Psychology in Trading: How to Manage Stress and Emotions

7 Tips for Dealing with Stress. Trading is like a roller coaster - peaks of joy, plunges into panic, decisions in seconds. The psychology of a trader is the boat that keeps you afloat. If you cannot control your emotions, even the best strategy will not save your deposit. This article contains daily techniques that allow you to improve your concentration and reduce stress in trading.

Table of content

Trading feels like a roller-coaster—spikes of joy, dives of panic, deadlines in seconds. Good trader psychology is the seat belt that keeps you inside the car. Classic human psychology tells us the brain craves quick wins, yet markets punish impatience. If you can’t control emotions, even the best strategy won’t save your account. This guide shows everyday tricks to improve focus and aim for low stress trading.

7 Street-Smart Tips to Handle Stress

- Plan before you click

Map out entry, exit and risk in advance, then follow the script. A written plan instantly improves confidence and is the first step toward mastering discipline.

Freeze emotional trades

Feel the urge to rage-trade? Stand up, breathe, sip water. Pausing helps you control emotions and stops impulse buy and sell moves that drain capital.Set real-world targets

One trade won’t make you rich. Modest, measurable goals stop wild expectations and remove pressure from every order.Quick reset rituals

Two-minute box breathing, a short stretch or eyes-closed meditation clears brain fog and improves reaction time.Look after the hardware

Sleep, balanced food and a walk at lunch keep the body in sync with the mind—another pillar of solid human psychology.Keep a trade journal

Note the setup, feeling and result. Reviewing patterns is about mastering yourself, not just the chart, and helps remove hidden mistakes.Talk to other traders

A private Discord or coffee with peers adds vital social support. Hearing how others control emotions gives fresh tools you can apply at the next buy and sell decision.

Beat Burnout Before It Bites

- Micro-breaks—five minutes away from screens can reset focus.

- Exercise—a fast walk or push-ups reboots energy.

- Life beyond charts—friends, hobbies, travel: that second layer of social fuel keeps markets in perspective.

Quick Reading List

- Trading in the Zone by Mark Douglas - core lessons on how to trade without emotions.

- The Psychology of Trading by Brett Steenbarger - practical drills to further improve mindset.

Bottom Line

Charts don’t move because of candles; they move because people do. Master the people—starting with yourself—and markets become far less scary.

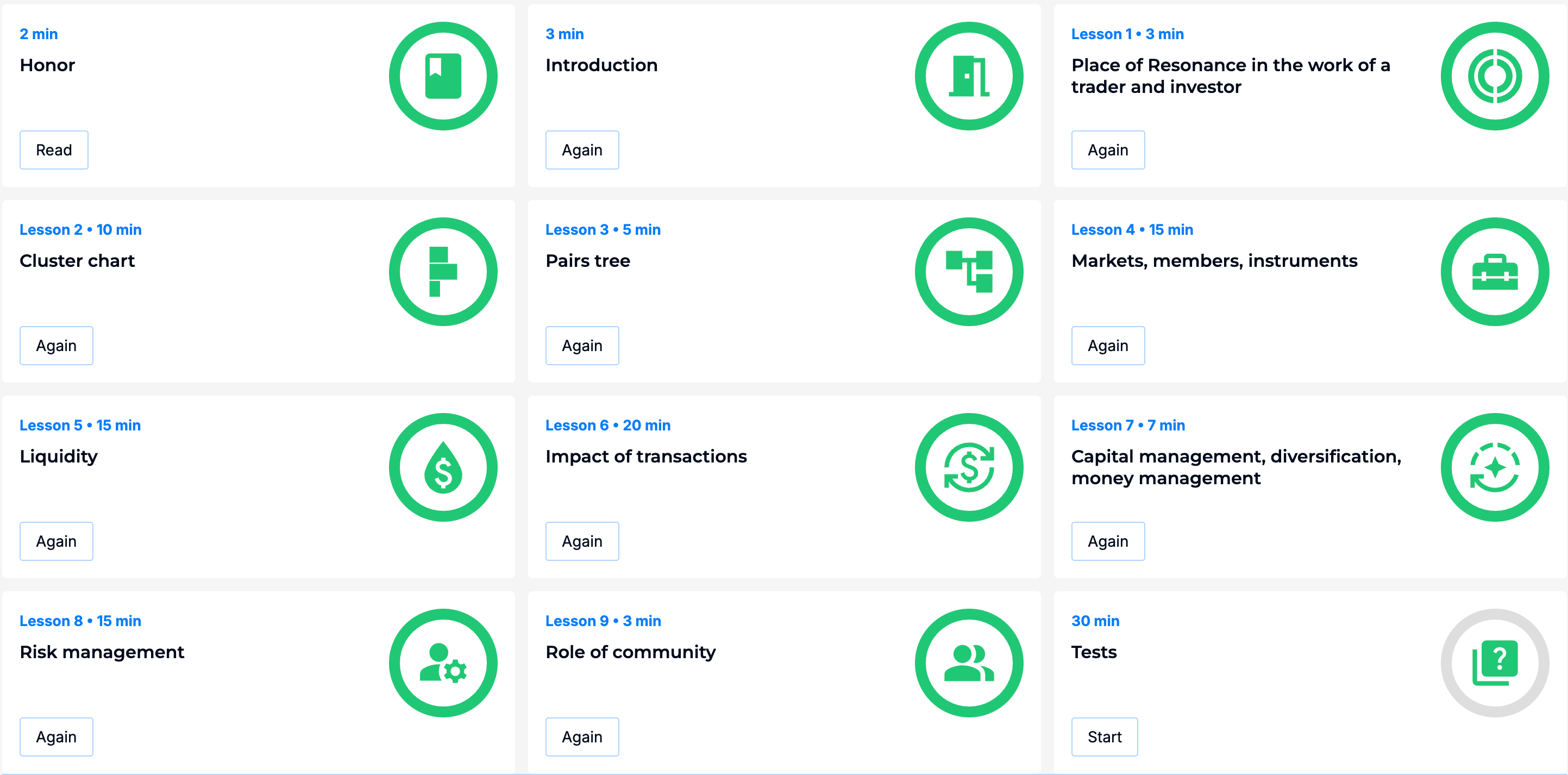

There’s no need to invent complicated schemes or look for the 'holy grail’. Use the tools on the Resonance platform.

Register via the link to get a bonus and start earning:

OKX | BingX | KuCoin.

Use promo code TOPBLOG to get 10% off any Resonance plan.

Understanding psychology in trading is what separates survival from consistency. The market reacts long before charts show it, and emotions in trading often push traders into decisions that have nothing to do with logic. When you treat trader psychology as a skill—something you train, analyse and refine—you finally gain control over your reactions instead of letting fear and excitement dictate your trades.

With the right habits and practical stress management, you can steadily improve psychology and build the mental framework that supports discipline, clarity and long-term profitability. Master the mind first, and the strategy will work the way it was designed to.