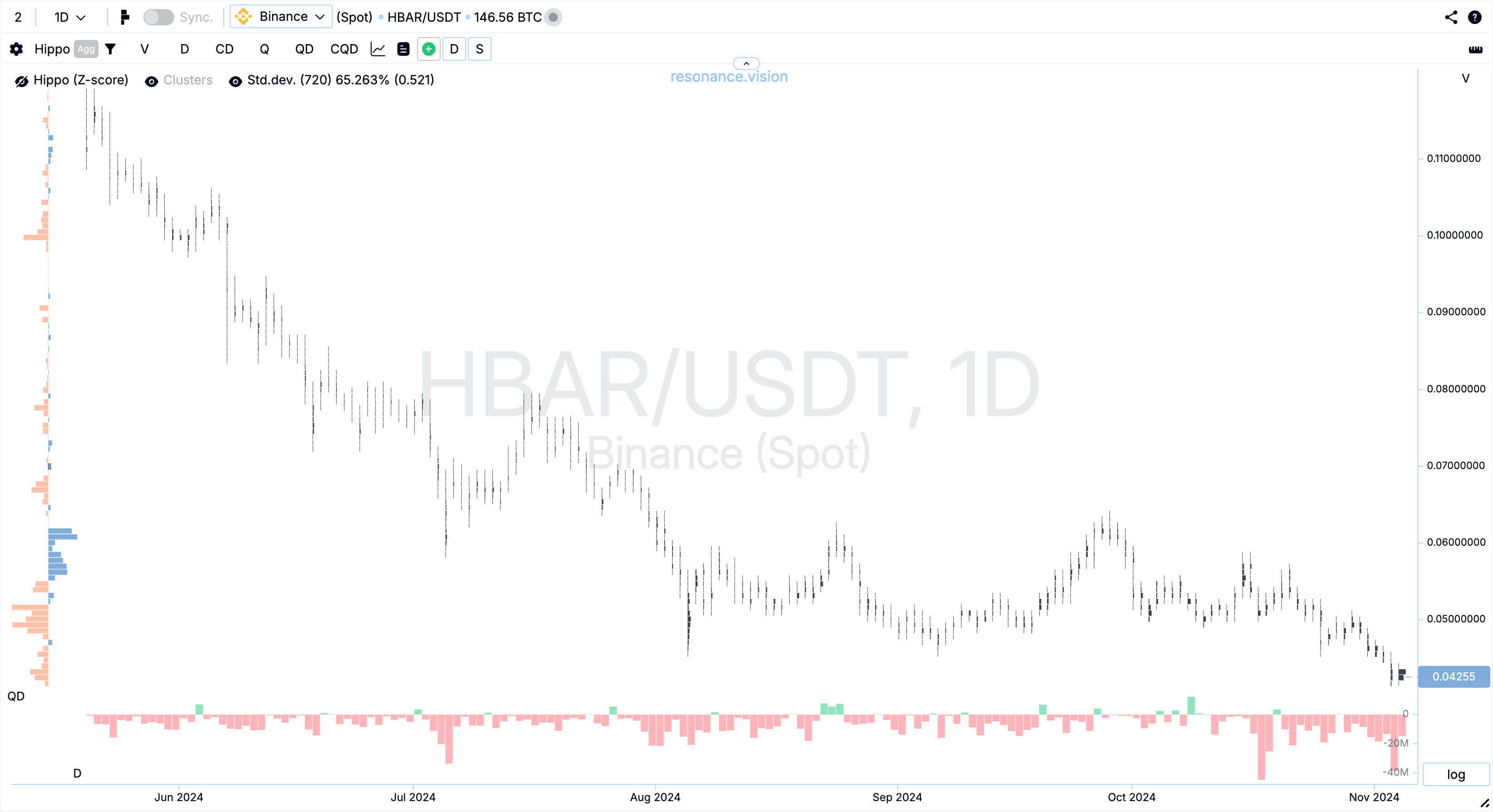

To see the impact of big capital on the market, let’s look at an example of how big players created a deficit on the HBAR coin. We begin with an analysis of the cluster chart:

- the price fell under selling pressure (section 1)

- large sales volumes ceased to have a significant impact on the price (section 2)

- a zone of accumulation of positions by large market participants was formed (section 3)

Note:

An accumulation zone is a price range in which, over a certain period of time, a large player or group of participants gradually gain positions by buying up an asset without drastic price movements.

The main characteristic of such a zone is that the price remains within a narrow range for a long time with increasing volumes, without a clear trend. This indicates that someone is systematically accumulating large volumes, concealing their activity so as not to move the market sharply up or down.

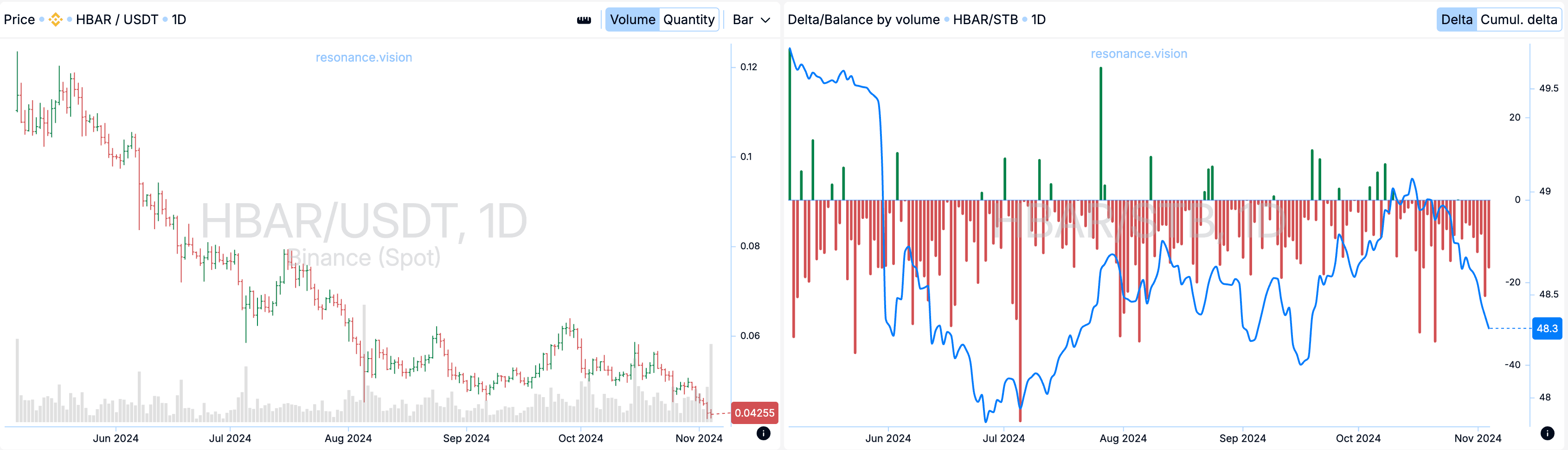

According to the aggregated delta/balance data in the dashboard, we can see that market sales prevailed (red delta bars), but they no longer had a significant impact on price movements:

In this case, the accumulation occurred because large capital accepted the flow of market sales into its limit orders.

Please note that this was a fairly long period of time — about 3 months. During this period, a relatively narrow price range formed, within which the so-called whales were able to gain positions.

Why do we say ‘relatively’ narrow? Because for scalpers or day traders, a 40% price fluctuation up or down already looks extremely large, while for investors with multi-million dollar portfolios, this is just a working corridor. The main thing for them is to accumulate the necessary volume of coins at an acceptable price, even if this range reaches several tens of percent.

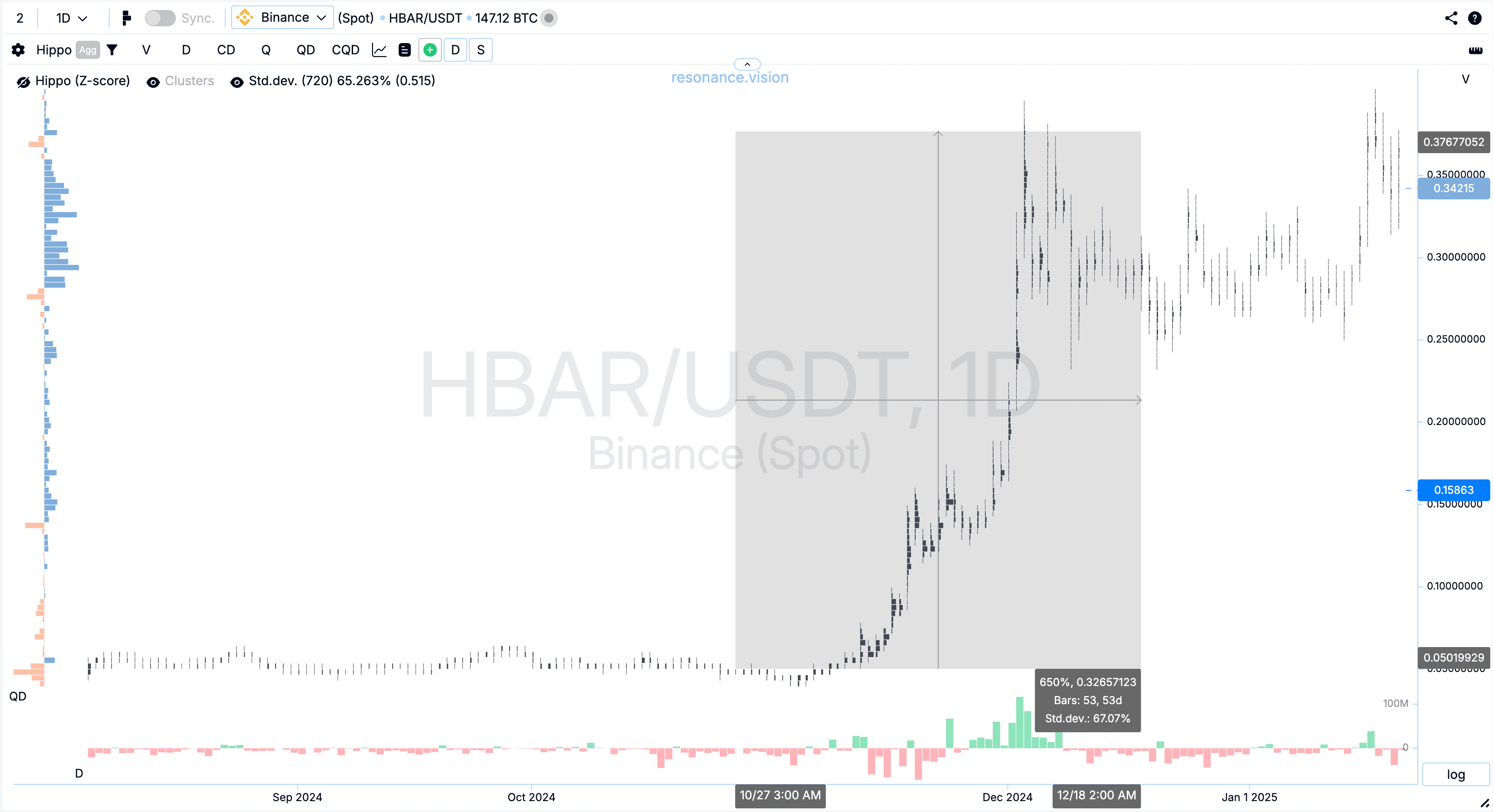

Now let’s look at the result: after accumulation and creation of a supply deficit, the price grew by 650%. If we exclude the accumulation range itself, the net profit would be approximately 600%. But this was only possible because the whales first created a deficit by buying up coins and blocking supply.

Impressive, isn’t it? You can find out about extreme market conditions in the article ‘How to determine a deficit or surplus?’

Why do whales act differently from traders?

- Liquidity

Whales are always limited by liquidity — it is difficult for them to enter a position completely with one click, so they buy or sell in parts. This allows them to avoid sharp price jumps. By the way, Resonance University has a simulator for large market participants. With its help, you can become a whale for a while and try to influence the price with your capital. This is a great way to understand why large volumes force you to act cautiously, how large positions are accumulated, and why whales always think several steps ahead when allocating their capital.

This practical experience will allow you to read the market better and avoid making the same mistakes that traders make when they do not take into account the influence of big money. - Time

Large players think long term. They do not need to take profits every day or every week — they can wait years for the price to reach their set targets. A trader with relatively small capital, on the other hand, can afford to trade as they please: from short-term speculation to long-term investment. They have more flexibility, as small volumes do not affect the market and allow them to enter or exit almost instantly.

The average trader can experiment with strategies, quickly change the direction of trading, and even enter into very risky deals without seriously threatening to ‘crash’ the market with their order. It is this ease of movement that is one of the main advantages of small market participants. - Risk

Whales can invest in many assets at the same time, diversifying their risks, which retail traders usually cannot afford to do, because if you have a small amount of capital, any diversification drastically reduces the size of each individual position and, therefore, the potential profit.

In addition, market participants with small accounts often need quick results to cover daily expenses or achieve current financial goals, so traders are forced to risk a larger portion of their deposit in each trade. Whales, on the other hand, with their multi-million dollar portfolios, can invest in parts, hedge risks and wait for a long-term market recovery without the threat of bankruptcy.

How to track the actions of whales?

It is possible to track the activity of large players, and this is one of the most powerful strategies for a trader: to go together with large capital.

Essentially, this is an analysis strategy based on identifying large traded volumes and their impact on price movements. In other words, analysing the distribution of liquidity, which reveals the intentions of whales. Instead of trying to predict the market using indicators or news, traders focus on where the big money is going.

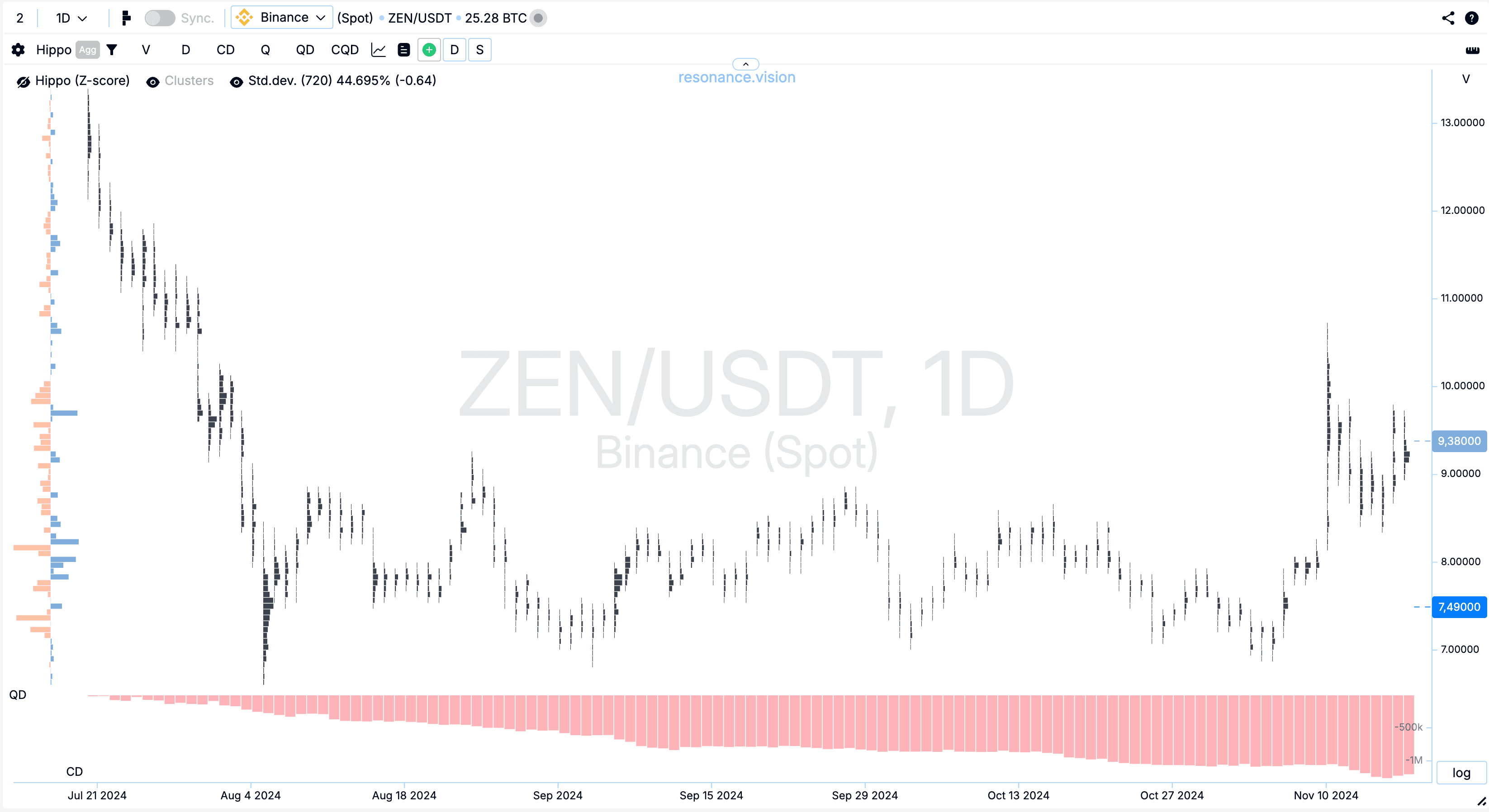

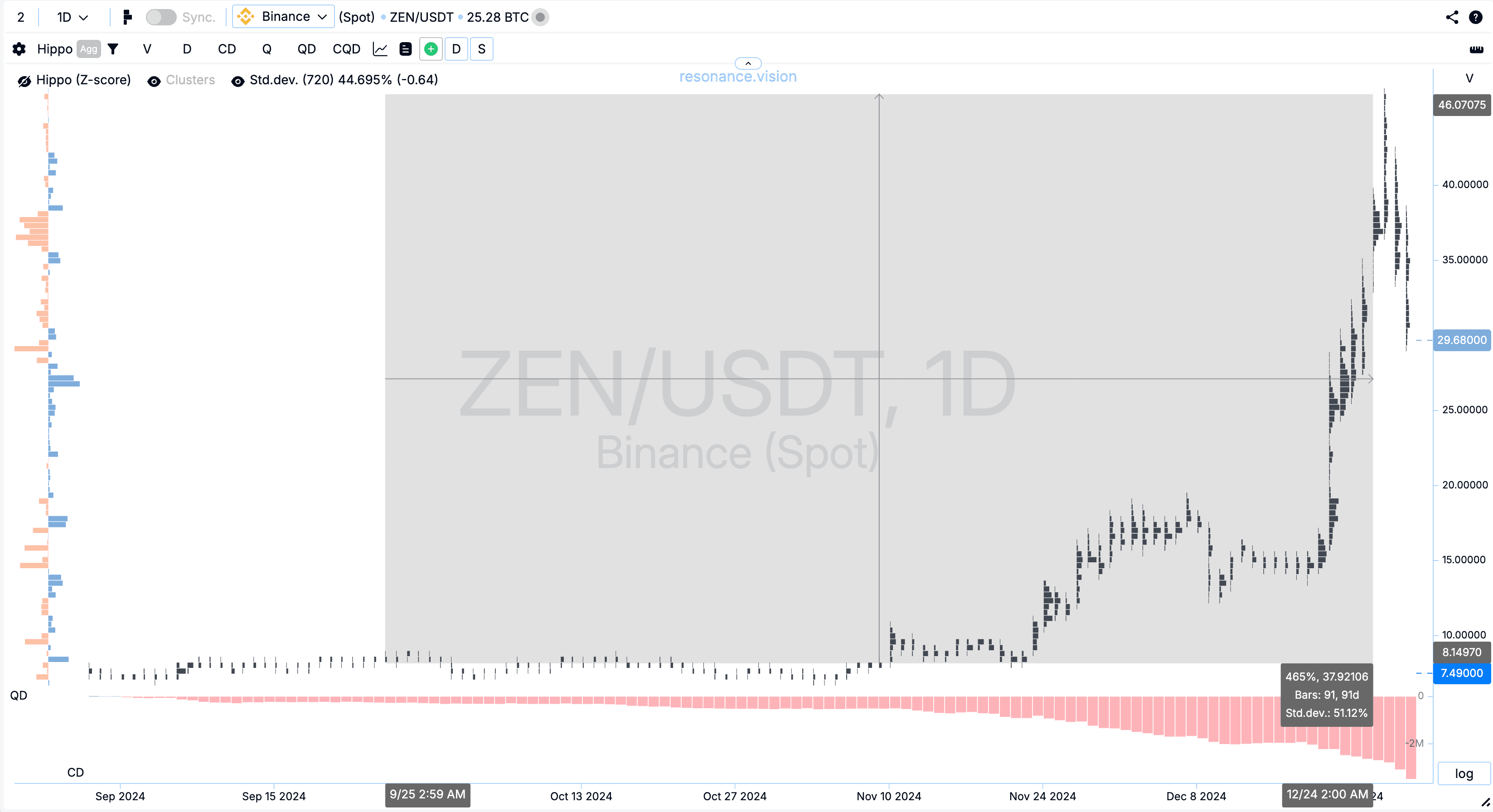

Let’s look at the example of the ZEN coin:

As in the previous example, after the decline, the price stopped and began to trade within a certain range. This is called a sideways trend. The cumulative delta showed that sales prevailed in this price range. This is also confirmed by the horizontal delta. At the same time, the heat map shows how buyers set large limits at each price decline, restraining sellers and preventing them from pushing the price of the coin lower.

Thus, we see a classic picture of position accumulation by large investors:

- sellers dump the coin at market price

- investors methodically accept this volume into their limits,

- thus creating a supply shortage for the future.

This scenario often signals that a large player is preparing for further movement.

As a result, there was a 460% increase after the accumulation was completed:

As you can see, large investors can drive trends with their large capital. Therefore, if you learn to recognise their footprints, you will be able to join the movement in its early stages and gain a significant advantage over most of the market.

This does not guarantee a 100% win, but it significantly increases your chances of working in the right direction alongside the strongest market players.

How to make money with whales?

Instead of trying to swim against the tide, it is much smarter for a trader or investor with a relatively small deposit to side with big capital.

If you see that whales are accumulating positions, gaining volume or, conversely, already fixing profits, it is much more effective to join this movement than to try to swim against the tide.

This means:

- using analytical tools that help identify states of deficit and surplus;

- looking for accumulation of positions by large market participants;

- avoiding panic deals and having your own risk management system;

- thinking in the medium and long term.

If you understand the logic of the whales, you will be able to profit from the wave they create.

To see the actions of big capital, you need high-quality analytical tools based on market mechanics logic, not just price indicators.

After all, price is a consequence, while the cause of the trend movement is liquidity and the balance of supply and demand. That is why it is necessary to use:

- cluster charts — allow you to see where large orders are concentrated;

- heat maps — show limits and abnormal volumes;

- screeners and search engines — help you quickly find coins with unusual activity;

- analytical dashboards — provide a comprehensive picture of the market, combining information about volumes, delta, limit activity, market balance as a whole and for individual coins in a single workspace.

Such tools help you see not only the direction of price movement, but also its causes and true strength, and respond in a timely manner to signals left by large capital. Only with such a multi-level approach can you not just guess the intentions of big players, but actually follow them and use their strategy to your own advantage.

This approach offers several advantages at once:

- a high probability of a stable trend;

- good liquidity, which will allow you to open/close a deal without losses;

- psychological confidence that you are acting in a direction supported by a large participant.

The main thing is to be able to correctly interpret market data and check several sources at once (for example, evaluate data on different exchanges) so as not to fall for fake signals.

If you are not yet fluent in supply and demand analysis, it is worth taking a training course that describes in detail the main principles of cryptocurrency analysis that work on any timeframe.

The market is not always predictable, but if you follow in the wake of big capital, your trading becomes much more reliable.

Do whales always make money?

It is a popular myth that whales never lose. In reality, big players can also fall into losses. The only difference is that they are prepared and have the resources to weather temporary losses or long periods of drawdown for the sake of large-scale profits. Their strategy is not limited to quick deals: it is a whole complex of risk management, liquidity management and long-term thinking.

That is why large investors often form positions gradually and cautiously, controlling volume and distributing entries.

An example from the traditional market: Warren Buffett could sit on billions in losses for years before his positions turned a profit.

Conclusion

The crypto market is an environment in which, in most cases, large players set the direction and pace of the trend. They can significantly influence supply and demand. But instead of fearing their actions, you can make them your allies.

If you learn to see their moves, track volumes, and react correctly to the actions of large market participants, you will gain real advantages in the crypto market. All the necessary analytical tools are already available on the Resonance platform. The main thing is to learn how to use them correctly, have strategies for analysing and realising trading ideas, and stick to risk management.

Choose the right side and move confidently — the market rewards those who understand its mechanics and are ready to act!

There’s no need to invent complicated schemes or look for the 'holy grail’. Use the tools on the Resonance platform.

Register via the link to get a bonus and start earning:

OKX | BingX | KuCoin.

Use promo code TOPBLOG to get 10% off any Resonance plan.