Trend Trading Strategy: How to Follow a Strong Move

In this article, we unpack what a trend is and how it forms, explain the role of volumes and “smart money”, and show how supply and demand work in the market. We’ll talk about tools for identifying a trend, practical approaches to entering and exiting positions, and what no strategy can function without. The material suits those who want to understand market mechanics and learn to use a strategy of following the trend in long-term and intraday trading.

Table of content

Introduction

There’s a well-known phrase: trend is your friend. And although in real time it can sound like a joke, the core idea is correct. Trading by trend is one of the most popular approaches because it allows you to follow strong market moves and profit from impulses.

On the crypto market this is especially relevant: volatility here is higher than on traditional markets, and the ability to work with the direction of price action often decides a lot. That’s why trading by trend remains a basic school for every trader, and a strategy of following the trend gives a foundation for growth to both beginners and professionals.

In this article you’ll find tips and recommendations on analysis and execution of trades according to the directional strategy from Resonance — including when to trade with the trend and how to apply a trend line trading strategy or trading with trend lines where appropriate.

What a Trend Is and Its Types

If you ask a trader what a trend is, most will answer: “the direction of price action.” Formally that’s true, but if you dig deeper, it gets more interesting.

Classical technical analysis (specifically Charles Dow’s theory of trends) distinguishes three main types:

- Uptrend — each new low and high is higher than the previous one.

- Downtrend — the mirror image: peaks and troughs move lower.

- Sideways — when the market “whipsaws” back and forth and no clear direction exists.

That’s how Charles Dow systematized market movement. He was the first to describe that a global trend is built from a sequence of lows and highs.

It’s important to understand: what we call a trend exists only in hindsight. When we look at a chart after the fact, everything seems obvious — here’s the rise, here’s the fall. But in real time it’s more complex: a trend forms gradually — trade by trade, volume by volume. That’s why debates about whether to trade with the trend always boil down to one thing — who and with what volumes is actually creating it.

Another nuance: the trend depends on the chosen timeframe. On a daily chart the market may be confidently rising, while on a one-minute chart you can see sharp pullbacks and local drops. For a scalper and a long-term investor the picture will be entirely different — and each will be right in their own logic. Hence the idea of a “trend within a trend.” Today this is called working across multiple timeframes: the daily move can be part of a weekly uptrend but still a correction intraday.

How a Trend Really Forms

Frankly, the idea that “the trend is your friend” sounds nice, but in reality this “friend” has a catch: it exists only in history. Everything we see on the chart has already been executed. The real-time trend is still forming, and you can read it only by watching how volumes behave.

When price falls on the back of active selling — that’s logical; sellers are pushing the market. But if at some point we see selling continue while price stops dropping — it means someone is aggressively absorbing that supply and creating scarcity (deficit). The reverse also holds: there are large buys, but price doesn’t rise — supply is so strong it absorbs demand.

Thus, a trend is always a reflection of a demand/supply imbalance. The cryptocurrency trading volume, specifically the delta (the difference between market buys and sells), is a key indicator. If sellers’ efforts stop producing results (further price decline), then buyers outnumber or overpower them — and vice versa.

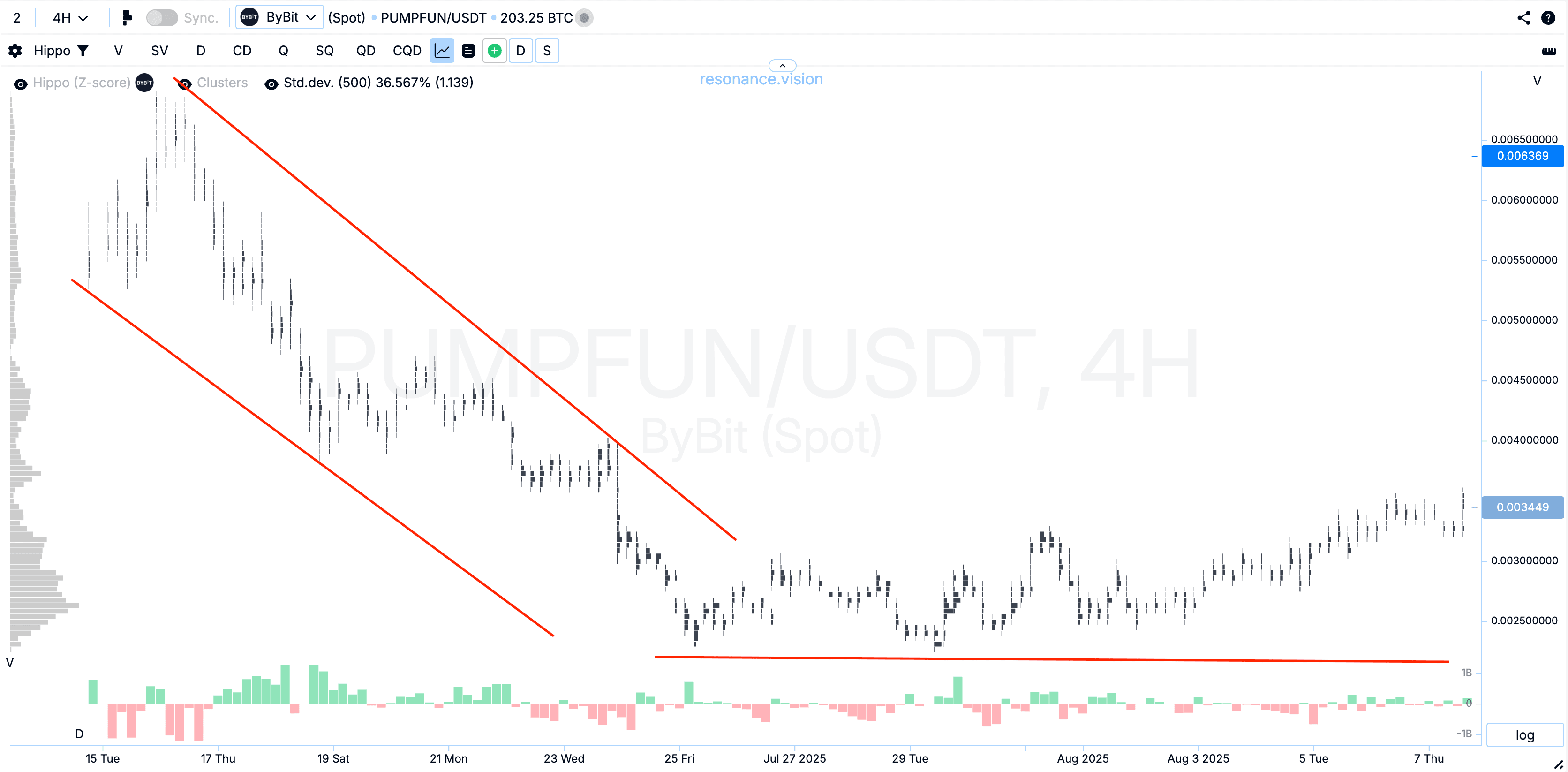

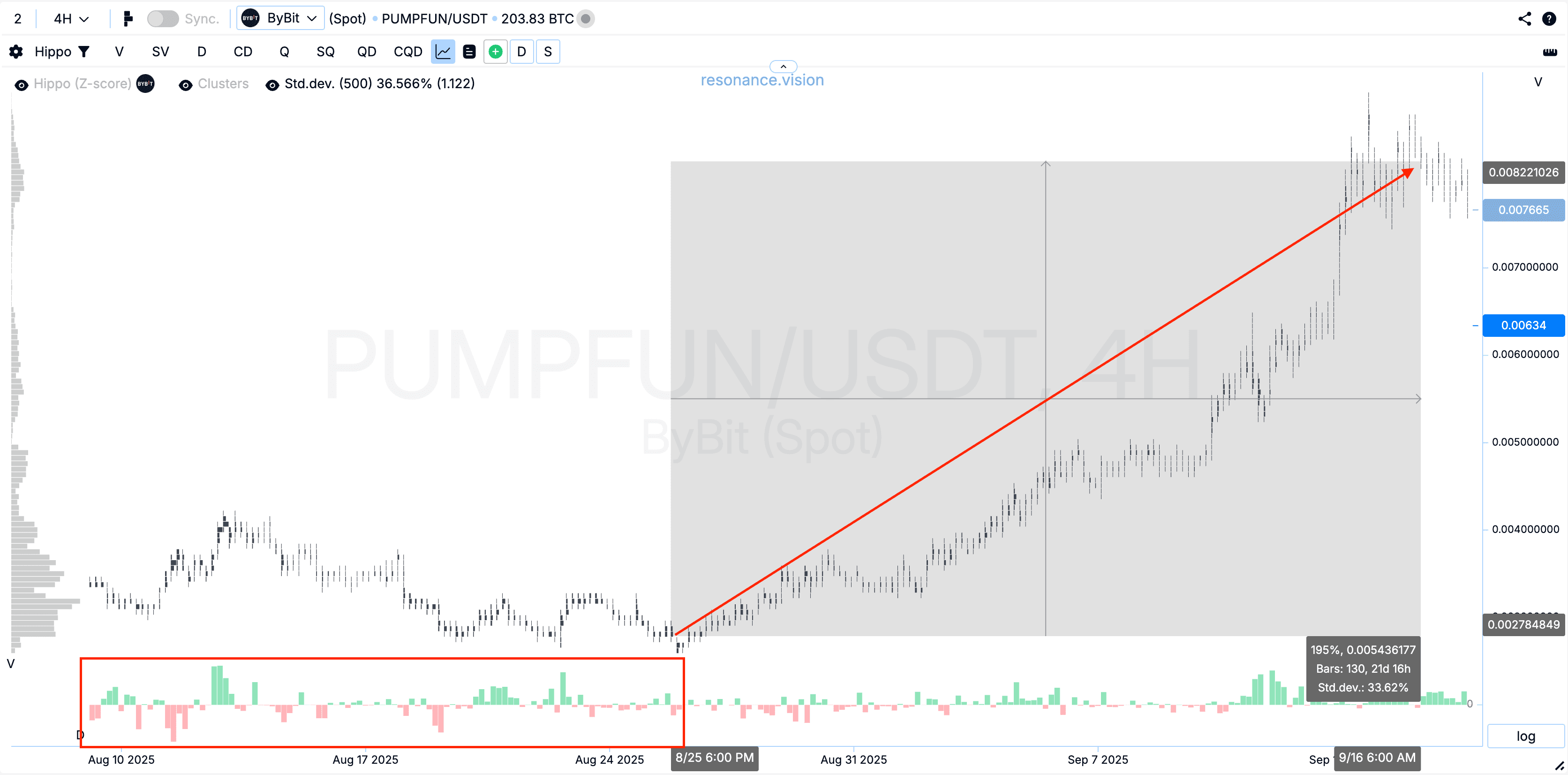

In practice, these are the very moments that signal a change of tendency. Suppose we’re in a downtrend, each low is lower than the previous one. Suddenly heavy selling appears, but price holds or even ticks up. That’s a clear sign the market is “restructuring,” and sellers no longer control the situation.

In essence, a trend is born not from drawn lines or pretty indicators, but from concrete participant actions — buying and selling that shift the balance of power. Deficit pushes the market up, surplus (profusion) pushes it down. If you look not at candlesticks but at the efficiency of volume’s impact on price, the direction becomes obvious far earlier than any course on patterns or smart-money lore will admit. This is where the best insights often arise for crypto traders.

Tools for Identifying a Trend

When traders try to gauge direction, they usually start with the simplest: draw trend lines or trade from support and resistance. That’s useful — but mainly as visual scaffolding. It connects to trading with trend lines and can inform a trend line trading strategy, but only if you understand the flows behind it.

Next come indicators. The common toolkit includes:

- Moving averages (simple, exponential, with different periods);

- MACD, which fundamentally stems from averaging prices;

- RSI, which flags “overbought/oversold” zones;

- Bollinger Bands, which extend the same average-value idea.

But remember: they all share one principle — they take price and pass it through formulas. Whether simple or exponential, it’s still averaging. So trend indicators reveal nothing fundamentally new; they smooth the picture and lag reality.

For example, moving-average crossovers are often presented as a “trend start signal.” In reality they merely confirm price has already shifted. Same with RSI: it looks “smart,” but mostly confirms that the market already ran up or down — a retrospective. That’s not the best primary cue.

This is why many professionals downplay classic indicators. You can confirm the trend only through volumes, clusters, and delta. That lets you see where large capital actually entered and whether those buys/sells were effective. Hence, cluster charts, heatmaps, and a dashboard are must-have tools for crypto trading — especially when combining price action with order-flow reads and patterns. Used well, they can be part of the best trend line trading strategy implementations.

Bottom line: a correct trend assessment always rests on who is moving price, and with what size. Even when trading with trend lines, context from flows matters more than lines themselves.

The Role of “Smart Money” and the Crowd

There’s a popular myth: the market is entirely controlled by market makers or funds that purposely “hunt stops” and manipulate. Reality is less linear. Yes, big players can move price. But on the cryptocurrency market a single actor can’t play puppeteer indefinitely. Why? Arbitrage and fierce competition. If price is inflated on one venue, arbitrageurs quickly normalize it across others.

So smart money acts differently: systematically — accumulating and distributing over time. Their goal isn’t to “hit your stop,” but to profit from structural demand/supply differences — the best edge they can find and follow.

The crowd is another matter. Crowd behavior creates the sharp swings that look like “manipulation.” Emotions dominate: fear pushes mass exits; greed triggers impulsive entries. These are real people’s money, reacting to headlines and candles. In simplified terms: smart money = systematic strategy; crowd = chaos and emotion. Recognizing these patterns helps guide your trading choices.

Deficit and Surplus as the Core of a Trend

To see where a trend comes from, return to the classic law of supply and demand:

- if demand rises while supply is limited — price increases;

- if supply expands while demand is weak — price falls.

In practice it’s subtler. It’s not just how many buy or sell, but how effective their actions are.

For example, the market may be flooded with sells; price “should” fall. But buyers place large bids, absorb the entire sell flow, and price holds — that’s deficit in action: there are many sellers, but they cannot push lower. Conversely, if heavy buying appears and price barely rises, supply is absorbing demand — a surplus.

Thus deficit/surplus is a dynamic redistribution of volume between buyers and sellers. When one side’s efforts stop moving price, the other gains advantage. That’s what reverses markets — not “levels” or patterns by themselves. Support works where buys absorb sells (deficit). Resistance works where supply overtakes demand (surplus).

Simplified:

- an uptrend is a sequence of small deficit states;

- a downtrend is a sequence of surpluses.

When one side ceases to be effective, a turn begins. This is crucial to trading decisions in crypto or any market you follow.

Trend Trading: Entries and Exits

There are no universal rules: entries and exits depend on your strategy and timeframe. But a shared logic remains — trade in the direction of the side that truly controls the market (buyers or sellers) and manage the position correctly.

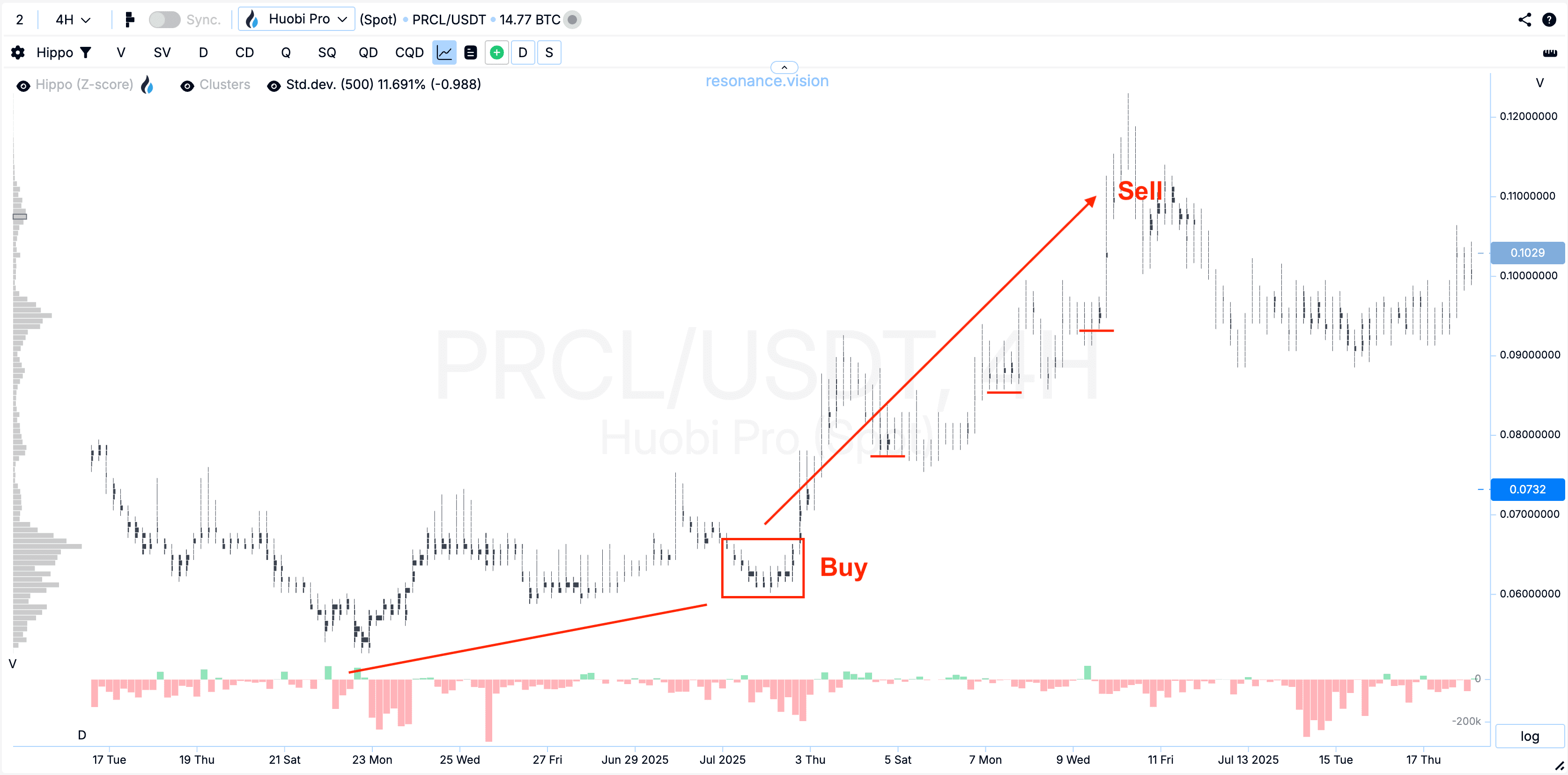

One key technique is partial profit-taking. No one nails the exact top of a trend; it’s better to scale out a portion as price action advances, locking results while the remainder rides the move.

Another important technique is adding to the position. When the trend is confirmed and the market offers a second chance (a consolidation or pullback), you can add size. That can improve outcomes, but demands strict risk control: if you add, move the stop-loss.

Below are several practical approaches commonly used by traders:

1. Buy and hold

A simple model for long-term investors: enter as deficit is confirmed and hold while the rise persists. Exit on surplus signs or when the global direction changes.

2. DCA strategy

Regular small purchases regardless of current price. This averages the entry and reduces volatility’s impact on your position. Works well if you believe in a long-term trend in the asset.

3. Active trading “from levels”

A “level” isn’t a line on a chart — it’s a zone where demand/supply balance shifts.

If sells stop pushing price down, buyers are absorbing supply — deficit — that’s a valid long entry from support (especially with visible passive bid support).

If aggressive buys stop lifting price, passive offers are absorbing — surplus — a mirror short setup.

Exit follows the same principle: once your side stops being effective, book profits.

These styles differ, but share one core: a strategy of following the trend. Not after a coin already did 10x, but when the market is just forming the move and volumes show one side losing effectiveness. Whether your horizon is long-term or intraday trading, the idea is the same: move with the market, including when trading with trend lines as part of a broader trend line trading strategy.

Pros are clear: potentially higher efficiency, alignment with large capital, clearer rules for selecting assets. The right filters help — avoid the market when no clear direction exists. For many, combining structured patterns, order-flow, and disciplined trading yields the best results in the cryptocurrency arena.

Tip: We recommend our directional mini-course from Resonance — useful for both newcomers and seasoned practitioners who follow structured methods.

Risk Management

Without capital protection, trend trading is doomed. Size your positions and risk no more than 2–3% per trade. The prime advice: think about risk before profit. Even the soundest trading approach won’t save you if you operate on an “all-or-nothing” basis.

Read more on sizing in the article “Strategy matters, but risks matter more.”

Conclusion

A trend trading strategy isn’t a magic button — it’s a systematic approach. It works when a trader understands what drives the move: demand, supply, and the efficiency of volumes. That’s what separates those who move with the market from those who chase a “pretty picture” of patterns.

To follow a trend means seeing in the volumes when one side loses control and entering when you have an edge. Keep to a few simple rules:

- look for entry zones where deficit or surplus appears;

- use partial exits and adds to accompany the position most effectively;

- never ignore risk management, the backbone of any trading approach — even the most profitable.

Follow new insights in our telegram channel.

No need to invent complex schemes and look for the "grail". Use the Resonance platform tools.

Register via the link — get a bonus and start earning:

OKX | BingX | KuCoin.

Promo code TOPBLOG gives you a 10% discount on any Resonance tariff plan.