Algorithmic Trading: Automating Profit on the Market

Dreaming of having your trading work for you even while you sleep? Algorithmic trading opens up such possibilities — but also brings new challenges. In this article, you’ll learn how trading algorithms are created, what mistakes can cost thousands of dollars, and why not every bot can generate profit. This is a real, honest story from practice that will help you avoid the traps and understand when automation truly makes sense.

Table of content

What is Algo Trading

In this article, a trusted author from the Resonance platform shares their experience with algorithmic trading. You’ll find real case studies and an analysis of the pros and cons of this type of trading. But first, to speak in more detail, let’s clarify the definition of this concept.

Algorithmic trading, or algo trading, is the automation of opening and closing trades on an exchange using special programs (trading bots) operating according to predefined strategies.

This form of trading can be used both in high-frequency trading and in longer-term approaches.

Now let’s examine what happens when a person tries to translate their vision and trading logic into code. We’ll begin with a success story. Then — we’ll analyze the challenges faced by those who decide to take algo trading seriously.

Can an Algorithm Trade Profitably?

From 2016 to mid-2017, I used a breakout strategy on cryptocurrencies. The logic was simple: on volatile pairs, I searched for key highs and lows, and when these levels were broken, I entered on the continuation of the impulse.

After a year and a half of manual trading, I realized that 99% of my actions were repetitive. This triggered the shift to algo trading — to create a system that would automatically reproduce the same actions.

Developing the algorithm took several months: everything a person perceives intuitively, the algorithm does not “see.” It was necessary to break down logic and behavior into steps and describe it in code.

The first versions of the algorithm only helped monitor market conditions and signal potential entries. Later, we taught it to open and close positions. And the result was great!

The algorithm, free of emotions, worries, or doubts, opened trades and held them to take-profit or stop-loss without thoughts like “what if the market reverses now.” It simply followed the strategy.

In the second half of 2017, the algorithm delivered +100% to the deposit. The reason — high volatility in the market, numerous entries, and unfortunately, a complete lack of risk management. Later, the results stabilized, and now the average annual return of this algorithmic strategy is 32% with moderate risk.

However, it’s important to understand: this is the only successful case in my experience. It was followed by many failed attempts to implement online algorithmic trading in other market conditions. Let’s analyze why.

Cases with Negative Outcomes

The main weakness of algo trading is inflexibility. The market changes: volatility comes and goes, new participants enter, and algorithms cannot adapt to the new conditions. Sometimes, this leads to significant capital losses. The feature of trading algorithms is that they act strictly according to instructions and execute them very, very quickly.

Case No. 1

A recent example from working with a decentralized futures exchange. The algorithm was supposed to place a limit sell order in the order book $0.0001 below the best ask (front-running) — the simplest scalping strategy.

In English, front-running means “running ahead.” It’s not a completely fair trade by private investors who try to place orders ahead of larger players. They earn decent profits because they know about the entry of a large player in advance and try to place a large enough lot to extract maximum profit from the trade. This trading strategy is mainly used by scalpers or day traders.

The idea was to place a limit order and, upon its execution, receive a commission rebate. Some clever market participant noticed this algorithm and took the time to write their own bot, which placed a matching limit buy order. As a result, our algorithm was no longer placing limit orders but was sending market orders. The limit order didn’t reach the book, so the algorithm kept trying again and again. We paid the fees, and the “outsider” earned them. Our average daily profit was $35, but on that day, we lost around $4,000 in just 45 minutes — purely on commissions.

The reason — high decision-making speed. The algorithm executed up to 20 trades per second. This property of high-frequency trading is both its strength and its weakness.

Developers might say: “You should have written a monitoring and verification system.” And I agree. But some errors are only revealed in live markets. And the price of such mistakes is money.

Case No. 2

To rebalance an options position, it’s crucial to correctly calculate the delta of the structure. The exchange rounded delta to the 5th decimal place. If there are one or two positions — no problem. But with 20–30 positions, the cumulative error becomes significant, and algorithmic trading starts to distort the result. Rebalancing goes wrong — which means the strategy collapses. This leads to money loss.

Algo Trading for Professionals?

Creating a system that can adapt to market conditions is a task for professionals. Developing such a system requires hundreds of hours of testing, debugging, integrations, and deep understanding of market behavior fundamentals. It’s very expensive.

Not surprisingly, good algorithmic systems that work reliably are developed by major players. For example, investment giant BlackRock developed its Aladdin system for over 20 years. Hundreds of analysts, programmers, and traders were involved in the project.

If you’re a retail trader and want to write an algorithm that competes equally with Aladdin — that’s hardly realistic.

When to Use Algorithms

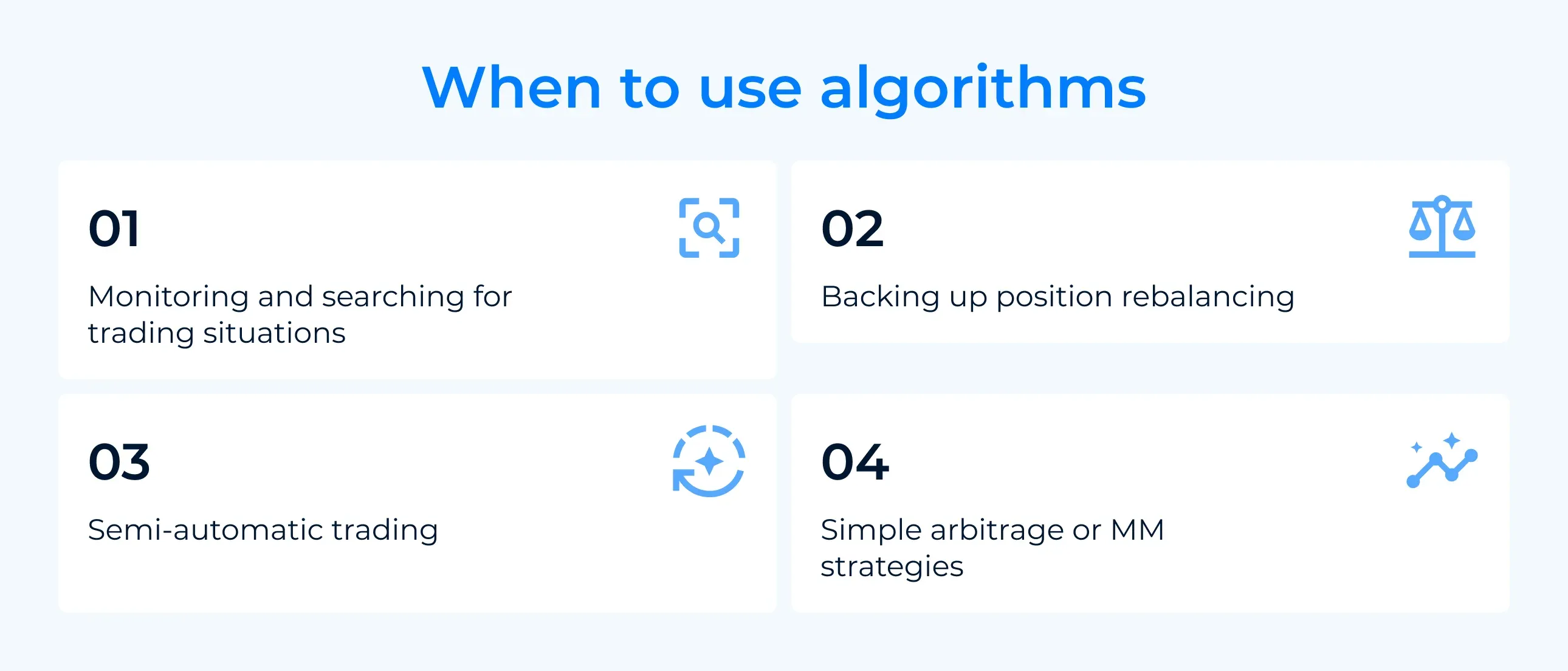

Still, I believe algo trading makes sense in certain scenarios:

- Monitoring and identifying trading situations. For example, alerts about large limits on cryptocurrencies: receiving a notification that a large limit order appeared in the order book on the XXX/USDT pair.

- Backup. For instance, at night, when I’m already asleep, rebalancing positions — this can be handled by an algorithm. If not done, losses can be significantly greater than the potential errors of the algorithm.

- Semi-automated trading, to execute orders (place stop-loss/take-profit) after I’ve already analyzed the situation, formed a trading idea, and am ready to execute it.

- Something very simple but requiring speed. For example, basic arbitrage or market-making (MM) strategies.

Such tasks require high speed but do not involve deep analysis. And here, algorithmic trading can indeed be beneficial.

Conclusion

Fortunately or unfortunately, the market consists of an enormous number of variables and nuances. Teaching an algorithm to understand everything is nearly impossible.

Many traders become fascinated with creating algorithms for the sake of it. But in reality, not every algorithm works stably in live market conditions. Real algo trading is not magic. It’s a tool — useful only when its limits and applicability are well understood.

So the best path is to train your brain, not just your code.

You can start with the basics — a mini-course on trading cryptocurrencies using a directional strategy. If that’s not enough — continue your training at our University.

Analyze liquidity flows, monitor volumes using the powerful analytics tools of the Resonance platform. Seek your edge not in speed, but in quality.

Which means — not in the robot, but in yourself.

Follow new insights in our telegram channel.

No need to invent complex schemes and look for the "grail". Use the Resonance platform tools.

Register via the link — get a bonus and start earning:

OKX | BingX | KuCoin.

Promo code TOPBLOG gives you a 10% discount on any Resonance tariff plan.