How to create your own trading strategy?

Your own trading system is the key to making the right decisions and getting good results. Here, we’ll talk about how to build a strategy, manage risks, pick the right times to get in and out, and test and improve your system. These practical tips will help you avoid chaotic trades and improve your trading discipline.

Table of content

- 01How to create your own trading strategy?

- 02How important is it for a trader to have a trading strategy?

- 03Rules for building a trading strategy

- 04What should a trading strategy not be?

- 05Conditions for creating a trading strategy

- 06Strategy testing

- 07What to do if the trading system is not profitable?

- 08Conclusion: clearly defined steps

Still trading on intuition? It’s time to change that. Develop your own strategy, learn to control risks and make confident decisions. Read our article and start your journey to professional trading today!

How to create your own trading strategy?

Do you need a trading strategy?

A trading strategy is a set of rules that a trader or investor follows. It includes conditions for selecting a trading instrument, entering and exiting a position, and selecting the volume of a deal.

How does a trader who does not have a trading system trade? He follows his intuition, uses various forecasting methods, and begins to imagine things on the chart that are not there. Any ideas or mentions of a particular asset in the chat are perceived as a signal. Not to mention the emotional component: the lack of a trading plan, the inability to manage money, and the desire to constantly be in the market greatly affect the trader’s psychological stability. By the way, we have already discussed emotion management in the article ‘The Psychology of Trading: How to Manage Stress and Emotions.’

The main function of a trading strategy is to relieve the trader’s psychological burden. Choosing entry and exit points and setting stop losses usually causes stress for an unprepared market participant.

Therefore, if your goals include ‘becoming a professional trader,’ you cannot do without a trading strategy. You can take a ready-made trading system and adapt it to your needs, or develop your own personal trading strategy from scratch — it doesn’t matter. The most important thing is to be firmly committed to following it.

How important is it for a trader to have a trading strategy?

Many years of experience of a lot of traders have shown that random, chaotic trades and trying to find the market bottom or top usually lead to disappointment. Sure, in the short term, spontaneous actions can even bring good profits, but a long trading period (several years) usually puts everything in its place.

Understanding what to look for on the chart and having a consistent algorithm of actions after finding it gives you a solid advantage over unprofessional market participants.

Their money may start flowing to you. Their mistakes can become your profit.

The main problem for those who have recently entered the market is simple greed. It is greed that prevents them from closing a losing position in time in the hope that the market will turn around. Or it pushes them to prematurely close profitable positions in order to see at least a minimal increase in their deposit.

Developing a trading strategy is necessary precisely to reduce the influence of emotions on trading decisions.

Rules for building a trading strategy

There is no trading system that can accurately predict where the price will go.

A trading system must contain conditions under which the price is highly likely (of course, not 100%) to move in the right direction. All you have to do is follow risk management and try to get as much out of this movement as possible.

But don’t think that with a ready-made trading strategy, you will immediately start earning consistently month after month. Planning, developing a trading strategy and following it is only one of the initial stages on the path to professional trading, but not the most important one. The main thing is the chosen method of analysis. Based on fundamental analysis or technical analysis, you can quickly come up with a hundred trading strategies.

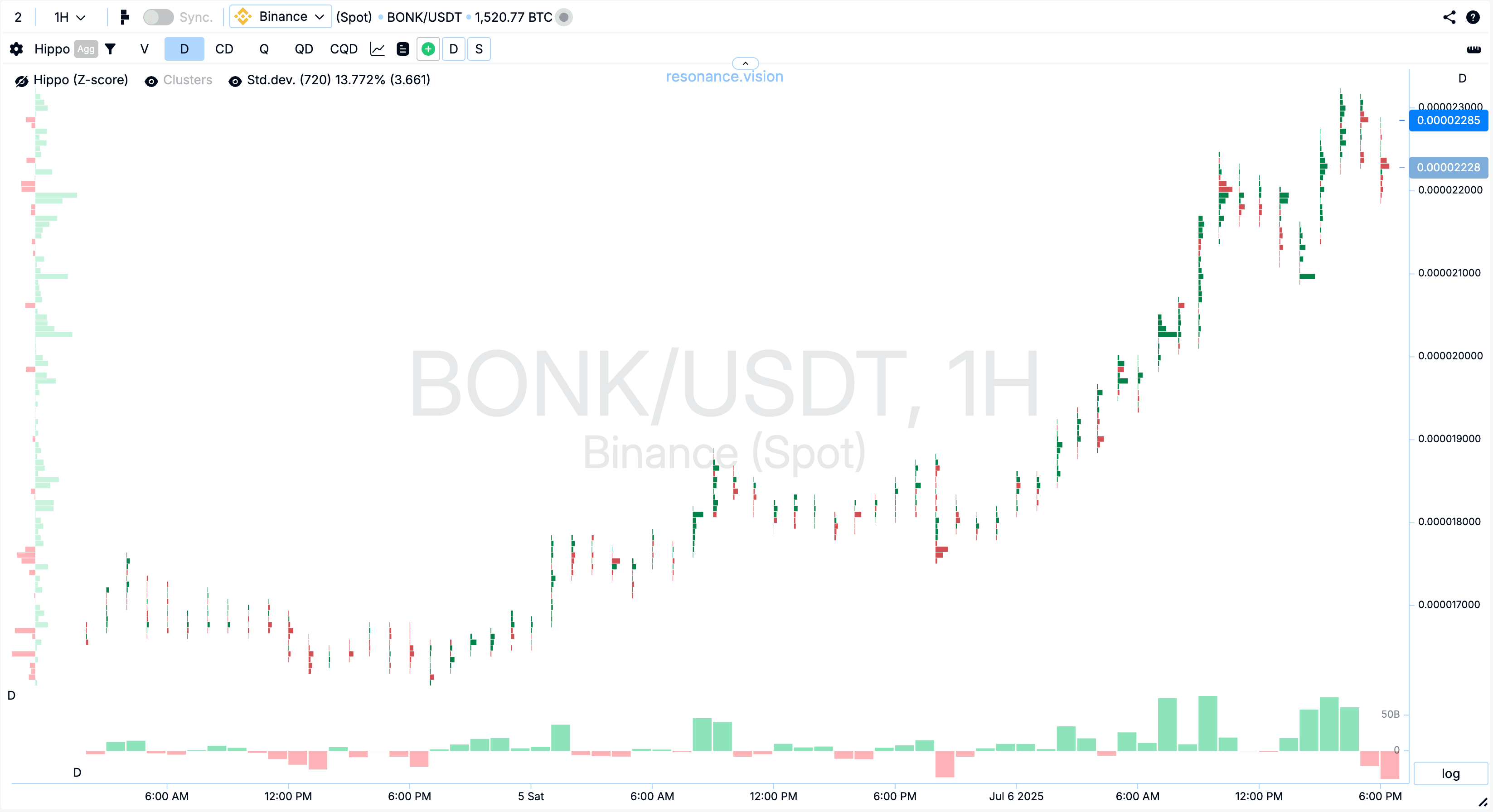

Trend trading, moving average crossovers, geometric figures, candlestick patterns, countertrend trading, and so on perfectly show how the price has changed in the past, but they do not answer the question of what is happening in the market with supply and demand here and now, which side’s efforts are causing the imbalance. Only a deep analysis of the volumes of trades already made can give us this information. The advantage of the Resonance approach is that by looking at a chart with abnormally large clusters and seeing a strong predominance of purchases/sales, we can clearly interpret what is happening from the point of view of market mechanics, unlike candlestick analysis, where different patterns on the same chart can give completely opposite entry directions.

To open a trade, it is important to:

- see the dynamics of volume changes in the order book

- the balance of indices and market delta, as they show how liquidity is allocated in the market

- the selected timeframe, as it determines how much time you are ready to devote to trading and market analysis.

What should a trading strategy not be?

Your trading system should not have:

- Clear fixed position sizes, stops and take profits. The cryptocurrency market is too volatile and influenced by a large number of different factors. Therefore, the conditions for entering a trade are constantly changing. Of course, when opening different trades for the same amount, there should not be such a gap that, for example, the stop loss for one trade is 10% and for another it is 30%. In addition, when closing trades at a loss or profit, the deposit amount also constantly changes. Read about calculating stop losses in the article ‘Strategy is important, but risks are more important.’

- Attempts to use Resonance tools in tandem with technical analysis elements. Why? Read more in the article ‘What’s wrong with technical analysis?’

- Too many conditions for opening trades. With a large number of filters, it may happen that you will have to wait weeks for the right conditions. This is also fundamentally wrong, as such a small number of trades will simply not allow you to test the strategy properly.

Conditions for creating a trading strategy

This point raises the most questions:

- What part of the deposit should be used for a single strategy?

- How to calculate the trade size?

- Where to place stops/takes?

- What percentage of the deposit is acceptable to risk in a single trade?

So, let’s start with the deposit. Let’s say we have tested our trading method on a demo or training deposit and feel ready to trade with a more substantial amount. But do you think it is reasonable to trade with your entire deposit within a single trading system? In my opinion, not really. Sooner or later, you will come to the conclusion that you need to divide your entire trading capital, for example, between scalping and medium-term trades. Thus, the total capital is diversified to some extent depending on the strategies used.

The next step is to set your trade size. To figure out your trade size, you just need to know two things:

the maximum risk you’re willing to take from your deposit for this strategy as a percentage

the distance from your entry point to the price at which your trade will be closed by a stop loss.

The risk should be reasonable and ideally should not exceed 1-2% of the deposit per trade.

Let’s move on to opening a trade. Here, everything is simple and complicated at the same time. On the one hand, you need to specify the conditions that will trigger the opening of a trade. On the other hand, you should also assess the global market situation. Based on this, a decision is made to open a trade at market price or to enter a lower limit order, split into several parts. Of course, all possible options must also be written down.

When exiting a position, there are several possible ways to go:

- Close the trade with a stop order to cut down on potential losses.

- Close the trade with a take profit order based on the risk/reward ratio.

- Early closing of trades. For example, if Market Delta indicates abnormal sales, the volume of which is growing with each new frame, it is not necessary to wait for all open trades to be closed by stop orders.

Strategy testing

Any personal trading strategy must be tested. Many people advise testing a strategy on historical data. But here it should be remembered that historical data very quickly loses its relevance and value. Therefore, it is much more useful to do this in real time.

To do this, you can use either a demo account or open a real account with a small amount.

During testing, it is important to eliminate the emotional component, so the size of the position and possible losses should not cause you anxiety.

Based on the testing, you can already collect statistics on the ratio of profitable and unprofitable trades in % on your chosen timeframe and, accordingly, how the deposit changes.

Testing is a complex and boring process. But at the same time, it has undoubted benefits, saves time and, most importantly, allows you to save the main part of your capital from unsuccessful experiments.

What to do if the trading system is not profitable?

Losses are an integral part of trading, even if you follow your trading strategy 100%. But this is definitely not a reason to despair. Your trading system should include an algorithm of actions in case, for example, the deposit loss exceeds 20% (this figure may vary for each individual). Once you have written down the rules for a series of losing trades, following them becomes as much a part of your trading system as stops, take profits and entry points. Thus, as the number of trades increases, your attitude towards losses gradually changes.

Besides, no one is forcing you to stick to one strategy. You should strive to have a range of different tested trading strategies from which you can choose the one that is most effective in the current market phase.

Conclusion: clearly defined steps

After selecting and testing strategies, all that remains is to write down your actions in a standard trade step by step. It is very important to always have the sequence of actions in front of you. When creating a trading strategy, you also need to specify when to open a trade and when not to, what your actions will be if the trade goes on for a very long time or in case of force majeure.

Ideally, you should keep a small checklist where you note the asset’s name and the set of factors that prompted you to open the trade. On the Resonance platform, the Notes tool serves as such a checklist.

If your personal trading strategy includes the above and justifies your every action, it can safely be called a good formalised trading system. The only thing left to do is to prove that it works and brings good results.

There’s no need to invent complicated schemes or look for the 'holy grail’. Use the tools on the Resonance platform.

Register via the link to get a bonus and start earning:

OKX | BingX | KuCoin.

Use promo code TOPBLOG to get 10% off any Resonance plan.