10 tips on how to protect your deposit

The right investment and trading strategy starts with the understanding that not everything goes according to plan. That is why diversifying your crypto portfolio is the insurance system that helps both traders and investors keep their capital and exit the market with a profit rather than disappointment.

Table of content

- 01Can one asset ‘drown’ the entire portfolio?

- 02Diversification: simply put

- 03The most common mistakes and how to avoid them

- 041. Not worrying about storage? — Take care of the security of your capital

- 052. Investing everything in one asset? — Distribute wisely

- 063. Buying everything in a row? — Filter, analyse, check

- 074. Don't you consider the correlation of assets? — Think like a strategist

- 085. Ignoring risk management? — Always calculate the risks

- 096. Looking at each trade separately? — Manage your total portfolio

- 107. Don't have a plan? — Build a strategy

- 118. Relying on just one strategy? — Be flexible

- 129. Not rebalancing? — Check your portfolio balance regularly

- 1310. Holding ‘dead’ coins? — Train yourself to cut your losses

- 14To sum up

Can one asset ‘drown’ the entire portfolio?

Hundreds of millions of transactions take place on the market every day. And even if an asset is popular and attracts attention from all sides, there is always a risk that something unexpected will happen that will seriously affect its price.

Imagine the situation: you are confident that this X token will now ‘make x5’. You invest your entire deposit in it — and… suddenly, news comes out that the project has been frozen, the founder has disappeared, and the market is in panic. Everyone who has this token starts selling it on the market… The price drops… Minus 70%. And along with it — your faith in crypto.

In 2022, many people invested everything in one token — Terra — on the hype. You know what happened next…

Unfortunately, this is not fiction. The market is emotional, volatile, and often illogical for some.

Of course, you might say, ‘Wait, we know that news alone does not move the market.’ And you would be right. What matters is not what was said in the news, but how market participants react to it. They are the ones who can move the price up or down with their money.

For an investor, the main risk is a sharp drop in demand for the asset in which they have invested. And if there are several such unsuccessful purchases, instead of the expected +30%, you can see, at a minimum, a deep drawdown and, at most, the loss of your deposit. And with it, the loss of motivation and desire to do anything at all.

That is why diversification is not just a smart decision. It is your safety net.

Diversification: simply put

Portfolio diversification is the forming of an investment set of various financial instruments that are independent of each other.

Simply put, it’s the same principle: don’t put all your eggs in one basket. In investing and trading, this is one of the most important rules for survival. Even if you are 100% sure that ‘this coin will definitely go up,’ investing all your capital in one asset is simply dangerous. It is much smarter to divide your funds between several independent assets with different levels of risk. This way, the failure of one will not drag down your entire portfolio.

But be careful: when beginners hear this rule, they often imagine something too simplistic. They think, ‘I’ll buy not two tokens, but ten — and that’s it, my portfolio is protected.’ But that’s not quite true.

Important: diversification does not mean buying as many coins as possible that are popular. It’s about making conscious choices based on strategy and understanding the analysis of volumes and the dynamics of supply and demand.

Because true diversification is not just about quantity, but about the quality of distribution. It’s not just how many assets you have in your portfolio that matters, but how different they really are from each other — in terms of market behaviour, segments, etc.

So, if you’re about to rush to the stock exchange and buy ‘everything in sight,’ stop. Let’s first figure out how to diversify your portfolio correctly so that it really works for you, and not just ‘for the sake of it.’

The most common mistakes and how to avoid them

We all come to trading with one goal: to make money. But the truth is, things don’t always go according to plan. The forecast didn’t come true — and your deposit starts to melt away.

How can you avoid going into the red and stay in the market?

Here are 10 tips for smart diversification of your crypto portfolio

1. Not worrying about storage? — Take care of the security of your capital

Even the best strategy won’t help if you lose access to your assets. Beginners often forget that investing doesn’t start with choosing coins, but with where to store your assets.

What to do right:

- Use several exchanges, not just one.

- For medium- and long-term positions — cold and hot wallets.

Don’t store seed phrases in your browser, check the reliability of exchanges, use two-factor authentication.

Security is the first step to successful trading.

By the way, we wrote in detail about choosing an exchange in the article ‘How to choose a platform for trading cryptocurrencies?’

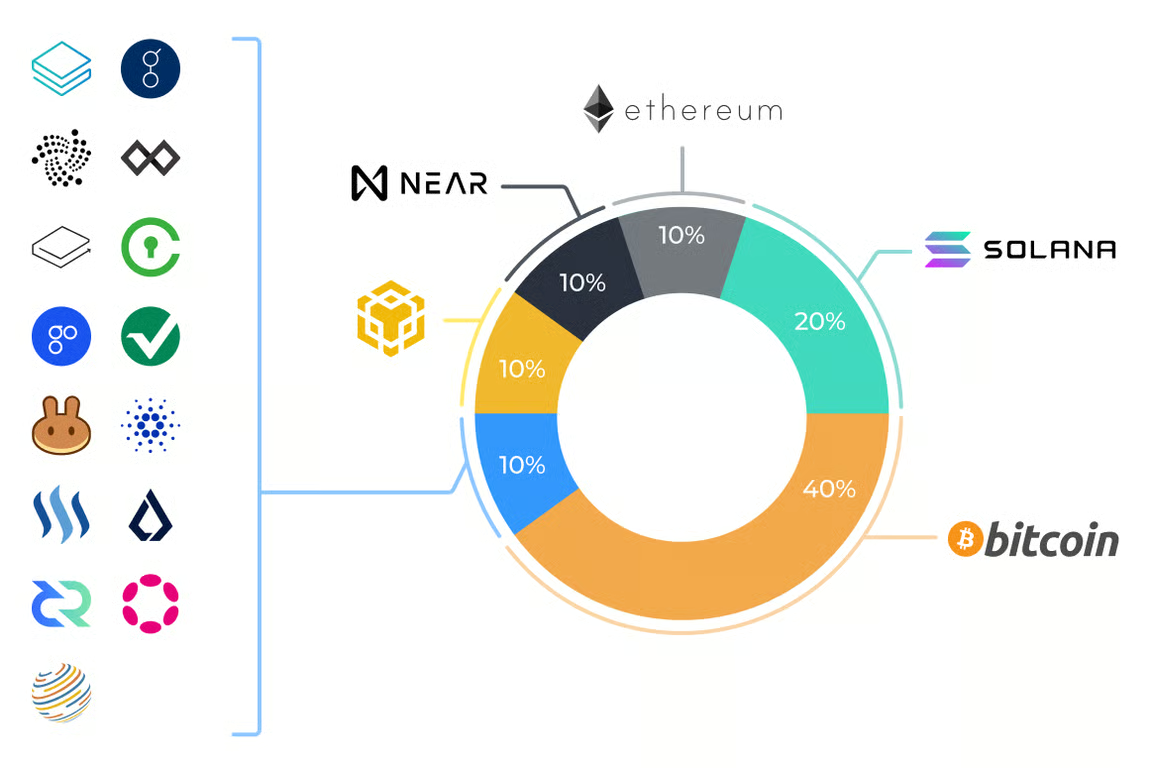

2. Investing everything in one asset? — Distribute wisely

One asset ≠ stability. Even if a coin looks promising, an 80% drop will leave your portfolio in the red.

The solution is portfolio diversification — distributing capital among different coins, sectors, and instruments.

This is the basis of investing and trading with a cool head.

Don’t invest all your funds in one asset!

3. Buying everything in a row? — Filter, analyse, check

Trading is not ‘I’ll take it because the TikToker said so.’ Hype is not a strategy.

A well-founded entry into a deal is part of the strategy. Even if a coin is promising, buying ‘at the top’ without analysing the volumes is a typical path to losses. Almost every beginner in the crypto market makes this mistake. Successful traders with experience always enter into deals in a reasonable manner.

On the Resonance platform, you will find everything you need for a smart approach.

With our analytical tools, you can:

- assess the whole market situation

- see where the battle between buyers and sellers is actually taking place and ‘who has the upper hand’

- analyse limit support and resistance

- quickly find interesting assets based on selected filters

- view coins by category (segments)

- conveniently track trading ideas and deals

And most importantly: entering a position is a strategic decision, not ‘I’ll buy with all my money because the coin is going up.’

4. Don’t you consider the correlation of assets? — Think like a strategist

Bought 5 DeFi coins and think you’ve diversified your portfolio? You’re wrong. If the entire sector declines, you lose on all positions at once.

Choose assets from different segments. This allows you to create the best balance of risk and potential profit.

5. Ignoring risk management? — Always calculate the risks

Without clear loss limits, you are playing against yourself. No trader or investor makes money on every deal. The right approach is to control losses:

- Risk in a deal ≤ potential profit

- Stick to a ratio of 1:3 minimum

- Set stops and takes — always

6. Looking at each trade separately? — Manage your total portfolio

A single one trade is only part of trading. It is important to monitor your total portfolio. Otherwise, you may not notice how the risk has ‘accumulated’.

A balanced approach: control the overall risk of the portfolio, do not exceed 15-20% of capital risk.

7. Don’t have a plan? — Build a strategy

Diversifying your crypto portfolio is not just about the allocation of your assets. You need to write a full-fledged strategy and stick to it. Otherwise, successful trading on the market will not work.

Think about:

- Investment/trading goals

- Assets proportions

- When to enter, buy more, fix profits and losses.

The Resonance platform will help you build the best strategy adapted to the real market situation.

For the first steps, see our article ‘Trading strategies for beginners in trading.’

8. Relying on just one strategy? — Be flexible

One strategy does not work in all market phases. DCA during a declining market is fine, but when the market has been growing for a long time and big players are locking in profits, a different approach is needed.

Combine:

- Investing and DCA

- HODL and staking

- Trading and grids

Work in different time horizons using different strategies.

Flexibility helps increase profitability in the market.

9. Not rebalancing? — Check your portfolio balance regularly

As the price of crypto assets changes, the portfolio balance gradually becomes unbalanced — after all, different market sectors grow or fall unevenly. This gradually changes the risk level of the portfolio and can make it more vulnerable to market fluctuations.

Therefore, you need to rebalance your portfolio from time to time. This is a diversification tool that is often overlooked.

10. Holding ‘dead’ coins? — Train yourself to cut your losses

Instead of accepting the loss and reallocating funds, many simply ‘sit on the asset’ in the hope that it will grow again. A loss-making asset with no demand is dead weight. And the longer you hold on to it, the harder it is to make the decision to cut your losses.

Solution: periodically check the supply and demand for assets. You need to be able to let go of coins that have lost the interest of market participants. It is better to free up capital for other opportunities.

To sum up

- Diversifying your crypto portfolio is not just about asset allocation, but a comprehensive investment strategy.

- Use volume analysis, understand how supply and demand work, and manage risks not only in a single transaction but also at the portfolio level.

- The Resonance platform provides tools to help traders and investors make the right decisions and avoid common mistakes.

- The best portfolio is one that not only generates profit but also reduces risk in the long term.

Start trading and investing in the crypto market the right way. And don’t forget — strategy is everything.

Follow new articles in our telegram channel.

No need to invent complex schemes and look for the "grail". Use the Resonance platform tools.

Register via the link — get a bonus and start earning:

OKX | BingX | KuCoin.

Promo code TOPBLOG gives you a 10% discount on any Resonance tariff plan.

When traders ignore the diversification of portfolio, even one unexpected collapse can erase months of progress. A smart diversification strategy is not about buying dozens of random coins — it’s about balancing risk across sectors, liquidity levels and behavior patterns on the market. That’s why professional investors treat investment portfolio diversification as a mandatory rule, not an optional add-on.

If you diversify crypto portfolio correctly — using volume analysis, market balance tools and clear rules for capital allocation — even sharp downturns in one asset won’t drag the rest of your capital underwater.